- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Blog

December 25

December 252015

Book Review: Momo Traders by Brady Dahl

A necessary disclaimer: I have received a complimentary copy of the book from its author, so my review may be biased due to that. is a book about successful day traders in stock markets. It was written by Brady Dahl and co-authored by Nathan Michaud. It is an interview book where best day traders (deemed such by the author) talk about their path to success and their way of trading. The book has a preface […]

Read more December 24

December 242015

Another Expert Advisor to Trade the News

A way to celebrate Christmas and the New Year for me is to share something with other traders. Years ago, I have uploaded Amazing EA for MT4 that was coded by someone calling himself FiFtHeLeMeNt. Five years ago, I have converted it to MT5. That expert advisor is rather bulky and does not reflect the current state of the Forex market — ultra-high volatility during news releases. That is why today, […]

Read more December 23

December 232015

EUR/USD Falls for First Day in Four

EUR/USD dropped today after three consecutive sessions of gains. Economic data released from the United States was mixed, providing no clue about timing of the next interest rate hike from the Federal Reserve. Trading has been slow lately and will likely remain such until the end of the holiday season. Both personal income and spending rose 0.3% in November. The income growth was above the median forecast of 0.2% […]

Read more December 21

December 212015

USD/RUB Short on Technical Analysis

I know, it has been only three days since I have closed my USD/RUB buy, but I have just went short on USD/RUB based on some pretty evident technical analysis factors. The currency pair is consolidating inside the ascending triangle on the weekly chart. During two previous instances of USD/RUB hitting the upper resistance (January and August), the pair retreated back to the lower trendline. I expect the same retracement this time too: […]

Read more December 21

December 212015

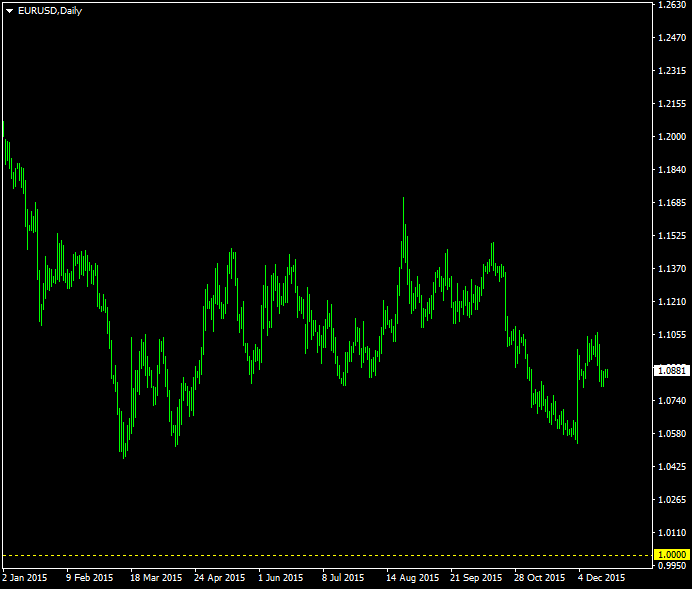

Will EUR/USD Continue to Parity in 2016? Poll

About a year ago, I have asked you about the possibility of EUR/USD reaching parity in the year 2015. As of now, it looks like the most voted option — Not this year — turned to be the correct one. Of course, there is a small chance of EUR/USD falling to the bottom during the remaining 9 trading sessions (8 if you cross out Christmas), but it does not look like a real possibility to me. […]

Read more December 19

December 192015

Weekly Forex Technical Analysis (Dec 21 — Dec 25)

EUR/USD Floor pivot points 3rd Sup 2nd Sup 1st Sup Pivot 1st Res 2nd Res 3rd Res 1.0499 1.0651 1.0756 1.0908 1.1013 1.1165 1.1270 Woodie’s pivot points 2nd Sup 1st Sup Pivot 1st Res 2nd Res 1.0639 1.0733 1.0896 1.0990 1.1153 Camarilla pivot points 4th Sup 3rd Sup 2nd Sup 1st Sup 1st Res 2nd […]

Read more December 19

December 192015

Forex Brokers Update — December 19th, 2015

One more Forex broker can now boast of being listed on EarnForex.com: OneTrade — a British company with FCA regulation. It claims to offer straight-through processing accounts with direct market access via MetaTrader 4 starting with $500. The maximum leverage is 1:100. OneTrade Some listed companies have been updated during the week: OctaFX now offers Micro accounts instead of Mini. Reduced its spreads […]

Read more December 18

December 182015

Schaff Trend Cycle Converted for cTrader (+ Alerts)

Four years ago, I have converted Schaff Trend Cycle (STC) for MetaTrader (MT4 and MT5) and uploaded it to EarnForex.com. In March 2014, I also shared an MT4 version with limited alerts capability. Starting from today, you can get a free Schaff Trend Cycle indicator for cTrader. Also, MT4 and MT5 versions now have four types of alerts to work with. Unfortunately, there is nothing I could do to add […]

Read more December 17

December 172015

EUR/USD Goes Down, Unable to Keep Upward Momentum

While EUR/USD was trying to keep going up after the Federal Reserve policy announcement yesterday, it has retreated by the end of Wednesday’s session and continued to sink lower today. Economic data from the United States was mixed, but there were no reports bad enough to hurt the dollar much. Philadelphia Fed manufacturing index dropped from 1.9 to -5.9 in December, proving wrong those analysts who had […]

Read more December 16

December 162015

EUR/USD Holds onto Gains After Fed Announcement

The Federal Reserve announced today its long-anticipated interest rate lift-off. EUR/USD dipped after the event but recovered quickly, continuing to move higher. Some market analysts explained such behavior by the fact that the Fed left its economic forecasts basically the same, making it illogical to raise interest rates while inflation is expected to remain below the 2% target till 2018. Housing starts were at the seasonally adjusted […]

Read more