- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Blog

August 16

August 162015

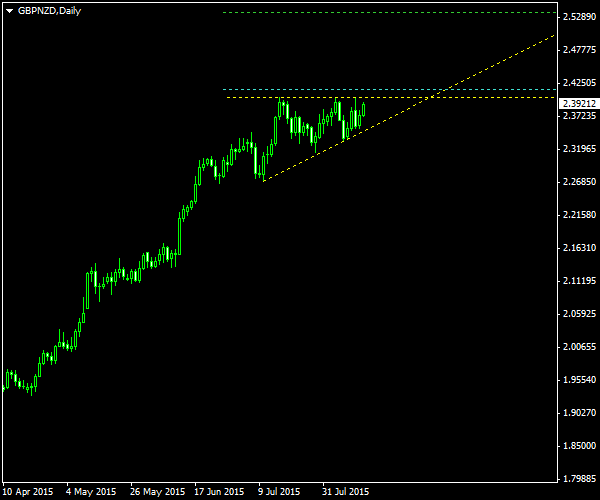

GBP/NZD — Transformation into Ascending Triangle

The double top pattern on GBP/NZD @ D1 chart that was spotted by me a week ago has transformed into a classic case of an ascending triangle. Although the double top pattern is not dismissed at this point (it can still work as a sort of a triple top formation), the new case offers a bullish breakout opportunity in addition to the bearish breakout of the previous pattern. As you can see, the yellow lines form the borders […]

Read more August 16

August 162015

EUR/AUD Shows Long-Term Ascending Channel

EUR/AUD is currently showing a very interesting pattern with multiple confirmations — a long-term ascending channel with a starting point on May 1 this year. It follows a bearish trend wave beginning in December 2014. The resulting continuation pattern offers a shorting opportunity in case of a bearish breakout. The dashed yellow lines on the image below mark the channel’s borders (note the number of price hits). The cyan line, placed at 10% of the channel’s height […]

Read more August 15

August 152015

Weekly Forex Technical Analysis (Aug 17 — Aug 21)

EUR/USD Floor pivot points 3rd Sup 2nd Sup 1st Sup Pivot 1st Res 2nd Res 3rd Res 1.0663 1.0794 1.0952 1.1083 1.1241 1.1372 1.1530 Woodie’s pivot points 2nd Sup 1st Sup Pivot 1st Res 2nd Res 1.0801 1.0966 1.1090 1.1254 1.1378 Camarilla pivot points 4th Sup 3rd Sup 2nd Sup 1st Sup 1st Res 2nd […]

Read more August 14

August 142015

EUR/USD Falls on Good US Data, Rises on Poor Sentiment

Following some large waves of early trading session volatility, the EUR/USD Forex pair fell as some positive macro reports came out of the United States today. Traders sold euro versus USD on high PPI and good industrial production expansion. The consumer sentiment report, which came as the latest US fundamental indicator for the week, ruined the fun for the dollar bulls and pushed EUR/USD to recovery. Producer Price Index increased by 0.2% in July […]

Read more August 13

August 132015

EUR/USD Falls Before and After US Data

The US dollar gained versus the euro for the most part of the daily trading session today. The EUR/USD drop deepened when the biggest part of the US data was out despite the fact that it was not that great. The recovery began soon after, but stalled after the remaining fundamental indicator had been released. Initial jobless claims were at 274k last week, up from 269k of the previous week and slightly […]

Read more August 12

August 122015

EUR/USD Rises on PBoC Actions

EUR/USD rose steadily today as the traders reacted to yet another currency intervention by the People’s Bank of China. Although the similar intervention resulted in a bearish move yesterday, traders began interpreting these currency market manipulations as a sign of danger to the upcoming US interest rate increase. The United States will be struggling to keep its currency competitive if China continues the devaluation policy. Crude oil inventories fell by 1.7 million barrels […]

Read more August 11

August 112015

EUR/USD Swayed by External News

The EUR/USD currency pair was influenced mostly by the news outside of the United States. The initial downmove was caused by the Peopleâs Bank of China — it has devalued the yuan by 1.9%, sending market participants to seek safety in such currencies as the US dollar (event A on the chart.) Six hours later, news came out of Greece announcing a bailout deal between the country’s government, the European financial organizations, and the IMF (event B on the chart.) Nonfrarm productivity […]

Read more August 9

August 92015

Forex Brokers Update — August 9th, 2015

One new broker has been added to EarnForex.com during the week: Capital Index — a regulated Cypriot broker with MetaTrader 4 platform and two account types: one based on fixed spreads, and the other one based on lower spreads and commission. The minimum account size is $100. Capital Index Some of the listed brokers have been updated: FXOpen added new account type under its FCA-regulated company: STP (FXOpen […]

Read more August 9

August 92015

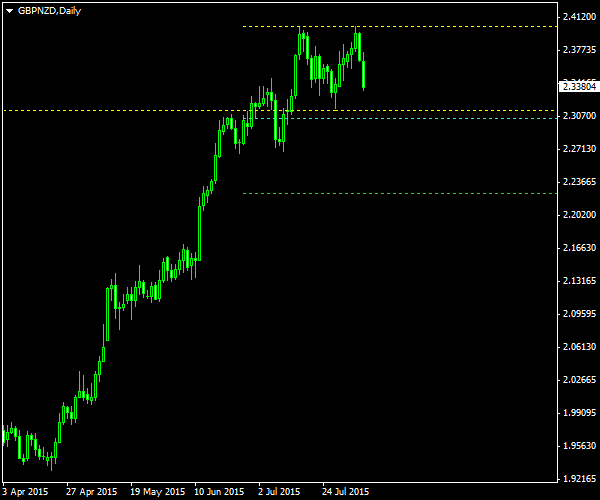

GBP/NZD After Double Top

A double top formation is currently threatening to terminate the incredibly fast ascension of GBP/NZD observed during the last four months. The pattern looks a bit short-lived but it it is also ending a rather compact uptrend, so it cannot be a detrimental disadvantage. Both tops are already in their place, and it is now time to wait for the neckline breakout. The chart below shows a double top delimited with […]

Read more August 8

August 82015

Weekly Forex Technical Analysis (Aug 10 — Aug 14)

EUR/USD Floor pivot points 3rd Sup 2nd Sup 1st Sup Pivot 1st Res 2nd Res 3rd Res 1.0728 1.0788 1.0876 1.0936 1.1024 1.1084 1.1172 Woodie’s pivot points 2nd Sup 1st Sup Pivot 1st Res 2nd Res 1.0795 1.0890 1.0943 1.1038 1.1091 Camarilla pivot points 4th Sup 3rd Sup 2nd Sup 1st Sup 1st Res 2nd […]

Read more