- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Blog

July 11

July 112015

Weekly Forex Technical Analysis (Jul 13 — Jul 17)

EUR/USD Floor pivot points 3rd Sup 2nd Sup 1st Sup Pivot 1st Res 2nd Res 3rd Res 1.0675 1.0796 1.0975 1.1095 1.1274 1.1395 1.1574 Woodie’s pivot points 2nd Sup 1st Sup Pivot 1st Res 2nd Res 1.0810 1.1004 1.1110 1.1304 1.1409 Camarilla pivot points 4th Sup 3rd Sup 2nd Sup 1st Sup 1st Res 2nd […]

Read more July 11

July 112015

Forex Brokers Update — July 11th, 2015

One new broker has been added during the week: FXPRIMUS — a CySEC-regulated company with MetaTrader 4 platform and ECN trading from $250. The maximum leverage is 1:500. CFD trading is also available (with maximum leverage of 1:100). FXPRIMUS Meanwhile, some of the Forex brokers have been updated: Tradingbanks became a regulated company in Belize. Forex-Market cut back on its multilingualism and now offers its website only […]

Read more July 10

July 102015

Rally of EUR/USD Continues

EUR/USD continued to rally today, rising more than 1 percent, as the traders’ mood was quite optimistic. Greece proposed to implement some austerity measures in exchange for the next tranche of a bailout, and now EU officials will review them while the Greek parliament should vote whether to accept such plans. The Chinese stock market continued to recover after the recent crash, adding to the traders’ optimism. Meanwhile, economic data from the United […]

Read more July 8

July 82015

EUR/USD Bounces After Sell-Off

EUR/USD bounced after yesterday’s sell-off as Greece continues to negotiate with creditors in a last-ditch effort to secure its place in the eurozone. Counterintuitively, the crisis in Greece made the dollar underperform compared to the euro as market participants speculated that the problems in Europe may hurt the US economy recovery. Considering the cautious minutes released by the Federal Reserve today, this can encourage the Fed to postpone its planned interest rate hike. US crude oil […]

Read more July 6

July 62015

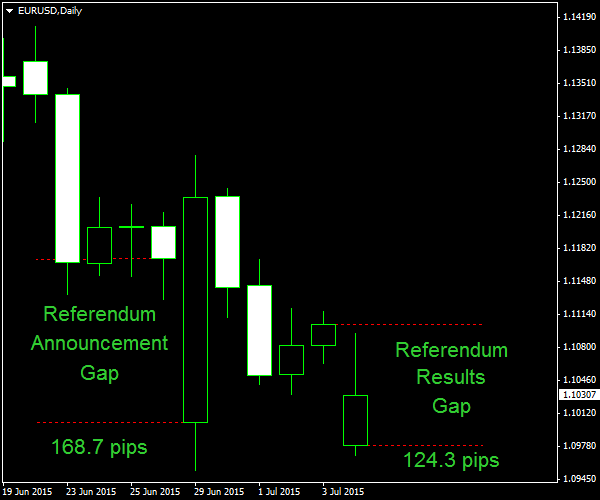

How Did Greek Referendum Affect Your Trading?

Last week, the development of the Greek debt crisis prompted the Forex brokers to make all the necessary preparations for the July 5 referendum. Brokers cut leverage, removed illiquid currency pairs from trading, convinced traders to close EUR positions before weekend, and switched many pairs, including EUR/USD to close-only mode. Of course, not all the brokers did that, but most did and for a good reason. The main motivation for all these preparations […]

Read more July 6

July 62015

EUR/USD Bounces After Opening Sharply Lower

EUR/USD opened sharply lower at the start of today’s trading session after Greece held a referendum over the weekend. The country rejected the austerity demands of its international creditors, increasing chances for the so-called Grexit (exit of Greece from the eurozone). Meanwhile, today’s data from the United States was somewhat soft, though not terrible at all. Final revision of Markit services PMI demonstrated a reading of 54.8 in June — exactly the same as analysts’ […]

Read more July 4

July 42015

Weekly Forex Technical Analysis (Jul 6 — Jul 10)

EUR/USD Floor pivot points 3rd Sup 2nd Sup 1st Sup Pivot 1st Res 2nd Res 3rd Res 1.0622 1.0788 1.0946 1.1112 1.1270 1.1436 1.1593 Woodie’s pivot points 2nd Sup 1st Sup Pivot 1st Res 2nd Res 1.0786 1.0942 1.1110 1.1266 1.1434 Camarilla pivot points 4th Sup 3rd Sup 2nd Sup 1st Sup 1st Res 2nd […]

Read more July 4

July 42015

Forex Brokers Update — July 4th, 2015

EarnForex.com now features two more companies: London FX — a regulated Forex broker from UK with a range of low-spread MT4 account types, starting with a hefty minimum of $1,000. The maximum leverage is only 1:100, but there are many instruments to choose from. London FX iClickNTrade — an Australian company regulated by ASIC. They offer one account type only — ECN with $500 minimum and 1:500 maximum […]

Read more July 2

July 22015

EUR/USD Bounces After Two-Day Decline

EUR/USD bounced today, following two days of losses, as economic news from the United States (particularly nonfarm payrolls) was mostly disappointing. This may prompt the Federal Reserve to postpone the planned interest rate, and such prospects are negative for the dollar. Still, it will be hard for the euro to keep gains as tensions surrounding the situation in Greece intensify. Nonfarm payrolls rose by 223k in June. It was not a bad figure […]

Read more July 1

July 12015

EUR/USD Continues to Move Down

EUR/USD demonstrated losses for the second consecutive session as economic news from the United States was fairly positive, especially the bigger-than-expected employment growth. Meanwhile, Greek authorities backed down and showed willingness to accept most of the austerity measures demanded by international creditors. Yet it looks like there is no more trust left for the indebted country as German Chancellor Angela Merkel said that there will be negotiations until […]

Read more