- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Blog

May 29

May 292015

Third Session of Gains for EUR/USD

EUR/USD rallied for the third straight session today after the release of economic data from the United States. Basically all US indicators were bad, even though some of them have exceeded expectations. As a result, the dollar lost some of its appeal for traders. According to the second (preliminary) estimate, US GDP fell 0.7% in Q1 2015 after rising 2.2% in Q4 2014. While the reading itself was not good, at least […]

Read more May 28

May 282015

EUR/USD Flat After Mixed US Data

EUR/USD traded flat today following US data that did not help the currency pair to find a clear direction. The pair was rising during the Asian trading session, sharply fell back during the European session and is trading sideways right now. Economic reports from the United States were mixed as unemployment claims rose unexpectedly while pending home sales reached the highest level since May 2006. […]

Read more May 27

May 272015

E-Book Review: The Predictive Power of Price Patterns

I have recently found an interesting research paper. It is almost twenty years old, but it provides a really great proof of candlestick patterns working as a predictive tool. was written by G. Caginal and H. Laurent from the Mathematics Department of the University of Pittsburgh. It was first published in the 5th issue of Applied Mathematical Finance journal in 1998 and is now available as a downloadble e-book. The introduction of the article begins with the description […]

Read more May 26

May 262015

EUR/USD Hits Monthly Low

EUR/USD hit the lowest level in a month today. While economic data from the United States was a bit mixed, there was enough good news to propel the already strong dollar even higher. Durable goods orders fell 0.5% in April, in line with analysts’ expectations. The March’s increase was revised from 4.0% to 5.1%. (Event A on the chart.) In March, S&P/Case-Shiller home price index advanced at the same 5.0% annual rate […]

Read more May 25

May 252015

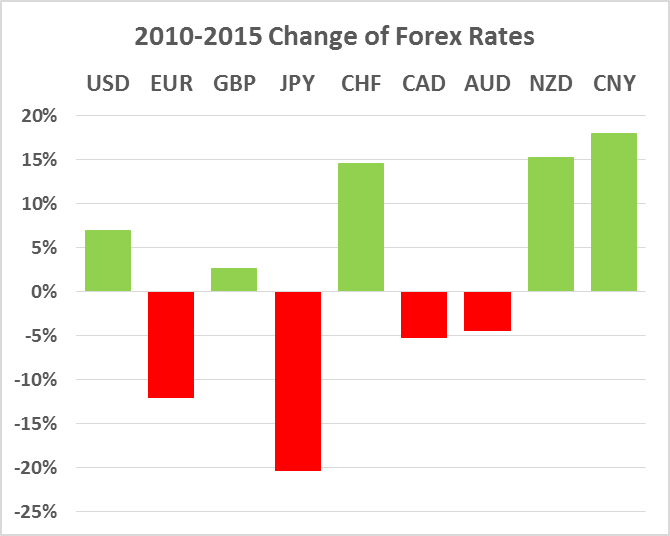

Which Currency Will Be the Biggest Forex Winner by 2020?

Without looking at any charts, my first thought about the strongest major currency during the last five years would have been the US dollar. After all, it was the major winner in the global financial crisis of 2008 when the markets had run for safety while the dollar’s rivals fared poorly. However, further analysis has shown that the biggest winner between 2010 and 2015 was not the USD. To measure the relative […]

Read more May 23

May 232015

Weekly Forex Technical Analysis (May 25 — May 29)

EUR/USD Floor pivot points 3rd Sup 2nd Sup 1st Sup Pivot 1st Res 2nd Res 3rd Res 1.0414 1.0708 1.0861 1.1155 1.1308 1.1602 1.1755 Woodie’s pivot points 2nd Sup 1st Sup Pivot 1st Res 2nd Res 1.0673 1.0791 1.1120 1.1238 1.1566 Camarilla pivot points 4th Sup 3rd Sup 2nd Sup 1st Sup 1st Res 2nd […]

Read more May 23

May 232015

Forex Brokers Update — May 23rd, 2015

No new brokers have been added during this update but the following changes have been made to existing listings: RoboForex now accepts bank deposits in Chinese yuan. FIBOGroup closed office in Australia. Added offices in Austria, Cyprus, Germany, Chile, and Singapore. Added CONTACT, Neteller, and Yandex.Money payment systems, but removed FasaPay, OKPAY, and QIWI. Demo accounts are no longer limited. Added MT5 demo. […]

Read more May 21

May 212015

EUR/USD Struggles to Keep Upward Momentum

EUR/USD rallied today as the dollar has been weakened by yesterday’s dovish FOMC meeting minutes as well as by today’s economic reports, almost all of which were disappointing. Yet the currency pair has problems with maintaining its upward momentum and is moving down right now. Initial jobless claims demonstrated an increase from 264k to 274k last week that was a bit higher than 271k predicted by analysts. (Event […]

Read more May 19

May 192015

Second Day of Losses for EUR/USD

EUR/USD declined for the second consecutive day during the current trading session as housing data from the United States exceeded market expectations. Today’s positive report followed Friday’s releases that were very disappointing for dollar bulls. Meanwhile, the German economic sentiment dropped to the lowest level since December, pushing the euro further down against the dollar. (Event A on the chart.) Both housing starts and building permits rose basically at the same seasonally […]

Read more May 17

May 172015

Forex Brokers Update — May 17th, 2015

No new companies have been listed on EarnForex.com this week but quite a few brokers have been updated: EXNESS added a cent account type. LiteForex removed old LITE, REAL, NDD, STP, and SGD account types. Added Cent accounts with $10 minimum. Forex Time reduced stop-out level for ECN accounts from 60% to 50%. Advanced Markets now offers trading in CFD, gold & […]

Read more