- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Fundamental Analysis

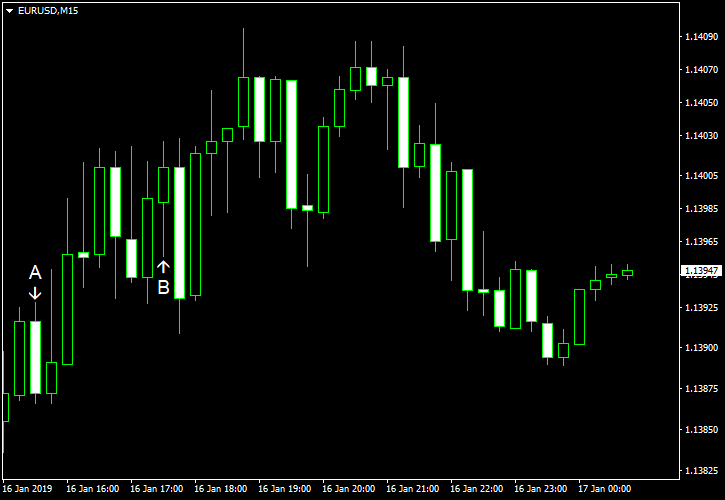

January 16

January 162019

EUR/USD Declines for Fourth Day in Five

EUR/USD declined today, falling for the fourth session in five. Some market analysts explained the gains of the dollar against the euro by rising Treasury yields, while others pointed at the pessimistic outlook for the eurozone economy as the reason for the decline of the currency pair. Both import and export prices fell in December. Import prices declined 1.0% following the 1.9% drop in November. Analysts had expected a bigger decrease by 1.3%. Export prices fell 0.6% following the 0.8% […]

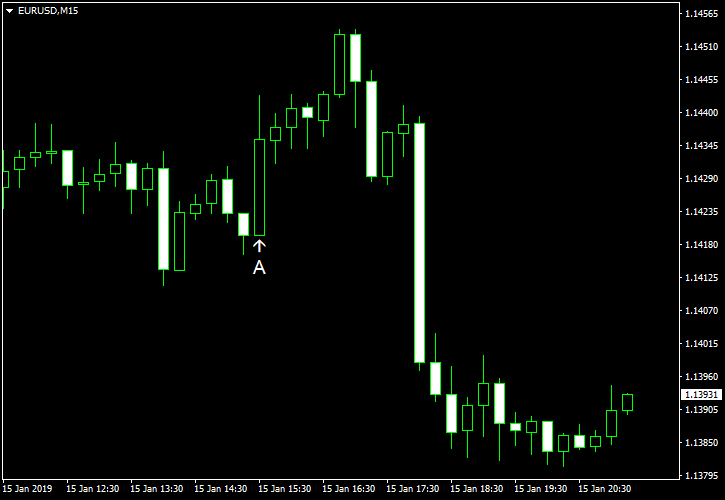

Read more January 15

January 152019

EUR/USD Crashes as German Economy Slows, Brexit Vote Starts

EUR/USD crashed today. There were a couple of likely causes of the crash: slowing growth of the German economy and the Brexit vote in the British parliament. The currency pair tumbled even as US macroeconomic data was disappointing. Talking about US data, there will be fewer releases than usual in the near future due to the US government shutdown. For example, the retail sales report that should have been released tomorrow will not […]

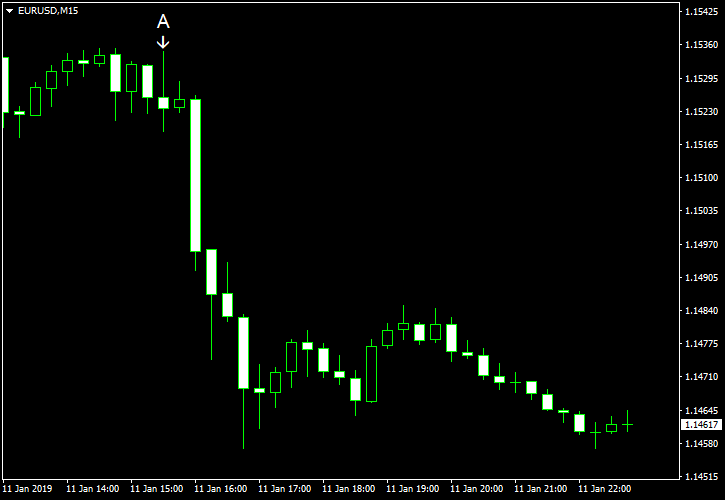

Read more January 11

January 112019

EUR/USD Drops After US CPI Matches Market Expectations

EUR/USD fell today after a report showed that US consumer inflation slowed last month but was within expectations. A report on treasury budget was planned for today, but it was postponed indefinitely due to the government shutdown. CPI declined 0.1% in December on a seasonally adjusted basis, in line with market expectations, after showing no change in November. (Event A on the chart.) Yesterday, a report on seasonally adjusted initial jobless […]

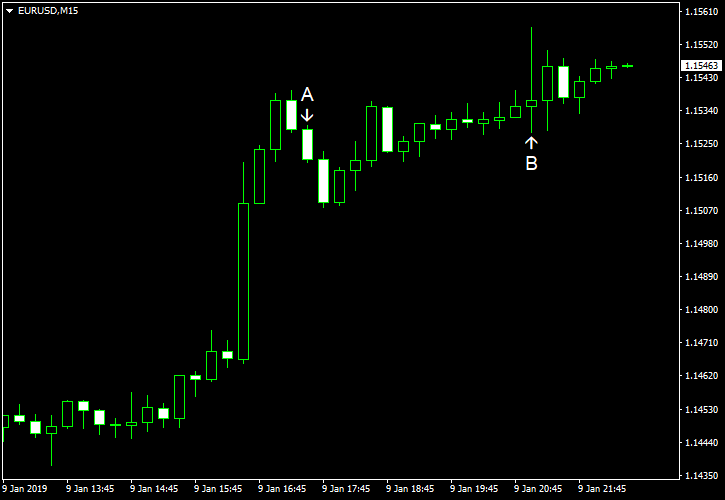

Read more January 9

January 92019

EUR/USD Surges, Maintains Gains After Dovish FOMC Minutes

EUR/USD surged today as dovish comments from US policy makers resulted in doubts whether the Federal Open Market Committee will continue monetary tightening in 2019. FOMC minutes released today added to such doubts as markets considered the notes to be dovish. US crude oil inventories shrank by 1.7 million barrels last week, though the decrease was not as big as 2.4 million predicted by analysts. The stockpiles remained above […]

Read more January 4

January 42019

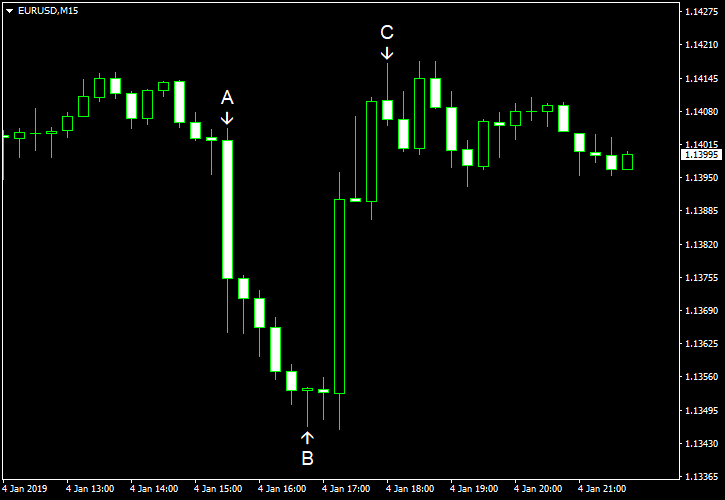

EUR/USD Experienced Great Volatility on Upbeat US Data

The US dollar has shown two spikes against the euro today — one up and one down — as markets reacted to the positive fundamentals released in the United States. EUR/USD is currently bound to end the day near its starting point. Nonfarm payrolls added 312k in December. This followed a growth by 176k in November (revised up from 155k) and was a much bigger gain than the median forecast of 179k. Average hourly earnings […]

Read more January 3

January 32019

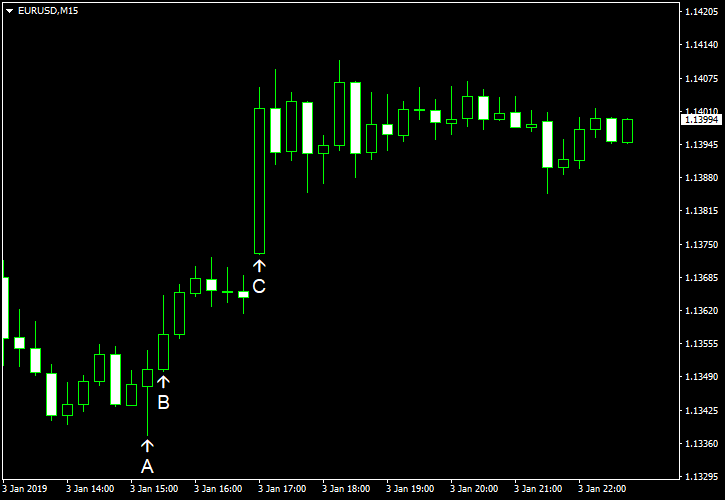

EUR/USD Rises Strengthened by Mixed US Indicators

The euro was rising against the US dollar during the daily session today and accelerated its growth after the US fundamental data disappointed dollar bulls. The currency pair stabilized afterwards. ADP employment report has shown a growth by 271k jobs in December after adding 157k jobs in November (revised down from 179k). The median forecast had been 179k for December. (Event A on the chart.) Initial jobless claims went up […]

Read more December 28

December 282018

EUR/USD Trades Without Direction on Mixed US Data

The euro could not find any definite direction in trading versus the greenback today. After the daily share of US fundamental indicators for have been released, EUR/USD has drifted to the downside mostly, however, without trending really. Chicago PMI fell from 66.4 to 65.4 in December instead of falling to 61.4 as market participants had expected. Pending home sales declined by 0.7% in November after falling by 2.6% a month earlier. Analysts […]

Read more December 27

December 272018

EUR/USD Spikes Up on Poor Consumer Confidence

EUR/USD traded in an uptrend for the most part today, largely ignoring the expected figures of the weekly employment report, but posting a high spike upon release of a monthly consumer confidence report. The bulk of market reaction seems to have happened right before the release though. Initial jobless claims fell from 217k to 216k in the United States last week. The value has been expected to remain at the previous level of 217k. However, such a small […]

Read more December 26

December 262018

EUR/USD Falls Despite Rally Attempt on Poor US Fundamentals

The euro was trading without persistent direction against the US dollar today until the poor macroeconomic report from the USA led to a strong upward wave, which turned out to be short-lived. The currency pair then declined significantly, proceeding to form a deeply bearish daily candlestick. S&P/Case-Shiller home price index increased by 5.0% in October compared to the previous year. It was expected to fall to 4.8% this time. The September growth […]

Read more December 21

December 212018

EUR/USD Declines as Risk Aversion Grabs Hold of Markets

EUR/USD declined today as markets were in the risk-off mode due to the slump of stocks around the world following the monetary policy announcement from the Federal Open Market Committee. Slightly disappointing US gross domestic product did little to halt the slump of the currency pair. US GDP expanded 3.4% in Q3 2018 according to the third and final estimate. Economists had expected the same 3.5% rate of growth demonstrated in the preliminary estimate. The US economy […]

Read more