- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Fundamental Analysis

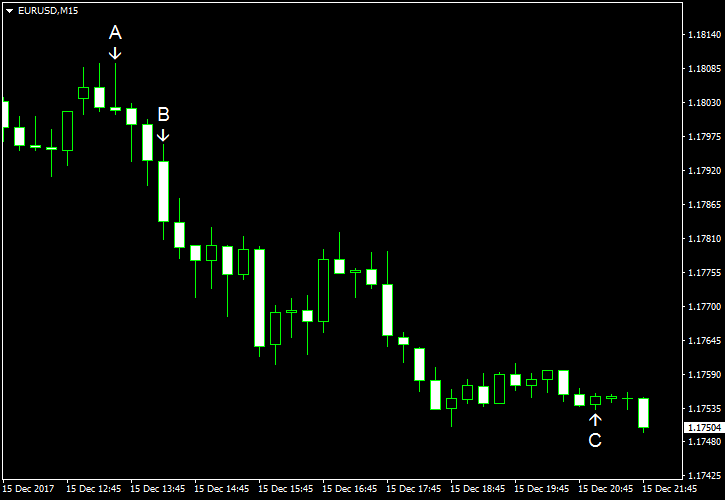

December 15

December 152017

EUR/USD Declines as Tax Reform Overshadows Economic Data

EUR/USD attempted to rally today but failed and dropped, even though almost all economic reports released in the United States were worse than expected. The possible reason for the drop were the signs that the Republicans were close to passing the US tax reform bill. NY Empire State Index fell from 19.4 in November to 18.0 in December. Analysts had promised a smaller decrease to 18.8. (Event A on the chart.) Industrial production rose […]

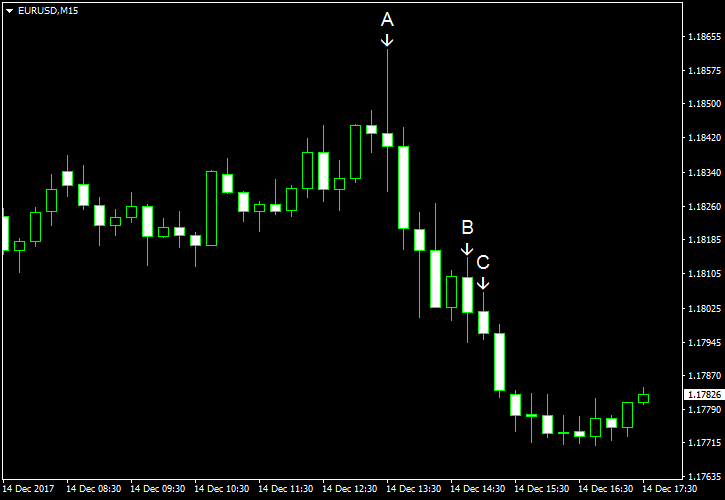

Read more December 14

December 142017

EUR/USD Jumps After FOMC, Core CPI Miss

EUR/USD rallied on Wednesday and remained elevated on Thursday due to news from the United States. Headline US inflation was within expectations, but the core figure missed forecasts. The Federal Open Market Committee hiked the benchmark interest rate as was expected, but there were two dissenters. And markets doubt that the FOMC will be able to perform three more hikes next year despite its projections. CPI rose […]

Read more December 14

December 142017

EUR/USD Drops After Release of Solid US Economic Reports

EUR/USD dropped today as almost all reports released in the United States over the trading session were good. The signs that the voting for the final version of the US tax reform bill may happen as soon as the next week also drove the currency pair down. Retail sales rose 0.8% in November, exceeding the median forecast of 0.3%. The previous month’s increase was revised from 0.2% to 0.5%. (Event A on the chart.) Import and export prices […]

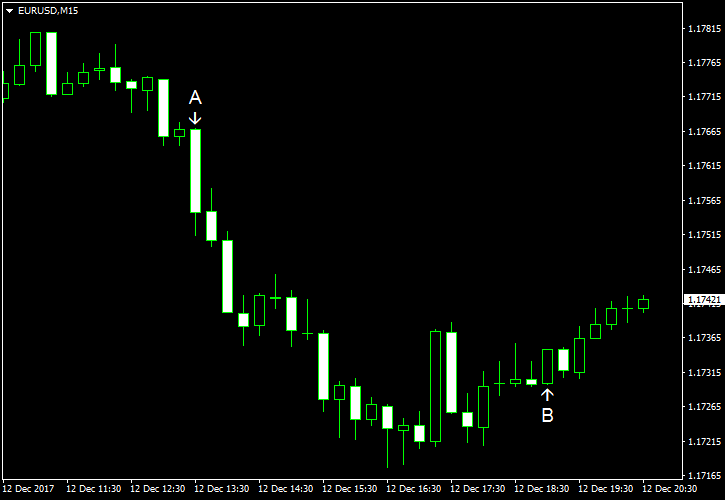

Read more December 12

December 122017

EUR/USD Drops as Traders Wait for FOMC, PPI Shows Stable Growth

EUR/USD dropped today as US producer inflation remained stable. Now, traders focus on the meeting of the Federal Open Market Committee. The FOMC started the two-day gathering today and will announce its decision tomorrow. It is widely expected that the Committee will raise interest rates further. PPI rose 0.4% in November, seasonally adjusted, in line with expectations and the same as in October. (Event A on the chart.) Treasury budget deficit widened from […]

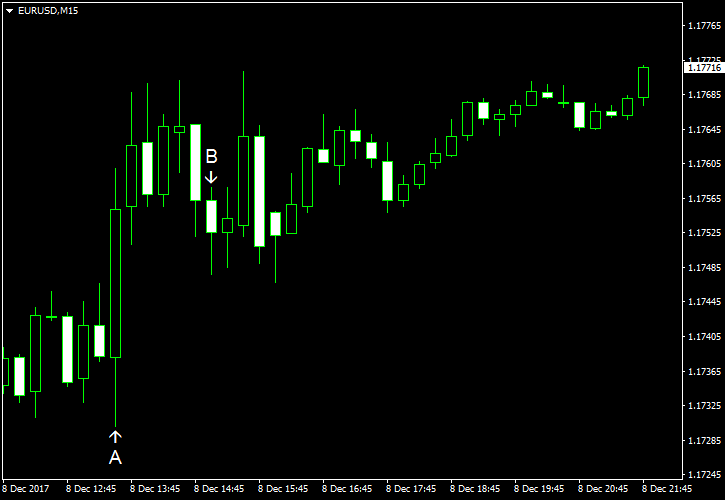

Read more December 9

December 92017

EUR/USD Erases Losses After NFP Show Disappointing Wage Growth

EUR/USD was attempting to extend its decline on Friday but bounced back to the opening level after the release of US nonfarm payroll. While employment growth was solid and even beat expectations, wage inflation missed expectations, even though it accelerated. Nonfarm payrolls rose by 228k in November, beating the common expectations of 198k. The October increase was revised down from 261k to 244k. Unemployment rate stayed at 4.1% as expected. […]

Read more December 7

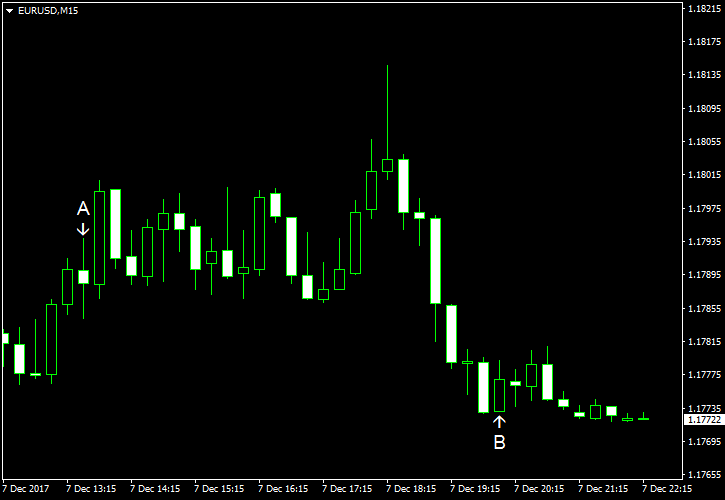

December 72017

EUR/USD Declines for Third Session as Traders Remain Hopeful for Tax Reform

EUR/USD extended its decline for the third session in a row today as investors remained hopeful that US politicians will implement the tax reform and it will be beneficial to the US economic growth. The currency pair also fell as risk aversion rose after US President Donald Trump said that Jerusalem is the capital of Israel. As for economic data, the current trading session was light on reports from the United States, but […]

Read more December 6

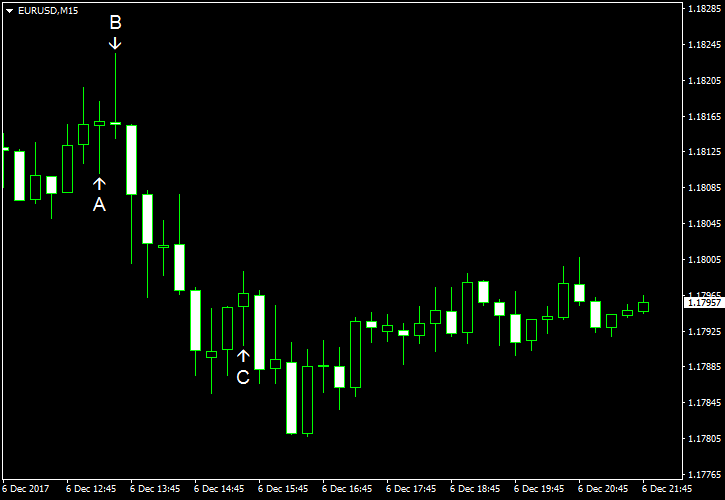

December 62017

EUR/USD Continues Move Down as Traders Wait for Tax Overhaul

EUR/USD continued its move down today as traders were waiting for US politicians to proceed with the tax reform. Analysts also said that the rally was a result of US companies wanting to repatriate cash parked overseas before the year-end. As for US economic data, the ADP employment report came within expectations, and traders wait for Friday’s nonfarm payrolls. ADP employment rose by 190k in November, in line with market expectations. The indicator […]

Read more December 5

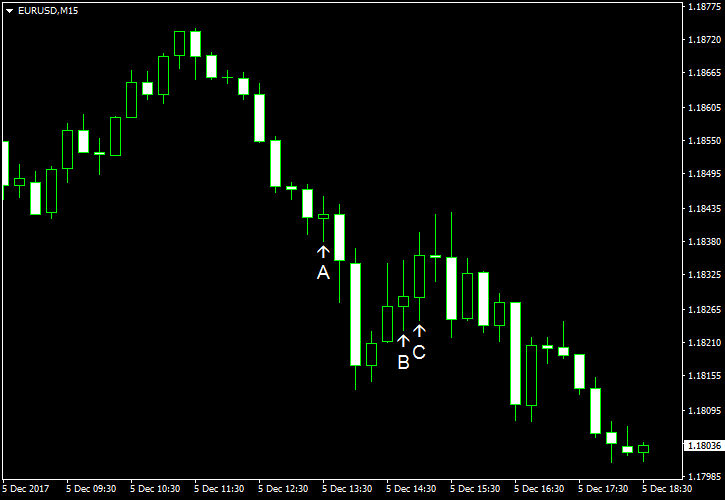

December 52017

EUR/USD Drops Despite Slowing US Services Sector

EUR/USD dropped today even though data released over the trading session revealed that growth of the US services sector slowed in November more than was expected. Market analysts attributed the dollar’s strength to the euphoria after the Senate passed its version of the tax reform bill on the weekend. Now, the Senate and the House of Representatives need to reconcile their versions of the bill, and markets may act erratically depending on the news they will hear. […]

Read more December 1

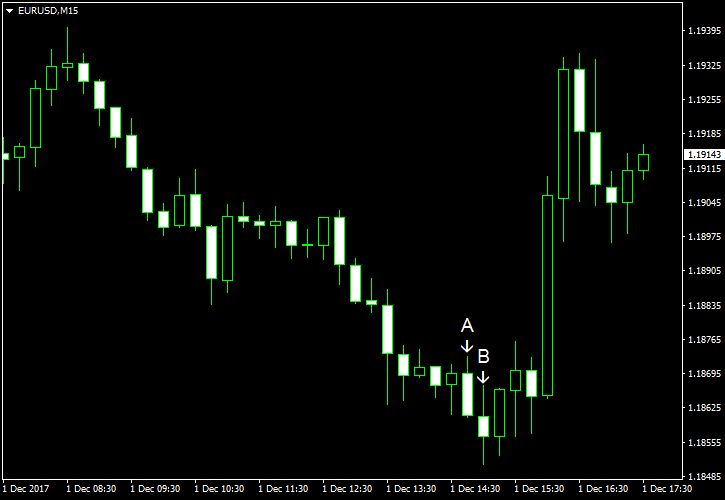

December 12017

EUR/USD Rebounds Sharply as Flynn Prepares to Testify Against Trump

EUR/USD was falling throughout the current trading session but bounced sharply after the report that US national security adviser Michael Flynn is prepared to testify that President Donald Trump directed him to make a contact with Russians. The news drew investors’ attention away from the question of the US tax reform and today’s US economic data. Markit manufacturing PMI slipped from 54.6 in October to 53.9 in November […]

Read more November 30

November 302017

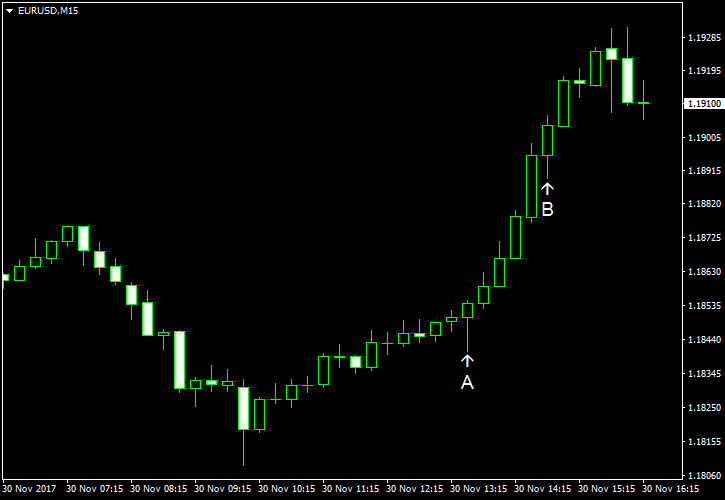

EUR/USD Jumps Despite Positive US Data

EUR/USD jumped today even though all macroeconomic reports released in the United States over the trading session were either good, or at least better than expectations. Nevertheless, the dollar was weak across the board. Analysts attributed that to tumultuous US politics, like the heated debates about the tax reforms or the news about replacement of the Secretary of State. Initial jobless claims were at the seasonally adjusted level of 238k last week, a bit […]

Read more