- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Fundamental Analysis

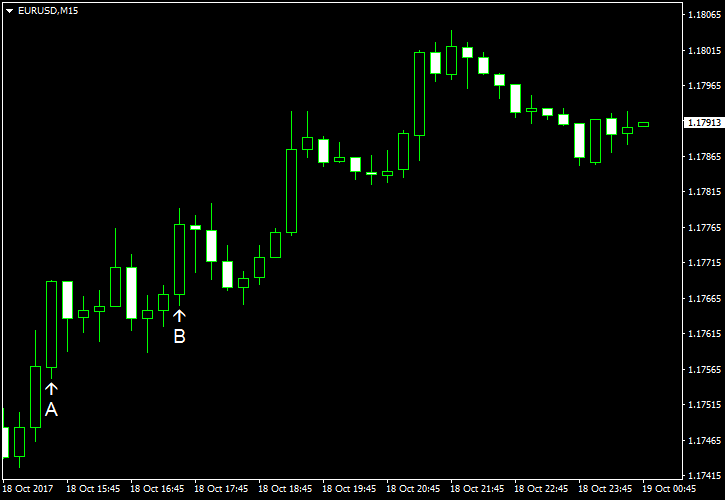

October 18

October 182017

EUR/USD Bounces from Daily Low, Logs Small Gain

EUR/USD was falling during the first half of the Wednesday’s trading session, but reversed its movement later and settled with a gain, albeit a small one. The worse-than-expected housing data released in the United States during the session probably contributed to the bounce of the currency pair. Housing starts were at the seasonally adjusted annual rate of 1.13 million in September, while analysts had expected the same 1.18 million rate as in August. Building permits were […]

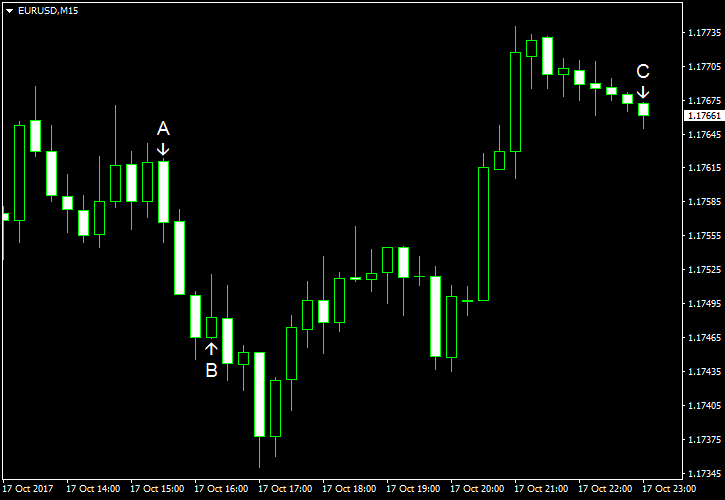

Read more October 17

October 172017

EUR/USD Dips on Prospects for Hawkish Fed Chair

EUR/USD dipped today amid speculations that a new Federal Reserve chief may be a hawk. Market participants consider a December interest rate hike almost a guarantee and think that another rate increase is possible in the first half of 2018. All that is bullish for the dollar, and the set of decent economic reports released in the United States today did not hurt the US currency either. Import and export prices rose […]

Read more October 16

October 162017

EUR/USD Little Changed as Euro & Dollar Struggle to Find Direction

EUR/USD moved lower today, but the drop was meager as neither the euro nor the dollar showed clear direction during the Monday’s trading session. The greenback continued to suffer from the Friday’s underwhelming inflation report, while the euro had troubles attracting traders due to uncertainty regarding the outlook for monetary policy of the European Central Bank. NY Empire State Index climbed from 24.4 to 30.2 in October, reaching the highest level in three […]

Read more October 12

October 122017

EUR/USD Slips After Four Sessions of Gains

EUR/USD fell today, driven down by a range of factors, solid US economic data released over the current session being one of them. Yesterday, the currency pair rose for the fourth consecutive trading session as FOMC meeting minutes came out unexpectedly dovish, though most market participants continued to anticipate a December rate hike. PPI rose 0.4% in September, exactly as analysts predicted, after rising 0.2% in August. (Event A on the chart.) […]

Read more October 6

October 62017

EUR/USD Drops After NFP Fall, Rebounds Later

EUR/USD was moving mostly sideways ahead of the release of nonfarm payrolls and dropped after the report came out, even though it showed the first drop of US employment in seven years. Yet markets were unfazed as the report mentioned that the result was affected by the damage done by two hurricanes, meaning that the decline does not reflect the underlying strength of the US economy. What is more, other components of the data were […]

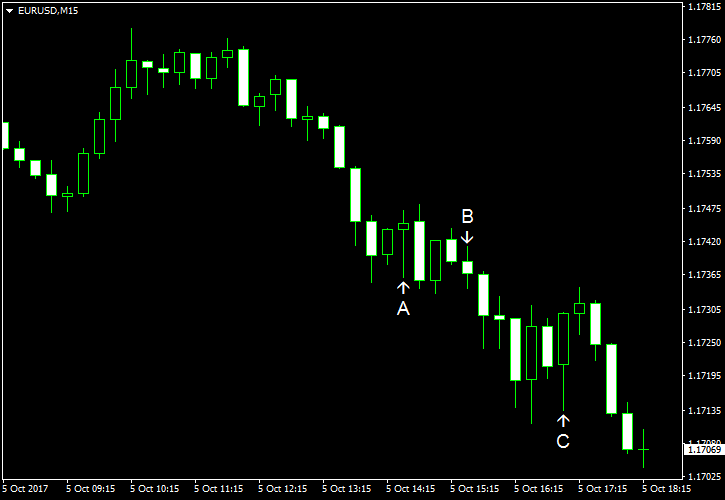

Read more October 5

October 52017

EUR/USD Drops After ECB Minutes, US Economic Data

EUR/USD dropped today as basically all economic reports released in the United States over the trading session were good. The European Central Bank released minutes of its latest policy meeting today, showing that some policy makers argued in favor of maintaining monetary stimulus. (Event A on the chart.) That was also negative to the currency pair. Initial jobless claims fell from 272k to 260k last week, below the average forecast […]

Read more October 4

October 42017

EUR/USD Shows Muted Reaction to US Data

EUR/USD was moving up and down during the current session, paying seemingly little heed to economic data, even though there were plenty of important reports released in the United States today. Both euro and the dollar had their own negative factors weighing on them. In Europe, the political crisis in Spain after the Catalan independence referendum was hurting the shared European currency, while the greenback suffered from uncertainty over the change […]

Read more October 2

October 22017

EUR/USD Drops After Catalan Independence Vote, US Manufacturing

EUR/USD slipped today after Catalonia voted for separating from the rest of Spain in the independence referendum, which was condemned by the Spanish government as unconstitutional and illegal. The solid expansion of the US manufacturing sector drove the currency pair further down. Seasonally adjusted Markit manufacturing PMI was up from 52.8 to 53.1 in September according to the final estimate. Analysts were expecting the same 53.0 reading as in the preliminary report. (Event A on the chart.) ISM manufacturing […]

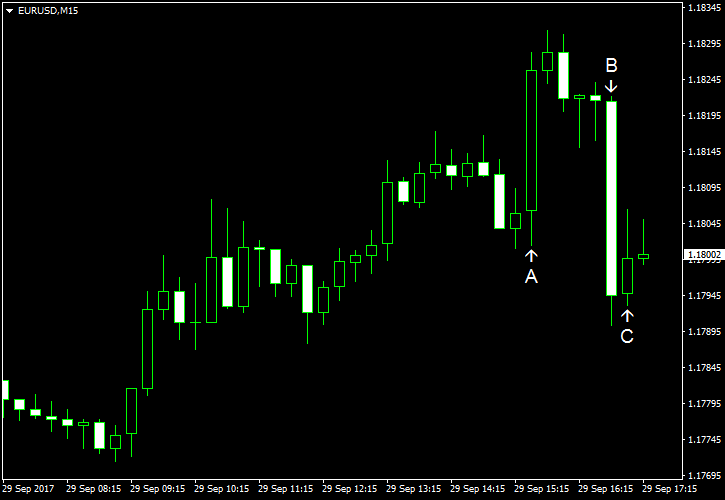

Read more September 29

September 292017

EUR/USD Rises After Core PCE Inflation Misses Expectations

EUR/USD was rising today and extended its rally after core PCE inflation, the Federal Reserve’s favorite gauge of consumer price growth, missed expectations. The consumer sentiment, while close to expectations, fell. The only better-than-expected indicator was the surprisingly good Chicago PMI, but it alone was unable to help the dollar (though caused a short-lived dive for EUR/USD). Both personal income and spending increased in August, rising by 0.2% and 0.1% […]

Read more September 28

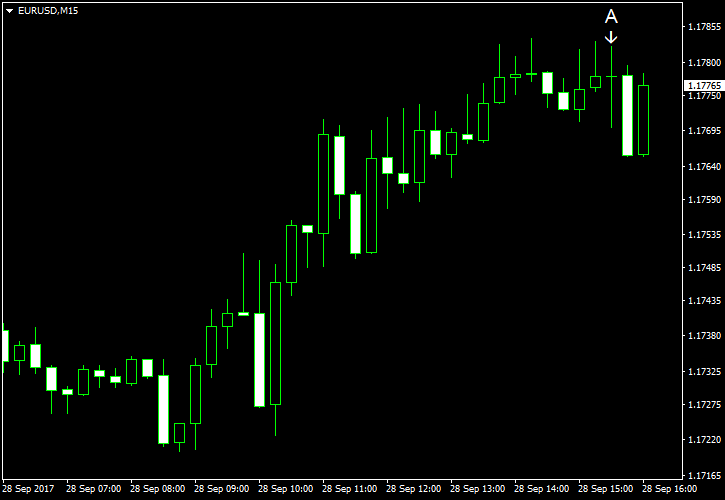

September 282017

EUR/USD Rises Despite Upward Revision to US GDP

US gross domestic product received an upward revision to its reading for the second quarter of this year. But that did not prevent EUR/USD from halting its decline today. GDP rose 3.1% in Q2 2017 according to the final estimate after increasing 1.2% in Q1. The actual reading was a bit better than the average forecast and the previous estimate of 3.0%. (Event A on the chart.) Initial jobless claims were at the seasonally adjusted […]

Read more