- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

News

May 8

May 82020

Australian Dollar Remains Strong After Economic Forecast

The Australian dollar remained firm today, being one of the strongest currencies on the Forex market, second only to the New Zealand dollar. The Australian central bank released its economic projections on Friday. While they were pessimistic in the short term, over the longer term the projections were fairly positive. The Reserve Bank of Australia released the Statement on the Monetary Policy today. As part of the release, the RBA provided updated economic projections. The country’s gross domestic […]

Read more May 8

May 82020

Japanese Yen Weakest on Forex After US-China Trade Talks

The Japanese yen was the weakest currency on the Forex market today after the market sentiment improved, limiting demand for the currency in its role as a safe haven. Traders felt more optimistic after the seemingly positive developments in the trade talks between the United States and China. Relations between the USA and China strained as US President Donald Trump was accusing the Asian nation of mishandling the coronavirus epidemic and withholding information about it, which led […]

Read more May 8

May 82020

USD/JPY Heading for the 105.55 Major Support

The US dollar versus the Japanese yen currency pair is approaching the weekly support level of 105.55. How may the market react? Long-term perspective After falling from the 111.70 high, the price extended until the 107.09 level, which served as support almost for the entire length of April. As the market was printing lower highs and the bulls were showing less and less conviction to drive the price higher, the expected outcome happens, as the price pierced […]

Read more May 7

May 72020

Turkish Lira Slightly Rebounds After Crashing to Record Low

The Turkish lira is slightly rebounding on Thursday after crashing to a record low against the US dollar early on Thursday. Investors are nervous about Turkeyâs response to the economic fallout from the coronavirus pandemic, as well as the decline in the central bankâs reserves. Could the world bail out Turkey once the COVID-19 crisis subsides? The Turkish economy was already under mounting pressure before the world was shut down due to the virus outbreak. […]

Read more May 7

May 72020

US Dollar Mixed As Pace of Historic Layoffs Slows Down

The US dollar is mixed against its G10 currency rivals on Thursday after new labor data suggests the pace of the historic layoffs in the aftermath of the coronavirus pandemic appear to have slowed down. All eyes will be on the Thursday jobs report, and analysts are anticipating 21 million lost jobs. Have investors already priced in a devastating reading into the broader financial markets? According to the Department of Labor, initial jobless claims […]

Read more May 7

May 72020

Australian Dollar Strongest After Australian & Chinese Trade Data

The Australian dollar rallied against all other most-traded currencies today after positive trade data released in China, Australia’s biggest trading partner, and Australia itself. Reports about the services sector were rather bad in both Australia and China but that did not prevent the Aussie from logging substantial gains. The Australian Industry Group Australian Performance of Services Index sank from 38.7 in March to 27.1 in April, seasonally […]

Read more May 7

May 72020

Euro Trades Sideways on Weak German Data, EU Differences

The euro today traded sideways against the US dollar amid weak macro reports from Germany and France as investors await crucial US jobs data. The EUR/USD currency pair today traded within a tight range following three daily pullbacks as divisions among EU nations persist. The EUR/USD currency pair today traded in a range marked by a high of 1.0816 and a low of 1.0778 and was within this range at the time of writing. The currency […]

Read more May 7

May 72020

Pound Spikes Higher on BoE Rate Decision, Retreats on Dovishness

The Sterling pound today spiked to new daily highs after the Bank of England announced its monetary policy decisions early in the London session. The GBP/USD currency pair later gave up most of its gains as investors digested the BoE’s seemingly dovish stance on the economy amid calls for more stimulus. The GBP/USD currency pair today spiked to a high of 1.2417 after the BoE rate decision, but later gave up most of its […]

Read more May 7

May 72020

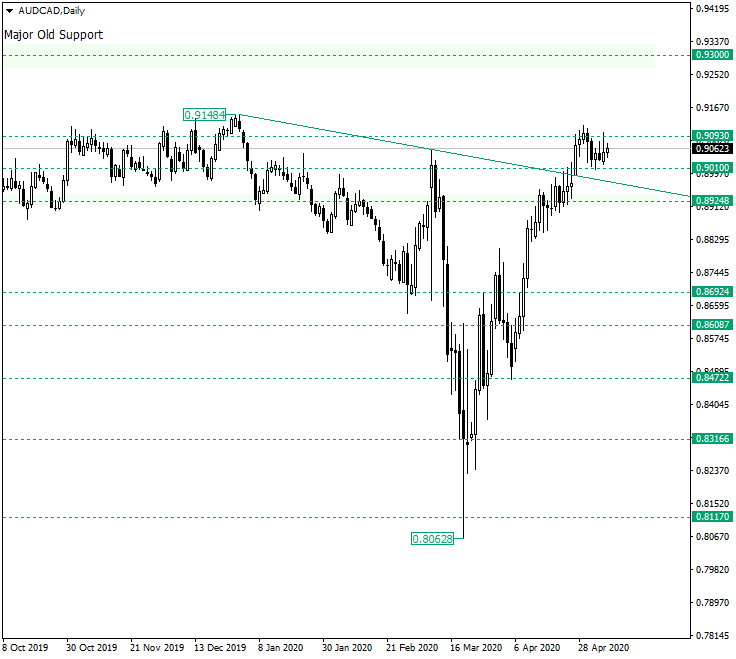

AUD/CAD Between 0.9093 and 0.9010

The Australian dollar versus the Canadian dollar currency is in a position from where it could go either up or down. Is there any hint on the direction? Long-term perspective The appreciation that started from the low of 0.8062, after the level of 0.8117 was confirmed as support, continued until it reached the double resistance area made possible by the level of 0.8924 and, more importantly, the trendline that starts from 0.9148. Once […]

Read more May 6

May 62020

Japanese Yen Rallies Against US Dollar on Safe Haven Flows

The Japanese yen today rallied against the US dollar driven by the risk-off market sentiment, which saw the yen benefit from safe-haven flows. The USD/JPY currency pair fell to new multi-week lows as the yen kept making gains against the greenback despite the DXY’s gains. The USD/JPY currency pair today fell from an opening high of 106.45 to a low of 105.98 in the American session but was slightly off these lows at the time of writing. […]

Read more