- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

News

May 6

May 62020

Chinese Yuan Slips on Reports US Considering Canceling Debt Owed to China

The Chinese yuan is weakening against its major currency competitors midweek on reports that the US administration is considering canceling all or part of the roughly $1.1 trillion debt owed to China. According to local reports, Beijing is now mulling over a plan that would reduce its holdings of Treasurys as part of overall efforts to diversify the nationâs foreign exchange reserves. The White House has blamed China for its mishandling […]

Read more May 6

May 62020

US Dollar Remains Strong Despite Worst Employment Drop in History

The US labor market lost the biggest amount of jobs in history last month. But the US dollar was hardly fazed by the disastrous data, remaining one of the strongest currencies on the Forex market during Wednesday’s trading. Automatic Data Processing released an employment report that showed an unprecedented drop of 20,236,000 from March to April on a seasonally adjusted basis. While the actual value was slightly better than the markets’ pessimistic expectations, it […]

Read more May 6

May 62020

Sterling Weakest After UK Construction PMI Sinks to Record Low

The Great Britain pound was the weakest currency on the Forex market during Wednesday’s trading. Initially, the euro was the second weakest but currently, the Canadian dollar replaced it, falling versus the shared European currency and trading about flat against the sterling. The drop of the UK construction index to the record low was among possible reasons for the slump of Britain’s currency. The headline seasonally adjusted IHS Markit/CIPS UK Construction Total Activity Index […]

Read more May 6

May 62020

Euro Among Weakest After Dire Macroeconomic Data

The euro was among the weakest currencies on the Forex market today after the release of a bunch of extremely poor macroeconomic reports and a very pessimistic economic forecast. While the currency has trimmed its losses by now, it is still trading lower against the vast majority of the most-traded currencies. The one exception was the Great Britain pound, which was even weaker than the euro. Eurostat reported that retail sales sank by 11.2% […]

Read more May 6

May 62020

NZ Dollar Attempts to Rise After Surprise Growth of Employment

The New Zealand dollar attempted to rally today following a surprisingly positive employment report that showed that New Zealand unexpectedly added jobs last quarter. The currency has retreated against some of its rivals by now but managed to keep gains versus others. Statistics New Zealand reported that the number of employed New Zealanders increased by 0.7% in the March quarter, seasonally adjusted, versus expectations of a 0.2% decline. Year-on-year, […]

Read more May 6

May 62020

Australian Dollar Edges Higher After Positive Retail Sales

The Australian dollar rose a bit today following the release of a better-than-expected retail sales report. Gains were limited, though, as the market sentiment was mixed, failing to help the currency in finding direction. The Australian Bureau of Statistics reported that retail sales climbed by 8.5% in March on a seasonally adjusted basis. Market participants were expecting an increase at the same 8.2% rate as in the preliminary report. The sales were up 0.6% in the prior month. Yesterday, the Reserve […]

Read more May 6

May 62020

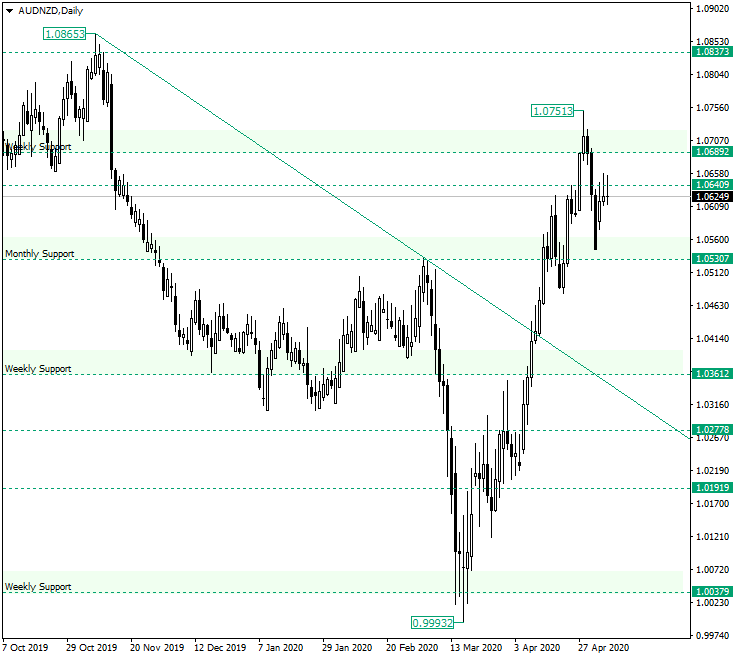

AUD/NZD at the 1.0640 Resistance

The Australian dollar versus the New Zealand dollar currency pair might be under bearish pressure. Long-term perspective The rally that started from the 0.9993 low after the weekly support level of 1.0037 was confirmed, extended until the high of 1.0751. But while approaching the old monthly and weekly supports of 1.0530 and 1.0689, respectively, the bulls began to lose momentum. This can be seen in the middle of April when the price oscillated […]

Read more May 5

May 52020

Swiss Franc Weakens As Manufacturing Slumps, Capped by SNB Intervention

The Swiss franc is weakening on Tuesday as the latest manufacturing figures highlighted an industry that is in a sharp decline. The franc’s slide was exacerbated by the central bankâs foreign exchange interventions to prevent currency appreciation. With Switzerland reopening in the aftermath of the coronavirus pandemic, could the economy rebound in the second half of 2020 and elevate the franc even more? The procure.ch manufacturing purchasing managersâ index (PMI) declined to 40.7 in April, down from 43.7 in the previous […]

Read more May 5

May 52020

US Dollar Weakens As Treasury to Borrow Record $3 Trillion in Q2

The US dollar is weakening against some of its G10 currency counterparts on Tuesday as the federal government announced that it would borrow $3 trillion in the second quarter. The US government has been going on a spending spree to contain the coronavirus pandemicâs economic fallout, making Washington poised for a $3.8 trillion deficit for the fiscal year 2020. The greenback is also getting a hit on disappointing economic data that continues to highlight the outbreakâs […]

Read more May 5

May 52020

GBP/CAD, Retesting the 1.7500 Level?

The Great Britain pound versus the Canadian dollar seems to be a little undecided. Long-term perspective After confirming the important 1.6620 level, the price extended until the long-time resistance area of 1.7811. In doing so, it also pierced the intermediary level of 1.7499. But when meeting the resistance of 1.7811, the price retreated, falling around the triple support area defined by the two trendlines and the 1.7160 level. From the triple support, the bulls attempted, yet […]

Read more