- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

February 20

February 202009

Rupee to Post Worst Weekly Drop This Year

The Indian rupee declined against the U.S. dollar today and is currently ready to show the biggest weekly drop since the beginning of the year as the slump of the U.S. stock markets was followed by the decline in the Asian markets. The Bombay Stock Exchange benchmark index (SENSEX) is currently falling by more than 2.5 percent. Such a strong decline in the stocks prompt foreign investment […]

Read more February 19

February 192009

EUR/USD Almost Snaps Previous Losses on Positive U.S. PPI

The euro and other major currencies were growing for the whole day against the U.S. dollar today. EUR/USD almost rose to its Tuesdays open level — the day when it fell by the most since February 4th. Currently EUR/USD is trading near 1.2684. PPI increased by 0.8% in United States in January. It was expected to rise by only 0.2% after falling down by 1.9% in December. It looks like […]

Read more February 19

February 192009

AUD Gains for 2nd Day as Confidence Grows

The Australian dollar showed the second day of growth against the U.S. dollar and the Japanese yen today as the traders feel a growing confidence in the Australian economy after the much-needed stimulus package has been adopted there. The strategists from Commonwealth Bank of Australia recommend buying the Aussie against the dollar, the euro and the yen, stating that it will […]

Read more February 18

February 182009

EUR/USD Stagnates as Housing and Industrial Production Declines

EUR/USD remained almost unchanged today on the Forex market after a huge drop yesterday. The market was affected by some important macroeconomic news from the United States today and the currency pair reacted with some moderate spikes in both direction. Now its trading near 1.2568. Building permits in January fell to the annualized and seasonally adjusted level of 521k — down from 547k reported […]

Read more February 18

February 182009

Euro Recovers From Yesterday Losses

The euro posted a moderate daily gain against the other major currencies today after some regional banks reported not-so-bad results for the fourth quarter of 2008. Among the banks that surprised the market analysts were the German Commerzbank AG and the Dutch ING Groep NV. Both of them reported lesser losses for the last quarter than the average estimates […]

Read more February 17

February 172009

Bad Empire State Manufacturing Survey and Good TIC Flows Make Euro to Go Down

EUR/USD declined significantly today (fastest since February 4) as the the mixed macroeconomic statistics from U.S. urged investors to sell the euro and the move for the U.S. dollar. EUR/USD is currently trading at 1.2598 after opening at 1.2795 today. Empire State Manufacturing Survey report showed a decline of the general business conditions index from -22.2 to a new record low of -34.7. The market participants expected only a small […]

Read more February 17

February 172009

Euro Weakens before ZEW Survey

The European single currency reached its lowest level against the dollar since the early December as the Forex traders expect that the ZEW Survey report will show that the Eurozones business confidence is at the very low levels today. There are also expectations that the credit rating of several big European banks may get downgraded soon on the concerns that their […]

Read more February 16

February 162009

USD/KRW Approaches 2-Month High

The South Korean won declined to almost two-month low level against the U.S. dollar today as the global economic crisis worsened, prompting investors to sell the emerging markets assets. Since January 1st until today the Korean currency has fallen 11 percent versus the dollar, showing one of the worst results among the most-traded Asian currencies. The Japanese economy slid by 12.7 percent […]

Read more February 15

February 152009

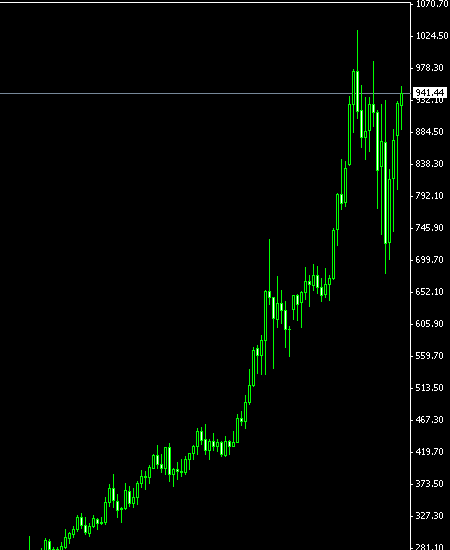

When Will the Gold Bubble Burst?

The gold seems to be becoming the favorite investment around as the traders are afraid of the crisis and the fiat currencies seem to be in a great danger when all those anti-crisis measures will induct a massive wave of inflation, reducing the moneyâs buying power. In such an environment gold looks like a good investment to save oneâs assets and to multiply them if you trade with a considerable leverage. Forex traders may also decide to capitalize the expected upward gold trend as many […]

Read more February 14

February 142009

Forex Technical Analysis for 02/16—02/20 Week

EUR/USD trend: hold. GBP/USD trend: buy. USD/JPY trend: hold. EUR/JPY trend: sell. Floor Pivot Points Pair 3rd Sup 2nd Sup 1st Sup Pivot 1st Res 2nd Res 3rd Res EUR/USD 1.2317 1.2518 1.2690 1.2891 1.3063 1.3264 1.3436 GBP/USD 1.3147 1.3641 1.3997 1.4491 1.4847 1.5341 1.5697 USD/JPY 87.48 88.58 90.21 91.31 92.94 94.04 95.67 EUR/JPY 110.31 […]

Read more