- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: June 15, 2012

June 15

June 152012

Dollar Suffers from Bad Fundamental Data

The US dollar fell today after bad fundamental reports spurred speculations that the Federal Reserve would implement the third round of quantitative easing nest week. The currency closed flat versus the euro. Industrial production fell 0.1 percent last month instead of rising as was expected. The University of Michigan preliminary index of consumer sentiment unexpectedly dropped to 74.1 in June from 79.3 in the month before. The bad data supports the case […]

Read more June 15

June 152012

Aussie Gains vs. Greenback & Euro, Falls vs. Yen

The Australian dollar rose against its US counterpart and climbed to the highest level since March versus the euro today. The currency declined against the Japanese yen, though trimmed its losses. The Australian currency (often called “Aussie”) managed to rally today even amid uncertainty about the future of the eurozone ahead of the Greek elections this weekend and poor macroeconomic reports from the United States. Rumors about coordinated efforts of central banks […]

Read more June 15

June 152012

Euro Pulls Back a Little on Uncertainty

Euro is pulling back a little on uncertainty today. Euro was higher earlier on the news that central banks would coordinate efforts in the event that Greek elections go badly this weekend, but there is enough disquiet about what’s ahead that the euro is slightly lower. Euro got a bit of a boost earlier on the expectation that central banks would unite in efforts to blunt the worst of the damage if […]

Read more June 15

June 152012

Canadian Dollar Pulls Back on Global Economic Concerns

Even though investors are sending stocks higher, there are plenty of concerns about the economy dragging down some of the high beta currencies, including the Canadian dollar. Loonie is down against the US dollar, heading lower on expectations of a slowing global economy. Concerns about the crisis in Europe, slowing growth in China, and sluggish recovery in the United States are all weighing on Canada, which relies heavily on exports (especially oil) […]

Read more June 15

June 152012

Won Gains on Hopes for QE3 from Fed, Gains Limited

The South Korean won rose today as speculations that the US Federal Reserve would stimulate the slowing economy continued to bolster higher-yielding assets of emerging markets. The won profited, as most other currencies associated with higher risk, from increasing probability of the third round of quantitative easing from the Fed. Gains were limited, though, as uncertainty about the outcome of the elections in Greece this weekend reduced investors’ willingness to risk. Analysts said […]

Read more June 15

June 152012

EUR/USD Down Ahead of Greek Elections

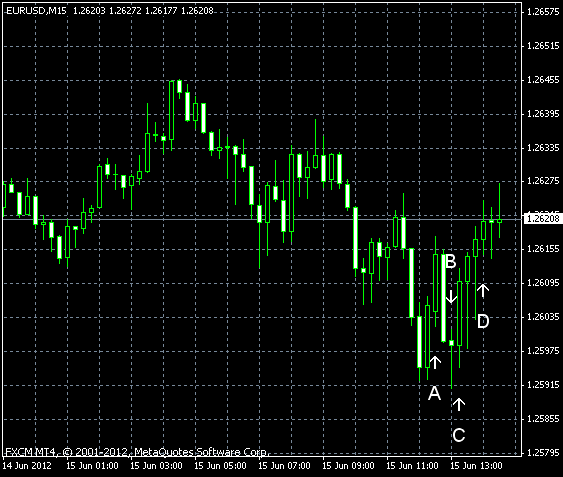

EUR/USD was a little down today ahead of the Greek elections this weekend that may decide the fate of the eurozone. The currency pair trimmed its earlier losses as all of today’s economic reports from the United States were worse than anticipated. This week was very bad for the dollar from the fundamental point of view as most of indicators were bad, prompting talks that the third round of quantitative easing may yet […]

Read more June 15

June 152012

Forex Point-and-Figure Charting Solutions

Contents 1 What Is Point-and-Figure? 2 Software P&F Solutions 2.1 Non-MetaTrader Solutions 2.2 MetaTrader Solutions 2.2.1 MT4 2.2.2 MT5 2.3 Paid Options 3 Books 3.1 Free 3.2 Paid 4 Conclusion What Is Point-and-Figure? Point-and-figure is a method to represent the price information on charts. It is like Japanese candlesticks, bars and lines but different. It does not use the time scale […]

Read more June 15

June 152012

Yen Jumps After BoJ Refrains from Stimulus

The Japanese yen climbed against all other major currencies today after the Bank of Japan left its monetary policy unchanged, refraining from expanding monetary stimulus. The BoJ left its main interest rate near zero and the size of asset purchases unchanged at today’s policy meeting. The central bank voiced hopes in its statement that the economy will “return to a moderate recovery path as domestic demand remains firm and overseas […]

Read more June 15

June 152012

Mexican Peso Rises as Traders Put Hopes on Central Banks

The Mexican peso gained on speculations that the Federal Reserve will stimulate the US economy as measure to support the faltering recovery and on rumors that European central bank will coordinate their efforts to bolster the European economy. With the recent wave of negative macroeconomic data from the United States, the third round of quantitative easing is a definite possibility. Aryam Vazquez, an economist at Wells Fargo & Co., voiced his opinion regarding the influence […]

Read more