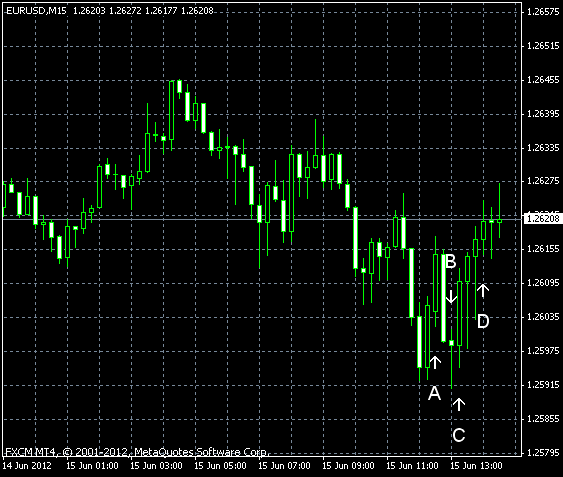

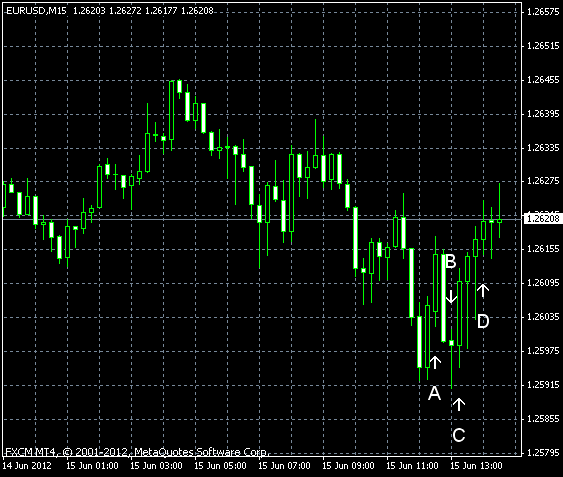

EUR/USD was a little down today ahead of the Greek elections this weekend that may decide the fate of the eurozone. The currency pair trimmed its earlier losses as all of today’s economic reports from the United States were worse than anticipated. This week was very bad for the dollar from the fundamental point of view as most of indicators were bad, prompting talks that the third round of quantitative easing may yet become a reality.

NY Empire State Index tumbled to 2.3 in June from 17.1 in May. The actual figure was far below the forecast of 13.6. (Event A on the chart.)

Net foreign purchase posted a drop to $25.6 billion in April from $36.0 billion in the preceding month instead of the expected increase to $45.3 billion. (Event B on the chart.)

Industrial production and capacity utilization fell in May. Production was down 0.1%, while it was expected to rise at the same rate. The revised April value was 1.0% growth. Utilization rate fell to 79.0%, while analysts promised it would stay at the April rate of 79.2%. (Event C on the chart.)

Michigan Sentiment Index decreased to 74.1 in June from 79.3 in May (revised up from 77.8), according to the preliminary estimate. That is compared to the predicted reading of 77.5. (Event D on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.