- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: May 9, 2018

May 9

May 92018

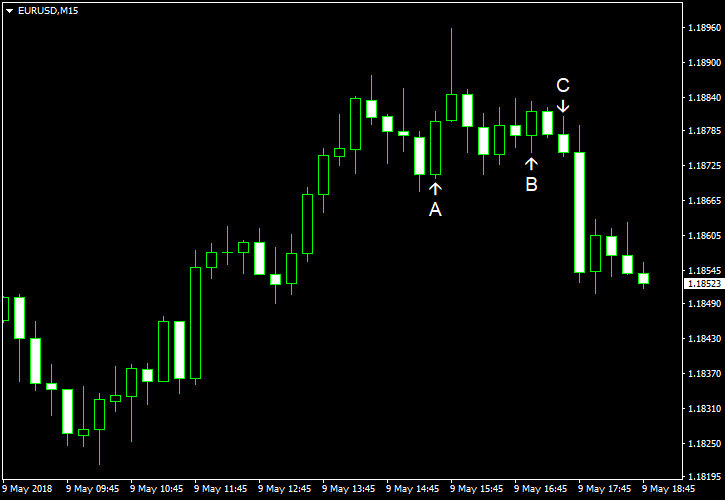

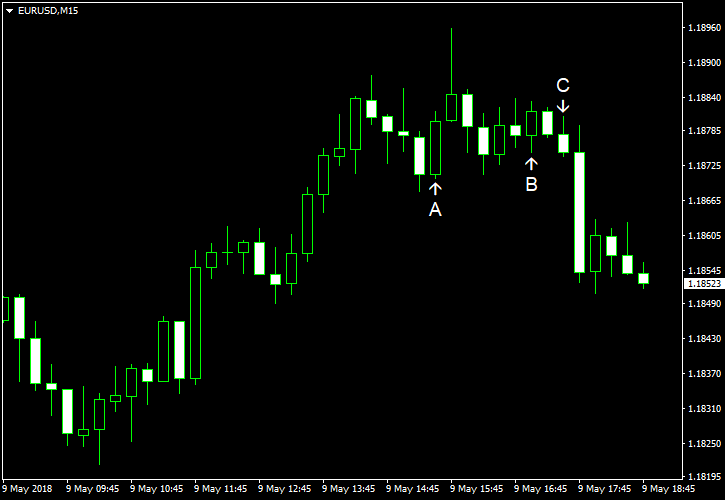

EUR/USD Pulls Back After Attempt to Rally

EUR/USD attempted to rally during the Wednesday trading session, but has pulled back by now, and is currently trading near the opening level. As for economic data, the US Producer Price Index missed expectations. Now, traders wait for tomorrow’s release of the Consumer Price Index. PPI rose by just 0.1% in April, seasonally adjusted. That was a slower rate of growth than 0.2% predicted by analysts and 0.3% registered in March. (Event A on the chart.) […]

Read more May 9

May 92018

New Zealand Dollar Could Recover Losses on RBNZ Rate Decision

NZD/USD Talking Points: New Zealand Dollar depreciated as RBNZ left rates unchanged at 1.75% as expected The RBNZ forecasted rates increasing further out and a delay in hitting 2% inflation NZD/USD downside momentum is slowing as we approach Thursday’s US CPI data Build confidence in your own NZD/USD strategy with the help of our free […]

Read more May 9

May 92018

EUR/USD Rallies From New 2018 Lows on Positive Market Sentiment

The EUR/USD currency pair today rallied from a new 2018 low set in the late Asian session based on improved investor sentiment towards the single currency. The currency pair’s rebound from its lowest levels since December 22 could have been triggered by technically oversold levels, which led to widespread short-covering trades. The EUR/USD currency pair today rallied from a low of 1.1822 to a high of 1.1895 before giving up […]

Read more May 9

May 92018

Crude Oil Prices Hit Resistance, Next Move May Be Lower

Crude oil talking points: – Both Brent and US crude oil prices have hit trendline resistance after Trump’s decision to pull out of the nuclear deal with Iran. – Now, they look likely to slip back. Check out the IG Client Sentiment data to help you trade profitably. And for a longer-term outlook take a […]

Read more May 9

May 92018

USD Rally Continues As US Bond Yields Rise Unabated

USD Analysis and Talking Points – US Treasury yields point to further USD strength. – Any slip back in USD strength should be temporary. Check out our new Trading Guides: they’re free and have been updated for the second quarter of 2018. IG Client Sentiment data show traders are long of EUR and GBP against […]

Read more May 9

May 92018

Bullish CAD Outlook Over Long Term Amid Rising Oil Prices; However, NAFTA Presents Biggest Risk

CAD Analysis and Talking Points CAD Bulls likely to cheer rising oil prices, which trade at 4yr highs. Strong Canadian Data Supports BoC rate hikes, however, NAFTA will ultimately decide whether the BoC hikes See our Q2 CAD forecast to learn what will drive the currency through the quarter. Rising Oil Prices Provides Support for […]

Read more May 9

May 92018

EUR, GBP and Gold All Punished by Strong USD

USD talking points: – The Dollar continues to show all-round strength as high US inflation makes further US interest rate rises this year ever more likely. – That’s weakening many other currencies, as well as gold. Check out the IG Client Sentiment data to help you trade profitably. And for a longer-term outlook take a […]

Read more May 9

May 92018

Cryptocurrency Price Analysis – Ether and Ripple on Edge | Webinar

The IG Client Sentiment Indicator is an essential trader’s tool for keeping in touch with market positioning and changes. Ether (ETH) and Ripple (XRP) on Guard Ahead of SEC Developments The cryptocurrency market is currently building a trading range, with a slight upside bias, testing and breaking resistance levels along the way. Volatility and volume […]

Read more May 9

May 92018

US AM Digest: Oil Price surges after President Trump withdraws from Iran Nuclear Deal

Receive the DailyFX US AM Digest in your inbox every day before US equity markets open – signup here US Market Snapshot via IG: DJIA +0.35%, Nasdaq 100 +0.24%, S&P 500 +0.3% Major Headlines Oil prices surge higher by over 2% following Trump’s decision to exit Iran Nuclear Deal UK BRC sales sees sharpest drop […]

Read more May 9

May 92018

EUR/USD Pulls Back After Attempt to Rally

EUR/USD attempted to rally during the Wednesday trading session, but has pulled back by now, and is currently trading near the opening level. As for economic data, the US Producer Price Index missed expectations. Now, traders wait for tomorrow’s release of the Consumer Price Index. PPI rose by just 0.1% in April, seasonally adjusted. That was a slower rate of growth than 0.2% predicted by analysts and 0.3% registered in March. (Event A on the chart.) […]

Read more