- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: June 25, 2018

June 25

June 252018

Chinese Yuan at Lowest Since December

The Chinese yuan fell to the lowest level in six months today amid worsening trade tensions between the United States and China, which led to risk aversion on the Forex market. Washington announced restrictions of Chinese investment in US in addition to the previously announced tariffs on Chinese goods — a move that will likely prompt a retaliation from the word’s second biggest economy. In the wake of worsening trade tensions, the People’s Bank of China reduced the reserve requirement […]

Read more June 25

June 252018

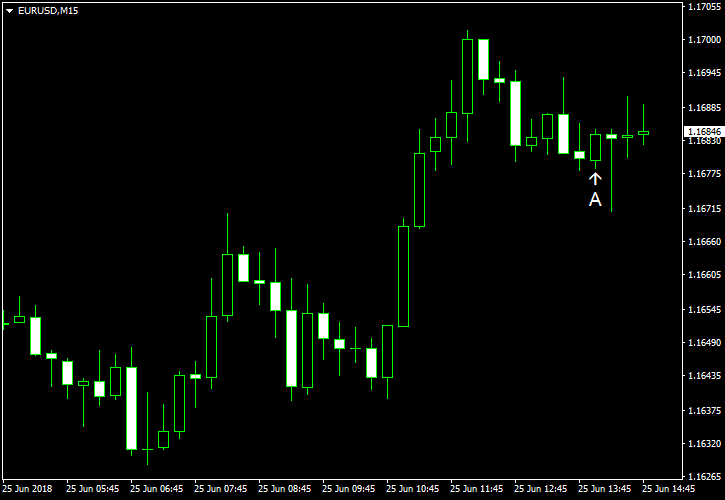

Euro Trades Sideways on Mixed German IFO Survey Data

The euro today rallied slightly higher after the release of the German IFO business climate index for June, which matched expectations. The euro opened today’s session on a downtrend even as the selling pressure on the single currency increased due to the ongoing trade tensions between the US, China and the European Union. The EUR/USD currency pair today traded in a sideways range marked by a high of 1.1669 and a low of 1.1629, but was looking to break higher at the time of writing. […]

Read more June 25

June 252018

SGD, IDR May Fall as Trade War Fears Boost USD – ASEAN Weekly

ASEAN Outlook Talking Points: Despite an end of week US Dollar pullback, MYR, IDR and SGD depreciated IDR looks to rate hike but may keep falling with others as USD rise resumes USD/SGD downside reversal warning sign has faded, faces key resistance Trade all the major global economic data live and interactive at the DailyFX […]

Read more June 25

June 252018

Asian Stocks Mixed As Trade Worries Dominate, EUR Holds Up

Talking Points: Asian stocks were mixed on Monday with no index moving far Local data were scant leaving investors to gnaw old trade worries The Euro held up against the US Dollar What makes the very best traders stand out from the rest? We’ve been looking hard at the numbers, trying to isolate the Traits […]

Read more June 25

June 252018

USDJPY Hit by Trade War Rhetoric; Technical Indicators Collide

USDJPY News and Talking Points – USDJPY gets a political bid as the US ramps up action against China and the EU. – Recent uptrend breaks as technical indicators collide. The DailyFX Q2 Trading Forecasts for all major currencies, commodities and indices, are now availableto download to help you make more informed trading decisions. USDJPY […]

Read more June 25

June 252018

EUR Unmoved by Mixed IFO Report; German Business Confidence Mired by Trade Wars

EUR Analysis and Talking Points German Business Confidence Mired by Slowing Growth and Trade Tensions President Trump Threatens to Impose Tariffs on EU Autos German Economic Outlook Deteriorates The Euro and DAX saw a subdued reaction following a relatively mixed German IFO report. The business climate in Germany dropped to 101.8 in June from 102.3 […]

Read more June 25

June 252018

Bitcoin, Ether, Ripple, Litecoin Chart Analysis – Off Multi-Month Lows

Prices, Charts and News – Bitcoin, Ripple, Ether, Litecoin – Japanese FSA announcement knocks market sentiment. – Chart levels have proved reliable to date. To see how retail traders are currently positioned in cryptocurrencies and what it means for the market looking forward, download the IG Client Sentimentpage. Bitcoin Hits a Seven-Month Low Bitcoin traded […]

Read more June 25

June 252018

Japanese Yen, Australian Dollar Unlikely To Benefit From Wage Pleas

Talking Points: The Bank of Japan has said that it would like to see higher wage settlements to try and boost pricing power The Reserve Bank of Australia has sung a similar tune However, wages are at least partly a function of inflation expectations, and neither central bank has managed to get those going Find […]

Read more June 25

June 252018

Asia AM Digest: Yen Eyes Risk Trends, CAD May Fall on OPEC Update

Weekend Developments – OPEC, Oil, PBOC RRR Cuts, EU Response to US Auto Tariff Threat Crude oil prices started off the new week with declines after Friday’s impressive performance saw it rally the most in a single day (+5.32%) since November 2016. There, the commodity rose as the real production increase agreed in the OPEC+ […]

Read more June 25

June 252018

EUR/USD Rallies After Intraday Drop

EUR/USD fell today, dragged down by fears of a trade war between the United States and the European Union as well as by mixed macroeconomic data in the eurozone. Yet the currency pair managed to bounce afterwards and remained stable after the underwhelming US housing report. New home sales were at the seasonally adjusted annual rate of 689k in May, missing traders’ expectations of 665k. Moreover, the April figure got a negative revision from 662k to 646k. (Event […]

Read more