- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: July 2, 2018

July 2

July 22018

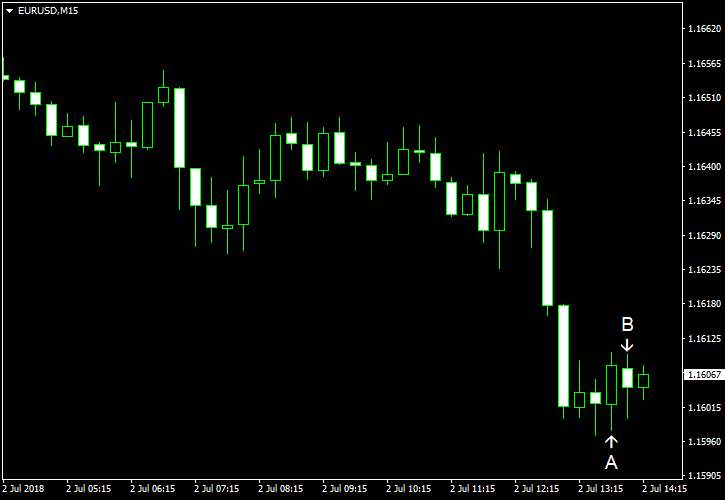

EUR/USD Continues to Feel Pressure from Trade War Fears

EUR/USD fell today as markets continued to feel pressure from fears of a trade war between the United States and their trading partners. Although all the markets took the hit, European assets were particularly vulnerable after US President Donald Trump shifted focus of his criticism from China to the European Union. Today’s US macroeconomic data was confusing as one report showed a slowdown of manufacturing growth, while other showed […]

Read more July 2

July 22018

How Does Your Ultimate Forex Success Goal Looks Like?

If we look at how Forex success is depicted in commercials we see online, on TV, in magazines, and so on, we would get a picture of a filthy-rich person living in a posh house with an assortment of sports cars, and other screaming attributes of extraordinary wealth. And that person also has to spend just one or two hours per day trading Forex to multiply the riches. This image may not be a true […]

Read more July 2

July 22018

FX Market Interest Set to Grow as Major Central Banks Alter Policy

Interest in foreign exchange (FX) markets appear to be picking up in 2018 as major central banks alter the course for monetary policy, and the rise in FX volume should present opportunities throughout the coming months especially as the Federal Reserve looks poised to deliver two more rate-hikes over the remainder of the year. Share […]

Read more July 2

July 22018

US Manufacturing Boasts Surprise Growth in June as Trade Wars Rage

Talking Points: The ISM’s monthly manufacturing figure came in at 62.3 versus an expected 58.5 As trade wars continue, the ISM report cited developing bottlenecks and concern on tariffs The positive release had substantial market impact for currencies paired with the US Stay up to date on important economic data with our Economic Calendar. The […]

Read more July 2

July 22018

US Dollar Emerges as Strongest Currency Courtesy of Trade War Fears

The US dollar emerged as the strongest currency on the Forex market today after trade war tensions continued to escalate as US President Donald Trump chose the European Union as the new target for his criticism of unfair trade deals. While previously Trump was chastising mostly China, he said in an interview yesterday: The European Union is possibly as bad as China, just smaller. It’s terrible what they do to us. But the mean […]

Read more July 2

July 22018

US Dollar Emerges as Strongest Currency Courtesy of Trade War Fears

The US dollar emerged as the strongest currency on the Forex market today after trade war tensions continued to escalate as US President Donald Trump chose the European Union as the new target for his criticism of unfair trade deals. While previously Trump was chastising mostly China, he said in an interview yesterday: The European Union is possibly as bad as China, just smaller. It’s terrible what they do to us. But the mean […]

Read more July 2

July 22018

Euro Trades Lower on Germany Political Crisis and Mixed PMI Releases

The euro today traded lower against the US dollar amid the deepening of the political crisis in Germany as the Interior Minister Horst Seehofer threatened to resign. The release of mixed Eurozone PMIs by IHS Markit in the early European session could not reverse the pair’s downtrend as the US dollar gained ground over the single currency. The EUR/USD currency pair today declined from an opening high of 1.1678 to a low of 1.1596 and was on a downtrend at the time of writing. The currency […]

Read more July 2

July 22018

Euro Trades Lower on Germany Political Crisis and Mixed PMI Releases

The euro today traded lower against the US dollar amid the deepening of the political crisis in Germany as the Interior Minister Horst Seehofer threatened to resign. The release of mixed Eurozone PMIs by IHS Markit in the early European session could not reverse the pair’s downtrend as the US dollar gained ground over the single currency. The EUR/USD currency pair today declined from an opening high of 1.1678 to a low of 1.1596 and was on a downtrend at the time of writing. The currency […]

Read more July 2

July 22018

EUR/USD Continues to Feel Pressure from Trade War Fears

EUR/USD fell today as markets continued to feel pressure from fears of a trade war between the United States and their trading partners. Although all the markets took the hit, European assets were particularly vulnerable after US President Donald Trump shifted focus of his criticism from China to the European Union. Today’s US macroeconomic data was confusing as one report showed a slowdown of manufacturing growth, while other showed […]

Read more July 2

July 22018

GBP Outlook: UK Manufacturing PMI Beat Provides Ammo for BoE Hawks

GBPUSD Analysis and News UK Manufacturing PMI beats expectations, providing a boost for BoE hawks. Initial Sterling gains short-lived amid the risk averse environment Check out our new Fundamental and Technical Q3 forecast guide for GBPUSD UK Manufacturing Output Remains Subdued UK Manufacturing PMI remained subdued at the end of the quarter, showing a rise […]

Read more