- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Blog

February 14

February 142017

Implementing My Long-Term Dollar Trade with USD/CHF Sell

If you remember my June post about the long-term future of the US dollar, you know that I am bearish on the USD for the coming months based on a set of fundamental reasons. And the optimal way of trading this sentiment is going short USD/CHF. Today, I am going to set up the stop order for entry into this position. I will also explain some other factors that strengthen my bearish view on USD/CHF. The main reasoning […]

Read more February 13

February 132017

Is It a Good Idea to Trade While Sick? Poll

Do you remember trying to spot the right entry conditions for your EUR/USD reversal trade while feeling drowsy from the cold you caught two days before? To me, it has always been a challenge. It is like trading late in the night or while being drunk. And a cold is nothing in comparison to how miserable my interaction with the market can be made by a flu. That an illness can affect cognition […]

Read more February 8

February 82017

Interview with Elisa Sandström from ActualTraders

Unfortunately, it looks like the whole ActualTraders setup turned out to be a scam. I hope you did not fall for it and I believe that there is a lesson for us to learn here. Have you ever want to trade for a prop shop? Have you seen any ads of prop shops hiring in your area? Me neither. ActualTraders is an online proprietary trading firm for common traders — like you and me. […]

Read more February 6

February 62017

Free Order Management EA with a Graphic Control Panel

I remember myself during my early Forex years, sitting on a bunch of positions across five or six currency pairs and thinking — how do I make them all close at once when their total profit reaches my target? Now, I have developed a tool that does exactly that. I am pleased to announce the launch of what I believe to be one of the most productive and efficient instruments for MetaTrader platform — Account Protector. Have you ever […]

Read more January 30

January 302017

What Is Your Experience with Forex Broker Customer Support?

According to our 2015 poll, a half of traders consider poor customer support service a valid reason for transferring to another broker. Our recent research of 241 brokers has shown that a quarter of online Forex companies fail to provide adequate support service. Apparently, such situation cannot exist for a long period, and traders should have some heart-breaking stories to tell us about their experience with their broker’s support. […]

Read more January 23

January 232017

NZD/Dairy Correlation — Not That Simple

In early 2008, when the global financial crisis started crippling the world economy, the New Zealand economy entered into recession. Correspondingly, for the most part of 2008, the Kiwi dollar remained on a declining note against the greenback. The New Zealand dollar is categorized as a commodity currency, along with its Australian and Canadian counterparts. While Australia is rich in raw materials, such as iron ore and coking coal, Canada owns the worldâs third-largest […]

Read more January 16

January 162017

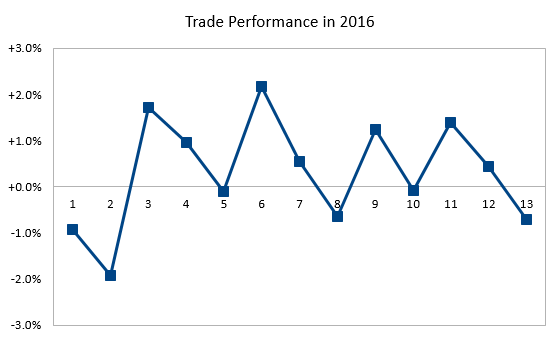

Your 2016 Trading Results Poll

I still have one 2016 trade active (NZD/USD short from ascending channel), and there is a pending order carried over from 2016 (USD/CAD ascending channel). Nevertheless, it is now time to calculate my profit for the past year. The remaining position and order will count for 2017 results. Contents 1 Profitable trades 2 Worst losers 3 Other trades 4 Poll Unfortunately my minuscule 2015 profitability has […]

Read more January 9

January 92017

Acting on My 2017 Forecast Using Binary Options

Forecasting the currency rates by simply stating some arbitrary ranges is easy, that is why I prefer to use some real money to back up my talks. Like the year before, I have decided to act on my 2017 Forex forecast. Since my predictions are all in a form of the year-end ranges, I have used the “Ends In” binary option contracts. Same as before, I have used Binary.com to place these trades — unfortunately, I have not […]

Read more January 2

January 22017

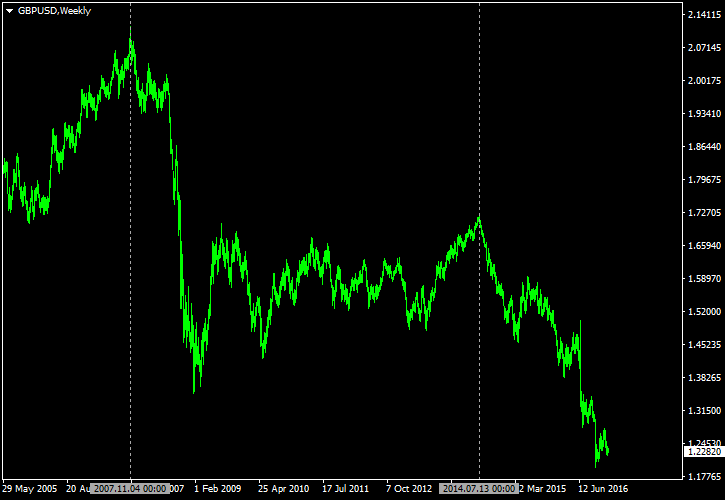

Will GBP/USD Reach Parity in 2017? Poll

The parity rate between the Great Britain pound and the US dollar is not something that many traders consider as a proximate possibility. Compared to the probability of the EUR/USD parity, the one for GBP/USD looks to be quite low even now, after its decline by 14% in 2016. The British pound has suffered greatly last year. The Brexit referendum resulted in a huge sale of GBP/USD. The downtrend that ensued is still active today, half […]

Read more January 1

January 12017

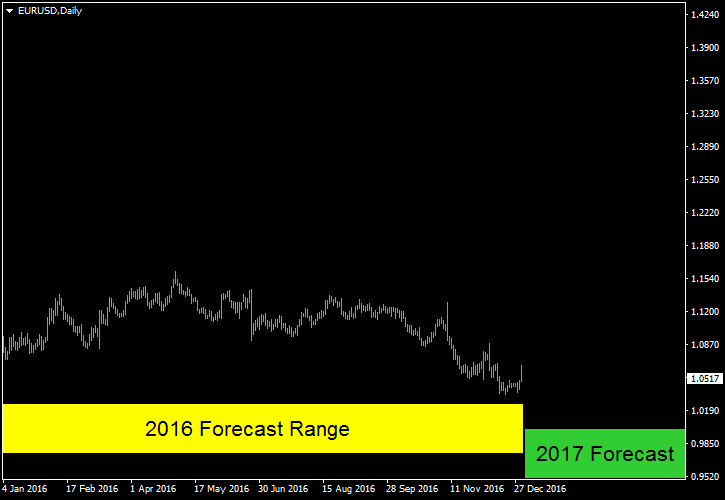

Forecast for 2017 — Forex, Gold, Oil, Interest Rates

2016 is done, and it is now time to see how my last year’s forecast compared to the harsh reality of the Forex market. Of course, I shall also make a new forecast for the year 2017. Contents 1 EUR/USD 2 GBP/USD 3 USD/JPY 4 USD/CAD 5 USD/CHF 6 Gold 7 Oil 8 Interest rates EUR/USD Even though the parity has not been reached in 2016, EUR/USD has ended […]

Read more