- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Blog

July 24

July 242016

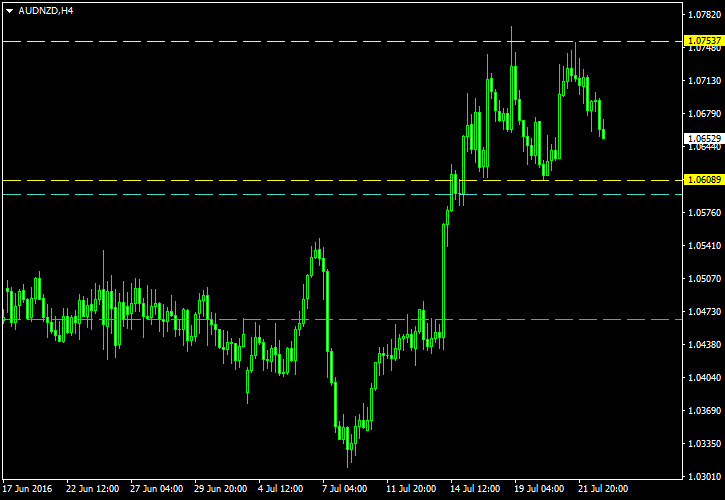

AUD/NZD to Finalize Double Top on H4 Chart

The Australian dollar had a rally going against the New Zealand dollar from July 8 through July 19. AUD/NZD has been consolidating in a kind of a double top pattern since then. The pattern is completed only when the right top’s slope reaches the neckline, but it is already time to set up a pending stop order in preparation for the breakout. The chart below shows the double top pattern delimited with […]

Read more July 24

July 242016

Forex Brokers Update — July 24th, 2016

Three new brokers became listed on EarnForex.com this week: JCMFX — an offshore company registered in Saint Vincent and the Grenadines. JCMFX offers Forex, CFD, and gold & silver trading starting from $100 via MT4 platform. JCMFX Hydra Markets — a Georgian Forex broker with standard and ECN accounts — both with $100 minimum account size and 1:1000 maximum leverage. Hydra Markets Adamant Finance — yet another offshore […]

Read more July 23

July 232016

Weekly Forex Technical Analysis (Jul 25 — Jul 29)

EUR/USD Floor pivot points 3rd Sup 2nd Sup 1st Sup Pivot 1st Res 2nd Res 3rd Res 1.0796 1.0876 1.0925 1.1005 1.1054 1.1133 1.1183 Woodie’s pivot points 2nd Sup 1st Sup Pivot 1st Res 2nd Res 1.0868 1.0910 1.0997 1.1039 1.1126 Camarilla pivot points 4th Sup 3rd Sup 2nd Sup 1st Sup 1st Res 2nd […]

Read more July 21

July 212016

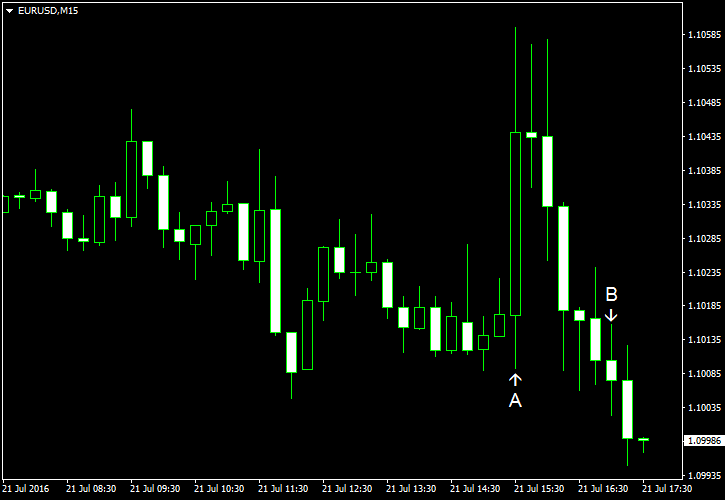

EUR/USD Tries to Rally — Retains Bearish Bias

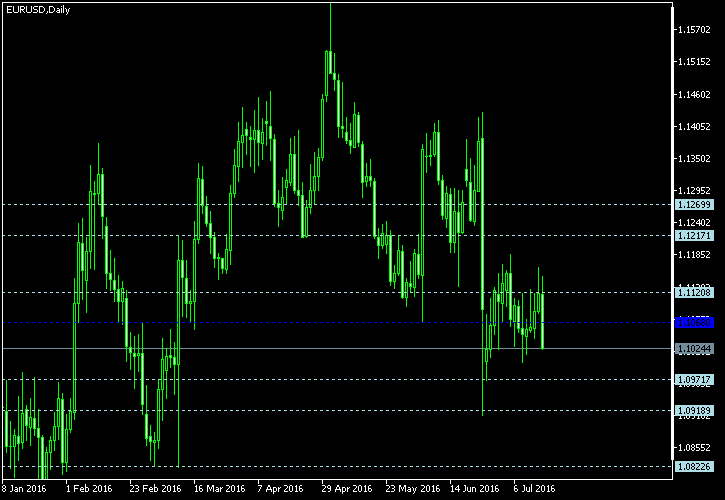

The EUR/USD currency pair was in a slow decline during the most of the trading session today. It had spiked up, attempting to start a rally, following some mediocre fundamental US data, but then quickly returned to its way downwards. Initial jobless claims went down from 254k to to 253k during the week ending on July 16. The indicator was somewhat better than the 265k forecast expected by the traders. (Event A on the chart.) […]

Read more July 19

July 192016

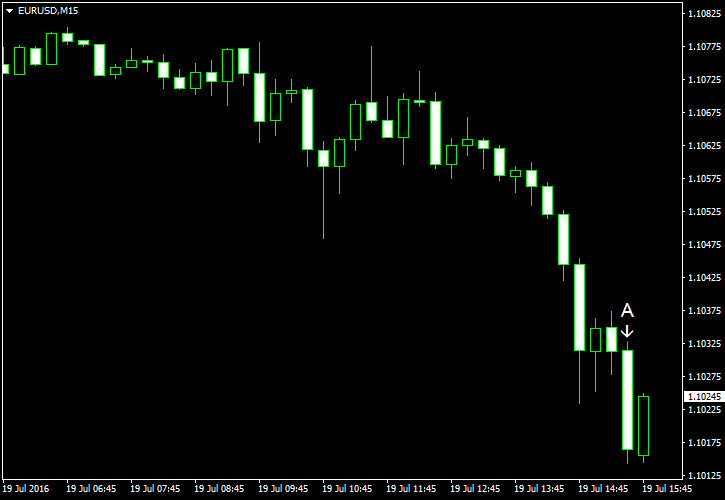

EUR/USD Declines Without Much Regard for Fundamentals

The US dollar is strengthening against the euro for the most part of the day today, without paying attention to reports released in the eurozone or the United States. The general market sentiment is skewed into risk-aversion as traders and investors remain worried about the Brexit. Housing starts rose from the seasonally adjusted annual rate of 1.135 million units to 1.189 million units in June. A growth to 1.165 million was expected. Building permits increased from […]

Read more July 18

July 182016

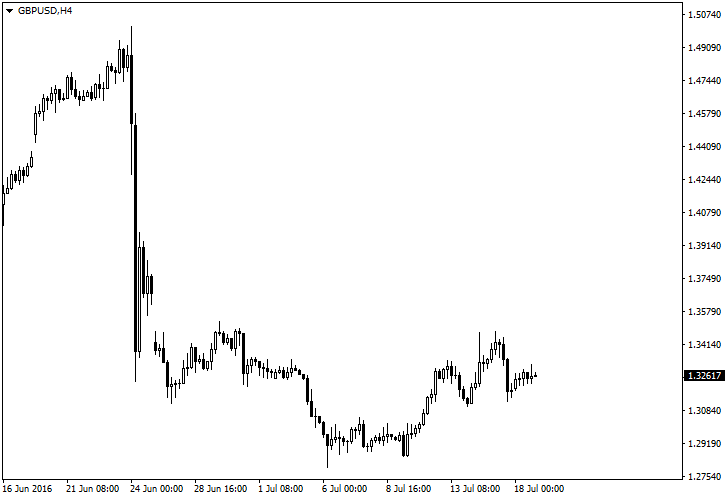

Brexit — Did You Win or Lose?

We have not written much about the Brexit because there already was a ton of analysis written by many respectable sources. And it all turned wrong on June 24 of course. Nevertheless, the unexpected outcome of the referendum offered a huge earning opportunity to FX traders. Even with brokers cutting leverage on GBP/USD and related pairs, the profit potential was enormous: After all, the moves of 2,000 pips in just a few hours are […]

Read more July 17

July 172016

Forex Brokers Update — July 17th, 2016

Two new Forex brokers have been added to the list during the week: FX Giants — a UK-regulated company with an interesting range of account types — from micro to zero spread, to zero commission STP. Only MetaTrader 4 is available as a trading platform. The maximum leverage is 1:500. FX Giants Milton Markets — a Forex broker registered in New Zealand with accounts starting from $250. The leverage on Forex and CFDs is […]

Read more July 16

July 162016

Weekly Forex Technical Analysis (Jul 18 — Jul 22)

EUR/USD Floor pivot points 3rd Sup 2nd Sup 1st Sup Pivot 1st Res 2nd Res 3rd Res 1.0823 1.0919 1.0972 1.1068 1.1121 1.1217 1.1270 Woodie’s pivot points 2nd Sup 1st Sup Pivot 1st Res 2nd Res 1.0908 1.0950 1.1057 1.1099 1.1206 Camarilla pivot points 4th Sup 3rd Sup 2nd Sup 1st Sup 1st Res 2nd […]

Read more July 15

July 152016

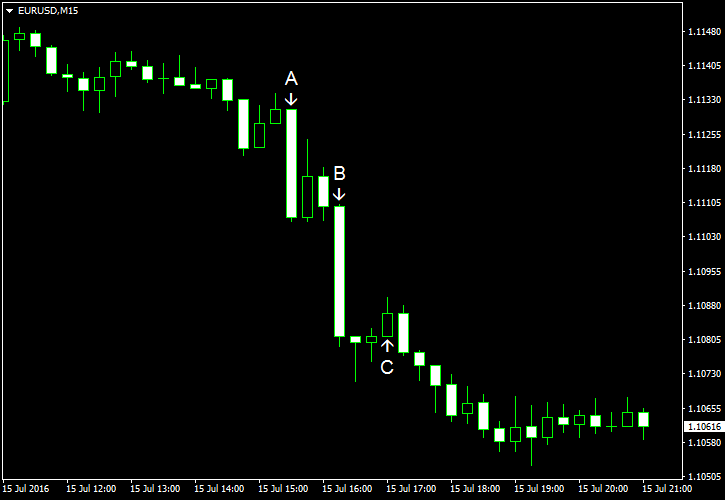

US Retail Sales and Industrial Production Help USD vs. EUR

EUR/USD was trending strongly down today thanks to the positive macroeconomic reports from the United States. Although not all of the released data was optimistic, the main numbers were better than forecasts. The currency pair attempted to stage a correction near 14:00 GMT but failed and continued down. Retail sales rose by 0.6% in June after going up by 0.2% in May (revised down from 0.5%). The growth exceeded the median […]

Read more July 14

July 142016

EUR/USD Climbs After BoE, Trims Gains Later

EUR/USD climbed today after the Bank of England surprised markets, deciding to avoid monetary easing for now. (Event A on the chart.) The euro profited from the resulting surge of risk appetite. Currently, the currency pair is moving sideways after retreating closer to the opening level as the BoE also signaled about the possibility of an interest rate cut in August. Additionally, positive economic data from the United States was helping the dollar to keep ground versus […]

Read more