- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Blog

March 19

March 192016

Weekly Forex Technical Analysis (Mar 21 — Mar 25)

EUR/USD Floor pivot points 3rd Sup 2nd Sup 1st Sup Pivot 1st Res 2nd Res 3rd Res 1.0819 1.0938 1.1103 1.1223 1.1388 1.1508 1.1673 Woodie’s pivot points 2nd Sup 1st Sup Pivot 1st Res 2nd Res 1.0950 1.1126 1.1234 1.1411 1.1519 Camarilla pivot points 4th Sup 3rd Sup 2nd Sup 1st Sup 1st Res 2nd […]

Read more March 18

March 182016

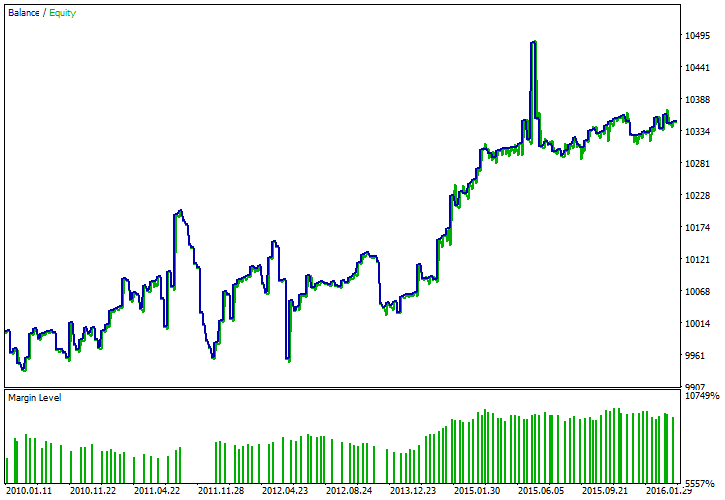

Predicting Weekly Gaps on Friday — Crazy Strategy?

The normal gap trading strategy — that is buy/sell after a weekly gap to profit from gap’s compensation — has a nice statistical evidence behind it. But what do we know about forecasting the weekly gaps based on information available to us on late Friday session? I have decided to backtest a simple trading system. The idea is to forecast the future gaps by looking at the current daily or weekly range. A trader could buy […]

Read more March 17

March 172016

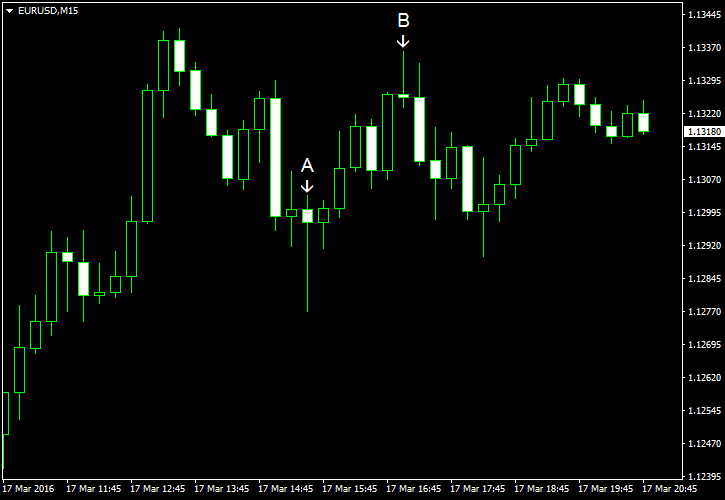

EUR/USD Surges for Second Day

EUR/USD demonstrated a strong rally today, surging for the second day. The dollar remained very weak as an aftershock after yesterday’s policy announcement from the Federal Reserve. As for US economic data, the manufacturing sector staged unexpected revival but other indicators were not especially good. Philadelphia Fed manufacturing index rose sharply from -2.8 in February to 12.4 in March. It was a far better reading than the predicted -1.4. (Event […]

Read more March 16

March 162016

EUR/USD Flat Ahead of FOMC Announcement

EUR/USD was flat ahead of the Wednesday’s policy announcement from the Federal Open Market Committee. The Committee has started its meeting on Tuesday and will reveal its decision on Wednesday. Markets do not count on any change to the policy, but traders preferred to exercise caution ahead of a major event, resulting in sideways trading for the currency pair. PPI fell 0.2% in February, matching forecasts exactly. The index was up 0.1% in January. […]

Read more March 16

March 162016

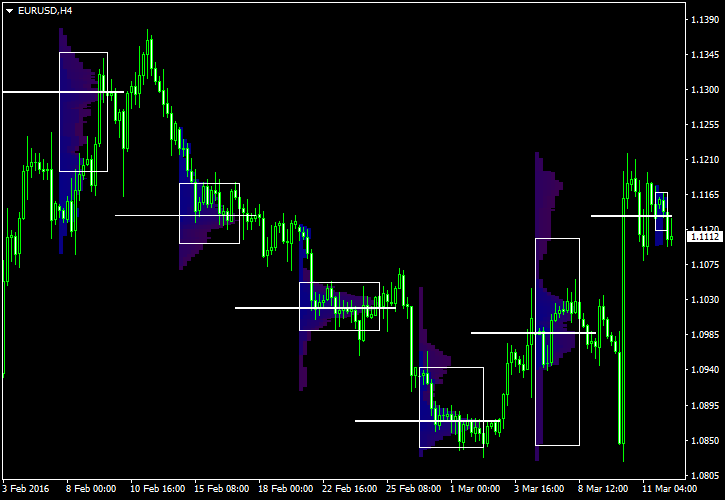

EUR/USD Soars After Fed Lowers Interest Rates Projections

EUR/USD was not moving far during the Wednesday’s session, slowly trailing down. Yet everything has changed after the Federal Open Market Committee ended its two-day monetary policy meeting. While the policy remained the same, the mostly dovish tone of the statement and the lowered economic projections resulted in a spike of the currency pair. US CPI declined 0.2% in February, and forecasters were right on the money, predicting exactly that outcome. Consumer […]

Read more March 14

March 142016

How to Use Market Profile in Forex Trading?

Market Profile indicator is a powerful tool developed by a CBOT trader. Its original purpose was to graphically organize price and time information obtained during a trading session in a manner useful to traders. Today’s Forex market is quite different from what commodity futures trading was back in 1985 when Peter Steidlmayer introduced his charting instrument to the public. Can Market Profile be a useful tool to Forex traders? […]

Read more March 13

March 132016

Forex Brokers Update — March 13th, 2016

One new broker has been added this week: CM Trading — a regulated South African FX company with MT4 platform and accounts starting with $250. Their fixed spreads are rather high. The leverage is maxed at 1:400 and the broker offers copy-trading facility. CM Trading Some of the listed brokers got their updates: DeltaStock is now regulated by FSC of Bulgaria. Allows the use of expert advisors and scalping […]

Read more March 12

March 122016

Weekly Forex Technical Analysis (Mar 14 — Mar 18)

EUR/USD Floor pivot points 3rd Sup 2nd Sup 1st Sup Pivot 1st Res 2nd Res 3rd Res 1.0510 1.0666 1.0906 1.1062 1.1302 1.1458 1.1698 Woodie’s pivot points 2nd Sup 1st Sup Pivot 1st Res 2nd Res 1.0687 1.0948 1.1083 1.1344 1.1479 Camarilla pivot points 4th Sup 3rd Sup 2nd Sup 1st Sup 1st Res 2nd […]

Read more March 10

March 102016

EUR/USD Soars After ECB Monetary Announcement

Thursday was light on economic data from the United States, but it would have little importance anyway. The major event today was the monetary policy meeting of the European Central Bank, and it was well worth the attention, throwing markets in disarray. EUR/USD sank initially after the event but recovered afterwards, demonstrating a strong rally. What has happened is that the ECB did not disappoint with the amount […]

Read more March 9

March 92016

EUR/USD Bounces Ahead of ECB Meeting

EUR/USD was falling during the current trading session but rebounded as of now. Tomorrow, the European Central Bank will hold a monetary policy meeting, and it is widely expected that the ECB is going to expand its monetary stimulus. US wholesale inventories increased 0.3% in January instead of falling 0.2% as analysts’ had predicted. Furthermore, the December’s change was revised from -0.1% to 0.0%. The rise of inventories means slowdown […]

Read more