- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Blog

January 25

January 252016

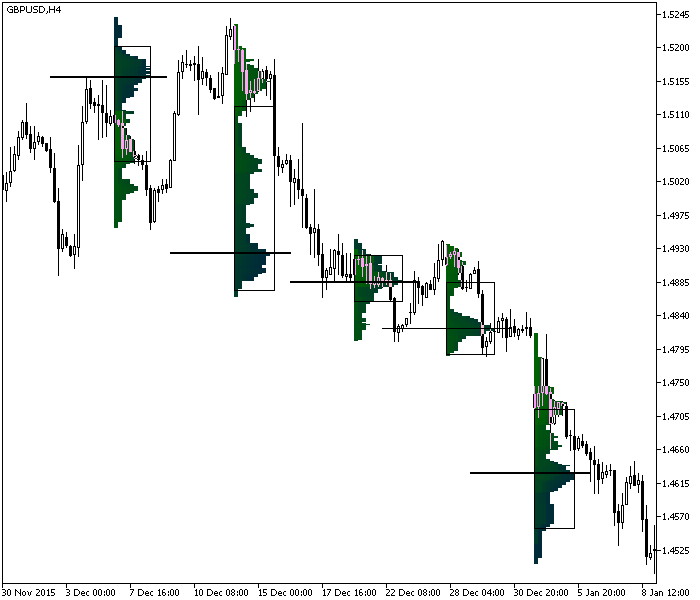

Display Weekly and Monthly Market Profile in MetaTrader

After introducing the MetaTrader Market Profile indicator back in 2010, today I have finally updated both the MT4 and MT5 versions to work with weekly and monthly trading sessions in addition to the daily ones. Also, I have improved its functionality and fixed a number of bugs: Color scheme selection is now done with a dropdown list rather than by a numeric input. Both MT4 and MT5 now feature a description with basic instruction […]

Read more January 24

January 242016

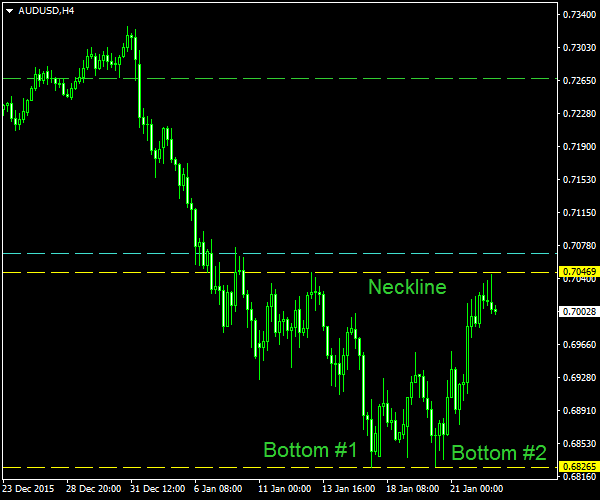

AUD/USD Finalizes Double Bottom on H4

The four-hour chart of the AUD/USD currency pair shows a consolidation of the price that resembles a classic double bottom pattern. The bearish wave preceding the formation lasted since December 31 through January 15. The pattern itself is just two weeks old and is rather rough — the bottoms are not that evident as there are many small spikes. Still, I will trade a bullish breakout from its borders as the potential reward […]

Read more January 23

January 232016

Weekly Forex Technical Analysis (Jan 25 — Jan 29)

EUR/USD Floor pivot points 3rd Sup 2nd Sup 1st Sup Pivot 1st Res 2nd Res 3rd Res 1.0525 1.0651 1.0724 1.0850 1.0922 1.1048 1.1121 Woodie’s pivot points 2nd Sup 1st Sup Pivot 1st Res 2nd Res 1.0638 1.0697 1.0836 1.0896 1.1035 Camarilla pivot points 4th Sup 3rd Sup 2nd Sup 1st Sup 1st Res 2nd […]

Read more January 22

January 222016

EUR/USD Moves Lower as European PMI Disappoint

EUR/USD extended its move down today as the vast majority of European Purchasing Managers’ Indexes came out below market expectations (though most of them remained safely above the neutral 50.0 level). Meanwhile, US economic data was positive for the most part with the exception of falling leading indicators. Flash Markit manufacturing PMI ticked up from the 38-month low of 51.2 in December to 52.7 in January. It was a nice […]

Read more January 21

January 212016

EUR/USD Dips After ECB Hints at Additional QE in March

EUR/USD dipped today after the European Central Bank kept monetary policy unchanged but hinted during the press-conference at additional quantitative easing in March. (Event A on the chart.) Currently, the euro is attempting to recover versus the dollar, but for now the currency pair trades below the opening level. The drop was limited by today’s US economic data that was not very good and prevented the greenback from rallying too much. Philadelphia […]

Read more January 20

January 202016

EUR/USD Misses Opportunity to Rally

EUR/USD was attempting to rally today as economic data released from the United States over the current trading session was not particularly great. Yet the currency pair has backed off and trades close to the opening level as of now. Housing starts slipped to the seasonally adjusted annual rate of 1.15 million in December from November’s 1.18 million while experts have predicted them to stay little changed. Building permits were […]

Read more January 19

January 192016

Biggest Forex Scam Pt. IX (Keith F. Simmons)

A conservative estimate of the amount lost by the American public, between 2008 and 2014, in Ponzi investment schemes stands at $50 billion. The estimated value does include the sum ripped off by con artists through stock, real estate, and commodity schemes as well. However, the majority of the investors lost their hard-earned money in Ponzi Forex trading schemes. The most disturbing fact about the Forex scams is that by the time a fraudster gets caught, a new […]

Read more January 18

January 182016

How Will Chinese Crisis Develop? USD/CNY Perspective

What all this fuss regarding China, Shanghai stock market index, and the Chinese yuan is really about? Is it something that Forex traders should watch or is it just some fad hyped by media as a convenient hot topic? The thing is, the ongoing crisis in China is likely a major global economic factor that will affect not just USD/CNY rate but the whole world’s economy […]

Read more January 17

January 172016

CHF/JPY Consolidates in Descending Triangle on 4-Hour Chart

A four-hour chart of CHF/JPY currency pair shows a clear downtrend active since December 4. The bearishness becomes particularly strong after January 1. However, the downtrend stalls into a consolidation on January 5. The consolidation eventually takes form of a descending triangle pattern. As you can see on the chart below, the triangle is marked with the yellow borderlines. The height (H) of the triangle is measured at its base. At 10% of H below the lower […]

Read more January 16

January 162016

Weekly Forex Technical Analysis (Jan 18 — Jan 22)

EUR/USD Floor pivot points 3rd Sup 2nd Sup 1st Sup Pivot 1st Res 2nd Res 3rd Res 1.0637 1.0721 1.0817 1.0901 1.0997 1.1081 1.1177 Woodie’s pivot points 2nd Sup 1st Sup Pivot 1st Res 2nd Res 1.0724 1.0823 1.0904 1.1003 1.1084 Camarilla pivot points 4th Sup 3rd Sup 2nd Sup 1st Sup 1st Res 2nd […]

Read more