- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Blog

May 16

May 162015

Weekly Forex Technical Analysis (May 18 — May 22)

EUR/USD Floor pivot points 3rd Sup 2nd Sup 1st Sup Pivot 1st Res 2nd Res 3rd Res 1.0894 1.1012 1.1229 1.1348 1.1565 1.1683 1.1901 Woodie’s pivot points 2nd Sup 1st Sup Pivot 1st Res 2nd Res 1.1037 1.1279 1.1372 1.1614 1.1708 Camarilla pivot points 4th Sup 3rd Sup 2nd Sup 1st Sup 1st Res 2nd […]

Read more May 14

May 142015

EUR/USD Pushes Higher for Third Straight Session

EUR/USD extended its move higher for the third session in a row today due to the general weakness of the US dollar. One of the reasons for the lackluster performance of the greenback was yesterday’s report that demonstrated stagnant retail sales. As a result, the currency pair traded near the highest level since February. PPI fell 0.4% in April on a seasonally adjusted basis, frustrating market experts who promised a 0.1% increase. The index was up 0.2% in March. […]

Read more May 11

May 112015

What Is Your View of the Forex Trading Industry?

One of the main obstacle for new traders to become profitable traders is the lack of a proper vision of the market and its role in their lives. I would not be surprised, for example, that the majority of laymen believes that Forex is just some kind of online scam. That point of view is easy to come by, it is fueled by a lot of hot news concerning Forex (brokers going bankrupt, scammers getting jailed, […]

Read more May 9

May 92015

Forex Brokers Update — May 9th, 2015

Two new companies were added to the list of brokers on our website this week: 10Markets — an unregulated European broker with an offer of mini, standard, ECN, and “tailor-made” accounts. The minimum deposit is just $200. The trading is done via MT4. 10Markets PhillipCapital UK — an FCA-regulated company from the United Kingdom. It offers MetaTrader 4 Forex, CFD, gold/silver, and oil trading starting with $10,000. The maximum leverage is […]

Read more May 9

May 92015

Weekly Forex Technical Analysis (May 11 — May 15)

EUR/USD Floor pivot points 3rd Sup 2nd Sup 1st Sup Pivot 1st Res 2nd Res 3rd Res 1.0727 1.0897 1.1053 1.1222 1.1378 1.1548 1.1704 Woodie’s pivot points 2nd Sup 1st Sup Pivot 1st Res 2nd Res 1.0893 1.1046 1.1219 1.1371 1.1544 Camarilla pivot points 4th Sup 3rd Sup 2nd Sup 1st Sup 1st Res 2nd […]

Read more May 8

May 82015

Worrying Nonfarm Payrolls Report Wreaks Havoc in EUR/USD

The euro stayed in a rather boring sideways market against the US dollar during the early European session today. Everything changed when the US employment report has been released. It showed some mixed data, which pushed the EUR/USD pair first up, then down, then up and down again, producing a significant volatility burst. However, it failed to produce any meaningful trend in the Forex pairs. Nonfarm payrolls […]

Read more May 7

May 72015

EUR/USD Dominated by Euro Macro Reports

EUR/USD was moving mostly under the influence from the macroeconomic reports that came out of the eurozone during the early trading session today. The currency pair’s reaction was slow but soon gave in to poor German factory orders, construction PMI, and retail PMI reports (events A, B, and C on the chart). The weekly unemployment statistics from the United States produced only a temporary rate spike on the Forex market. US initial […]

Read more May 6

May 62015

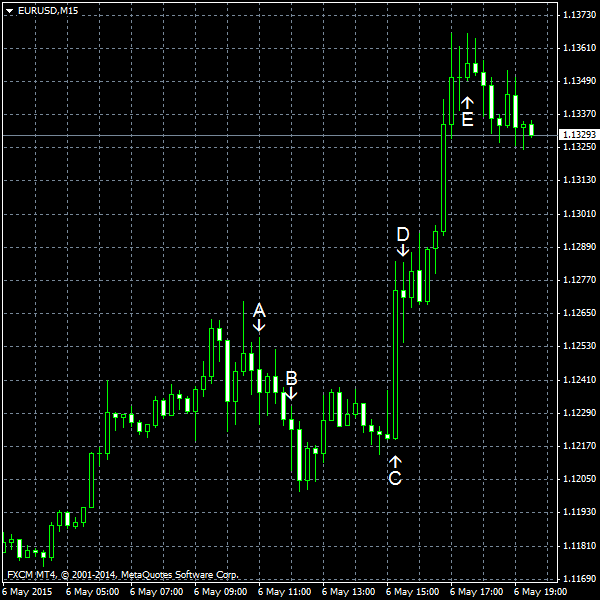

EUR/USD Soars on Poor Employment Expectations

The currency pair was rising steadily before the opening of the European trading session today. The rally did not last long following the not-so-goodMarkit PMI and retail sales reports from the eurozone (events A and B on the chart). The correction ended when the US employment data from ADP had been released. ADP employment added 169k jobs in April after 175k growth in March (revised down from 189k). It also fell […]

Read more May 5

May 52015

EUR/USD Rises, Halts Rally Upon PMI Release

The US dollar was falling against the euro during the most active part of the early trading session today. The euro has increased its strength vs. the greenback after the report has shown a widened US trade balance deficit. In less than two hours, the services PMI numbers pushed the EUR/USD down very fast. US trade balance deficit increased at an unexpectedly fast pace in March of this year — it went […]

Read more May 3

May 32015

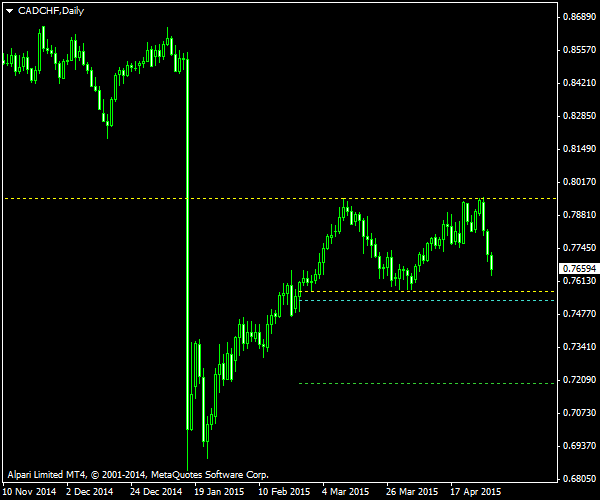

Double Top on the Daily Chart of CAD/CHF

CAD/CHF is not one of the most popular Forex pairs, but I often observe some tradable technical patterns on its charts. The daily timeframe is currently showing a double top formation that looks to be capping the post-SNB recovery rally. Both peaks are significant enough and with a noticeable trough between them; the duration of the pattern confirms its validity too. You can see the pattern marked with the yellow […]

Read more