- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Blog

December 23

December 232014

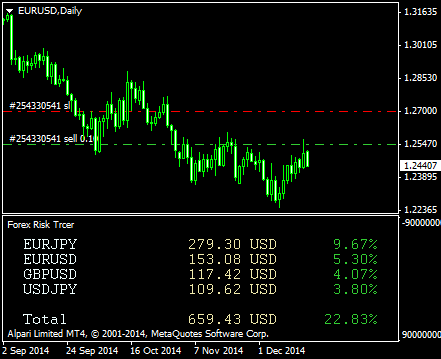

EUR/USD Continues Rally to New Lows

EUR/USD extended its downward rally today, reaching yet another multi-year low. Positive indicators, including strong economic growth, added to speculations about early monetary tightening from the Federal Reserve. Not every report was good though, and the housing market in particular demonstrated disappointing results. US GDP grew 5.0% in Q3 2014 according to the third (final) estimate. The actual growth was above the analysts’ predictions of 4.3%, […]

Read more December 22

December 222014

When More Risk Is Too Much in Forex?

According to one of my old polls, the majority of active FX traders prefers to risk no more than 5% of their balance on one trade. I personally, prefer my risk per trade to be near 1%-2%. But how should we, as traders, act when a new opportunity arises and we already have an open position with our risk limit hit? Should we use the opportunity and double our potential risk? How […]

Read more December 20

December 202014

Weekly Forex Technical Analysis (Dec 22 — Dec 26)

EUR/USD Floor pivot points 3rd Sup 2nd Sup 1st Sup Pivot 1st Res 2nd Res 3rd Res 1.1755 1.1988 1.2105 1.2337 1.2455 1.2687 1.2804 Woodie’s pivot points 2nd Sup 1st Sup Pivot 1st Res 2nd Res 1.1959 1.2048 1.2309 1.2397 1.2658 Camarilla pivot points 4th Sup 3rd Sup 2nd Sup 1st Sup 1st Res 2nd […]

Read more December 20

December 202014

Forex Brokers Update — December 20th, 2014

While there was no new additions to the list of brokers on EarnForex.com this week, quite a few of the companies’ listings have been updated: FXtradeweb removed its office from Finland and no longer accepts US clients. FinFX added German and Swedish versions of its website. Univell Broker has no office in BVI now. Bloombex Options added new languages to their website: Dutch, Italian, Japanese, Spanish. Opened […]

Read more December 19

December 192014

EUR/USD Extends Losses

EUR/USD continued to decline following the Wednesday’s monetary policy statement from the Federal Reserve. Falling US unemployment claims supported the dollar while the sharp drop of manufacturing index did not affect the currency much. Initial jobless claims fell from 295k to 289k last week instead of rising to 297k last week. (Event A on the chart.) Philadelphia Fed manufacturing index sank from 40.8 in November to 24.5 in December, even lower […]

Read more December 17

December 172014

EUR/USD Jumps After FOMC, Resumes Decline Later

EUR/USD was falling during the current trading session but jumped after the monetary policy statement of the Federal Open Market Committee turned out to be less hawkish than dollar bulls have hoped for. The rally was short-lived, though, and the currency pair resumed its decline quickly. The dollar was firm even as the recent macroeconomic data from the United States was rather poor. CPI fell 0.3% in November […]

Read more December 16

December 162014

12 Reasons for the Russian Ruble Collapse

The Russian ruble has made it to the new all-time low against the US dollar and the euro today and demonstrated the biggest one-day fall in its history. USD/RUB has reached as high as 77.87 (at Bid price) after closing at 65.34 yesterday and trading as low as 32.63 in January this year. EUR/RUB has rallied above 100 (at Ask price) before retracing back to 84.96. There is a multitude of factors that influenced the Russian currency […]

Read more December 15

December 152014

Dollar Gains as Industrial Production Expands

The dollar gained on the euro today as US industrial production expanded, beating specialists’ estimates. The greenback rallied even though other reports were not particularly good. This week, the Federal Reserve will hold the last policy meeting for this year, which should be rather important for the US currency and the Forex market as a whole. NY Empire State Index demonstrated a sharp drop from 10.2 in November to -3.6 in December, frustrating […]

Read more December 14

December 142014

Forex Brokers Update — December 14th, 2014

We have added one new broker to the list this week: MXTrade — a CySEC regulated broker with $1,000 minimum account size and MetaTrader 4 platform (including web, Android and iOS versions). Currency trading leverage is maxed at 1:400. MXTrade Other changes to the Forex brokers include: FBS added CFD and futures trading on its Standard accounts; gold and silver trading on its Cent accounts. RFXT now has […]

Read more December 13

December 132014

Weekly Forex Technical Analysis (Dec 15 — Dec 19)

EUR/USD Floor pivot points 3rd Sup 2nd Sup 1st Sup Pivot 1st Res 2nd Res 3rd Res 1.2057 1.2152 1.2305 1.2400 1.2552 1.2647 1.2800 Woodie’s pivot points 2nd Sup 1st Sup Pivot 1st Res 2nd Res 1.2166 1.2333 1.2414 1.2581 1.2662 Camarilla pivot points 4th Sup 3rd Sup 2nd Sup 1st Sup 1st Res 2nd […]

Read more