- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Fundamental Analysis

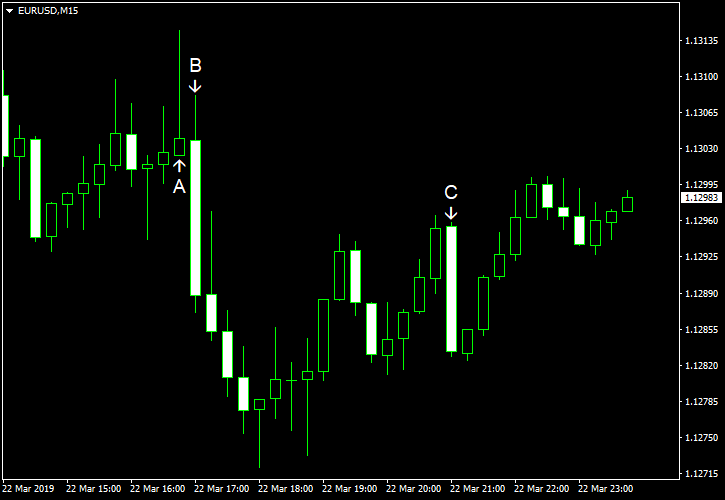

March 22

March 222019

EUR/USD Sinks After Terrible Data in Eurozone

EUR/USD dropped today as basically all macroeconomic reports for the eurozone released today were bad. US economic data were bad for the most part as well (with the exception of the housing data) but that did not prevent the dollar from gaining on the euro. Flash readings for Markit manufacturing PMI and Markit services PMI were released today. Manufacturing PMI dropped to 52.5 in March from 53.0 in February instead of rising to 53.5 […]

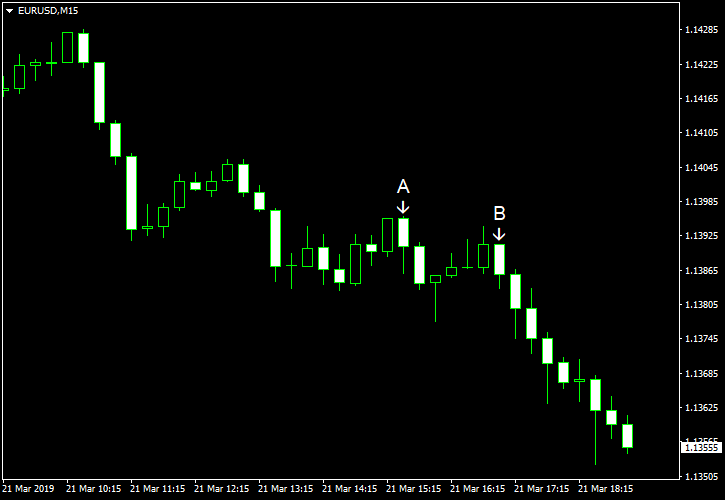

Read more March 21

March 212019

EUR/USD Reverses Gains Caused by Dovish FOMC

EUR/USD fell today, reversing yesterday’s gains caused by the extremely dovish stance of the Federal Open Market Committee, as traders were digesting the news. Market analysts speculated that the retreat can be just profit-taking after the sharp rally made the currency pair overbought, and in the future the dollar may still feel the pressure from the dovish stance of US policy makers. Yet for now the greenback is rebounding, and today’s US macroeconomic reports, being […]

Read more March 20

March 202019

EUR/USD Surges After Dovish FOMC

EUR/USD jumped sharply today after the Federal Open Market Committee turned out to be even more dovish than was expected. While most market participants were expecting the FOMC to reduce the planned number of interest rate hikes in 2019 from two to one, the Committee actually dropped plans to hike rates this year entirely. US crude oil inventories shrank by as much as 9.6 million barrels last week […]

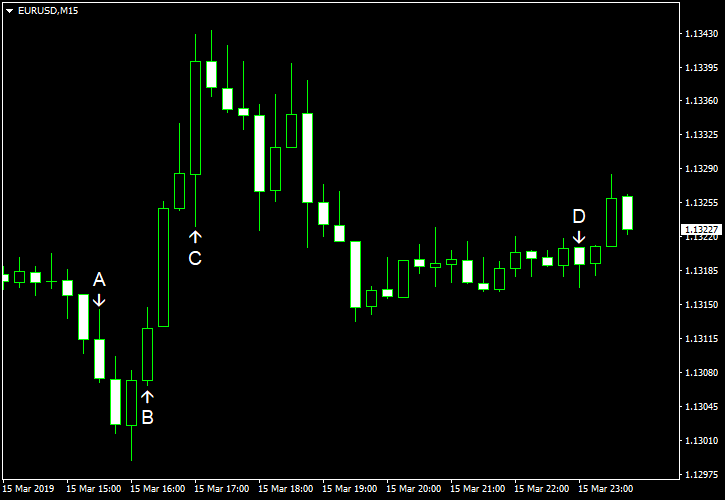

Read more March 15

March 152019

EUR/USD Rises, Then Falls amid Directionless Trading

EUR/USD was rising today but has trimmed its gains by now. Trading was rather directionless on Friday as there was no major market-moving news. As for US data, it was mixed. NY Empire State Index dropped from 8.8 to 3.7 in March instead of rising to 10.1 as analysts had predicted. (Event A on the chart.) Industrial production rose just 0.1% in February, whereas experts had predicted an increase by 0.4%. […]

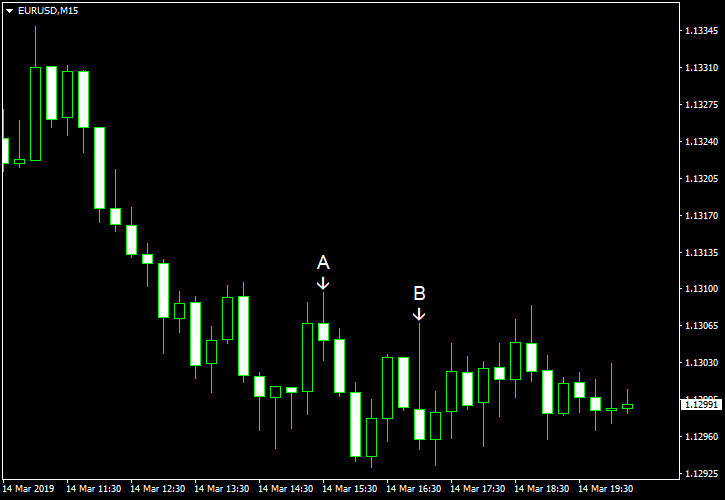

Read more March 14

March 142019

EUR/USD Ends Its Four-Day Rally

EUR/USD declined today, ending its four-day rally. There were several possible reasons for that. Some analysts named German inflation, which missed expectations, as one of them. But surprisingly, the currency pair actually rose after the release, not fell. Other reasons named by market analysts were concerns about the Brexit and somewhat weak Chinese macroeconomic indicators. As for US macro reports: Both import and export prices rose […]

Read more March 13

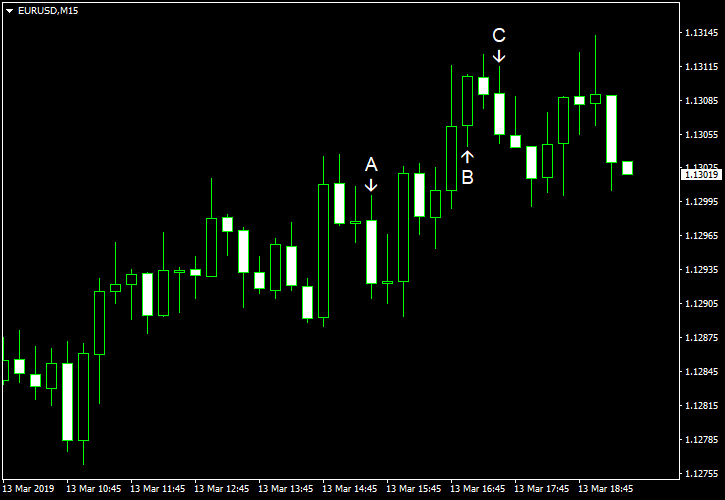

March 132019

EUR/USD Rises for Fourth Consecutive Session

EUR/USD gained today, rising for the fourth consecutive trading session. Some market analysts explained the rally by US producer inflation, which missed expectations. But other US indicators were good, and it did not seem that macroeconomic data affected the currency pair to a great degree. Other analysts speculated that the euro benefited from the news from Great Britain. The UK Parliament rejected the revised Brexit deal agreed […]

Read more March 12

March 122019

EUR/USD Rallies After Core US CPI Misses Mark

EUR/USD rallied today following the release of US inflation data. While the headline figure matched expectations, underline inflation slowed unexpectedly. CPI rose 0.2% in February, matching analysts’ expectations exactly. The index showed no change in January. Core CPI rose just 0.1%, whereas market participants were expecting the same 0.2% rate of growth as in the previous month. (Event A on the chart.) If you have any comments on the recent EUR/USD […]

Read more March 11

March 112019

EUR/USD Moves Sideways, Ignores US Retail Sales

EUR/USD was moving sideways in a range today. US retail sales came out better than expected, but the currency pair shrugged off the news. Retail sales rose 0.2% in January, whereas market participants had expected no growth. The decline in December was revised from 1.2% to 1.6%. (Event A on the chart.) Business inventories expanded 0.6% in December, matching analysts’ forecasts exactly, after demonstrating no change in the prior […]

Read more March 8

March 82019

EUR/USD Rallies After US NFP, Unable to Erase Thursday’s Losses

EUR/USD rallied today, though the rally was not nearly enough to erase yesterday’s slump caused by the dovish European Central Bank. The currency pair rallied as US nonfarm payrolls surprised markets, showing barely any growth of employment. Yet the rally was capped by other parts of the report. Both the unemployment rate and average hourly earnings improved and exceeded expectations. Furthermore, the housing report was also better than forecasts had […]

Read more March 7

March 72019

EUR/USD Tanks to Almost 2-Year Low After Dovish ECB Meeting

EUR/USD tumbled today, touching the lows not seen since June 2017. The reason for the sharp dive was the extremely dovish monetary policy meeting of the European Central Bank. While the ECB kept its interest rates unchanged, it announced a new round of 2-year TLTROs in September this year and significantly downgraded its growth forecasts. Nonfarm productivity rose 1.9% in Q4 2018 after increasing 2.3% in Q3. Analysts had […]

Read more