- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Fundamental Analysis

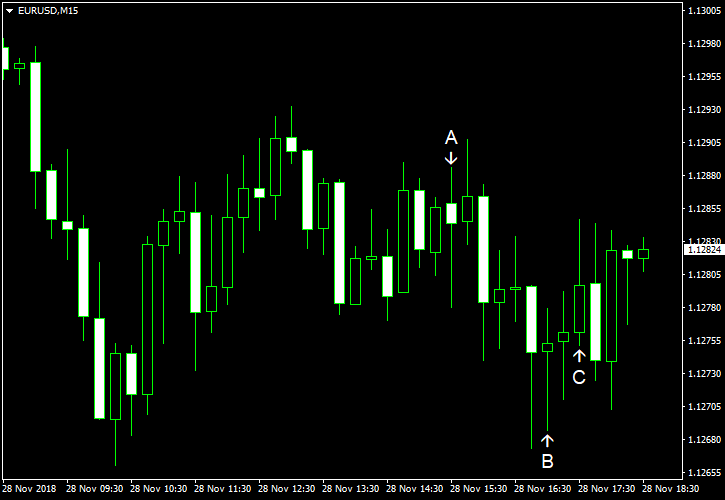

November 28

November 282018

EUR/USD Stable Ahead of Powell’s Speech

EUR/USD was stable today. While basically all macroeconomic reports released in the United States over the current trading session were disappointing, traders were not concerned with that, focusing their attention on the upcoming speech of Federal Reserve Chair Jerome Powell. US GDP grew 3.5% in Q3 2018 according to the preliminary (second) estimate, unchanged from the advance (first) estimate. Market participants have hoped for a small upward […]

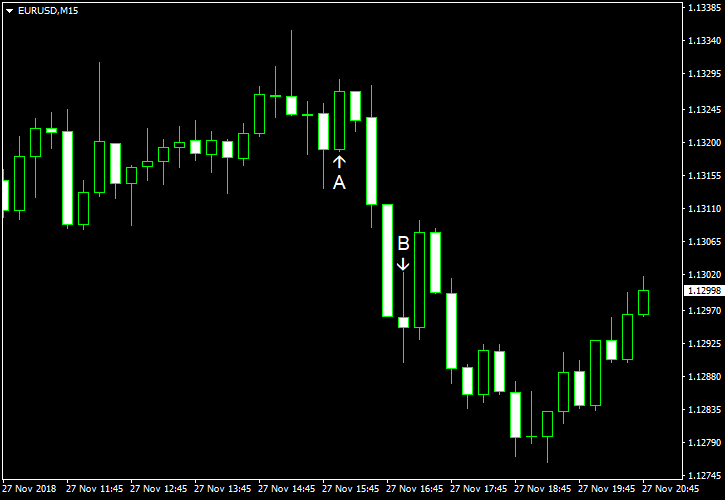

Read more November 27

November 272018

EUR/USD Drops on Trade Tensions, Interest Rate Speculations

EUR/USD dropped today for the third consecutive day. Some analysts speculated that is because US President Donald Trump threatened additional sanctions against China, while others argued that the drop was result of comments from Federal Reserve Vice Chairman Richard Clarida, who backed the idea of additional interest rate hikes. S&P/Case-Shiller home price index rose 5.1% in September, year-on-year. That is a slower rate […]

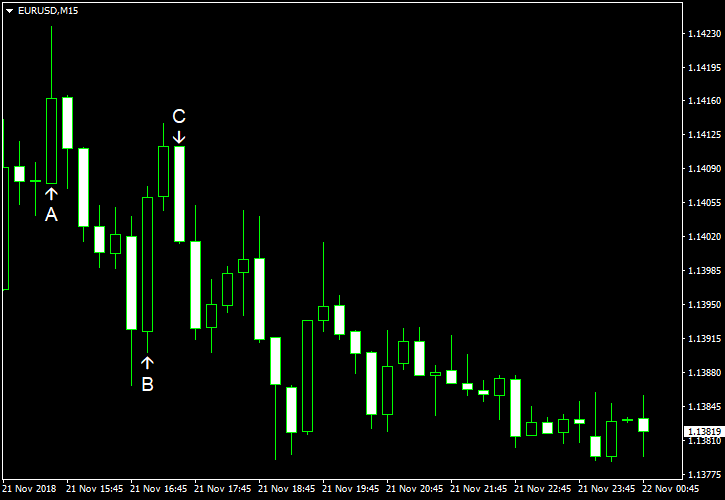

Read more November 21

November 212018

EUR/USD Trims Gains After Climbing Intraday

EUR/USD climbed today but trimmed gains by the end of the trading session. Most US macroeconomic indicators released today were below expectations but that did not help the currency pair to keep gains. Durable goods orders dropped 4.4% in October — two times the forecast decline of 2.2%. The orders rose 0.7% in September. (Event A on the chart.) Initial jobless claims were at the seasonally adjusted rate of 224k last week, above […]

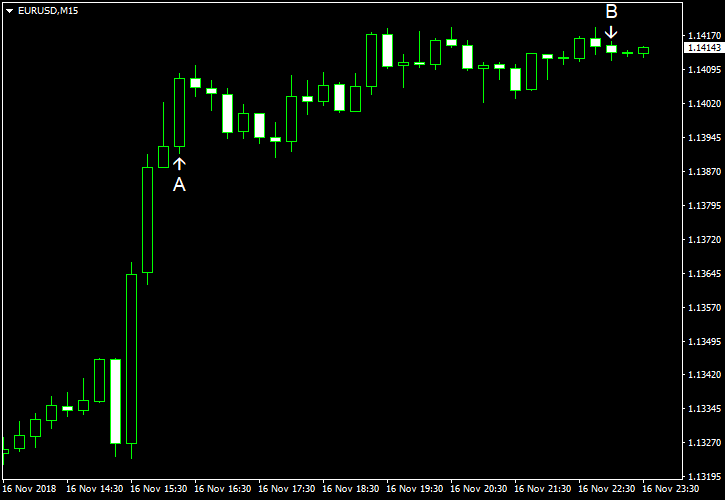

Read more November 16

November 162018

EUR/USD Jumps on Dovish Fed

EUR/USD jumped today. Market analysts speculated that the possible reason for that was the dovish tone of several Federal Reserve officials. While Fed Chairman Jerome Powell was optimistic about US economic growth, he cautioned against headwinds to growth and fading fiscal stimulus. Fed Vice Chairman Richard Clarida said that the benchmark interest rate is getting close to a neutral level. Meanwhile, US economic reports […]

Read more November 15

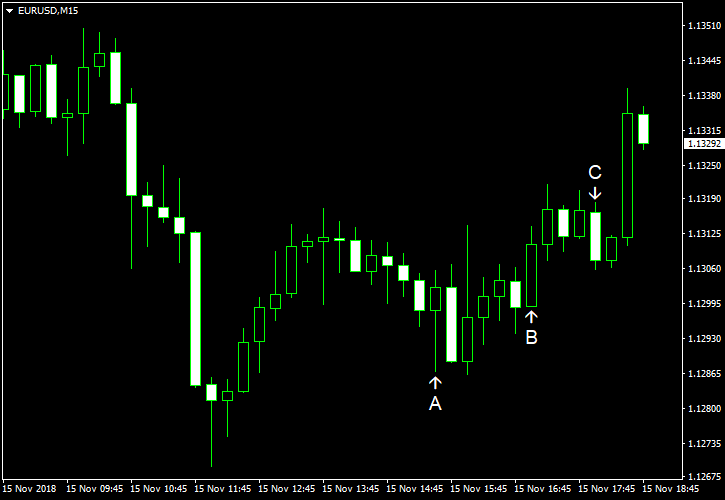

November 152018

EUR/USD Recovers After Sharp Drop Despite Positive US Data

EUR/USD dropped sharply intraday but rebounded later despite the fact that most of US macroeconomic reports released today were better than expectations. Retail sales rose 0.8% in October, exceeding market expectations of a 0.6% increase. The September reading was revised from an increase by 0.1% to a decrease of the same rate. (Event A on the chart.) Philadelphia Fed manufacturing index decreased from 22.2 in October to 12.9 in November, far below the forecast […]

Read more November 14

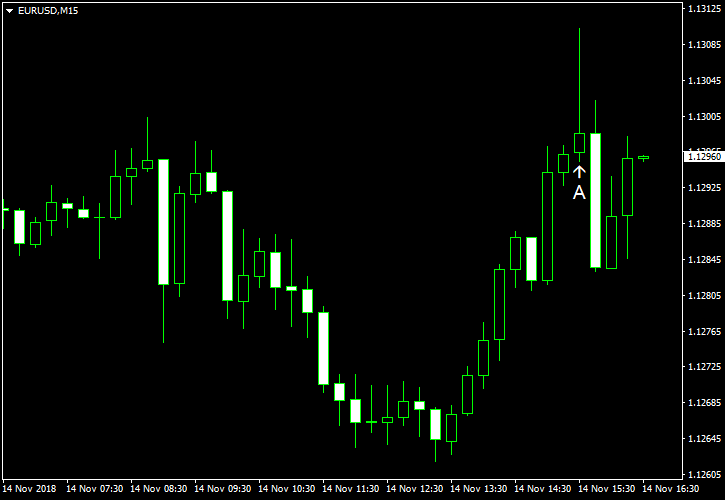

November 142018

EUR/USD Demonstrates Volatile Reaction to US CPI

EUR/USD reacted with volatility to the US Consumer Price Index, which came out within expectations. Initially, the currency pair spiked but retreated very quickly, demonstrating a sharp pullback. CPI rose 0.3% in October, matching analysts’ forecasts exactly. The index increased 0.1% in September. (Event A on the chart.) Yesterday, a report on treasury budget was released, showing a deficit of $100.5 billion in October, which was smaller than the shortage of $116.6 […]

Read more November 9

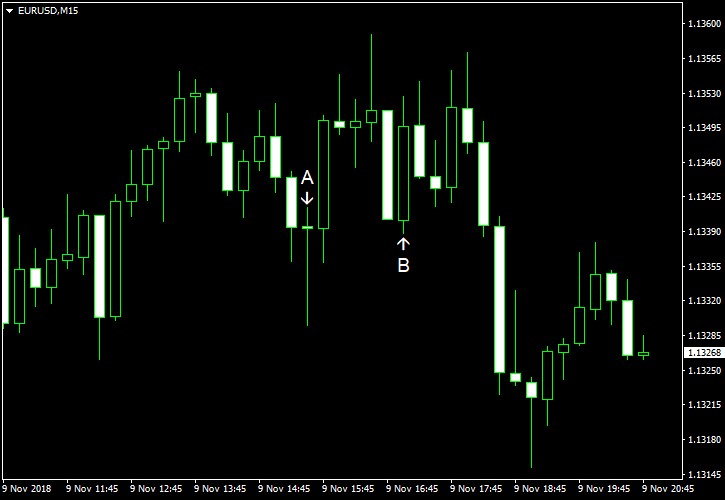

November 92018

EUR/USD Trades Lower Following Better-Than-Expected US PPI

EUR/USD fell today. Some market analysts attributed the decline to the better-than-expected US Producer Price Index print, which boosted the dollar. But the currency pair actually did not respond to the release, continuing to move largely sideways after it and falling later. The EUR/USD pair was heading to end the week lower. PPI rose 0.6% in October, whereas specialists had expected the same 0.2% rate of growth as in September. (Event A on the chart.) […]

Read more November 8

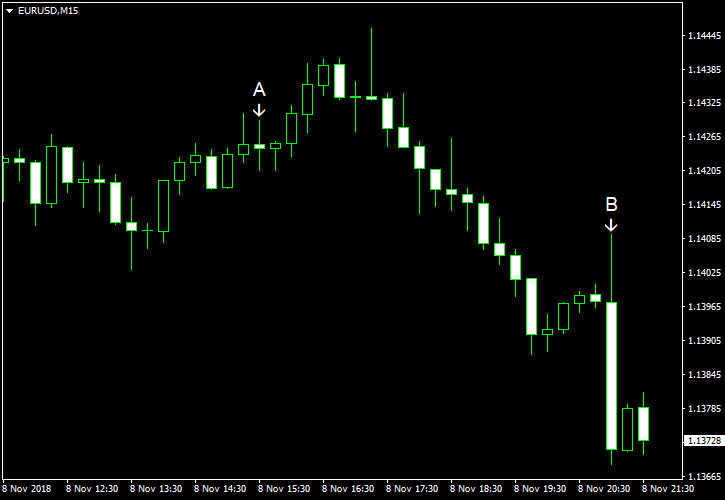

November 82018

EUR/USD Moves Lower Following FOMC Announcement

EUR/USD was moving down today and fell further after the Federal Open Market Committee decided to leave its monetary policy without change. Initial jobless claims fell a bit from 215k to 214k last week, in line with analysts’ forecasts. (Event A on the chart.) FOMC left interest rates unchanged to no ones surprise. (Event B on the chart.) FOMC continued to anticipate additional rate hikes in the future, saying: The Committee […]

Read more November 7

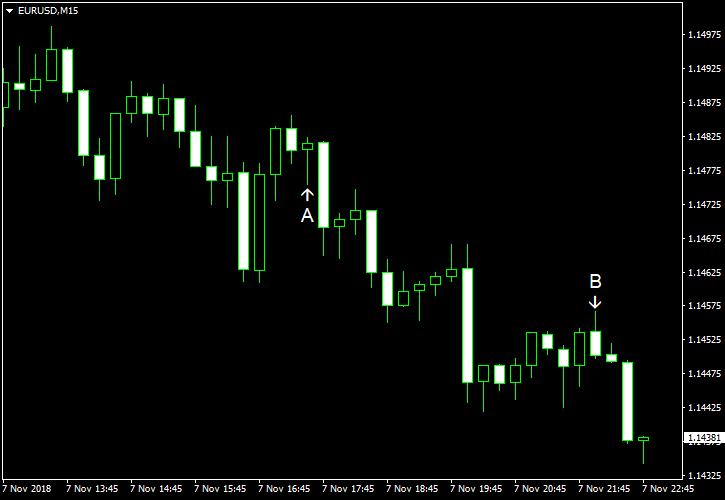

November 72018

EUR/USD Gains After US Midterm Elections

EUR/USD gained today as markets were digesting the results of the US midterm elections. Democrats secured control of the House, while Republicans won the Senate. There were few macroeconomic reports in the United States today, and they were not particularly important, having limited impact on the currency pair. Now, traders wait for tomorrow’s policy announcement from the Federal Reserve. US crude oil inventories increased by 5.8 million barrels last week, […]

Read more November 5

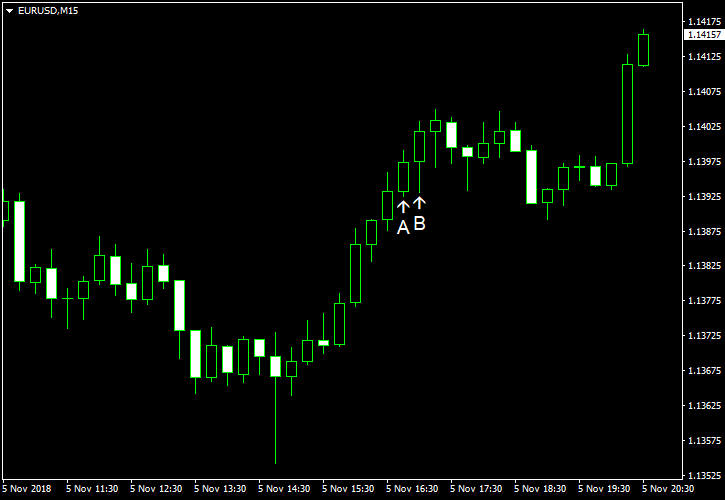

November 52018

EUR/USD Bounces Ahead of Midterm Elections

EUR/USD fell intraday but bounced later, currently trading above the opening level. Market experts explained the bounce by the sell-off of the dollar ahead of the US midterm elections on Tuesday. Markit services PMI climbed to 54.8 in October from 53.5 in September according to the final estimate. The actual reading was in line with analysts’ forecasts and the preliminary estimate of 54.7. (Event A on the chart.) ISM services PMI fell 60.3% in October from 61.6% in September. […]

Read more