- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Fundamental Analysis

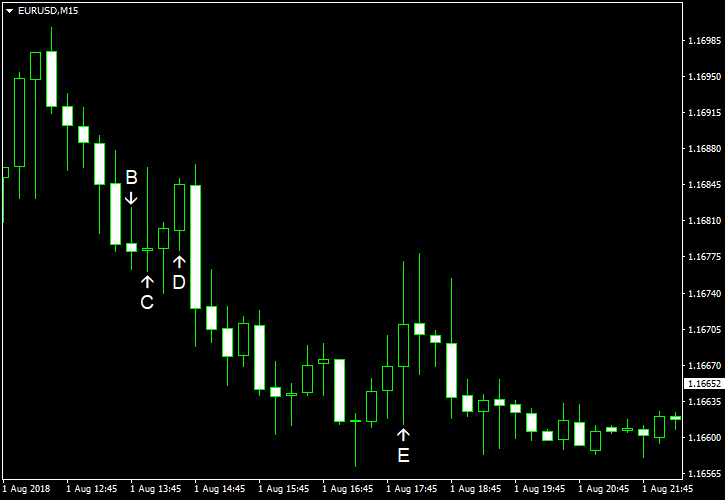

August 1

August 12018

EUR/USD Drops, Pays Little Attention to FOMC Policy Announcement

EUR/USD was falling on Wednesday even as most US macroeconomic reports were underwhelming (with the notable exception of employment data). The policy meeting of the Federal Open Market Committee was in focus today, but in reality its impact on the market was limited. While traders did not expect any changes for monetary policy, they were looking for the statement to provide more clues about the FOMC plans. But the statement had not […]

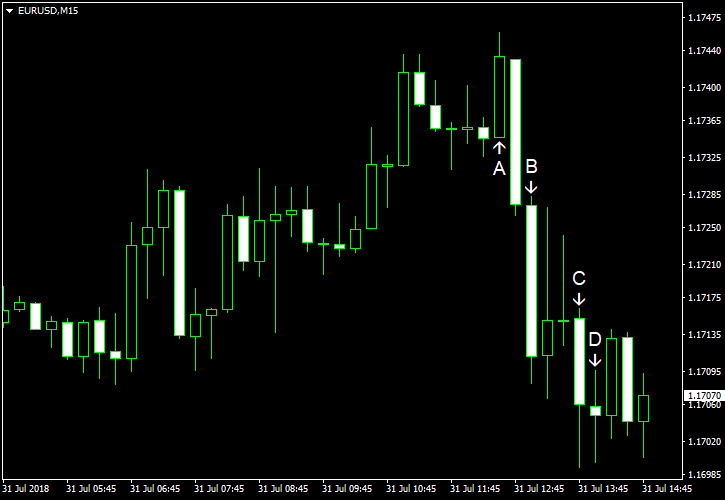

Read more July 31

July 312018

EUR/USD Attempts to Rally on Eurozone Inflation, Retreats to Opening

EUR/USD attempted to rally today, bolstered by the better-than-expected inflation print for the eurozone, but failed and is now trading near the opening level. US reports released over the Tuesday’s session were decent, and some of them were noticeably better than expectations. Both personal income and spending rose 0.4% in June, matching expectations. That is compared to the previous month’s growth of 0.4% for income and 0.5% for spending. Core PCE inflation rose […]

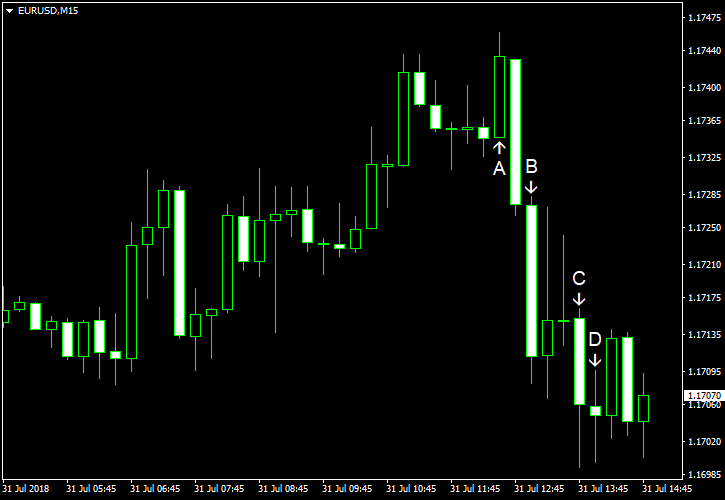

Read more July 31

July 312018

EUR/USD Attempts to Rally on Eurozone Inflation, Retreats to Opening

EUR/USD attempted to rally today, bolstered by the better-than-expected inflation print for the eurozone, but failed and is now trading near the opening level. US reports released over the Tuesday’s session were decent, and some of them were noticeably better than expectations. Both personal income and spending rose 0.4% in June, matching expectations. That is compared to the previous month’s growth of 0.4% for income and 0.5% for spending. Core PCE inflation rose […]

Read more July 27

July 272018

EUR/USD Recovers, Unfazed by Solid US GDP

EUR/USD dropped during the current trading session but has bounced by now. Even the solid gross domestic product report in the United States, which showed the fastest growth of the US economy in four years, did not prevent the rally of the currency pair. US GDP rose 4.1% in Q2 2018. The increase was a bit smaller than 4.2% predicted by analysts but far bigger than 2.2% registered in Q1. (Event A on the chart.) […]

Read more July 27

July 272018

EUR/USD Recovers, Unfazed by Solid US GDP

EUR/USD dropped during the current trading session but has bounced by now. Even the solid gross domestic product report in the United States, which showed the fastest growth of the US economy in four years, did not prevent the rally of the currency pair. US GDP rose 4.1% in Q2 2018. The increase was a bit smaller than 4.2% predicted by analysts but far bigger than 2.2% registered in Q1. (Event A on the chart.) […]

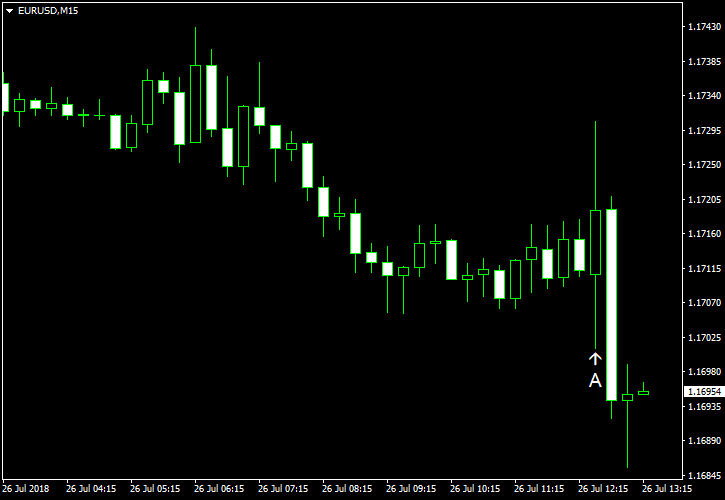

Read more July 26

July 262018

EUR/USD Volatile After ECB Meeting, Settles Lower

EUR/USD was volatile after the European Central Bank policy meeting but ultimately decided to go lower. As was expected, the ECB kept its policy unchanged. ECB President Mario Draghi reiterated the pledge to end quantitative easing at the end of this year. He also reiterated that the interest rates will remain unchanged till at least summer of the next year. (Event A on the chart.) Meanwhile, the United States and the European Union reached […]

Read more July 26

July 262018

EUR/USD Volatile After ECB Meeting, Settles Lower

EUR/USD was volatile after the European Central Bank policy meeting but ultimately decided to go lower. As was expected, the ECB kept its policy unchanged. ECB President Mario Draghi reiterated the pledge to end quantitative easing at the end of this year. He also reiterated that the interest rates will remain unchanged till at least summer of the next year. (Event A on the chart.) Meanwhile, the United States and the European Union reached […]

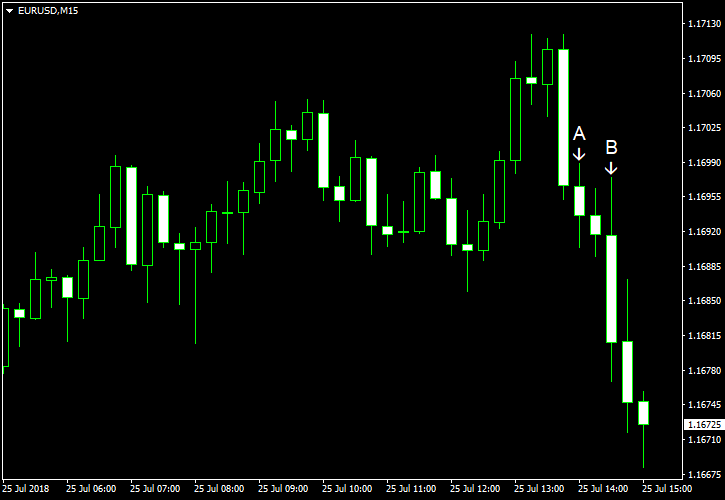

Read more July 25

July 252018

EUR/USD Consolidates Ahead of ECB Meeting

EUR/USD attempted to rally today but has retreated to the opening level by now. Traders wait for the outcome of talks between US President Donald Trump and European Commission President Jean-Claude Juncker, who will try to avoid starting trade wars, but many experts do not believe that the meeting will bring any meaningful results. Market participants also wait for tomorrow’s meeting of the European Central Bank. New home […]

Read more July 25

July 252018

EUR/USD Consolidates Ahead of ECB Meeting

EUR/USD attempted to rally today but has retreated to the opening level by now. Traders wait for the outcome of talks between US President Donald Trump and European Commission President Jean-Claude Juncker, who will try to avoid starting trade wars, but many experts do not believe that the meeting will bring any meaningful results. Market participants also wait for tomorrow’s meeting of the European Central Bank. New home […]

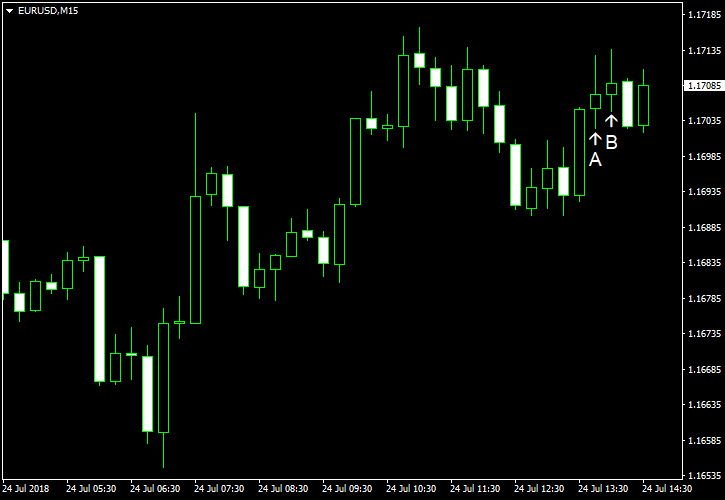

Read more July 24

July 242018

EUR/USD Bounces amid Mixed Data

EUR/USD was falling at the start of today’s trading session, but has reversed its movement at 7:00 GMT, and is now trading above the opening level. Macroeconomic data was mixed both in the United States and the eurozone, but that did not prevent the rebound. Market analysts believe that the currency pair will remain volatile till the European Central Bank policy meeting on Thursday. As for US reports, a couple were released […]

Read more