- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Fundamental Analysis

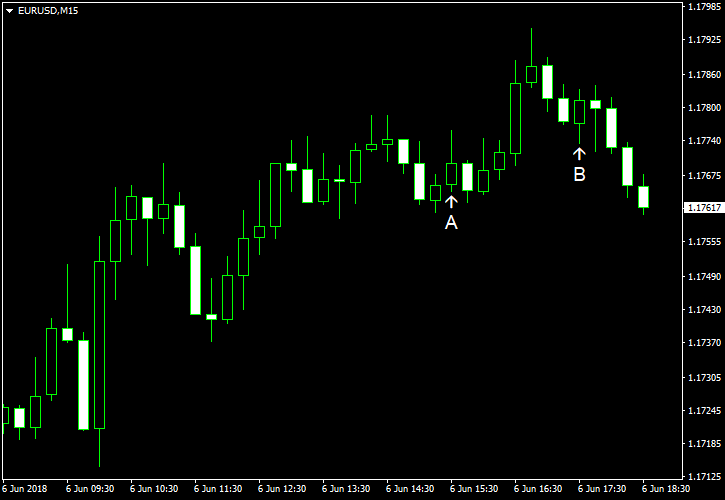

June 6

June 62018

EUR/USD Rallies After Hawkish Comments from ECB Officials

EUR/USD rallied today after European Central Bank chief economist Peter Praet said that the next week’s policy meeting will be a “judgment” call for the quantitative easing program. Some experts interpreted the words as a sign that the ECB will decide next week the date of a QE end sometime later this year. That allowed the currency pair to gain despite positive US economic data. Nonfarm productivity rose […]

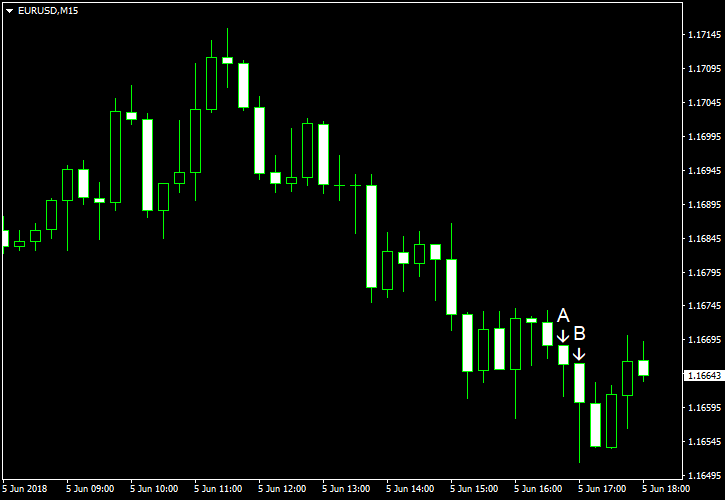

Read more June 5

June 52018

EUR/USD Slips After US Services Data

EUR/USD fell today, changing its direction for the third day in a row. Some market analysts predicted that the currency pair will be trading in a range in a near future as the most important fundamentals, like geopolitical risks and monetary policy, are already priced in. Meanwhile, both reports about the US service sector released today beat expectations, driving the EUR/USD pair further down, though currently it is attempting […]

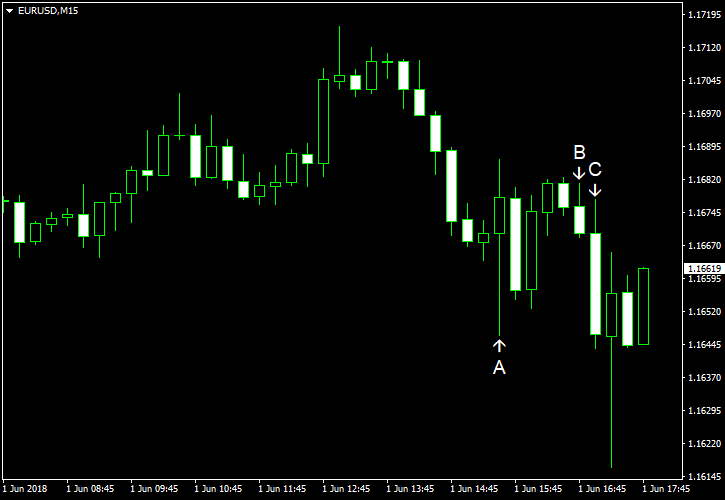

Read more June 1

June 12018

EUR/USD Rallies as Employment Data Exceeds Expectations

EUR/USD rallied today even though trade wars between the United States and their trading partners have started. Yet macroeconomic data in the United States overshadowed other news. Almost all indicators released today were very solid. The employment report drew the most attention from traders as basically all of its components were better than expected. Nonfarm payrolls rose by 223k in May, demonstrating a much faster rate […]

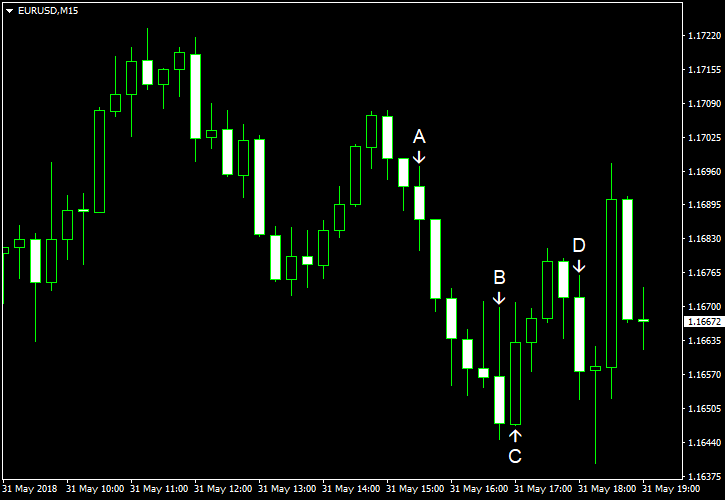

Read more May 31

May 312018

EUR/USD Volatile amid Geopolitical Uncertainty

EUR/USD was rather volatile today, attempting to rally intraday but trading near opening level now, as traders were digesting news about political turmoil in Europe and reports that the United States will implement the postponed tariffs on goods from its closest allies as the exemption from the duties will expire tonight. Most US macroeconomic reports released over the trading session were good, with the exception of pending home […]

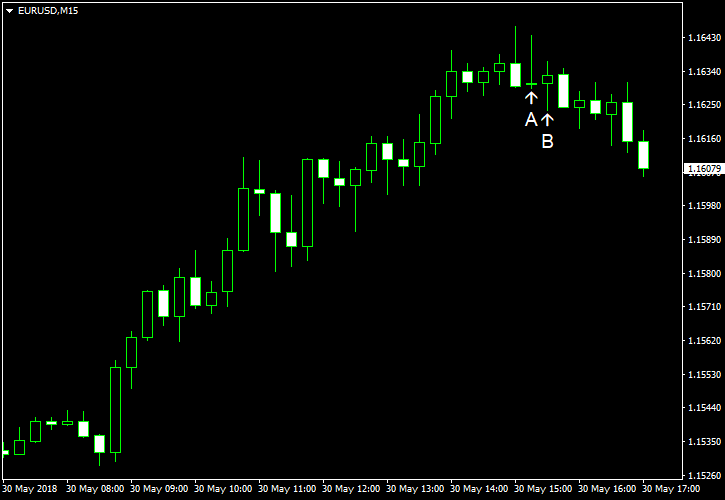

Read more May 30

May 302018

EUR/USD Recovers As Political Concerns Ease

EUR/USD was falling at the start of the Wednesday’s trading session, but managed to halt the decline, and is now rallying. The reason for the rally was the fact that fears associated with the political turmoil in Italy waned. Instead, there were hopes for a new government that will not be biased against the euro. Meanwhile, macroeconomic reports released in the United States over the trading session missed forecasts, adding to the upward momentum of the currency pair. […]

Read more May 29

May 292018

EUR/USD Falls to New Lows amid Europe’s Political Turmoil

EUR/USD fell today, extending yesterday’s decline and touching new lows for the year, amid ongoing political crisis in Europe. The decent macroeconomic reports released in the United States over the current trading session added to the downward momentum of the currency pair. S&P/Case-Shiller home price index rose 6.8% in March, year-on-year, the same as in February. Analysts had expected a slowdown to 6.5%. Month-over-month, the index was up as much as 1%. (Event A on the chart.) Consumer confidence […]

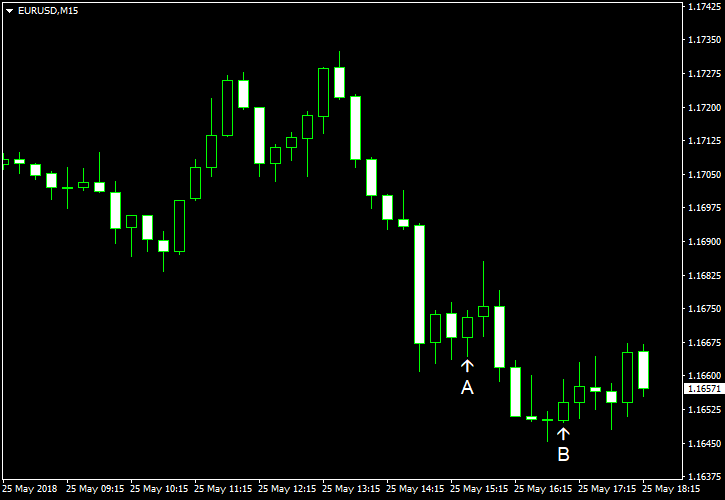

Read more May 25

May 252018

EUR/USD Resumes Decline as Geopolitical Tensions Don’t Escalate

EUR/USD attempted to rally yesterday on the back of geopolitical tensions, but the rally did not last long, and now the currency pair moves down again. Analysts explained the decline, which pushed the EUR/USD pair to the lowest since November, by the fact the tensions did not escalate. Today’s macroeconomic data in the United States was disappointing, but even that was unable to support the currency pair. Durable goods orders dropped 1.7% in April. […]

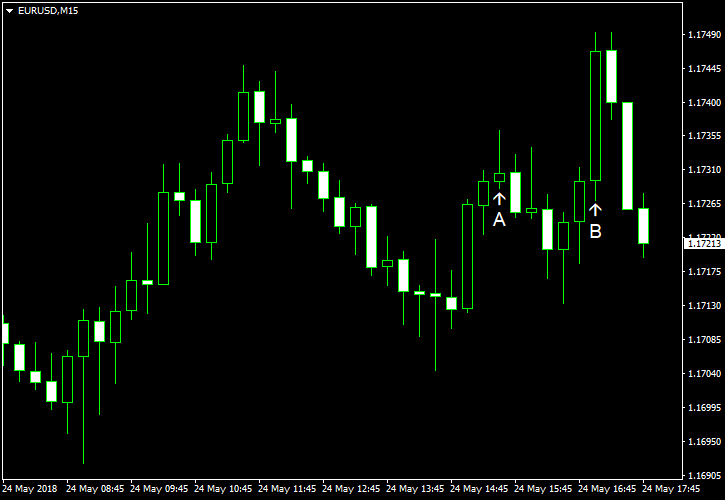

Read more May 24

May 242018

EUR/USD Rises As Geopolitical Tensions Resurface

EUR/USD rose today as the dollar was under pressure from resurfacing geopolitical tensions. US President Donald Trump was pushing for tariffs on imported cars. He also announced that the planned meeting with North Korean leader Kim Jong-un was cancelled. Meanwhile, US economic data released today was disappointing, adding to the pressure on the greenback. Initial jobless claims rose from 223k to 234k last week instead […]

Read more May 23

May 232018

EUR/USD Remains Subdued After FOMC Minutes

EUR/USD was falling during the Wednesday’s trading session. While the currency pair attempted to rebound after policy minutes released by the Federal Open Market Committee, it did not go far. Market analysts considered the minutes actually supportive to the dollar, basically confirming a June interest rate hike. Flash Markit manufacturing PMI was at 56.6 in May, little changed from 56.5 in April and matching forecasts. Flash Markit services […]

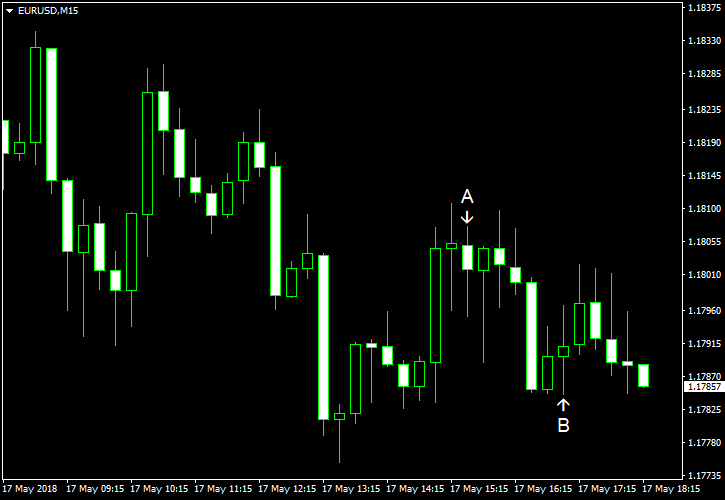

Read more May 17

May 172018

US Treasury Yields Continue to Push EUR/USD Lower

EUR/USD fell today, extending its decline for the fourth consecutive trading session, as persistently firm US Treasury yields continued to bolster the US dollar. Macroeconomic data released in the United States over the current session was good for the most part, with the exception of unemployment claims that rose more than was expected. Initial jobless claims climbed from 211k to 222k last week, exceeding market expectations of 216k. (Event […]

Read more