- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Fundamental Analysis

April 27

April 272018

EUR/USD Bounces as Markets Ignore US GDP

EUR/USD was falling today following yesterday’s steep sell-off. While the currency pair attempted to recover, it ended Thursday’s session lower. During the current session, the EUR/USD pair had extended the decline intraday, but has managed to bounce by now. The pair benefited from the fact that markets had muted reaction to the better-than-expected US gross domestic product print. US GDP grew 2.3% in Q1 2018. While the growth […]

Read more April 26

April 262018

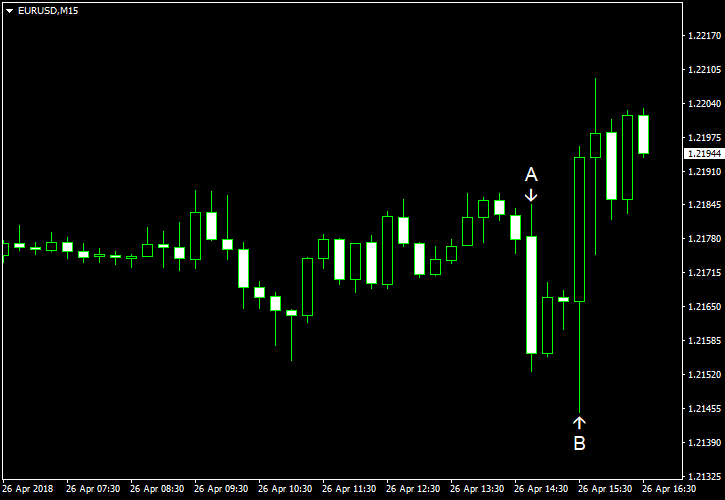

EUR/USD Recovers as Mario Draghi Downplays Poor Data

EUR/USD dropped today after the European Central Bank left its monetary policy unchanged and signaled that it is going to keep interest rates low for a long time. (Event A on the chart.) Yet the currency pair bounced after ECB President Mario Draghi downplayed the recent negative macroeconomic reports in his introductory statement before the press conference, saying that the data is “consistent with a solid and broad-based expansion of the euro […]

Read more April 24

April 242018

EUR/USD Currency Pair Acts in Contradiction to Macroeconomic Data

EUR/USD acted in contradiction to economic reports released during the current trading session. The currency started its rally after the surprisingly weak German Ifo Business Climate (event A on the chart) and continued to rise even as US data was good for the most part. The possible reason for such a weird behavior was profit-taking after the dollar’s recent rally in preparation for tomorrow’s policy announcement by the European Central Bank. S&P/Case-Shiller home price index climbed […]

Read more March 29

March 292018

EUR/USD Slows Rally Ahead of Holiday

EUR/USD slowed its rally today as market were preparing for the Good Friday. Many US markets will be close for the holiday and trading volumes will be light. As for today’s US economic data, it was mostly decent with the exception of Chicago PMI. Personal income rose 0.4% and personal spending rose 0.2% in February. Both registered the same rate of growth as in January and both matched analysts’ expectations. Core PCE […]

Read more March 28

March 282018

EUR/USD Drops, Extends Decline After US GDP

EUR/USD continued to fall today, extending its decline after the release of better-than-expected US GDP report. The currency pair also remained under pressure from the same factors as yesterday — subsiding fears of trade wars and end-of-quarter flows. US GDP rose 2.9% in Q4 2017 according to the third and final estimate. The revised figure was above the predicted increase of 2.7% and the preliminary reading of 2.5%. The US economy grew by 3.2% in Q3 2017. […]

Read more March 27

March 272018

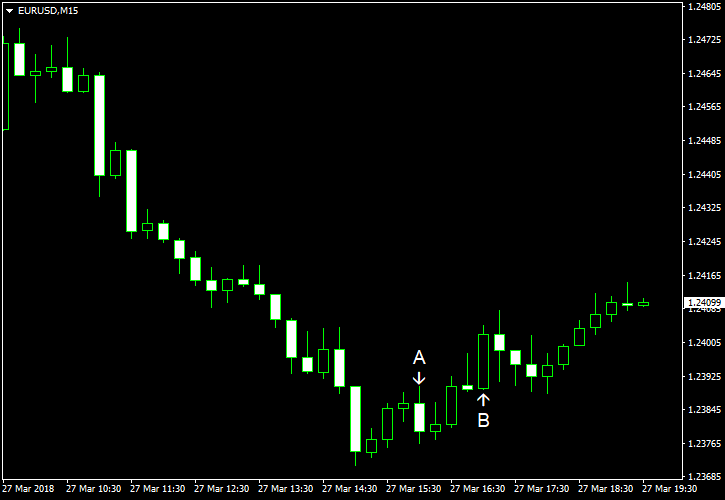

EUR/USD Falls as Dollar Sell-Off Halts

EUR/USD fell today as the dollar was rebounding after the previous sell-off. Market analysts named several possible reasons for the rebound. One of them was subsiding fears of trade wars between China and the United States as the two countries were negotiating about a trade agreement. The other were month-end flows as investors were converting their earnings into the US currency. S&P/Case-Shiller home price index rose 6.4% in January, year-on-year. That […]

Read more March 23

March 232018

EUR/USD Rebounds as Markets Fear Trade Wars

EUR/USD rebounded after yesterday’s decline. US macroeconomic data released over the trading session was mixed, but traders barely paid any attention to it. Rather, they were focusing on the threat of trade wars. Additionally, US President Donald Trump promised to veto the spending bill unless it includes funding for the wall he promised in his election campaign, meaning that the US government may face yet another […]

Read more March 22

March 222018

EUR/USD Fails to Maintain FOMC-Infused Rally

EUR/USD attempted to extend yesterday’s FOMC-infused rally today but failed. The possible reason for that were manufacturing and services reports for the eurozone released by Markit during the current trading session. Meanwhile, today’s US data was good for the most part. Initial jobless claims rose from 226k to 229k last week, whereas analysts had expected them to be little changed. (Event A on the chart.) Markit manufacturing PMI rose from […]

Read more March 21

March 212018

EUR/USD Climbs After FOMC Keeps Dot Plot Unchanged

EUR/USD jumped today following the policy announcement by the Federal Open Market Committee. While the FOMC raised interest rates, as was widely expected, it retained its dot plot, meaning no fourth hike is projected for 2018. This was certainly a disappointment for dollar bulls, therefore the greenback retreated against its rivals after the announcement. US current account deficit increased to $128.2 billion in Q4 2017 from $101.5 […]

Read more March 16

March 162018

EUR/USD Declines for Third Day as Markets Prepare for Fed Hike

EUR/USD fell for the third day in a row despite turmoil in the US government. The dollar got some support from today’s macroeconomic reports, which were good for the most part, with the exception of the housing data. But the most important reason for the greenback’s rally was anticipation of an interest rate hike from the Federal Reserve next week. Housing starts and building permits fell in February. Housing starts were at the seasonally adjusted annual rate […]

Read more