- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Fundamental Analysis

January 30

January 302018

EUR/USD Rallies After European GDP Figures

EUR/USD gained today, getting support from GDP figures released in the eurozone during the current trading session. Among them, the report for the whole eurozone showed that the economic growth remained stable at 0.6%. (Event A on the chart.) US economic reports were good as well, making the currency pair give away some of its gains by now. S&P/Case-Shiller home price index rose by 6.4% in November from a year ago. Analysts had […]

Read more January 26

January 262018

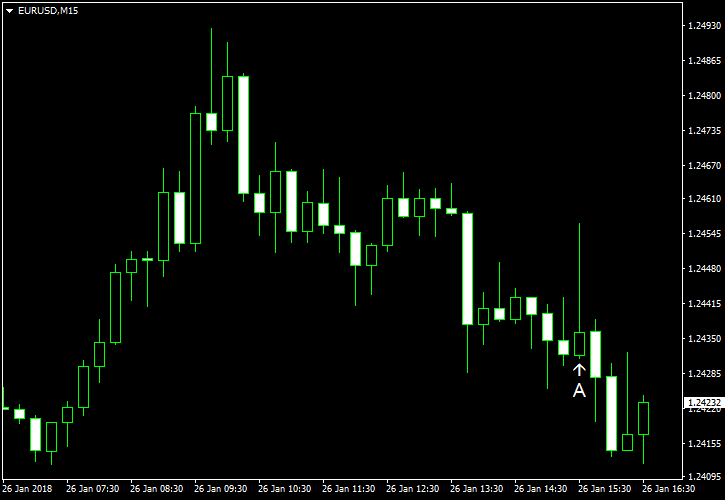

EUR/USD Resumes Rally After Losing Thursday’s Gains

EUR/USD resumed its upward movement today after losing its gains yesterday. The currency pair retreated after US President Donald Trump said that he wants stronger dollar. Today, EUR/USD rebounded, though is struggling to keep gains right now. Advance estimate for US GDP showed growth by 2.6% in Q4 2017. That was below the average forecast of a 3.0% increase and the 3.2% growth registered in Q3. […]

Read more January 25

January 252018

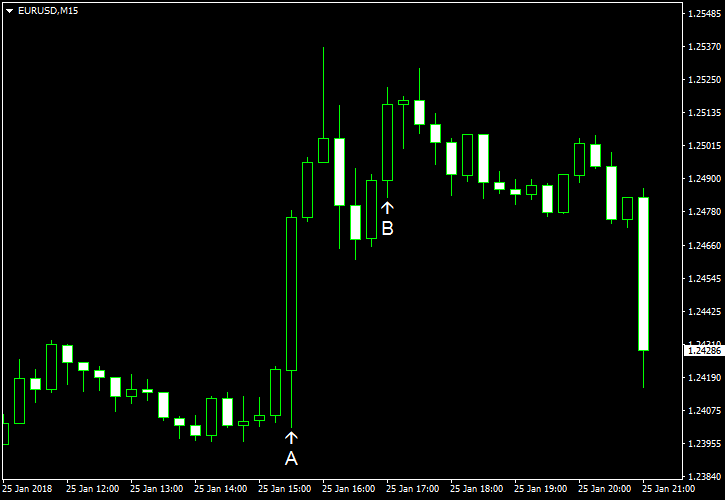

EUR/USD at New Highs After ECB Stays Put

EUR/USD continued to rise today after the European Central Bank left its monetary policy unchanged and ECB President Mario Draghi voiced confidence in economic growth and inflation. (Event A on the chart.) Meanwhile, economic data released in the United States was mixed but mostly positive. Seasonally adjusted initial jobless claims rose from 216k to 233k last week but were still below the forecast level of 239k. (Event A on the chart.) […]

Read more January 24

January 242018

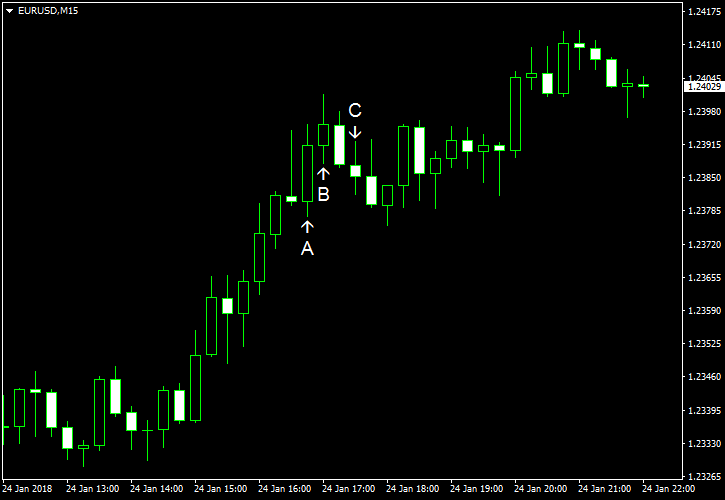

EUR/USD Rises to Highest in Three Years

EUR/USD climbed to the highest level since the end of 2014 today after US Treasury Secretary Steven Mnuchin suggested that a weaker dollar is beneficial to the US economy. Economic reports released in the United States over the trading session were not helpful to the US currency either, with the manufacturing index being the only positive indicator. Flash Markit manufacturing PMI rose from 55.1 in December to 55.5 in January, reaching the highest […]

Read more January 23

January 232018

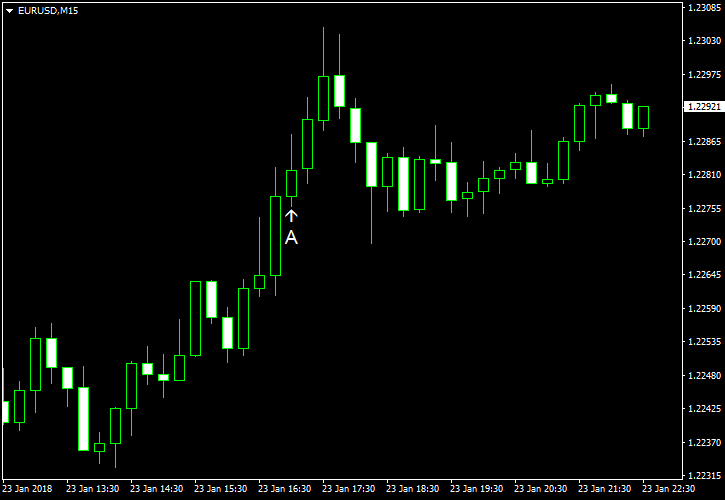

EUR/USD Rises with German Economic Sentiment

EUR/USD rose today following the release of the better-than-expected report about the German economic sentiment and continued to rise after the bigger-than-expected drop of the US manufacturing index. The currency pair was down before that as the dollar got boost from the reopening of the US government. Richmond Fed manufacturing index fell from 20 to 14 in January. That was a bigger drop than the one predicted by analysts, who had expected just a minor decrease […]

Read more January 18

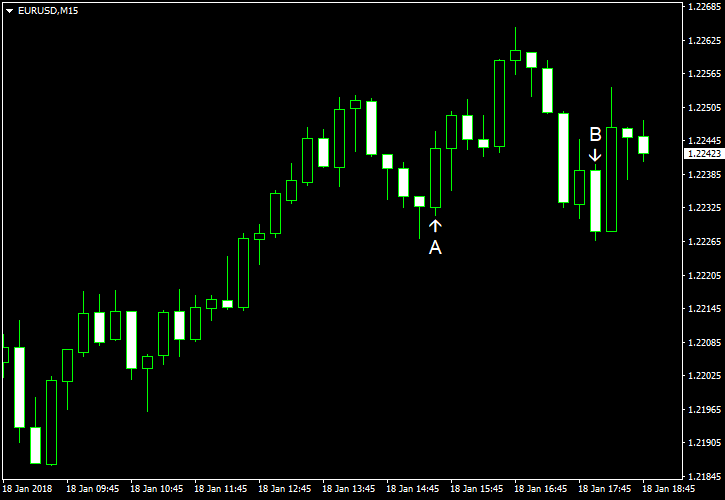

January 182018

US Fundamentals Support Short-Lived EUR/USD Rally

The US dollar had been falling against the euro throughout today’s trading session, but it had stopped its descent just before the New York trading session began. The rally in the EUR/USD currency pair was reignited by the release of the scheduled US macroeconomic statistics. US housing starts and building permits failed to rise in December. Housing starts slumped from 1.30 to 1.19 million units despite the median forecast of 1.28 […]

Read more January 17

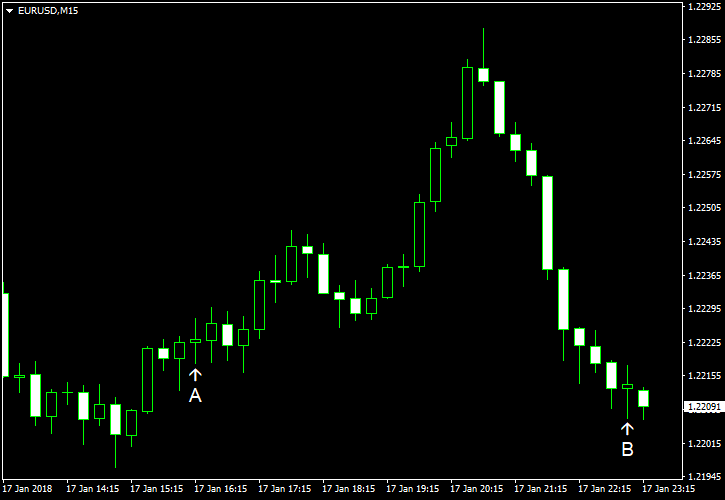

January 172018

EUR/USD Rises and Falls, Ignores US Macros

The euro was on the rise against the US dollar during the first half of the New York trading session but declined afterwards. The currency pair paid little attention to the macroeconomic data that was released in the United States today. Industrial production increased by 0.9% in December after 0.1% decline in November (revised negatively from 0.2% growth). The output growth was significantly higher than the median forecast of 0.5%. Capacity utilization rose […]

Read more January 12

January 122018

EUR/USD Rally Stopped by Good CPI Report

Having initially rallied on the Brexit deal news (event A on the chart), EUR/USD dipped on the US inflation and retail sales data, but returned to a slow uptrend afterwards. It looks like it is becoming difficult for the currency pair to continue its growth above the multi-year highs. US CPI increased by 0.1% in December following 0.4% growth in November. The rise was the same as the forecast value. However, core CPI (excluding food and energy […]

Read more January 11

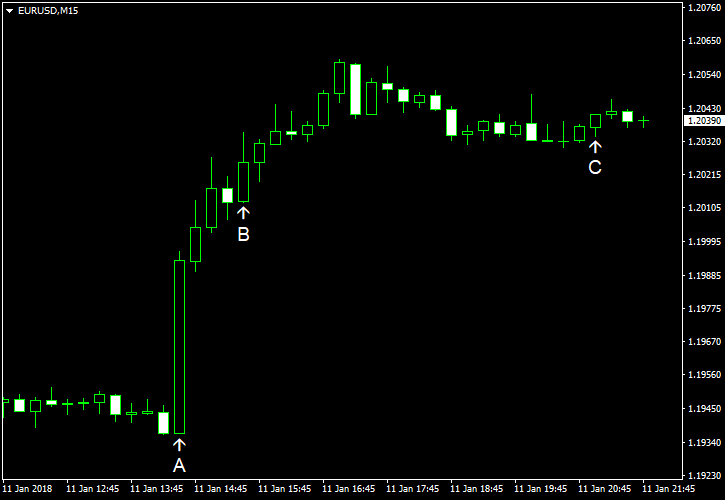

January 112018

EUR/USD Rallies on ECB Meeting Account and Poor US Data

The euro rallied versus the US dollar immediately after the December ECB meeting accounts have been made public (event A on the chart). The account turned out to be more hawkish compared to what the market participants had expected. The currency pair then continued to grow following the poor macroeconomic data from the USA. Producer price index (PPI) fell by 0.1% in December instead of rising by 0.2% in accordance with the median forecast. November […]

Read more January 10

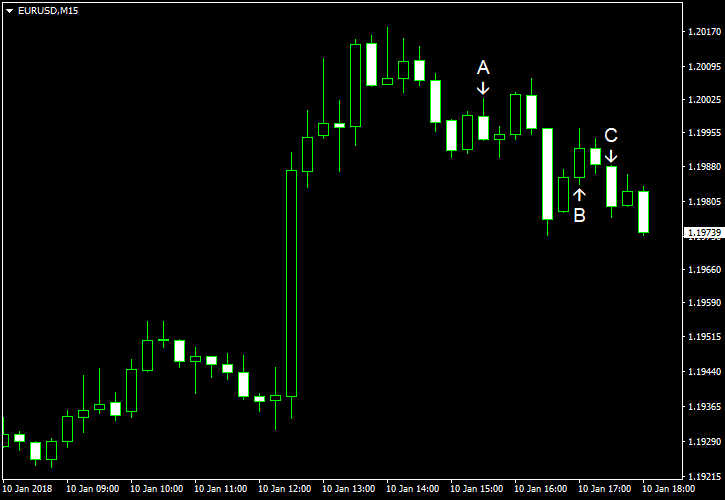

January 102018

EUR/USD Fails to Restart Rally on Mediocre US Data

The euro rallied against the US dollar earlier today on the rumors that China may reduce or stop its purchases of the US Treasury notes. The US dollar regained some of the losses after the initial upswing in EUR/USD and did not weaken much following lackluster domestic macroeconomic data. Export and import prices report disappointed the US dollar bulls. Import prices rose by 0.1% in December after rising by 0.8% in November. Meanwhile, export […]

Read more