- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Fundamental Analysis

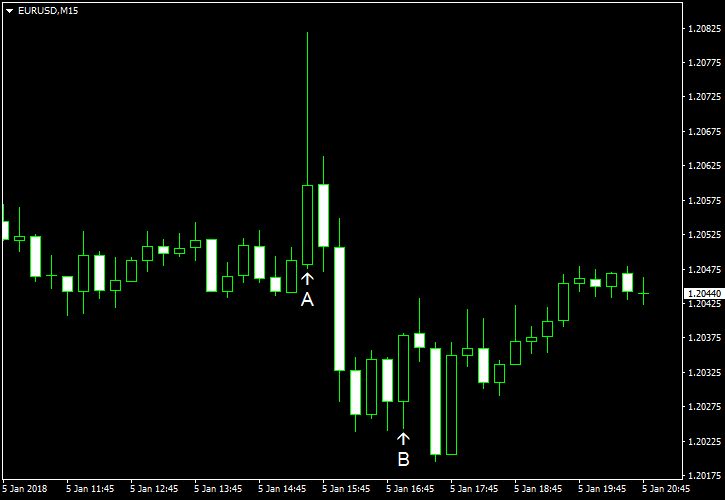

January 5

January 52018

EUR/USD Fails to Stage Rally on Back of Weak NFP

US nonfarm payrolls came out worse than analysts expected. It was a stark contrast to the private ADP employment report released earlier this week, which surprised market participants positively. EUR/USD attempted to rise after the release, but the rally was extremely short-lived, and the currency fell below the pre-rally levels. Most other macroeconomic releases that came out over the current trading session were disappointing as well, […]

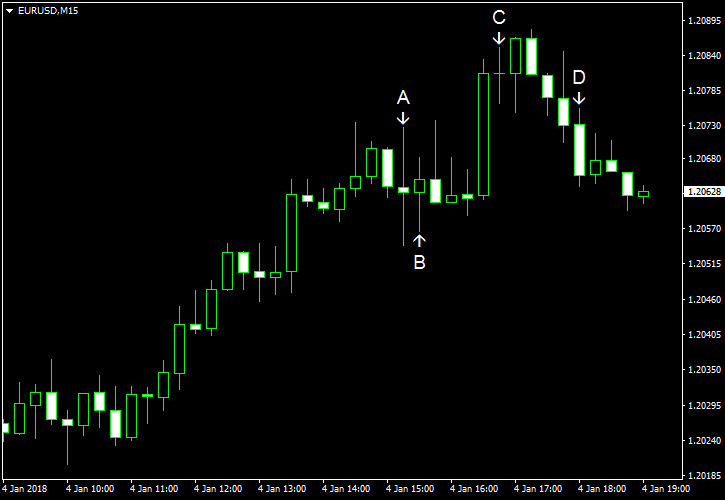

Read more January 4

January 42018

EUR/USD Sticks to Gains Following ADP Employment Report

EUR/USD was rising today, and the stellar employment data from Automatic Data Processing was unable to stop that. Some market analysts argued that the reason for that was risk appetite among investors. Others pointed out at the set of solid PMI figures released by Markit today as the reason for the euro’s gains on the dollar. ADP employment rose by 250k from November to December. It was a far bigger growth than 191k […]

Read more January 3

January 32018

EUR/USD Slips as US Economic Data Supports Greenback

EUR/USD fell today as economic reports released in the United States in the course of the trading session beat market expectations. FOMC policy minutes had no big revelations, but the currency pair slid after they were released nonetheless. ISM manufacturing PMI climbed from 58.2 in November to 59.7 in December, while analysts had expected the index stay little changed. (Event A on the chart.) Construction spending rose 0.8% in November from […]

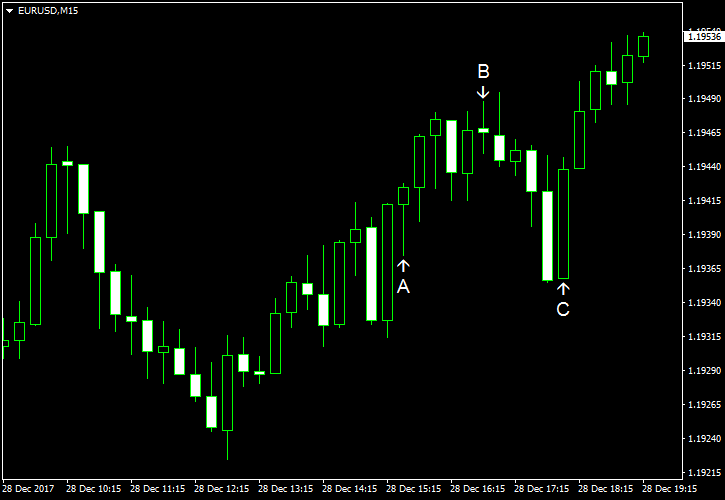

Read more December 28

December 282017

EUR/USD Continues to Rise Ahead of Year’s End

EUR/USD climbed today, maintaining its upward trend. US economic reports were mixed, but the good portion of the data barely slowed the rise of the currency pair. Initial jobless claims were at the seasonally adjusted rate of 245k last week, unchanged from the previous week’s unrevised level. Experts had hoped for a small drop to 240k. (Event A on the chart.) Chicago PMI climbed from 63.9 in November to 67.6 in December, ending the year […]

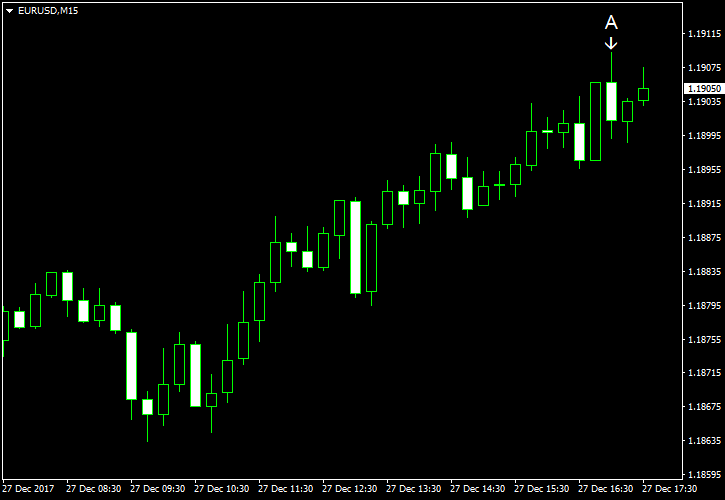

Read more December 27

December 272017

EUR/USD Rises During Slow Holiday Trading

EUR/USD rose during the Wednesday’s slow trading. With absence of any major fundamental drivers, traders flocked to riskier currencies, avoiding safer ones. US economic data was mixed as the housing market continued to show decent performance, while the consumer confidence tanked unexpectedly. Consumer confidence dropped to 122.1 in December from the negatively revised reading of 128.6 registered in November (129.5 before the revision). The actual drop was far bigger […]

Read more December 26

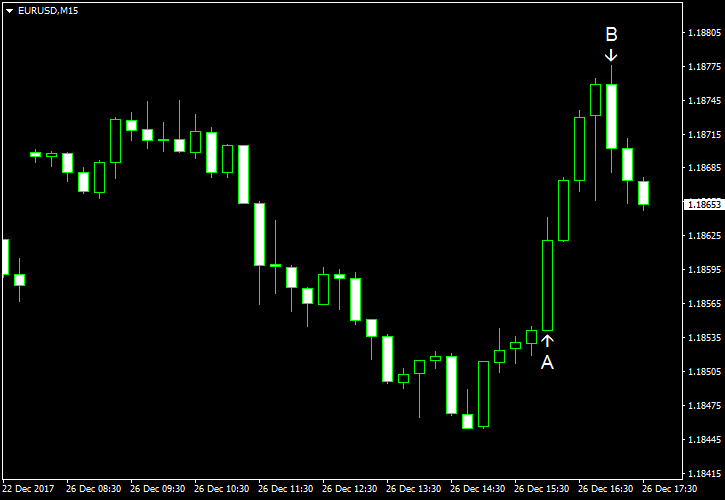

December 262017

EUR/USD Stable During Holiday Trading

EUR/USD was stable today as trading continued to be thin during the Christmas and New Year holiday period. Economic data in the United States was mixed. The housing market continued to show strength, while the manufacturing sector demonstrated slower growth. S&P/Case-Shiller home price index rose 6.4% in October, year-on-year. That was a faster growth than was predicted by analysts (6.3%) and registered in the previous months (6.2%). Month-over-month, the index was […]

Read more December 22

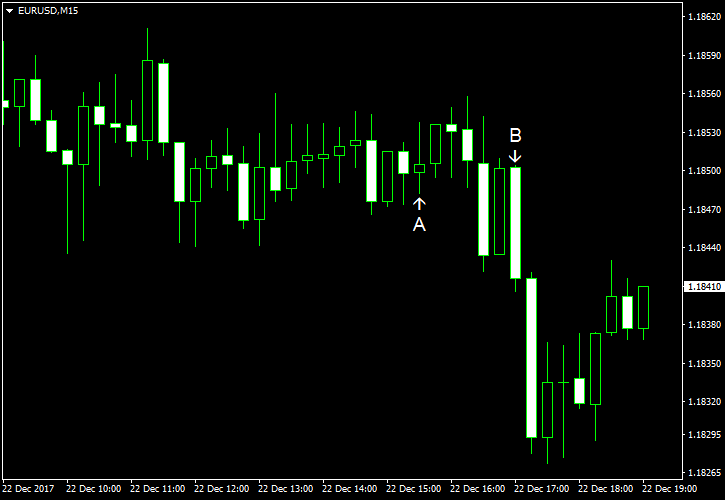

December 222017

EUR/USD Drops as Catalan Separatists Win Elections

EUR/USD dropped today despite mixed economic data released in the United States over the trading session. The major reason for the drop was the victory of Catalan separatist parties, which gained majority in the parliament. The news sparked fresh worries for integrity of Spain and the future of the eurozone as a whole. Durable goods orders rose 1.3% in November, failing to meet the average forecast of 2.1%. The previous month’s dropped got a positive revision from 1.2% to 0.8%. (Event […]

Read more December 21

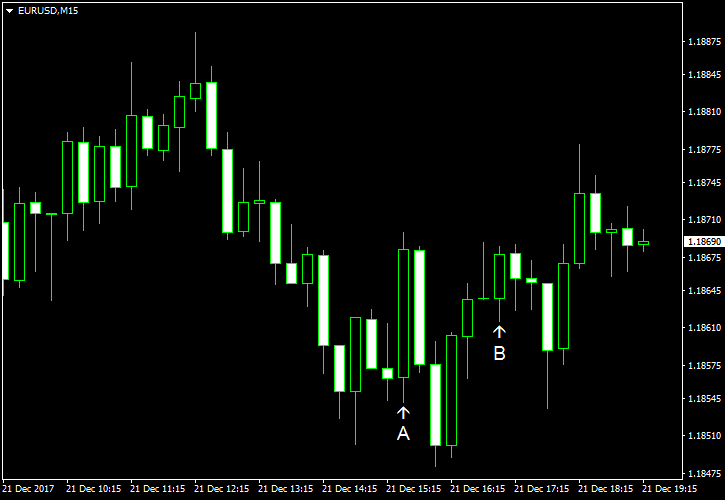

December 212017

EUR/USD Flat After Mixed US Data

EUR/USD was flat today following mixed US data. While the currency pair halted its rally that it has started at the beginning of the week, so far EUR/USD was still trading 1.1% higher on the week. US GDP rose at the annual rate of 3.2% in Q3 2017 according to the final estimate. Analysts had expected the same 3.3% increase as in the preliminary estimate. GDP grew by 3.1% in Q2. (Event A on the chart.) Philadelphia […]

Read more December 20

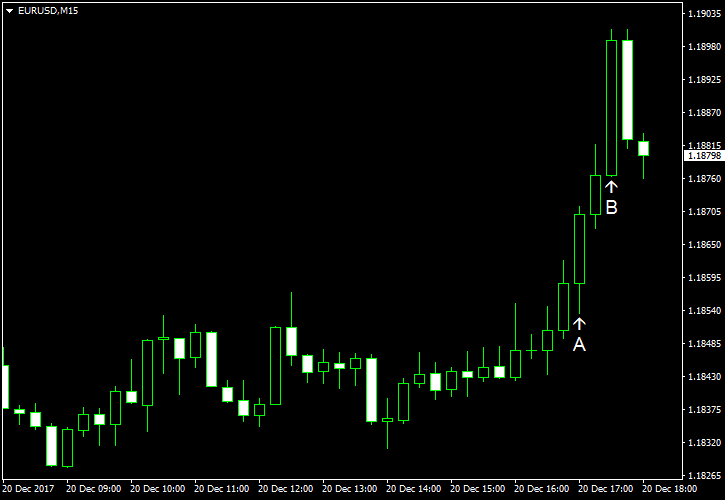

December 202017

EUR/USD Trades Higher as US Congress Close to Passing Tax Reform Bill

EUR/USD rose today even as US Congress was very close to voting for the final version of the tax reform bill. Markets were apathetic to the news as the reform was priced in and trading was becoming lighter ahead of Christmas. Better-than-expected US housing data did not boost the dollar. Existing home sales jumped to the seasonally adjusted annual rate of 5.81 million in November from the upwardly revised 5.50 million in October. That was […]

Read more December 19

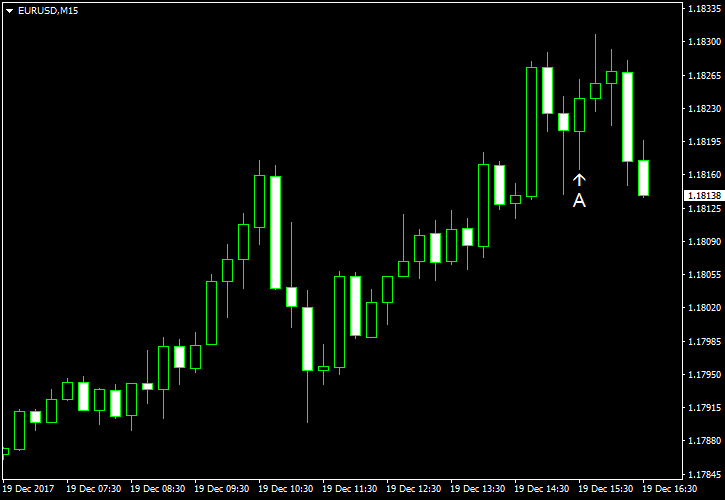

December 192017

EUR/USD Rallies, Ignoring Data from United States & Eurozone

EUR/USD rallied today. That was a surprise, considering that the economic data in the eurozone was disappointing, while all the US indicators released over the trading session were better than expected. Analysts explained such performance by doubts that the planned US tax reform will be helpful to the US economy in the long run. Both housing starts and building permits were at the seasonally adjusted annual rate of 1.30 million in November. […]

Read more