- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Fundamental Analysis

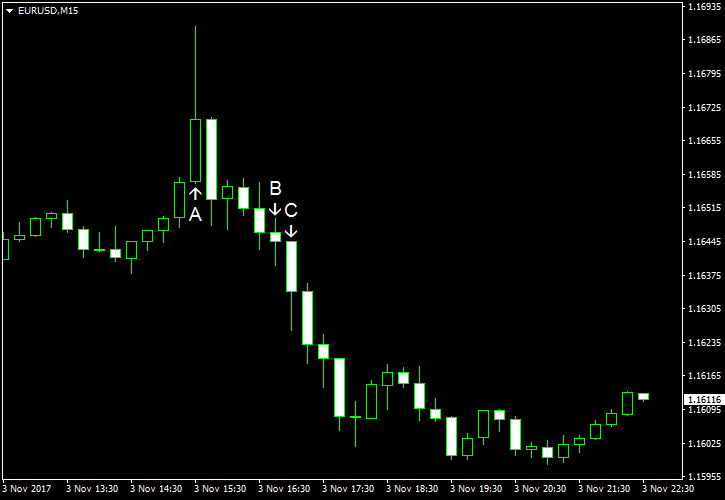

November 3

November 32017

EUR/USD Unable to Rally on Back of Poor US NFP

EUR/USD attempted to rally after the poor nonfarm payrolls released today but quickly reversed its movement following the short-lived spike to the upside. The currency pair accelerated its move down after the positive US services report. As with the manufacturing data, reports from Markit and ISM contradicted each other to some degree as one showed an increase of the indicator, while the other a decrease (though both showed expansion of the sector). This time, […]

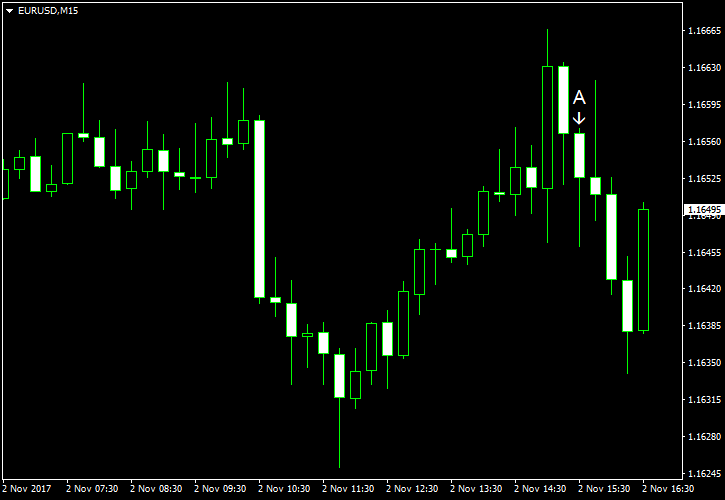

Read more November 2

November 22017

EUR/USD Volatile After Employment, Manufacturing Reports

EUR/USD was volatile on Wednesday, sinking after the ADP employment report but bouncing after the confusing manufacturing data. While the Markit indicator of manufacturing rose, the ISM indicator declined. The meeting of the Federal Open Market Committee turned to be non-event as the FOMC did not change it policy, nor it said anything particularly interesting. It looks like markets were more interested in the tax reform, which was delayed […]

Read more November 2

November 22017

EUR/USD Gains on Eurozone Manufacturing

EUR/USD traded higher today as manufacturing reports released in the eurozone over the trading session were very good for the most part. The gains were not big, though, and the currency pair pulled back after US jobless claims fell unexpectedly. Now, markets wait for an announcement of a new Federal Reserve chief and unveiling of a tax bill. Initial jobless claims dropped from 234k to 229k last week even though forecasts had […]

Read more October 31

October 312017

EUR/USD Flat as US Politics Diminish Impact of Good Economic Reports

EUR/USD traded almost flat on Tuesday as the Federal Open Market Committee started its two-day policy meeting. Economic reports released in the United States over the day were universally good, but that did not result in a rally of the dollar versus the euro. One of possible reasons for that were political tensions in the United States. Another one was concerns that the most likely candidate for the Federal Reserve Chair post Jerome […]

Read more October 27

October 272017

EUR/USD Extends Decline, Driven Down by Adverse Fundamentals

EUR/USD declined today, extending yesterday’s slump. There were several reasons for that. Catalonia announced independence after all, and that was certainly not good for the euro. Meanwhile, economic data released in the United States was amazing, driving the dollar higher. Additionally, hopes that a new Federal Reserve Chairman will be a hawk were also helping the greenback. US GDP grew by 3.0% in Q3 2017 according to the first, […]

Read more October 26

October 262017

EUR/USD Sinks More Than 1% After ECB Meeting

EUR/USD has started a decline at about 5:30 GMT today and accelerated the move down after the European Central Bank meeting. (Event A on the chart.) The ECB cut the size of its monthly asset purchases from â¬60 billion to â¬30 billion starting in January, but extended the asset purchase program, which should have ended this year, till September 2018. While such decision was withing expectations, markets still considered […]

Read more October 25

October 252017

Positive US Data Doesn’t Prevent Rally of EUR/USD

EUR/USD rallied today even though macroeconomic reports released in the United States today were good. Some analysts explained the rally by profit-taking after the dollar has strengthened recently. Overall, fundamentals still look good for the US currency, though tomorrow’s meeting of the European Central Bank may boost the euro further up against the greenback. Durable goods orders increased 2.2% in September, almost two times the forecast increase of 1.0%. […]

Read more October 24

October 242017

EUR/USD Stable After Economic Releases

Markit released Purchasing Mangers’ Indices for both the eurozone and the United States today, and almost all of them were better than expectations. Market participants anticipate that the European Central Bank will reduce its asset purchase program this week, but that did not boost EUR/USD so far. Flash readings for Markit US manufacturing PMI and Markit US services PMI in October were released today. The manufacturing […]

Read more October 20

October 202017

EUR/USD Drops After Senate Passes Budget Draft

EUR/USD dropped today as US Senate approved a budget blueprint that should pave the way for tax cuts promised by US President Donald Trump in his election campaign. Positive macroeconomic data released in the United States over the Friday’s session also dragged the currency pair down. Existing home sales rose to the seasonally adjusted annual rate of 5.39 million in September from 5.35 million in August. That is instead of falling […]

Read more October 19

October 192017

EUR/USD Rallies Despite Political Turmoil in Spain

EUR/USD rallied today, demonstrating strength that was surprising considering that political turmoil in Spain persisted. Meanwhile, two of the three important economic reports released in the United States today were good, while the leading indicators demonstrated a surprising drop, being the only negative release. Initial jobless claims fell from 244k to 222k last week, while forecasters had anticipated a much smaller drop to 240k. (Event A on the chart.) […]

Read more