- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Fundamental Analysis

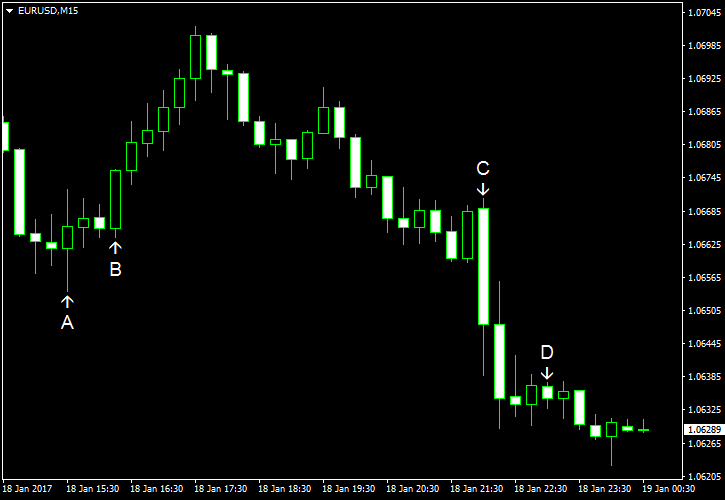

January 18

January 182017

EUR/USD Backs Off After Strong Move Up

EUR/USD went down today after yesterday’s move up. The currency pair rushed especially fast to the downside after Janet Yellen, Federal Reserve Chair, said during today’s speech that policy makers should not wait too long before raising interest rates further. (Event C on the chart.) Positive macroeconomic data released from the United States also put pressure on the currency pair. CPI rose 0.3% […]

Read more January 13

January 132017

EUR/USD Fails to Rally for Third Day

EUR/USD was attempting to extend to extend its rally for third day today but failed and is now trading near the opening level. The currency pair halted its rally after the better-than-expected PPI and retail sales reports from the United States. PPI rose 0.3% in December. This is compared to the median forecast of 0.1% and the 0.4% increase in November. (Event A on the chart.) Retail sales advanced 0.6% in December. The actual reading exceeded […]

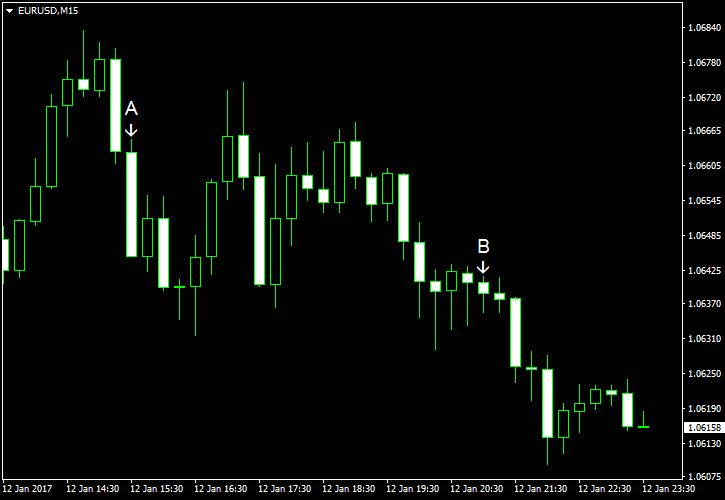

Read more January 12

January 122017

EUR/USD Rallies for Second Day Following Donald Trump’s Press Conference

EUR/USD rose today, though trimmed its gains by now. It was the second day of gains after US president-elect Donald Trump spoke at the press conference on Wednesday. Markets were disappointed by the fact that he did not address his planned fiscal policies. As for US economic data, it was mixed. Initial jobless claims went up from 237k to 247k last week, though the increase was not […]

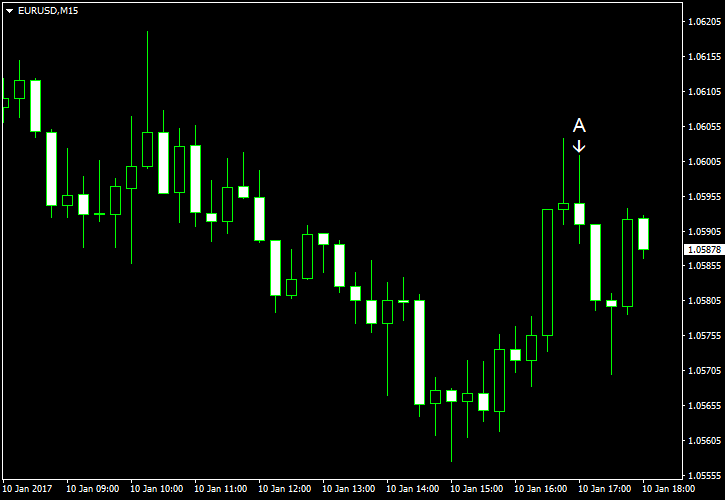

Read more January 10

January 102017

EUR/USD Struggles to Keep Rising for Second Day

EUR/USD rose today following yesterday’s rally but currently is struggling to keep gains. This week is light on economic data from the United States for the most part, Friday being the exception with plenty of reports. Wholesale inventories rose 1.0% in November according to the final estimate while analysts had predicted the same 0.9% as in the preliminary report. The stockpiles were down 0.4% in October. (Event A on the chart.) Yesterday, a report on consumer […]

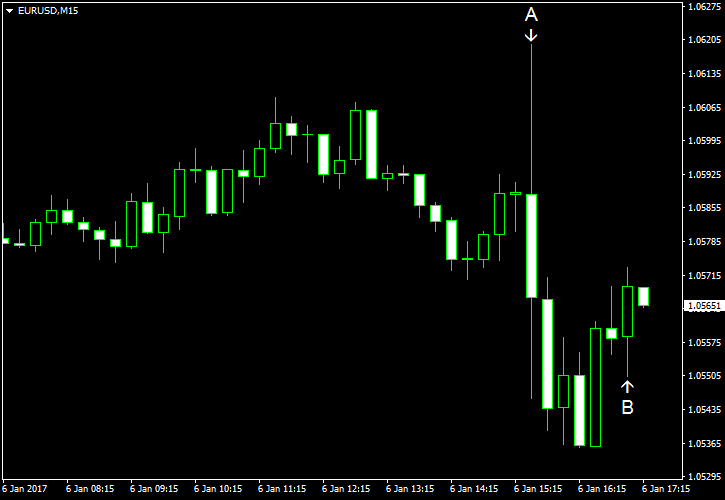

Read more January 6

January 62017

Nonfarm Payrolls Cause Volatility, Push EUR/USD Down

EUR/USD declined today even though the fundamental indicators that came out from the United States were rather mixed. Traders preferred to buy the dollar despite the fact that the news brought nothing positive about the US economy. Trade balance deficit widened from October’s reading of $42.6 billion to $45.2 billion in November. The result was not far from the median forecast of $45.5 billion. (Event A on the chart.) Nonfarm payrolls […]

Read more January 5

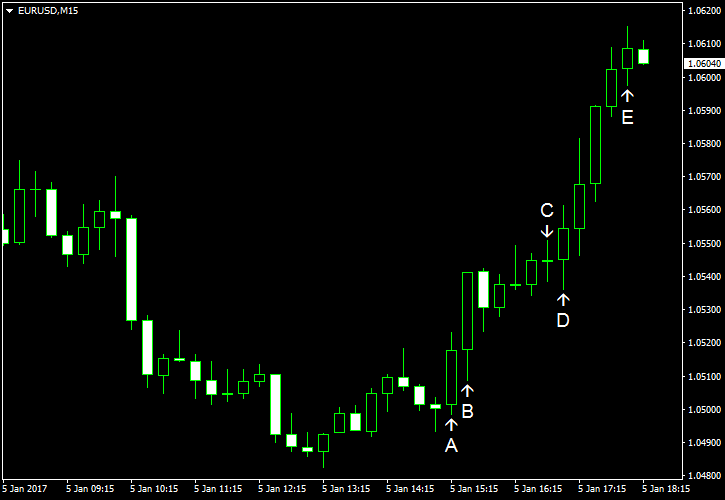

January 52017

EUR/USD Rises on Negative US Employment Expectations

Even though some of the US macroeconomic reports were positive today, the dollar fell against the euro. The decline was triggered by a rather weak ADP employment data. ADP employment went down from 215k to 153k new jobs in December. Traders had expected a less abrupt drop to 175k. Weak ADP numbers set poor sentiment towards the non-farm payrolls due for release tomorrow. (Event A on the chart.) Initial jobless claims […]

Read more January 3

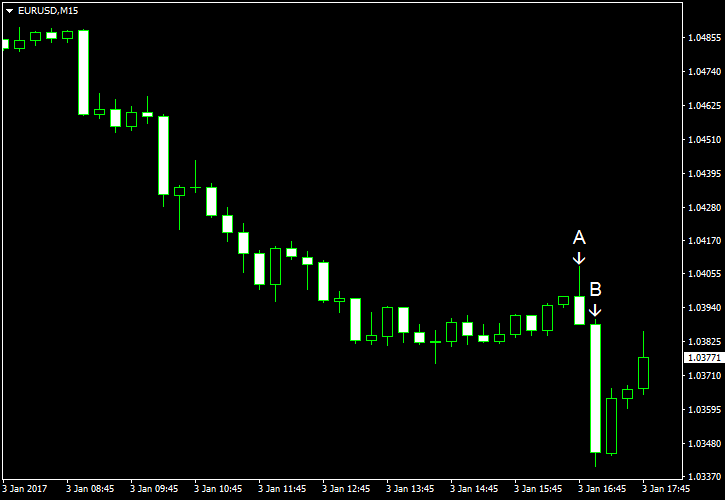

January 32017

US PMI Reports Push EUR/USD Down on Year’s First Trading Session

The euro was falling against the US dollar during the entire day today. The positive macroeconomic reports that have been released from the USA have pulled the currency pair even deeper. Markit manufacturing PMI rose to 54.3 according to its final report for December. That’s slightly better than 54.2 of the preliminary report. (Event A on the chart.) ISM manufacturing PMI rose from 53.2 to 54.7 in December. The median forecast for this […]

Read more December 29

December 292016

Dollar Down Despite Declining Jobless Claims

EUR/USD increased during today’s session after a some less important economic reports had been made available to the market participants. They were rather positive, but turned to be negative for the dollar. Initial jobless claims fell from 275k to 265k last week, just in line with the markets’ expectations. (Event A on the chart.) Crude oil inventories added 0.6 million barrels during the week ending on December 23. This […]

Read more December 27

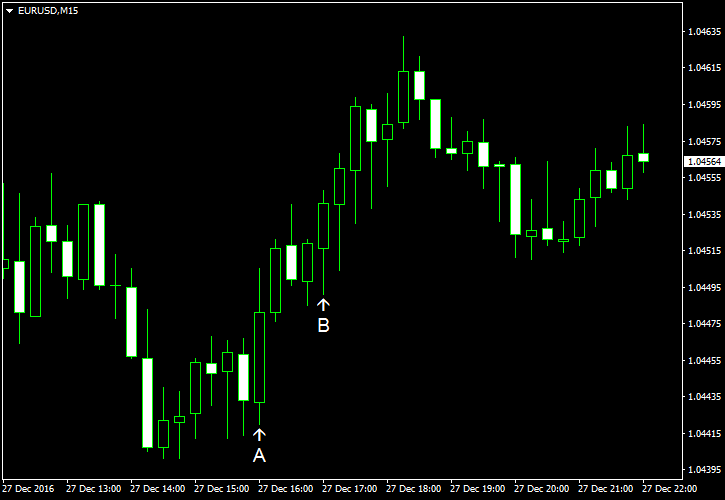

December 272016

EUR/USD Trades Positively on Positive US Fundamentals

The euro added momentum against the greenback during today’s trading session after some better-than-expected macroeconomic indicators had been released in the United States. The positive mood in the financial markets has contributed to the risk-on sentiment, which is hurting the USD. S&P/Case-Shiller home price index added 5.1% in October compared to the same month a year ago. The growth was slightly above both the expectations and the last month’s value — 5.0%. (Event A on the chart.) […]

Read more December 23

December 232016

EUR/USD Moves Little Higher During Quiet Christmas Trading

EUR/USD rose a little today, extending its rally for the third straight day. The gains were small, though, as volumes were low during quiet trading ahead of Christmas. While the dollar paused its rally for now, analysts believe that it was just a sign of end-year profit taking and the currency should resume its upward movement at the start of the next year. Today’s session was light on economic news from the United […]

Read more