- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: June 15, 2018

June 15

June 152018

Oil Prices to Leak Lower as OPEC Look to Switch On Supply Taps

Fundamental Forecast for Crude Oil Price: Bearish Crude Oil Analysis and Talking Points: Saudi Arabia and Russian Set to Turn the Supply Taps on OPEC likely to relax production quota’s question is, by how much? OPEC Preview: A Crude Awakening OPEC’s 174th ordinary meeting is set to take place on June 22nd with the JMMC […]

Read more June 15

June 152018

S&P 500, DAX & FTSE – Fed and ECB Over With, BoE Next

Talking Points: FOMC raised 25-bps, light calendar next week; S&P could test support line ECB sparked big volatility in euro and stocks; DAX difficult to get a handle on BoE on Thursday; FTSE range has traders scratching their heads for directional cues For forecasts, trade ideas, and educational guides, check out the DailyFX Trading Guides. […]

Read more June 15

June 152018

US Consumer Sentiment Rises in June, Unfazed by Trade Wars

Talking Points: The UofM measure of consumer sentiment clocked in at 99.3 versus 98.0 for May Confidence was buoyed by strong economic growth and low unemployment among other factors Trade wars remain an important factor influencing consumer confidence, despite this month’s increase Learn the number one mistake traders make when trading. Download our Traits of […]

Read more June 15

June 152018

Chart Setups for Next Week – Bitcoin, Ether, Ripple, Litecoin

Bitcoin, Ripple, Ether, Litecoin – Charts, Prices and News – US Justice Department continues to investigate illegal practices in the cryptocurrency market. – Bitcoin and Ether are not securities says the SEC. Cryptocurrency Market Continues to Sag Despite SEC Announcement After a negative week, the crypto-market got a short-term reprieve after the SEC decided that […]

Read more June 15

June 152018

US Dollar Shrugs Off US-China Trade War Escalation for Now

USD – Trade War News and Talking Points – $50 billion of new trade tariffs expected to be announced by the US today. – The US dollar remains strong despite dispute escalation. The DailyFX Q2 Trading Forecasts for all major currencies, commodities and indices, are availableto download to help you make more informed trading decisions. […]

Read more June 15

June 152018

US AM Digest: USD Dips from YTD Highs as Trade War Uncertainty outweighs ECB-Fed Policy Divergence

US Market Snapshot via IG: DJIA -0.7%, Nasdaq 100 -0.5%, S&P 500 -0.5% Major Headlines President Trump approves $50bln tariffs on Chinese goods BoJ stands pat on monetary policy and cuts inflation assessment USD: The greenback had printed fresh 2018 highs on the back of the diverging monetary policy stance between the ECB and Fed. […]

Read more June 15

June 152018

Canadian Dollar Weakens Against US Dollar on Risk-Off Sentiment

The Canadian dollar today dropped significantly against the US dollar as the risk-off sentiment in the markets drove the USD/CAD currency pair to new highs. The loonie’s slide against the greenback was further accelerated by the tariffs imposed by President Donald Trump‘s administration against Canadian imports. The USD/CAD currency pair today rallied from an opening low of 1.3111 to a high of 1.3199 in the early American session. The currency pair’s rally began yesterday in the early European session […]

Read more June 15

June 152018

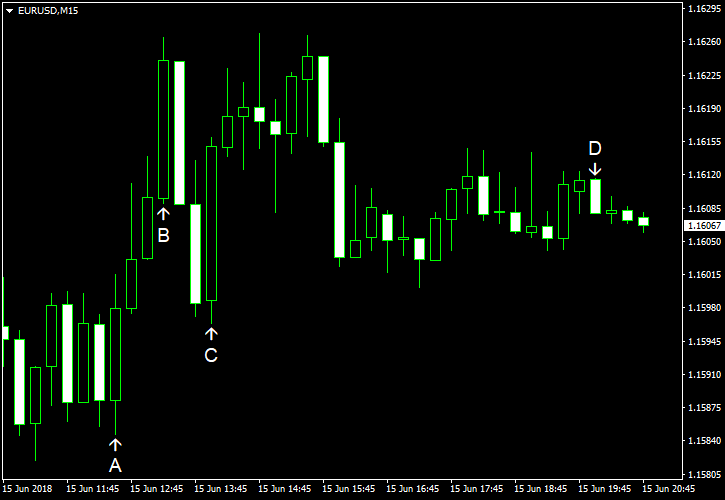

EUR/USD Recovers As US-China Trade War Intensifies

EUR/USD rebounded a bit following yesterday’s big slump, though the rally was not nearly enough to erase losses posted during yesterday’s session. The dollar was relatively weak today due to an intensifying trade war between the United States and China. The USA announced new tariffs on Chinese imports, and China promised to respond in a similar manner, imposing levies on US goods. NY Empire State Index climbed from 20.1 to 25.0 […]

Read more June 15

June 152018

Japanese Yen Soft After BoJ Policy Meeting

The Japanese yen traded lower against its major peers today after the Bank of Japan left monetary policy unchanged, preserving its unprecedented stimulus. The BoJ left its benchmark interest rate at -0.1% and the annual pace of Japanese government bond purchases at Â¥80 trillion. Such decision was universally expected by market participants and analysts. There was one dissenter, Mr. G. Kataoka, who argued in favor of additional stimulus: […]

Read more June 15

June 152018

NZ Dollar Falls After Manufacturing Expansion Slows

The New Zealand dollar fell today after a report showed that nation’s manufacturing expansion slowed, though remained at a high level. By now, the currency has trimmed its losses. The BusinessNZ Performance of Manufacturing Index eased to 54.5 in May from 59.1 in April. Despite the drop, the reading was the third highest over the last six months. Furthermore, the report stated: BusinessNZ’s executive director for manufacturing Catherine Beard said that while […]

Read more