- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Blog

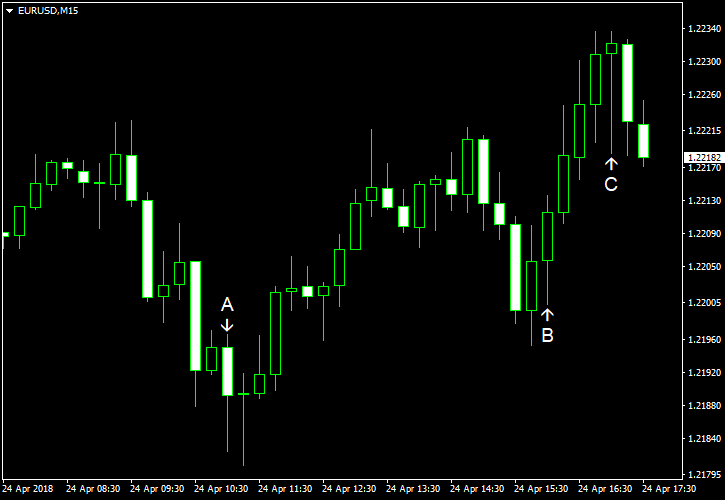

April 24

April 242018

EUR/USD Currency Pair Acts in Contradiction to Macroeconomic Data

EUR/USD acted in contradiction to economic reports released during the current trading session. The currency started its rally after the surprisingly weak German Ifo Business Climate (event A on the chart) and continued to rise even as US data was good for the most part. The possible reason for such a weird behavior was profit-taking after the dollar’s recent rally in preparation for tomorrow’s policy announcement by the European Central Bank. S&P/Case-Shiller home price index climbed […]

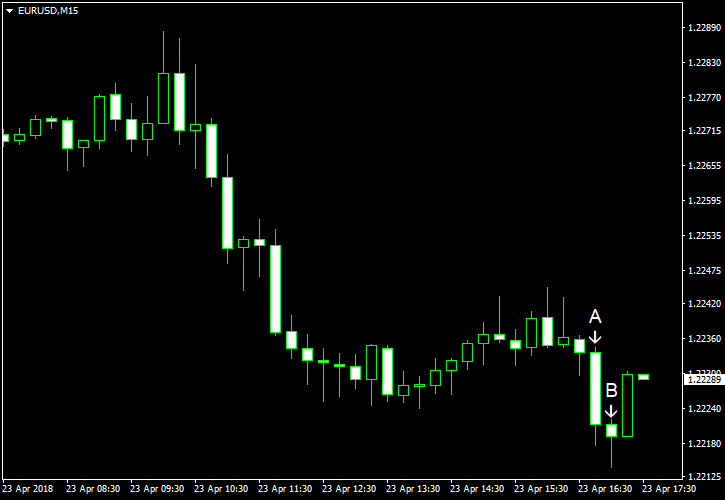

Read more April 23

April 232018

EUR/USD Down for Third Day as US Treasury Yield Surges

EUR/USD fell today, declining for the third consecutive trading session. Market analysts explained the dollar’s strength by the surging yield for 10-year US Treasuries, though bets on an interest rate hike from the Federal Reserve in June were certainly helping the currency as well. US macroeconomic reports released today were universally positive, giving the greenback yet another reason to rally. Flash Markit manufacturing PMI climbed from 55.6 in March to 56.5 […]

Read more April 21

April 212018

Weekly Forex Technical Analysis (Apr 23 — Apr 27)

EUR/USD Floor pivot points 3rd Sup 2nd Sup 1st Sup Pivot 1st Res 2nd Res 3rd Res 1.2056 1.2153 1.2220 1.2317 1.2384 1.2481 1.2548 Woodie’s pivot points 2nd Sup 1st Sup Pivot 1st Res 2nd Res 1.2145 1.2205 1.2309 1.2369 1.2474 Camarilla pivot points 4th Sup 3rd Sup 2nd Sup 1st Sup 1st Res 2nd […]

Read more April 19

April 192018

EUR/USD Drops on Quiet Thursday

EUR/USD was falling during quiet trading today. The market lacked any major theme to drive currencies. Nevertheless, the currency pair was falling since the European session and continued to decline following the release of rather positive US data. Philadelphia Fed manufacturing index rose from 22.3 in March to 23.2 in April. That was a positive surprise considering that forecasters had promised a drop to 20.8. (Event A on the chart.) Initial jobless […]

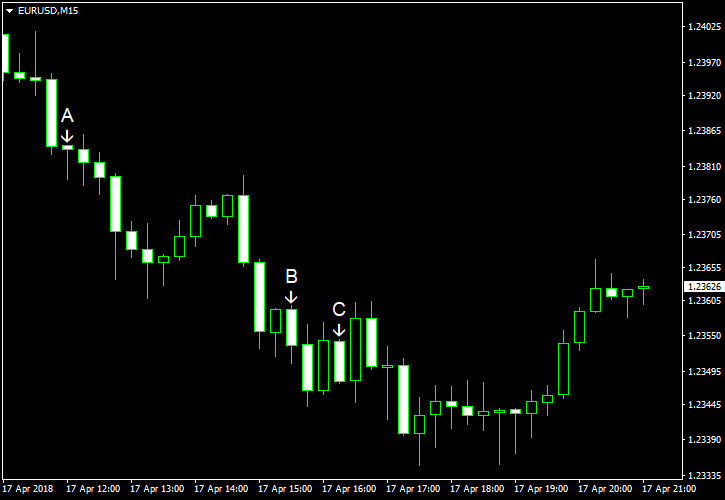

Read more April 17

April 172018

EUR/USD Falls as ZEW Economic Sentiment Disappoints

EUR/USD slipped today as the ZEW Economic Sentiment Indicator for Germany came out far worse than was expected. The index for the whole eurozone was not good either. (Event A on the chart.) Meanwhile, US data released on Tuesday was pretty solid. Both housing starts and building permits rose in March. Housing starts were at the seasonally adjusted annual rate of 1.32 million, compared to the February reading of 1.30 million and the predicted value […]

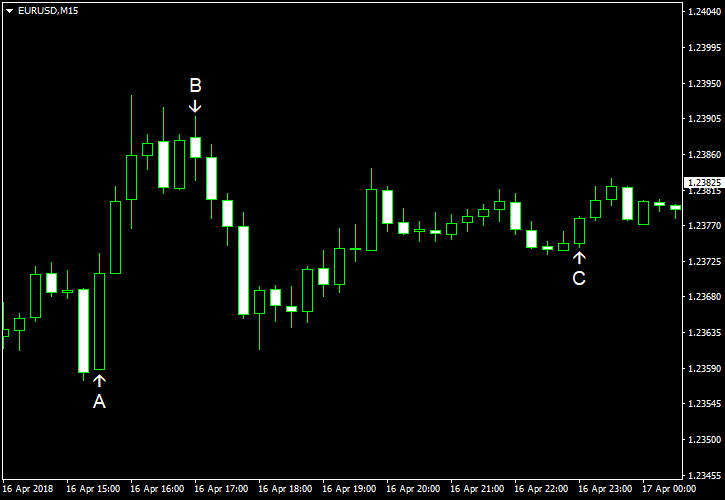

Read more April 17

April 172018

EUR/USD Rises on Monday as Markets Dismiss News from Syria

EUR/USD rallied on Monday as markets largely dismissed the news about US performing missile strikes on Syria over the weekend. It looked like the conflict is not going to escalate, therefore traders were willing to buy riskier currencies, ignoring the dollar in the meantime. As for US data, it was mixed. Retail sales increased beyond expectations, but other reports were not so hot. Retail sales rose 0.6% in March, […]

Read more April 15

April 152018

Forex Brokers Update â April 15th, 2018

Yet another week has passed with no new broker listings being added to EarnForex.com. Updates to the listed brokers were as follows: FXTM added MetaTrader 5 platform to its FXTM Pro live accounts. City Index now offers trading in ETH/USD, LTC/USD, XRP/USD, and BCH/USD. Forex.com joined the cryptocurrency trading industry with the following five pairs: BTC/USD, ETH/USD, LTC/USD, XRP/USD, and BCH/USD. FX Giants did the same […]

Read more April 14

April 142018

Weekly Forex Technical Analysis (Apr 16 — Apr 20)

EUR/USD Floor pivot points 3rd Sup 2nd Sup 1st Sup Pivot 1st Res 2nd Res 3rd Res 1.2124 1.2192 1.2261 1.2329 1.2397 1.2465 1.2533 Woodie’s pivot points 2nd Sup 1st Sup Pivot 1st Res 2nd Res 1.2192 1.2261 1.2329 1.2397 1.2465 Camarilla pivot points 4th Sup 3rd Sup 2nd Sup 1st Sup 1st Res 2nd […]

Read more April 12

April 122018

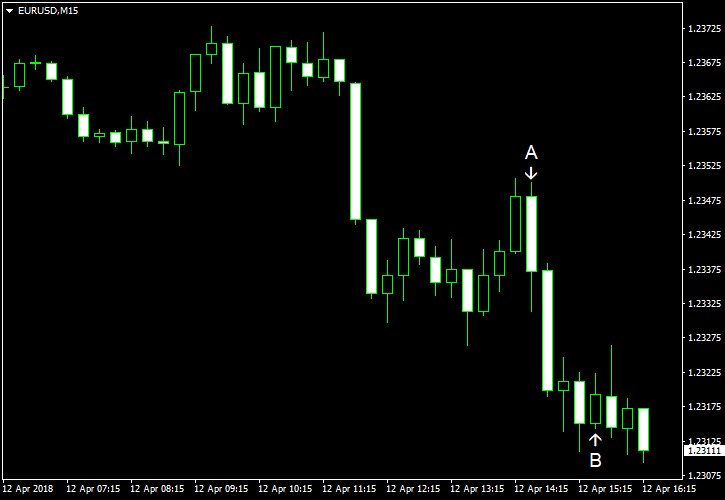

EUR/USD Accelerates Decline After ECB Minutes

EUR/USD, which was holding ground yesterday, was falling today and accelerated its decline after the European Central Bank released minutes of its March policy meeting. (Event A on the chart.) The notes showed that policy makers were discussing repercussions of potential trade wars with the United States and voiced concerns about the strong currency. The current trading session was light on economic data from the United States, which had […]

Read more April 11

April 112018

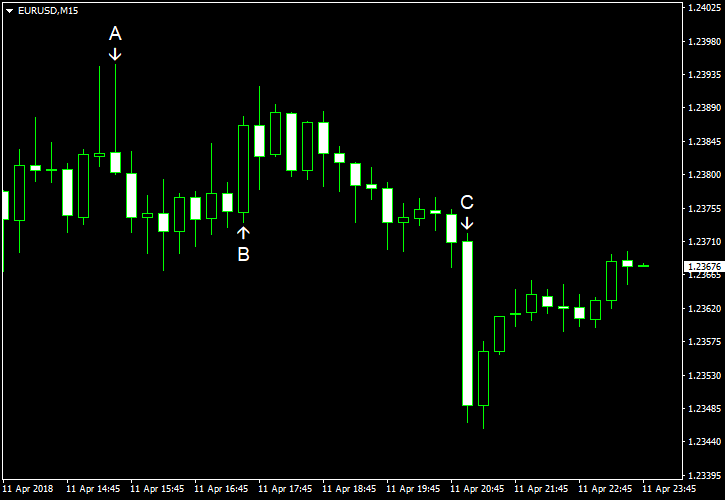

EUR/USD Stays Above Opening After Hawkish FOMC Minutes

EUR/USD was gradually rising today but dipped after the Federal Open Market Committee released minutes of its March meeting, which were considered to be rather hawkish by market participants. Yet the currency pair has managed to recover a bit by now and is currently trading above the opening level. US CPI decreased by 0.1% in March on a seasonally adjusted basis, whereas experts had anticipated no change. The index was […]

Read more