- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Blog

June 30

June 302016

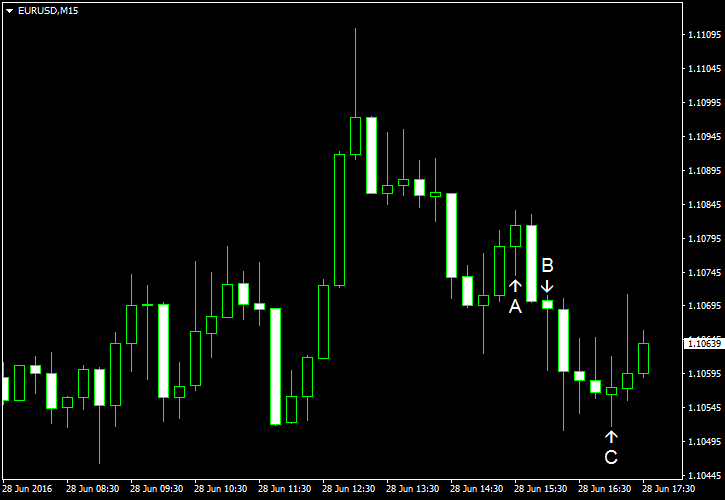

EUR/USD Halts Post-Brexit Rally

EUR/USD halted its post-Brexit rebound today. US economic data was mixed. Jobless claims rose, though they were in line with market expectations, while the Chicago PMI climbed much more than was predicted by experts. Initial jobless claims rose to the seasonally adjusted level of 268k last week, in line with analysts’ expectations of 267k, from the previous week’s revised rate of 258k. (Event A on the chart.) Chicago […]

Read more June 29

June 292016

EUR/USD Rises for Third Day in Row

EUR/USD rose for the third consecutive day during the current trading session, though the rally was nowhere near being enough to erase the Friday’s huge drop. Markets continue to calm down as they digest the result of Britain’s referendum. While market participants feel less anxious, the future remains uncertain, and that may cause traders to stick to safe currencies. The problem for the dollar is that it has lost its appeal due […]

Read more June 28

June 282016

EUR/USD Up as Markets Recover After Brexit

EUR/USD rose from the second session today following the big slump on Friday that followed the surprise decision of Great Britain to leave the European Union. Markets are recovering from the shock even though traders remain cautious. As for economic data from the United States, it was mixed with the unexpected deterioration of manufacturing but the huge improvement of the consumer sentiment and growth of the economy. US GDP rose 1.1% in Q1 2016 according […]

Read more June 25

June 252016

Weekly Forex Technical Analysis (Jun 27 — Jul 1)

EUR/USD Floor pivot points 3rd Sup 2nd Sup 1st Sup Pivot 1st Res 2nd Res 3rd Res 1.0343 1.0627 1.0859 1.1143 1.1376 1.1660 1.1892 Woodie’s pivot points 2nd Sup 1st Sup Pivot 1st Res 2nd Res 1.0614 1.0833 1.1130 1.1349 1.1647 Camarilla pivot points 4th Sup 3rd Sup 2nd Sup 1st Sup 1st Res 2nd […]

Read more June 24

June 242016

EUR/USD Crashes as Britons Vote for Brexit

EUR/USD sank more than 2% today after yesterday’s referendum in Britain. As it turned out, Britons voted for leaving the European Union even though votes for staying were leading in polls. While the Great Britain pound was obviously the biggest loser, the euro also suffered greatly due to uncertainty about the future of the EU and the eurozone. As for US data, it was bad but that did not mean much to markets […]

Read more June 23

June 232016

EUR/USD Backs Off from Daily Highs, Remains Above Opening

EUR/USD rallied today as Britons were voting whether to stay in the European Union or leave it. Polls were showing that there were more people preferring to remain in the Union than to leave it. This gave boost to European currencies, limiting demand for safe currencies (like the dollar). US economic data, which was poor for the most part, was not helping the greenback either. The currency pair backed off from […]

Read more June 22

June 222016

EUR/USD Trades Above Opening Ahead of Britain’s Referendum

EUR/USD was rising for the most part of today’s trading session (though trimmed gains by now) as the referendum nears about the place of Great Britain in or outside of the European Union. Meanwhile, the cautious stance of US policy makers and the possible delay of interest rate hikes made the dollar less appealing to traders. Existing home sales rose to the seasonally adjusted annual rate of 5.53 million in May, matching forecasts exactly, from the downwardly revised 5.43 […]

Read more June 21

June 212016

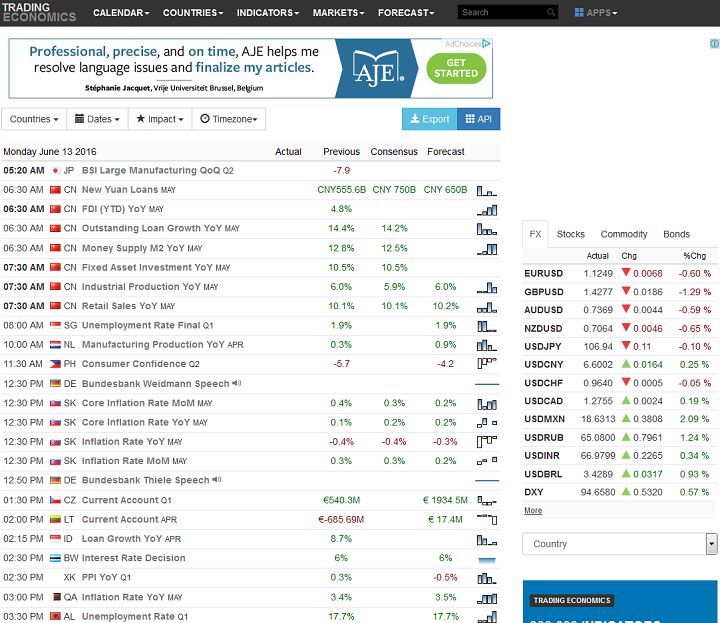

Top 10 Forex Calendars in 2017

Contents 1 The List 2 Interface 2.1 Appearance 2.2 Legend 2.3 Images/Currency Codes 2.4 Additional Details 2.5 Charts 2.6 Revisions 2.7 Filters 2.8 Timezone 2.9 Time Browsing 2.10 Week Beginning 2.11 Self-Updating 2.12 Mobile-Friendly 2.13 Delays 2.14 Notification 3 Loading Speed 4 Number of Events 5 Forecast Accuracy and Similarities 6 Translations 7 Extra Features 8 Exporting and Printing […]

Read more June 20

June 202016

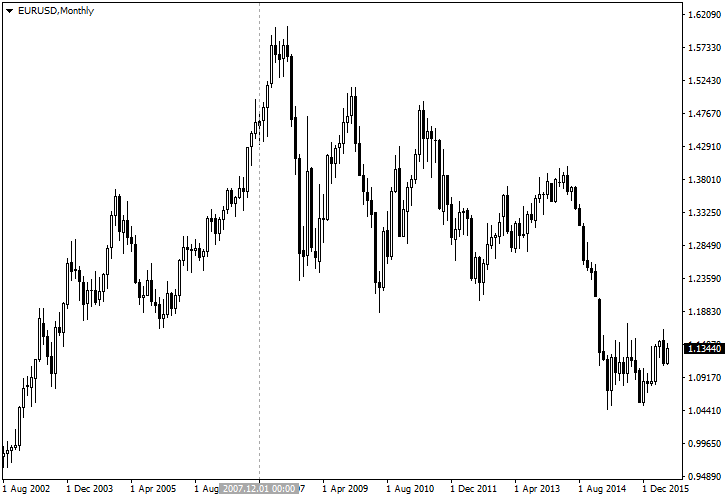

Is the Fall of the US Dollar Inevitable?

Introduction The goal of this article is to study the likelihood of the long-term US dollar depreciation vs. its major counterparts in the coming years. I presume the status of the US dollar as the global reserve currency (international currency) to be unchanged in the near future and I base my research and conclusion on the the strengths and weaknesses pertinent to the USD due to such status. Contents 1 Introduction 2 What Does the Data Tell Us? 3 What Causes Dollar to Depreciate? 4 […]

Read more June 19

June 192016

Forex Brokers Update — June 19th, 2016

One new broker has been listed on EarnForex.com during the week that is ending today: ECN PRIME — an unregulated offshore company positioning itself as a pure ECN trading facility. It offers Forex accounts starting from $100 with such trading platforms as MetaTrader 4, Currenex Viking, and cTrader. Leverage on currency pairs can be as high as 1:400. ECN PRIME Some listed brokers have been updated […]

Read more