- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Blog

June 18

June 182016

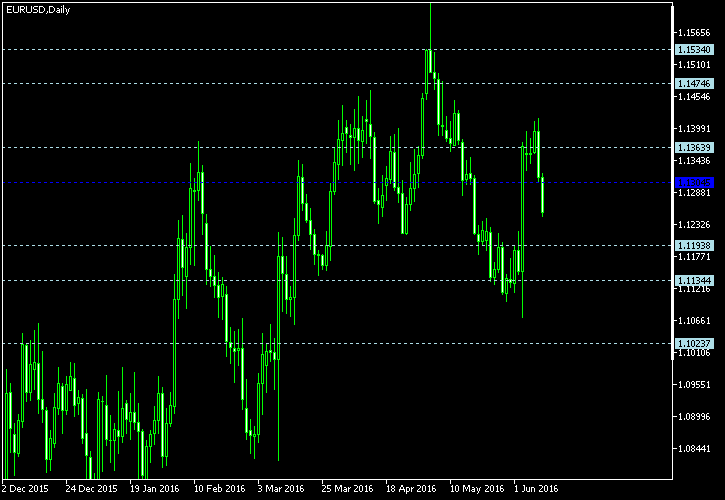

Weekly Forex Technical Analysis (Jun 20 — Jun 24)

EUR/USD Floor pivot points 3rd Sup 2nd Sup 1st Sup Pivot 1st Res 2nd Res 3rd Res 1.0998 1.1064 1.1170 1.1236 1.1342 1.1408 1.1514 Woodie’s pivot points 2nd Sup 1st Sup Pivot 1st Res 2nd Res 1.1074 1.1189 1.1246 1.1361 1.1418 Camarilla pivot points 4th Sup 3rd Sup 2nd Sup 1st Sup 1st Res 2nd […]

Read more June 16

June 162016

EUR/USD Loses Wednesday’s Gains

EUR/USD was unable to keep yesterday’s gains, falling today more than it had risen during the previous trading session. Economic data from the United States was not very good, therefore it was not the reason for the dollar’s gains versus the euro. The most likely reason for such behavior was fears of the Brexit and possible ramifications for the European economy. CPI rose 0.2% in May, failing to meet market expectations […]

Read more June 15

June 152016

FOMC Lowers Interest Rate Expectations, EUR/USD Jumps

EUR/USD surged today after the Federal Open Market Committee left its monetary policy unchanged and lowered its economic expectations. Of the particular note was the forecast for interest rates that was also cut. It showed a smaller number of interest rate hikes in 2017 and 2018. Furthermore, chances for a rate increase in summer have basically evaporated. Unsurprisingly, the dollar fell against its rivals after the news, though the drop was […]

Read more June 14

June 142016

EUR/USD Crashes as FOMC Starts Meeting

EUR/USD tumbled today ahead of tomorrow’s announcement from the Federal Reserve. The Fed starts its two-day policy meeting today and will announce its decision tomorrow. The currency pair was also hit by fears of the so-calledBrexit. Retail sales grew 0.5% in May, a bit more than analysts had predicted (0.4%) but slower than the April’s 1.3% rate of growth. (Event A on the chart.) Import and export prices demonstrated a strong gain […]

Read more June 13

June 132016

See Currency Rate Change in Percents on Your Chart

Daily Percentage Change is the latest addition to the list of free MT4/MT5 indicators I share on EarnForex.com. It is loosely based on this MT4 indicator. The main advantage of such an indicator is that it can be used in price action trading to get the understanding of the current session’s direction at a glance. Its main features are: Daily, weekly, and monthly change display. Time shift input parameter to help with the brokers who […]

Read more June 12

June 122016

Forex Brokers Update — June 12th, 2016

Three new brokers have been listed during the week: Trade Fintech — an unregulated company from the United Kingdom. It combines spot Forex trading and binary options trading in a single account. The minimum account size is $250. Trading is done in MetaTrader 4 platform. Trade Fintech TempletonFX — an FCA-regulatedECN broker with $2,000 minimum account size, unknown commission size, and 1:400 leverage on Forex pairs. TempletonFX Atiora — […]

Read more June 11

June 112016

Weekly Forex Technical Analysis (Jun 13 — Jun 17)

EUR/USD Floor pivot points 3rd Sup 2nd Sup 1st Sup Pivot 1st Res 2nd Res 3rd Res 1.1024 1.1134 1.1194 1.1304 1.1364 1.1475 1.1534 Woodie’s pivot points 2nd Sup 1st Sup Pivot 1st Res 2nd Res 1.1122 1.1168 1.1292 1.1338 1.1462 Camarilla pivot points 4th Sup 3rd Sup 2nd Sup 1st Sup 1st Res 2nd […]

Read more June 10

June 102016

EUR/USD Drops Further

EUR/USD extended its decline today following the relatively positive sentiment report from the University of Michigan. Now, traders anxiously anticipate the next week’s policy meeting of the Federal Reserve. Michigan Sentiment Index fell from 94.7 in May to 94.3 in June though it still was above the predicted value of 94.1. (Event A on the chart.) Treasury budget logged a deficit of $52.5 billion in May following the surplus of $106.5 billion in April. The median […]

Read more June 9

June 92016

EUR/USD Turns Sharply Lower

EUR/USD was moving down during the current trading session and extended the decline after US unemployment claims had shown an unexpected drop. The currency pair was also under pressure from the threat of the Brexit. Mario Draghi, President of the European Central Bank, mentioned in his speech today that “uncertainty over the institutional stability of the euro area also matters for monetary policy, since it too can slow down the transmission […]

Read more June 7

June 72016

EUR/USD Trades in Range

EUR/USD was trading in a relatively narrow range during the past two trading sessions as traders continued to speculate about timing of an interest rate hike from the Federal Reserve. Yesterday’s speech of Fed chief Janet Yellen gave no clarity to the issue. The current trading week is somewhat light on economic data, meaning that the currency pair may have troubles in establishing a clear trend. Nonfarm productivity fell 0.6% in Q1 […]

Read more