- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Blog

December 6

December 62015

Forex Brokers Update — December 6th, 2015

Two new brokers have been added to the list of FX companies on EarnForex.com this week: Kawase — a regulated Cypriot broker with a Japanese name. They offer cTrader STP accounts starting with $1. Spreads are quite low, but they charge commission. Multiple trading instruments are available with up to 1:100 leverage. Kawase LMFX — a brand new unregulated Macedonian Forex broker with MetaTrader 4 […]

Read more December 5

December 52015

Weekly Forex Technical Analysis (Dec 7 — Dec 11)

EUR/USD Floor pivot points 3rd Sup 2nd Sup 1st Sup Pivot 1st Res 2nd Res 3rd Res 1.0148 1.0335 1.0607 1.0794 1.1065 1.1252 1.1524 Woodie’s pivot points 2nd Sup 1st Sup Pivot 1st Res 2nd Res 1.0356 1.0649 1.0815 1.1107 1.1273 Camarilla pivot points 4th Sup 3rd Sup 2nd Sup 1st Sup 1st Res 2nd […]

Read more December 4

December 42015

EUR/USD Flat After Nonfarm Payrolls

EUR/USD trades flat as now after falling earlier during the current session. The currency pair demonstrated a huge rally yesterday, and while US nonfarm payrolls were good, it was not enough to reverse the upward momentum of the pair. Nonfarm payrolls grew by 211k in November, the growth being not far from analysts’ predictions of 201k. The already huge October’s gain of 271k was revised to even bigger number of 298k. Nonfarm […]

Read more December 3

December 32015

EUR/USD Jumps 3% After ECB

EUR/USD demonstrated a huge leap today, jumping 3%, after the European Central Bank disappointed those market participants who were counting on extensive stimulus measures. While the central bank added some stimulus, it left its main interest rate and the size of asset purchases unchanged. Meanwhile, the US service indices missed expectations, further bolstering the euro versus the dollar. Initial jobless claims rose from 260k to 269k […]

Read more December 1

December 12015

EUR/USD Bounces After Four-Day Decline

EUR/USD gained for the first time in five sessions during Tuesday’s trading as manufacturing data from Institute for Supply Management was unexpectedly poor, demonstrating the first contraction in the sector in three years. The news was detrimental to the dollar, making speculators doubt whether the Federal Reserve would hike interest rates this month. Markit manufacturing PMI fell from 54.1 in October to 52.8 during November according the final estimate. It was […]

Read more November 30

November 302015

EUR/USD Stays in Decline at Start of Important Week

EUR/USD remained in decline for the fourth trading session in a row on Monday. This trading week should be very important for the currency pair as the European Central Bank will conduct its policy meeting Thursday, and the vast majority of experts believe that the central bank may announce an expansion of its monetary stimulus. As for US news, market participants wait for the release of nonfarm payrolls on Friday. Chicago PMI fell to 48.7 in November from 56.2 […]

Read more November 30

November 302015

Pips Display in Position Size Calculator Indicator

I am releasing a new version of Position Size Calculator indicator today. The main new feature is the display of pips distance for stop-loss and take-profit below the respective lines on the chart. It is turned on by default, so you will need to set ShowLineLabels to false if you do not like the new feature. Other changes in this new version: Fixed a bug with the text label for commission per lot not deleting […]

Read more November 29

November 292015

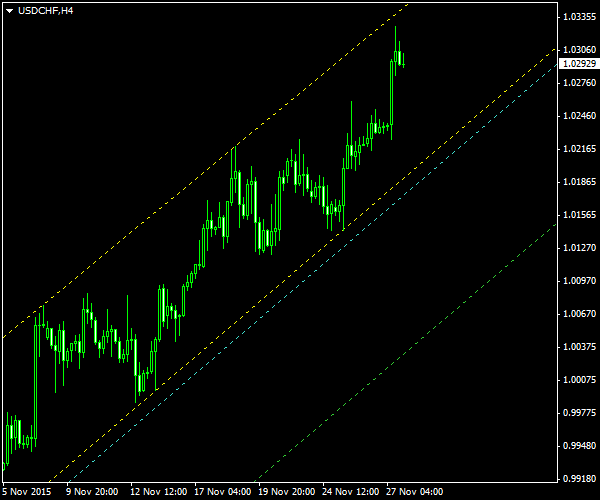

USD/CHF in Month-Long Ascending Channel

USD/CHF has entered a discernible ascending channel in late October this year. The pattern is most visible on 4-hour timeframe. It continues the major rally in the currency pair persistent since October 15. The channel has multiple border confirmations from the price and presents an opportunity to sell the USD vs. the franc if the lower border gives in. The image shows the channel with its borders as yellow lines. The cyan line is […]

Read more November 29

November 292015

USD/RUB Long on Fundamental Analysis

If you follow my blog, you have probably noticed that I had had two unsuccessful attempts (first and second) to short the Russian ruble following my big hit in December of 2014. This time, I am expecting to enter a long USD/RUB trade based on some simple fundamental analysis with pretty standard technical levels chosen for entry, stop-loss, and take-profit. The main reason for buying USD vs. RUB this time is […]

Read more November 28

November 282015

Weekly Forex Technical Analysis (Nov 30 — Dec 4)

EUR/USD Floor pivot points 3rd Sup 2nd Sup 1st Sup Pivot 1st Res 2nd Res 3rd Res 1.0420 1.0493 1.0543 1.0616 1.0667 1.0739 1.0790 Woodie’s pivot points 2nd Sup 1st Sup Pivot 1st Res 2nd Res 1.0487 1.0532 1.0611 1.0655 1.0734 Camarilla pivot points 4th Sup 3rd Sup 2nd Sup 1st Sup 1st Res 2nd […]

Read more