- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Blog

January 3

January 32015

Forex Brokers Update — January 3rd, 2015

The first update this year is without new companies. Instead, two companies have been delisted while several others have been updated: MFC Investment and MyTrade Markets are no longer active. Forex Optimum launched a website in Lao language. COMMEXFX added several new languages: Arabic, Spanish, Russian, Greek, Indonesian, and Vietnamese. Sensus Capital removed Czech version of its website but added Italian […]

Read more January 2

January 22015

EUR/USD Starts Year with Drop

The dollar started the year on a strong note even though US economic indicators were disappointing. In fact, EUR/USD opened sharply lower and fell to the new multi-year low over the current trading session. ISM manufacturing PMI dropped from 58.7% in November to 55.5% in December. The actual drop was much bigger than a decline to 57.6% predicted by analysts. (Event A on the chart.) Construction spending fell 0.3% in November from October. This is […]

Read more January 2

January 22015

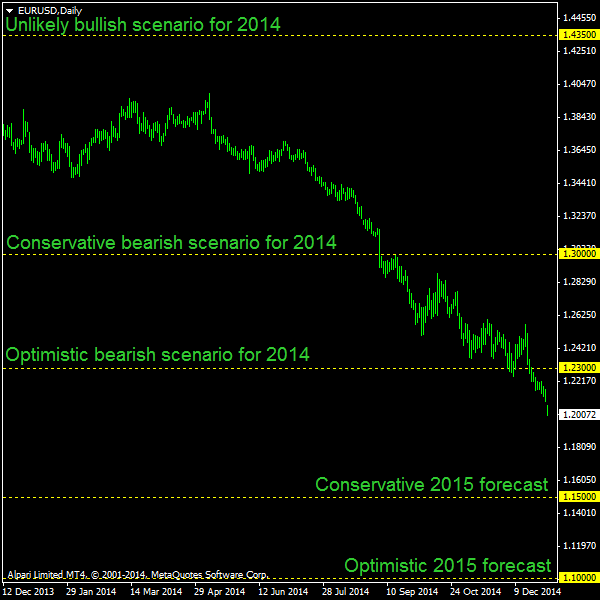

Forecast for 2015 — Forex, Gold, Oil, Interest Rates

Although my 2014 forecast was not as bad as the one I posted for 2013, it was not too accurate either. It is now time to offer my expectations for the year 2015. I will also comment on my 2014 forecast and the actual outcome for every financial instrument. Contents 1 EUR/USD 2 GBP/USD 3 USD/JPY 4 EUR/CHF 5 Oil 6 Gold 7 Interest rates EUR/USD My bearish scenario forecast for 2014 played […]

Read more January 1

January 12015

7 Things Forex Traders Learned from 2014

2014 is over, but Forex traders do not forget the recent past so quickly. It was a great year to earn from some strong fundamental trends in the market, and it was a great year to learn from the rare events that were packed into these twelve months: 1. Selling EUR/USD was a better money-making opportunity than buying USD/JPY. Although USD/JPY advanced by 13.86% in 2014 while […]

Read more December 31

December 312014

EUR/USD Resumes Decline

While EUR/USD halted its drop yesterday, the currency pair resumed its decline today. Economic data from the United States was not particularly supportive for the US currency during the current trading session, but this did not prevent the dollar from gaining on the euro. Initial jobless claims rose from 281k to 298k last week, exceeding market expectations of 287k. (Event A on the chart.) Chicago PMI dropped from […]

Read more December 30

December 302014

Dollar Halts Rally, Remains in Bull Mode

EUR/USD was flat today following two trading sessions of losses. The currency pair reached the lowest level since July 2012 intraday though. While the dollar backed off due to profit taking as well as after consumer confidence missed expectations, analysts remain bullish on the US currency over longer term. The outlook for tighter monetary policy and robust economic growth helped the greenback to gain on all other most-traded currencies this […]

Read more December 28

December 282014

One More Bullish Triangle on GBP/JPY @ H4

Less than a month ago, I have already posted about the same chart pattern on the same currency pair and even on the same timeframe. That time, the trade setup has been executed successfully and the position ended up in profit the same week the trade was opened. This time, GBP/JPY is trading slightly above those levels after experiencing a full-scalepull-back and reversion. The bullish breakout looks imminent, though the slow trading prevalent […]

Read more December 27

December 272014

Weekly Forex Technical Analysis (Dec 29 — Jan 2)

EUR/USD Floor pivot points 3rd Sup 2nd Sup 1st Sup Pivot 1st Res 2nd Res 3rd Res 1.2029 1.2097 1.2137 1.2205 1.2245 1.2313 1.2353 Woodie’s pivot points 2nd Sup 1st Sup Pivot 1st Res 2nd Res 1.2090 1.2123 1.2198 1.2231 1.2306 Camarilla pivot points 4th Sup 3rd Sup 2nd Sup 1st Sup 1st Res 2nd […]

Read more December 27

December 272014

Forex Brokers Update — December 27th, 2014

Only existing listings have been updated during the Christmas week: Goldstein Brokers added French, Hungarian, Polish, and Romanian website languages. SmartTradeFX launched Arabic website. SkyFx added German, Polish, Turkish, French, and Italian website versions. NordFX opened an office in Egypt. Infin Markets added Turkish website. ICM Capital opened offices in China and Mauritius. Launched Italian website. Larson & Holz IT no longer […]

Read more December 24

December 242014

Dollar Retreats vs. Euro, Doesn’t Fall Far

EUR/USD bounced today following yesterday’s drop to a new multi-year low. The dollar’s decline was not big, and the US currency regained some of its strength after unemployment claims fell unexpectedly. Initial jobless claims fell from 289k to 280k last week, a nice surprise for those dollar bulls who have counted on an increase to 291k. (Event A on the chart.) Crude oil inventories swelled by 7.3 million barrels last week […]

Read more