- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Blog

May 16

May 162018

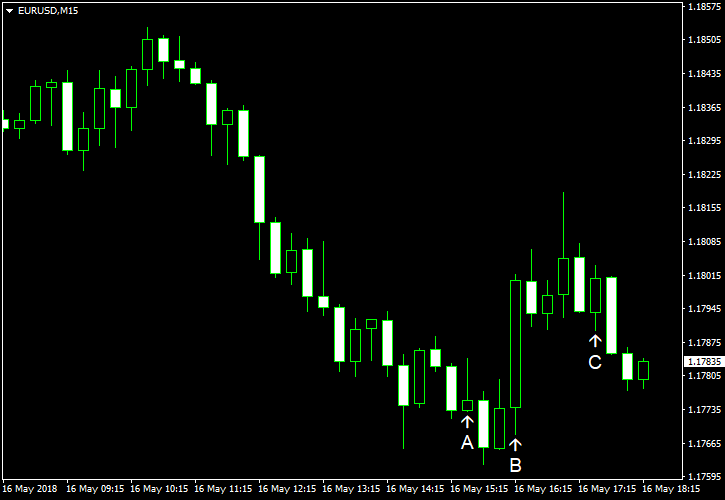

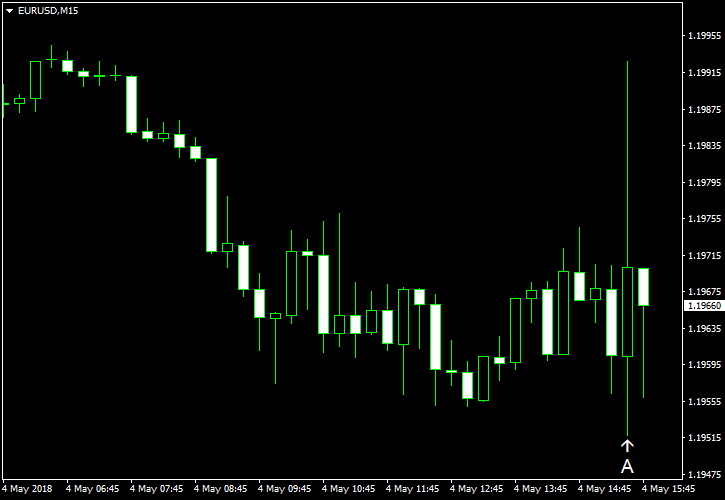

EUR/USD Falls on European Politics

EUR/USD dropped today on speculations that the Italian populist coalition may seek government debt forgiveness from the European Central Bank, though officials denied such allegations. As for US macroeconomic released, the data was mixed, but no indicator was really bad. Housing starts were at the seasonally adjusted annual rate of 1.29 million in April, down from 1.34 million in March and missing the analysts’ average estimate of 1.32 million. […]

Read more May 13

May 132018

Forex Brokers Update â May 13th, 2018

Just a few updates this week: CMC Markets launched Pro accounts for those traders who wish to avoid being hit by the new ESMA Forex rules and qualify to become elective professionals under MiFID II. FP Markets now offer VPS service for $25/month to their customers. Darwinex now also offers stock trading. ActivTrades added trading in ETFs to its MT5 accounts. If you have any questions […]

Read more May 12

May 122018

Weekly Forex Technical Analysis (May 14 — May 18)

EUR/USD Floor pivot points 3rd Sup 2nd Sup 1st Sup Pivot 1st Res 2nd Res 3rd Res 1.1695 1.1759 1.1850 1.1914 1.2006 1.2070 1.2161 Woodie’s pivot points 2nd Sup 1st Sup Pivot 1st Res 2nd Res 1.1766 1.1864 1.1921 1.2019 1.2076 Camarilla pivot points 4th Sup 3rd Sup 2nd Sup 1st Sup 1st Res 2nd […]

Read more May 11

May 112018

EUR/USD Extends Rally Caused by CPI Miss

EUR/USD extended yesterday’s rally caused by the miss of the inflation data. Today’s data in the United States was a bit mixed, but mostly decent. Yet that did not prevent the currency pair from rising, erasing its losses over the week. Both import and export prices rose in April. Import prices increased by 0.3%, missing the average forecast of a 0.5% increase. On top of that, the March reading was revised from no […]

Read more May 10

May 102018

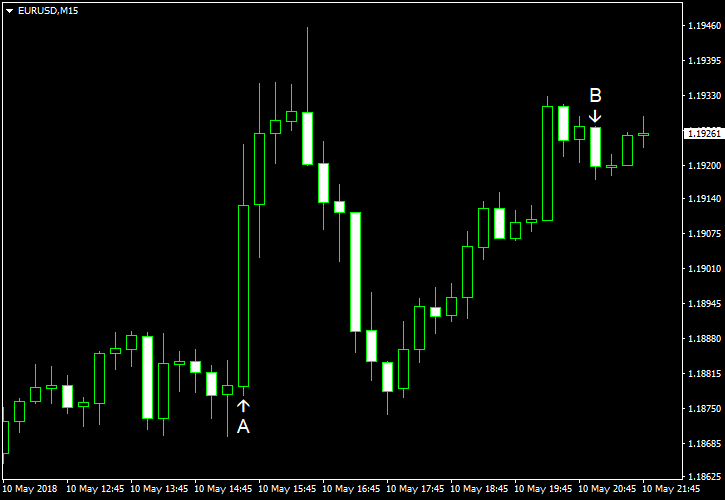

EUR/USD Halts Decline After US CPI Misses Expectations

EUR/USD rose for the first time after four consecutive sessions of losses as the US Consumer Price Index rose less than was expected. Other macroeconomic indicators released in the United States over today’s trading session beat expectation, but that hardly affected the rally. CPI rose 0.2% in April, failing to meet the consensus forecast of a 0.3% growth. The index fell 0.1% in March. (Event A on the chart.) Initial jobless claims were […]

Read more May 9

May 92018

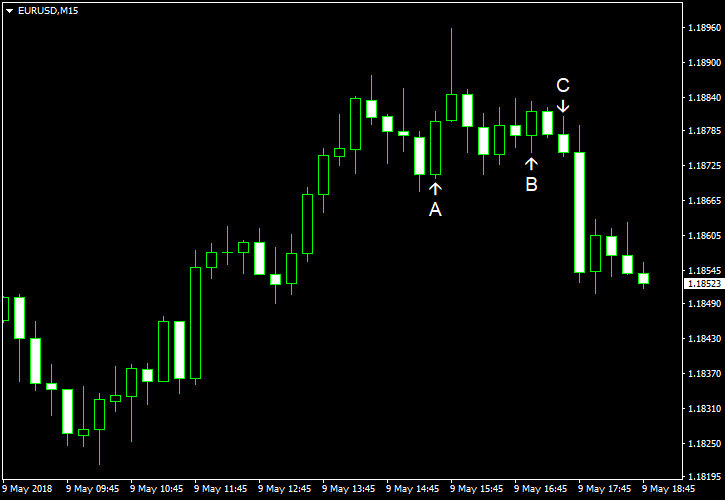

EUR/USD Pulls Back After Attempt to Rally

EUR/USD attempted to rally during the Wednesday trading session, but has pulled back by now, and is currently trading near the opening level. As for economic data, the US Producer Price Index missed expectations. Now, traders wait for tomorrow’s release of the Consumer Price Index. PPI rose by just 0.1% in April, seasonally adjusted. That was a slower rate of growth than 0.2% predicted by analysts and 0.3% registered in March. (Event A on the chart.) […]

Read more May 6

May 62018

Forex Brokers Update â May 6th, 2018

One new broker has become listed on our website during the week that is ending today: Capital Street FX — an offshore Forex company registered with FSC of Mauritius. The broker uses ActTrader platform for demo and live trading. The minimum account size is $100 and the leverage of up to 1:2500 is available. Capital Street FX Updates to the listed companies this week include: AvaTrade added BTC/JPY, BTC/EUR, and BTG/USD […]

Read more May 6

May 62018

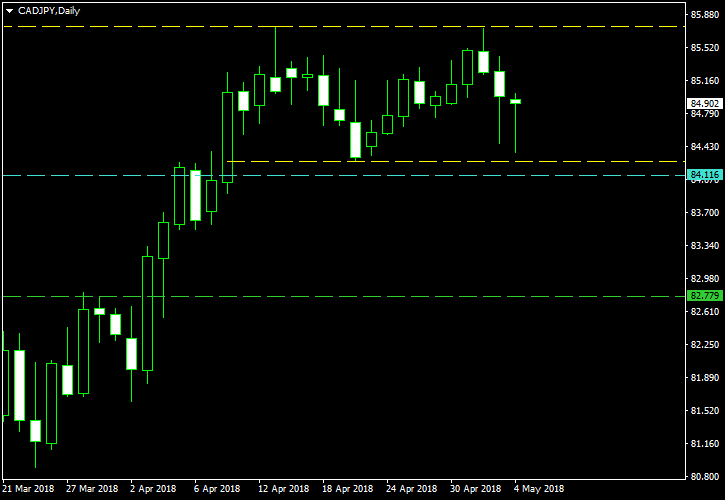

CAD/JPY Double Top to Put an End to Its Minor Rally

CAD/JPY was trading in a strong downtrend since the beginning on the year, but that decline turned to a minor rally in mid-March. It entered a consolidation phase just less than a month later. The currently visible double top can serve as a reversal pattern to let the currency pair return to its long-term downtrend. On the chart below, you can see the yellow lines marking the tops and the “neckline” of the double top formation. The cyan line will […]

Read more May 5

May 52018

Weekly Forex Technical Analysis (May 7 — May 11)

EUR/USD Floor pivot points 3rd Sup 2nd Sup 1st Sup Pivot 1st Res 2nd Res 3rd Res 1.1640 1.1776 1.1868 1.2003 1.2096 1.2231 1.2324 Woodie’s pivot points 2nd Sup 1st Sup Pivot 1st Res 2nd Res 1.1765 1.1847 1.1993 1.2075 1.2221 Camarilla pivot points 4th Sup 3rd Sup 2nd Sup 1st Sup 1st Res 2nd […]

Read more May 4

May 42018

EUR/USD Fails to Rally on Disappointing Nonfarm Payrolls

US nonfarm payrolls came out surprisingly weak, prompting EUR/USD to jump immediately after the release. But the rally was extremely short-lived, and the currency pair is still hanging below the opening level right now. Nonfarm payroll employment increased by 164k in April, failing to meet the consensus forecast of a 190k increase. The March gain got a positive revision from 103k to 135k. Average hourly earnings rose by just 0.1%, also […]

Read more