- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Fundamental Analysis

March 6

March 62019

EUR/USD Volatile After US Macro Releases, Decides to Go Upside

EUR/USD was volatile after macroeconomic releases in the United States but ultimately decided to go upside. That is not surprising as basically all of US indicators released today were disappointing. ADP employment rose by 183k from January to February, slightly less than markets had expected — 190k. The previous month’s already substantial increase got a huge positive revision from 213k to 300k. (Event A on the chart.) US trade […]

Read more March 5

March 52019

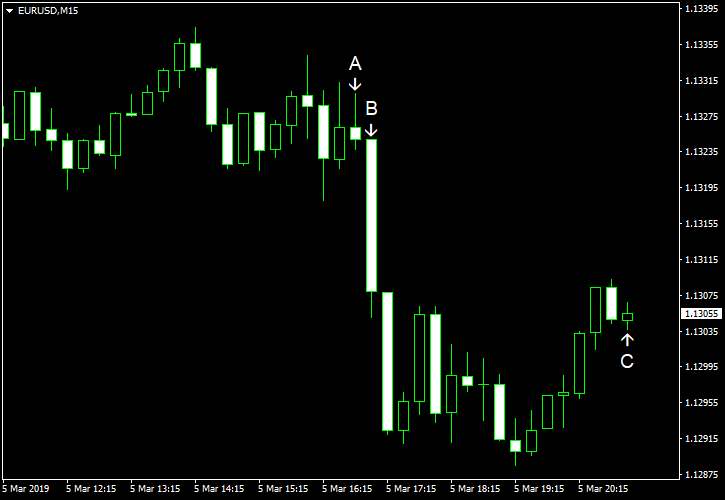

EUR/USD Falls on US Treasury Yields, Positive US Economic Data

EUR/USD fell today. Positive US macroeconomic reports were pushing the currency pair down, though market analysts pointed at the rising US Treasury yields as another possible reason for the decline. Basically all of economic reports released in the United States today were good, and most of them beat expectations. Markit services PMI climbed to 56.0 in February from 54.2 in January according to the final estimate. The actual figure was not far […]

Read more March 1

March 12019

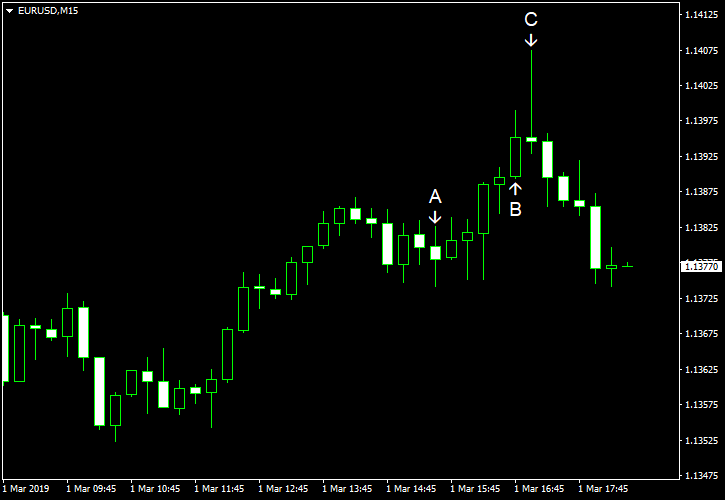

EUR/USD Trims Gains Caused by Poor US Data

EUR/USD attempted to rally today on the back of US macroeconomic reports, virtually all of which were worse than expected. The currency pair was unable to hold onto gains for long, though, and has retreated to trade just slightly above the opening level by now. Due to the government shutdown, the December estimates for personal income and spending as well for core PCE inflation came out just today, while January data was only available […]

Read more February 28

February 282019

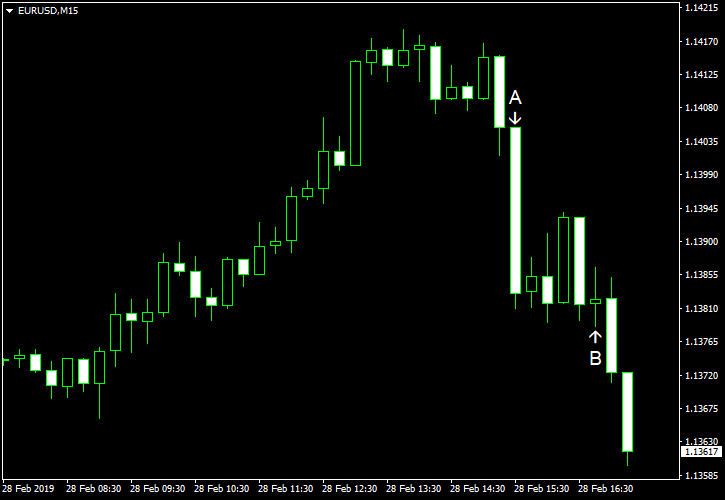

EUR/USD Loses Gains After Release of US GDP

EUR/USD was rising today but has lost all of its gains by now after a report showed that US gross domestic product rose last quarter more than was expected. Meanwhile, meeting between the US and North Korean leaders ended abruptly, putting markets into a risk-off mode. US GDP rose 2.6% in Q4 2018 according to the advance (first) estimate. Analysts had predicted a smaller increase […]

Read more February 27

February 272019

EUR/USD Mixed amid Risk Aversion, Mixed US Data

EUR/USD fell today amid risk aversion caused by geopolitical tension. US data released today was mixed as factory orders showed almost no growth but pending home sales rose more than was expected. Factory orders rose just 0.1% in December versus 1.5% predicted by analysts. It was not enough to offset the drop by 0.5% registered in the previous month. (Event A on the chart.) Pending home sales […]

Read more February 26

February 262019

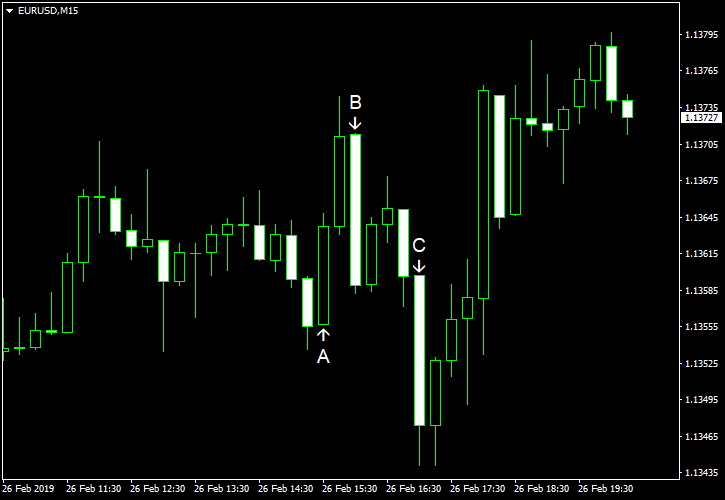

EUR/USD Retains Strength After US Data, Powell’s Testimony

EUR/USD gained today. The currency pair rallied after disappointing macroeconomic reports in the United States. Wile the EUR/USD pair dipped after several positive US releases and the testimony of Federal Reserve Chairman Jerome Powell, it has managed to regain its strength by now. Housing starts were at the seasonally adjusted annual rate of 1.08 million in December, down from the revised November estimate of 1.21 million (1.26 million before the revision). […]

Read more February 21

February 212019

EUR/USD Volatile After Torrent of Economic Releases

EUR/USD demonstrated significant volatility today after a big number of economic reports were released both in the United States and the eurozone. The dollar and the euro were mixed as traders were trying to digest the data. Currently, the EUR/USD pair trades slightly below the opening level after attempting to rally earlier. US durable goods orders rose 1.2% in December, missing the analysts’ average forecast of a 1.6% increase. The orders were up 0.7% in November. […]

Read more February 15

February 152019

EUR/USD Bounces After Mixed US Data

EUR/USD was heading lower at the beginning of the Friday’s trading session but has bounced later and is now trading near the opening level. Data in the United States was mixed, but it looks like traders paid more attention to bad parts as the currency were moving higher after almost each release. Empire State Manufacturing Index climbed from 3.9 in January to 8.8 in February, exceeding the median forecast of 7.1. […]

Read more February 14

February 142019

EUR/USD Jumps After US Retail Sales Drop Most in 9 Years

EUR/USD jumped sharply after US retail sales demonstrated the biggest decline in more than 9 years. While the currency pair has backed off from the daily highs by now, it is still trading firmly above the opening level. Earlier, the EUR/USD advanced after eurozone GDP came out in line with expectations. (Event A on the chart.) PPI fell 0.1% in January after declining 0.2% in December. That frustrated […]

Read more February 13

February 132019

EUR/USD Slides After Eurozone Industrial Production Contracts

EUR/USD fell today, reversing yesterday’s gains. Market analysts argued that the possible reason for the decline was the bigger-than-expectedcontraction of eurozone industrial production. (Event A on the chart.) Macroeconomic data in the United States was not good as well, but that did not prevent the dollar from rising against the euro. US CPI was flat in January on a seasonally adjusted basis, whereas analysts had expected an increase by 0.1%. The index declined 0.1% […]

Read more