- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Fundamental Analysis

July 24

July 242018

EUR/USD Bounces amid Mixed Data

EUR/USD was falling at the start of today’s trading session, but has reversed its movement at 7:00 GMT, and is now trading above the opening level. Macroeconomic data was mixed both in the United States and the eurozone, but that did not prevent the rebound. Market analysts believe that the currency pair will remain volatile till the European Central Bank policy meeting on Thursday. As for US reports, a couple were released […]

Read more July 19

July 192018

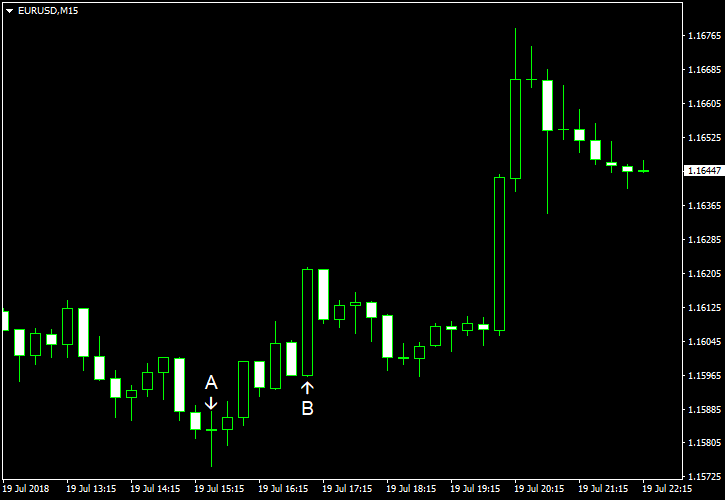

EUR/USD Soars Despite Positive US Data

EUR/USD was on the rise today during the New York trading session despite the fact that the US macroeconomic indicators came out pretty good this time. Philadelphia Fed manufacturing index rose from 19.9 to 25.7 in July, coming out better than 21.6 expected by market participants. (Event A on the chart.) Initial jobless claims declined to 207k in the week ending July 14. It was a positive surprise for USD bulls […]

Read more July 19

July 192018

EUR/USD Soars Despite Positive US Data

EUR/USD was on the rise today during the New York trading session despite the fact that the US macroeconomic indicators came out pretty good this time. Philadelphia Fed manufacturing index rose from 19.9 to 25.7 in July, coming out better than 21.6 expected by market participants. (Event A on the chart.) Initial jobless claims declined to 207k in the week ending July 14. It was a positive surprise for USD bulls […]

Read more July 18

July 182018

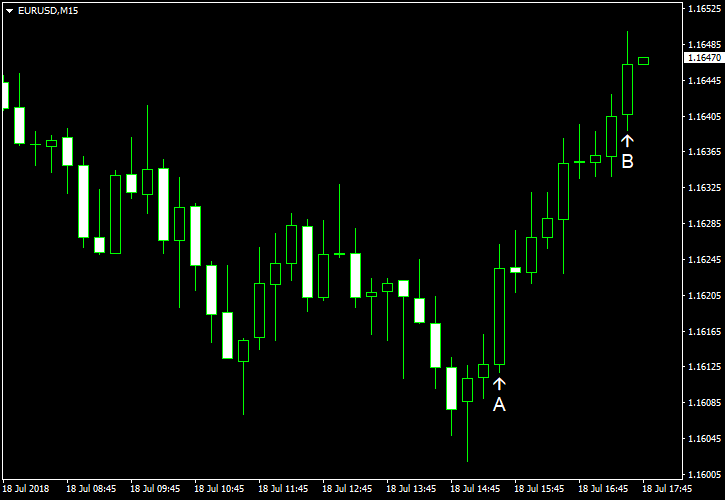

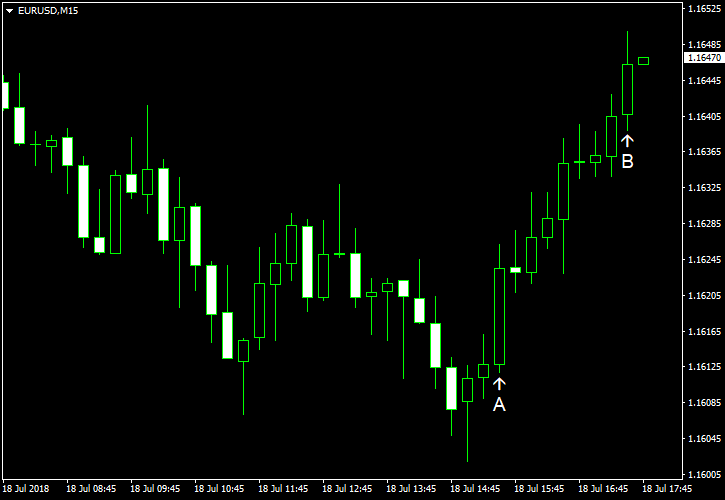

EUR/USD Declines, Recovers on US Housing Data

The US dollar had been winning against the single European currency during the late London and early New York trading sessions today before the poor US real estate statistics indicators made euro jump up. EUR/USD has not yet recovered all of its early losses but is doing quite well as of now. Housing starts and building permits declined significantly in the United States in June. Housing starts […]

Read more July 18

July 182018

EUR/USD Declines, Recovers on US Housing Data

The US dollar had been winning against the single European currency during the late London and early New York trading sessions today before the poor US real estate statistics indicators made euro jump up. EUR/USD has not yet recovered all of its early losses but is doing quite well as of now. Housing starts and building permits declined significantly in the United States in June. Housing starts […]

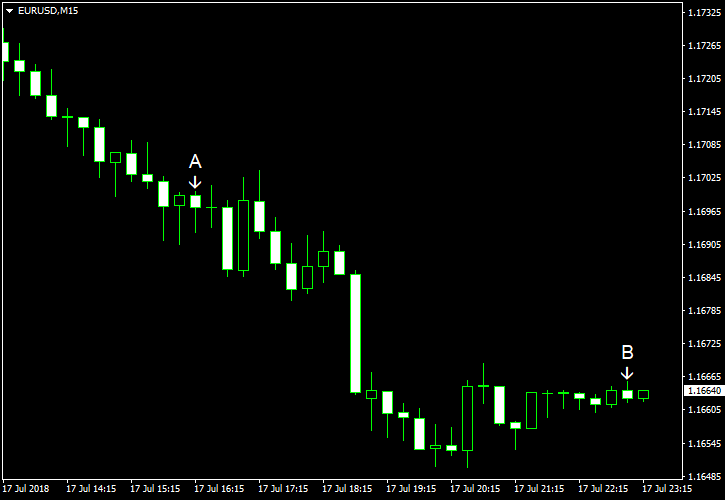

Read more July 17

July 172018

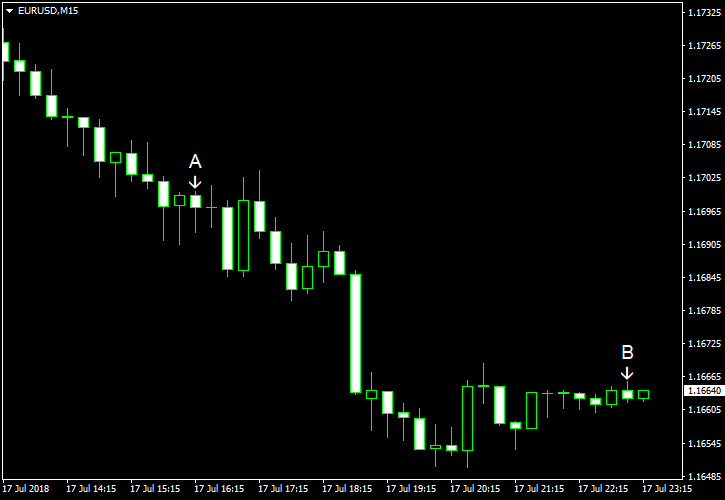

EUR/USD Declines Ignoring Mixed US Reports

The euro was falling against the US dollar during the bigger part of both the European and the American trading sessions. It ignored the US fundamentals but came to a halt after 16:00 GMT, entering a consolidation phase. Industrial production and capacity utilization both increased in May. Industrial production added 0.6% after declining by 0.5% in April (revised from a 0.1% drop). The indicator was expected to add 0.5% in May. Capacity utilization went […]

Read more July 17

July 172018

EUR/USD Declines Ignoring Mixed US Reports

The euro was falling against the US dollar during the bigger part of both the European and the American trading sessions. It ignored the US fundamentals but came to a halt after 16:00 GMT, entering a consolidation phase. Industrial production and capacity utilization both increased in May. Industrial production added 0.6% after declining by 0.5% in April (revised from a 0.1% drop). The indicator was expected to add 0.5% in May. Capacity utilization went […]

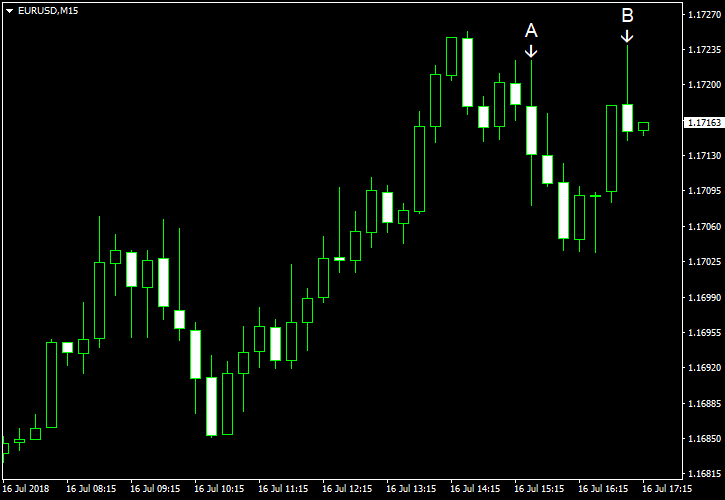

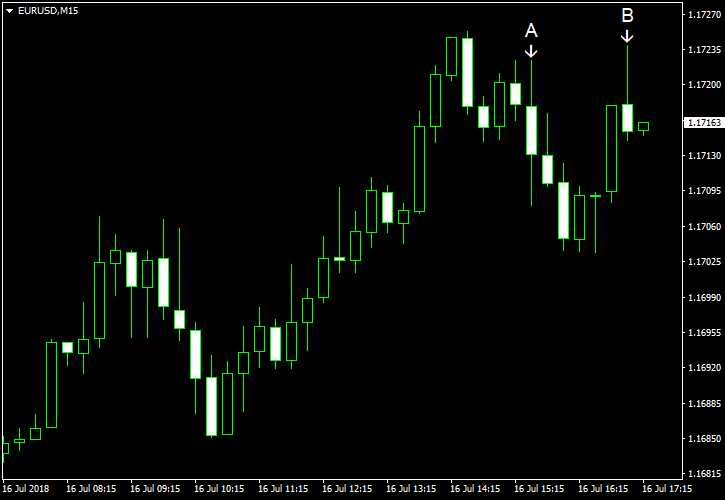

Read more July 16

July 162018

EUR/USD Gets Temporary Correction from Positive US Data

The euro was in a positive trend against its US counterpart during the most part of the trading session today. Later, the uptrend encountered a minor correction fueled with the better-than-expected macroeconomic indicators released by the US agencies. However, the correction failed to reverse the prevailing trend so far. Retail sales rose 0.5% in June 2018 in the United States. The growth exceeded the median forecast of 0.4%, but what is more important, the May’s growth […]

Read more July 16

July 162018

EUR/USD Gets Temporary Correction from Positive US Data

The euro was in a positive trend against its US counterpart during the most part of the trading session today. Later, the uptrend encountered a minor correction fueled with the better-than-expected macroeconomic indicators released by the US agencies. However, the correction failed to reverse the prevailing trend so far. Retail sales rose 0.5% in June 2018 in the United States. The growth exceeded the median forecast of 0.4%, but what is more important, the May’s growth […]

Read more July 13

July 132018

EUR/USD Fails to Enter Downtrend, Ignores US Fundamentals

EUR/USD was falling during the European trading session and rising during the US one today, but did not pay a lot of attention to the macroeconomic indicators. Those were largely negative for the US dollar. US export and import prices demonstrated mixed performance in June. Export prices increased by 0.3% while the import prices decreased by 0.4%. The latter was a bitter surprise for the dollar bulls who had hoped for a 0.1% increase. On a brighter […]

Read more