- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Fundamental Analysis

September 27

September 272017

EUR/USD Continues to Fall for Third Day

EUR/USD extended its decline for the third day today. US economic data was mixed, but traders paid more attention to the positive durable goods orders report than to the negative housing data. Yesterday’s speech of Federal Reserve Chairwoman Janet Yellen, which confirmed that the Fed is going to continue monetary tightening, also put pressure on the currency pair. Anticipation of a US fiscal reform announcement was also driving […]

Read more September 26

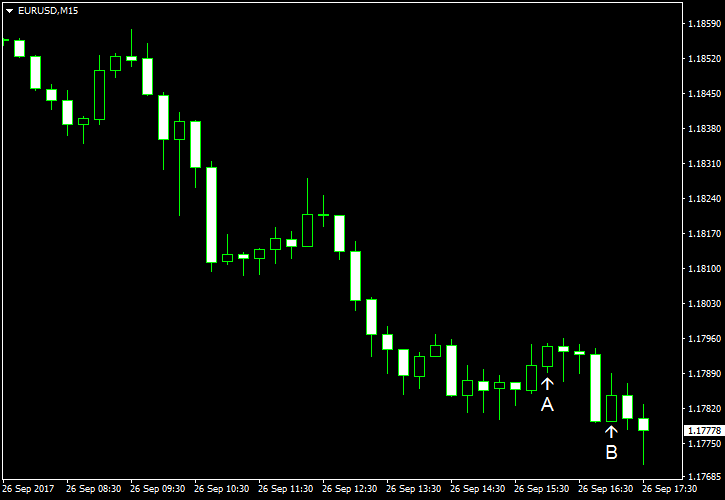

September 262017

EUR/USD Falls for Second Day, Ignores US Data

EUR/USD fell today, declining for the second day, as the inconclusive outcome of the German federal election overshadowed falling US consumer confidence and home sales. S&P/Case-Shiller home price index rose 5.8% in July, year-on-year, compared to the forecast of 5.7% and the previous month’s increase if 5.6%. Month-over-month, the index was up 0.7%. (Event A on the chart.) Richmond Fed manufacturing index rose from 14 to 19 in September, whereas analysts were expecting the indicator […]

Read more September 22

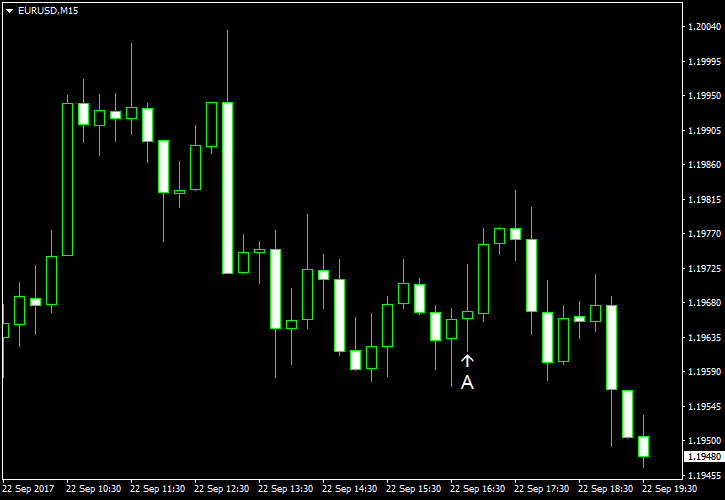

September 222017

EUR/USD Drifts Closer to Opening After Strong Start of Session

EUR/USD rallied during the first half of the current trading session but has drifted down closer to the opening level by now. The dollar was under pressure from growing tensions between the United States and North Korea. Meanwhile, the euro was getting support from the fact that all Purchasing Managers’ Indices released in the eurozone today (for major countries as well as for the currency union as a whole) were above expectations. Markit US manufacturing […]

Read more September 19

September 192017

EUR/USD Resumes Rally Started Yesterday

EUR/USD has started a rally during yesterday’s American trading session, which continued into the early hours of today’s European session. The currency pair retreated a bit afterwards, but it looks like EUR/USD is going to resume the rally. Housing starts were at the seasonally adjusted annual rate of 1.18 million in August, near the predicted level of 1.17 million and the July revised rate of 1.19 million. Building permits climbed to the seasonally […]

Read more September 15

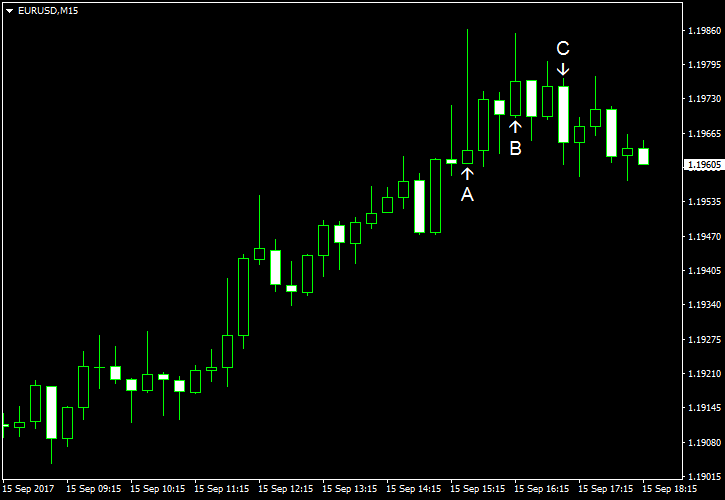

September 152017

EUR/USD Goes Higher After Friday’s US Data

EUR/USD went higher today during the session that was busy in terms of macroeconomic data from the United States. Plenty of economic reports were released and unfortunately (at least for dollar bulls) quite a few of them were disappointing. Additionally, prospects for monetary tightening from the European Central Bank continued to support the currency pair. Retail sales fell 0.2% in August, whereas experts had predicted an increase by 0.1%. Moreover, the July increase […]

Read more September 14

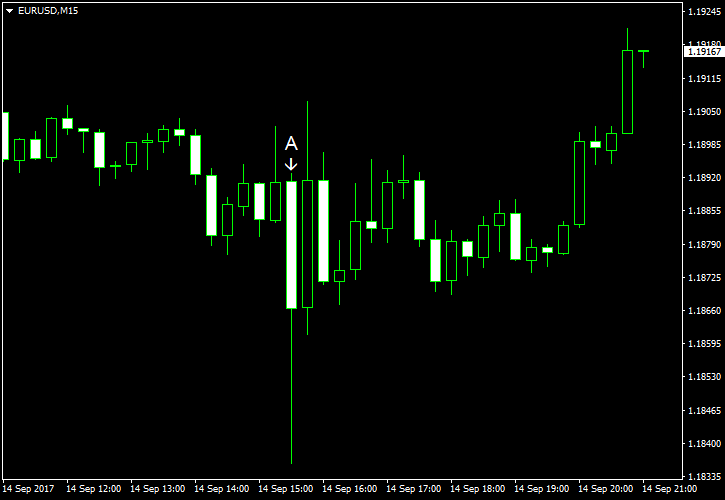

September 142017

EUR/USD Shrugs Off Pressure from Positive US CPI

EUR/USD fell today after the release of the US Consumer Price Index, which exceeded market expectations. Yet the currency pair quickly recovered and is now trading above the opening level. CPI rose 0.4% in August, exceeding the previous month’s growth of 0.1% and exceeding the forecast of 0.3%. (Event A on the chart.) Initial jobless claims dropped from 298k to 284k last week, surprising analysts who had anticipated an increase to 303k. (Event […]

Read more September 13

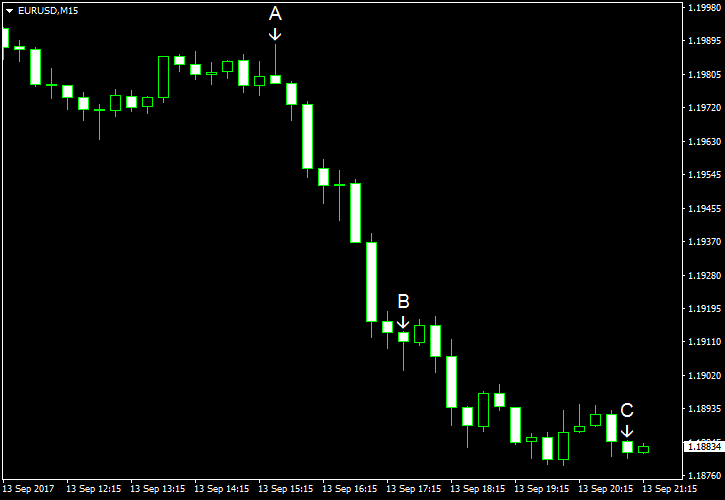

September 132017

EUR/USD Falls Even as US PPI Misses Forecasts Slightly

EUR/USD fell today even as US producer price inflation missed expectations. The miss was not big, though, and the markets’ attention was glued to tomorrow’s consumer price data anyway. Meanwhile, crude oil stockpiles continued to swell, while gasoline stockpiles were falling, as plenty of refineries were closed as a result of Hurricane Harvey. PPI rose 0.2% in August, seasonally adjusted. That was a better reading that the drop by 0.1% […]

Read more September 8

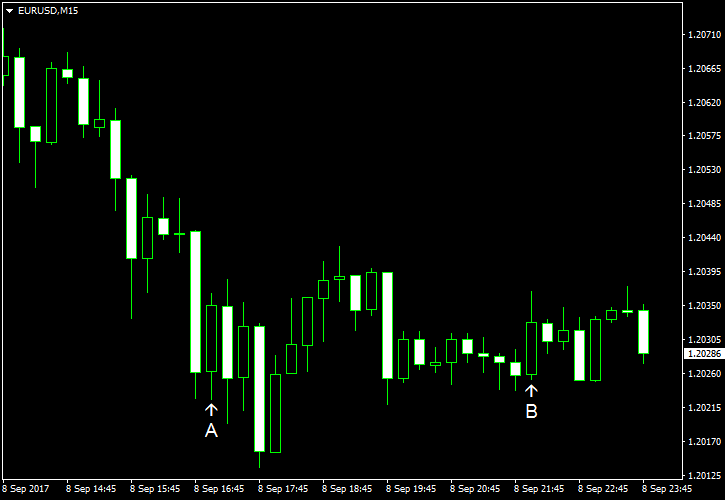

September 82017

EUR/USD Ends Session Almost Losing Gains

EUR/USD rallied during the Friday’s trading session but closed almost at the opening level. The dollar was generally weak on Friday due to a range of factors, including concerns about North Korea and possibility of another nuclear test by the rogue nation, decreasing chances for another interest rate hike from the Federal Reserve this year, and the threat from Hurricane Irma just shortly after the disastrous impact of Hurricane Harvey. As for US economic data, […]

Read more September 7

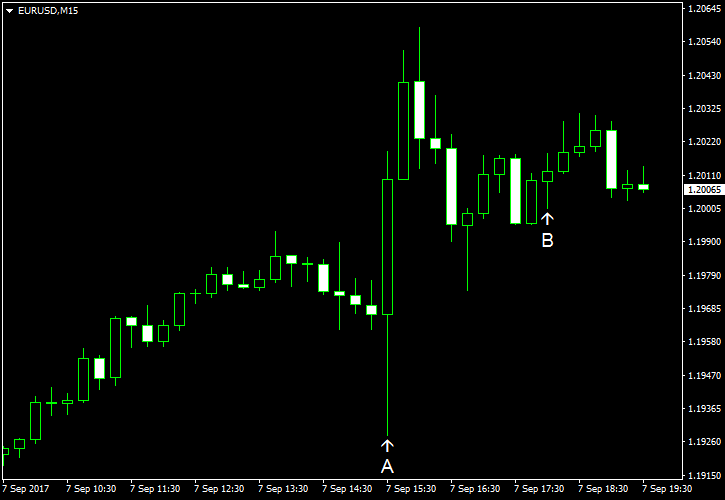

September 72017

EUR/USD Jumps on ECB, US Jobless Claims

EUR/USD rallied today after Mario Draghi, President of the European Central Bank, signaled at the press conference after the monetary policy meeting that quantitative easing tapering will be discussed in October. (Event A on the chart.) Meanwhile, jobless claims in the United States jumped to the highest level since March 2015 as a result of Hurricane Harvey. Initial jobless claims jumped from 236k to 298k last week, far above the predicted level of 245k. […]

Read more September 6

September 62017

EUR/USD Little Changed as Traders Assess Chances of Rate Hike

EUR/USD was little changed today but was heading to weekly gains as US policy makers talked down chances for another interest rate hike by the end of the year. US economic data was mixed today, giving the currency pair no direction. Trade balance deficit was at $43.7 billion in July, almost unchanged from $43.5 billion in June, revised. Forecasters had predicted an increase to $44.6 billion. (Event A on the chart.) […]

Read more