- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Blog

May 3

May 32018

EUR/USD Attempts to Rally on Profit-Taking, Fails

EUR/USD attempted to rally today as the dollar seemed rather soft due to profit-taking that followed the greenback’s strong performance yesterday. Yet the rally failed, and the currency pair is trading near the opening level right now. Macroeconomic data was not beneficial to the currency pair as eurozone inflation slowed unexpectedly (event A on the chart), while US reports were good for the most part. Nonfarm productivity rose 0.7% in Q1 2018. That […]

Read more May 2

May 22018

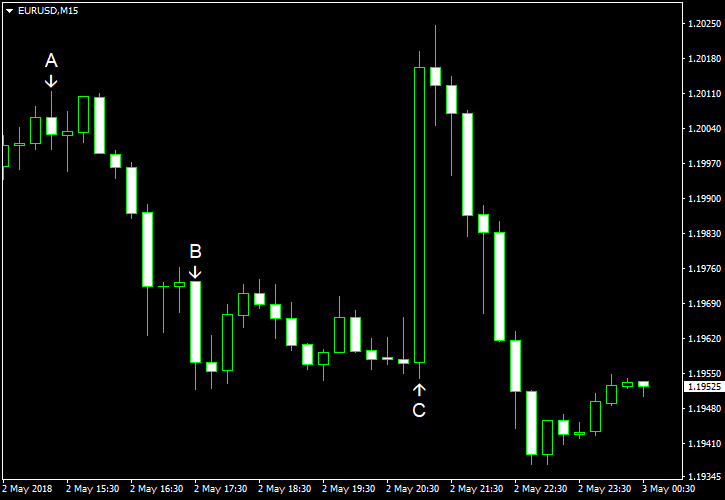

EUR/USD Volatile After FOMC Announcement

EUR/USD was very volatile after the release of a policy statement by the Federal Open Market Committee. The currency pair leaped after the release but immediately started to back off and went below the opening level after some time. Market analysts thought that the FOMC made some dovish changes to the statement, and that was the reason for the initial jump. Yet it looked like the outlook for monetary policy did not change substantially […]

Read more May 1

May 12018

EUR/USD Drops Ahead of Wednesday’s FOMC Announcement

EUR/USD fell today, dropping for the ninth time in eleven session. Market analysts thought that the currency pair was driven by the same forces as previously — mainly by anticipation of higher interest rates from the Federal Reserve. While basically nobody expects the Fed to announce a hike tomorrow, traders still wait for the Fed’s statement, hoping that it may signal whether US policy makers consider four hikes it total this […]

Read more April 30

April 302018

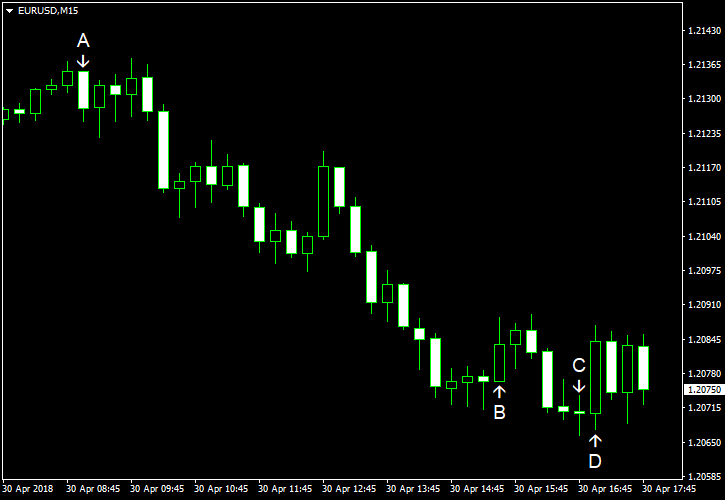

EUR/USD Declines After Disappointing German Retail Sales

EUR/USD was trading in a range at the start of Monday’s trading but began a decline shortly after German retail sales came out, turning out to be much worse than was expected. (Event A on the chart.) US macroeconomic data was not hot either, but that did not help the currency pair. This week will be full with important releases in the United States, including PMIs, employment data, […]

Read more April 30

April 302018

[Poll] Worst Streak of Losses

When assessing your trading performance, it is useful to look not only at such parameters as the average win size, average loss size, or the ratio of winning trades to losing ones. Looking at the maximum one-time gain or, conversely, at the worst losing trade can also shed light on the viability of the employed trading method. However, one of the overlooked parameters is the maximum length of the losing streak encountered by a trader. For example, catching three […]

Read more April 29

April 292018

Forex Brokers Update â April 29th, 2018

One new company became listed on our website during the two weeks that passed since the last update: Videforex — a rather strange amalgamation of a binary options broker, Forex/CFD platform, and a video chat. They use a custom web-based trading solution and are not regulated anywhere. The minimum account size to start trading is $250. Videforex Some brokers have been updated: ATFX added cryptocurrency trading with BTC/USD, […]

Read more April 29

April 292018

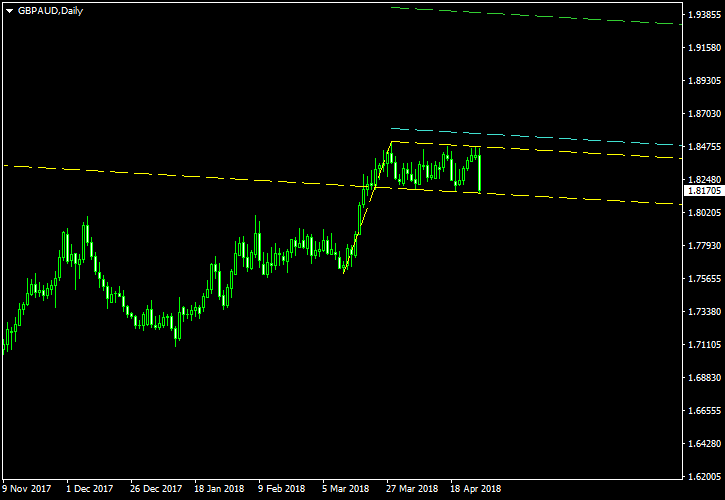

GBP/AUD in a Visible Bullish Flag

Following a failed symmetrical triangle formation in early March, the British pound has formed a bullish flag pattern versus its Aussie counterpart. The flag part is now about one month long and follows a pronounced upswing in the currency pair. The chart screenshot below shows the flag’s borders and the pole marked with the yellow lines. My potential entry level is marked with the cyan line and is located at 10% of the pole’s length […]

Read more April 28

April 282018

Weekly Forex Technical Analysis (Apr 30 — May 4)

EUR/USD Floor pivot points 3rd Sup 2nd Sup 1st Sup Pivot 1st Res 2nd Res 3rd Res 1.1792 1.1924 1.2027 1.2158 1.2261 1.2392 1.2495 Woodie’s pivot points 2nd Sup 1st Sup Pivot 1st Res 2nd Res 1.1917 1.2012 1.2151 1.2246 1.2385 Camarilla pivot points 4th Sup 3rd Sup 2nd Sup 1st Sup 1st Res 2nd […]

Read more April 27

April 272018

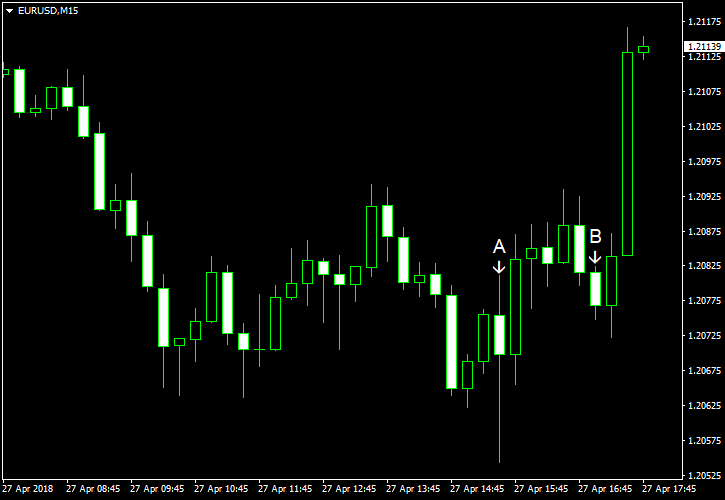

EUR/USD Bounces as Markets Ignore US GDP

EUR/USD was falling today following yesterday’s steep sell-off. While the currency pair attempted to recover, it ended Thursday’s session lower. During the current session, the EUR/USD pair had extended the decline intraday, but has managed to bounce by now. The pair benefited from the fact that markets had muted reaction to the better-than-expected US gross domestic product print. US GDP grew 2.3% in Q1 2018. While the growth […]

Read more April 26

April 262018

EUR/USD Recovers as Mario Draghi Downplays Poor Data

EUR/USD dropped today after the European Central Bank left its monetary policy unchanged and signaled that it is going to keep interest rates low for a long time. (Event A on the chart.) Yet the currency pair bounced after ECB President Mario Draghi downplayed the recent negative macroeconomic reports in his introductory statement before the press conference, saying that the data is “consistent with a solid and broad-based expansion of the euro […]

Read more