- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Blog

October 4

October 42016

Book Review: Trade Mindfully by Gary Dayton

This book was recommended to me by a fellow redditor from /r/Forex. Trade Mindfully: Achieve Your Optimum Trading Performance with Mindfulness and Cutting Edge Psychology is one of the books on trading psychology that provide valuable advice and actionable techniques. Another trading book of such a high quality level that I have read was Trading in the Zone by Mark Douglas. Trade Mindfully was written by Gary Dayton in 2014. Gary […]

Read more October 3

October 32016

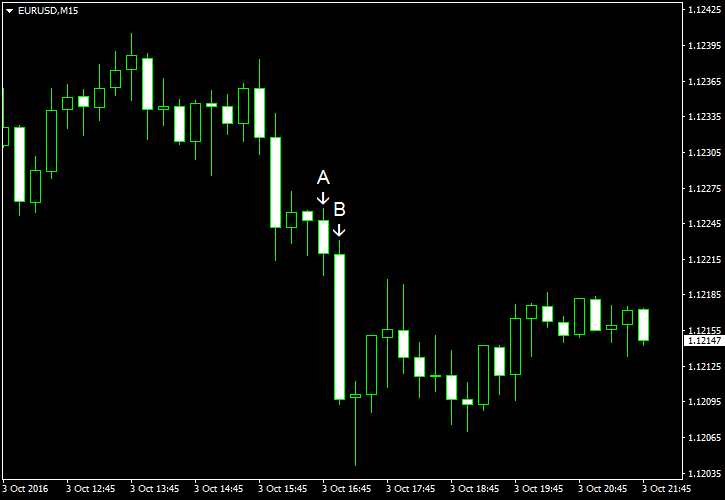

EUR/USD Falls as ISM Manufacturing PMI Returns to Expansion

EUR/USD fell today after the manufacturing Purchasing Managers’ Index from Institute for Supply Management rose above the neutral 50.0 level, suggesting that the US manufacturing sector turned from contraction to expansion. The report from Markit also confirmed that the sector is expanding. Meanwhile, construction spending demonstrated an unexpected drop. Markit manufacturing PMI fell from 52.0 in August to 51.5 in September according to the final estimate, in line with […]

Read more October 2

October 22016

Forex Brokers Update — October 2nd, 2016

One new company has been added to the list of Forex brokers this week: Land-FX — a British broker with regulation by FCA and FSP (New Zealand). It is an MT4 broker. Their standard accounts start with $300 and their ECN accounts start with $2,000. The maximum FX leverage is 1:500 on the former and 1:200 on the latter. Land-FX The list of changes to the already listed brokers includes only two items this […]

Read more October 2

October 22016

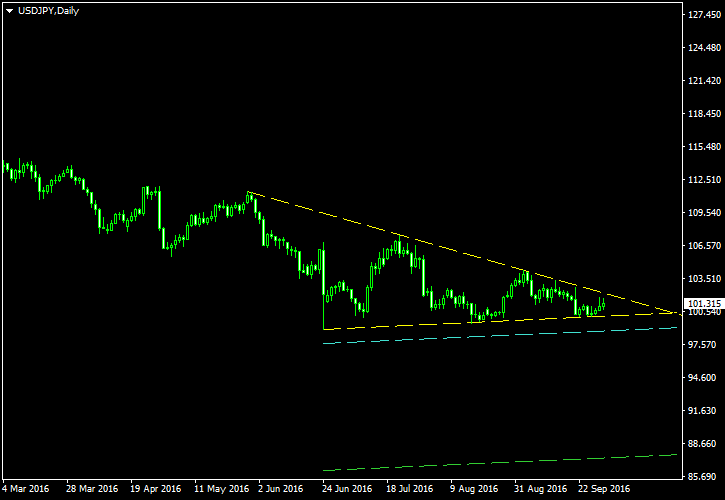

USD/JPY to Follow CAD/JPY in a Triangle Pattern?

It was not easy to decide whether it should be called a descending triangle or a symmetrical one. In reality, it is something in between, but the descending triangle looks to be a more appropriate designation for this USD/JPY pattern because the lower border’s slope is significantly less pronounced than the upper one’s. The formation serves as a long-term consolidation following a year-long downtrend in the currency pair. It is also correlated with […]

Read more October 1

October 12016

Weekly Forex Technical Analysis (Oct 3 — Oct 7)

EUR/USD Floor pivot points 3rd Sup 2nd Sup 1st Sup Pivot 1st Res 2nd Res 3rd Res 1.1043 1.1098 1.1169 1.1224 1.1295 1.1350 1.1420 Woodie’s pivot points 2nd Sup 1st Sup Pivot 1st Res 2nd Res 1.1102 1.1177 1.1228 1.1303 1.1354 Camarilla pivot points 4th Sup 3rd Sup 2nd Sup 1st Sup 1st Res 2nd […]

Read more September 30

September 302016

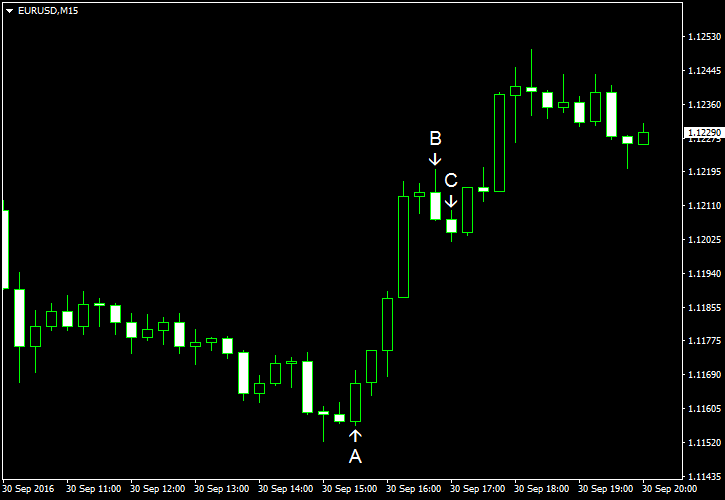

EUR/USD Recovers Despite Good Data from USA

EUR/USD was falling today but started to recover intraday despite economic data from the United States that was coming out good. The possible reason for the bounce were easing fears surrounding Deutsche Bank. There are still concerns that Germany’s biggest bank may yet collapse, potentially creating a Lehman Brothers situation. Personal income rose 0.2% in August, in line with expectations, after increasing 0.4% […]

Read more September 29

September 292016

Dollar Rises vs. Euro After GDP, Loses Gains Later

The US dollar attempted to rally against the euro during the Thursday’s trading session as the final revision of US gross domestic product was better than the preliminary one. Yet the greenback failed to keep its rally, and currently EUR/USD trades above the opening level. US GDP rose 1.4% in Q2 2016 according to the third and final estimate after increasing 0.8% in Q1. The actual value was above the predicted 1.3% and the preliminary 1.1%. […]

Read more September 28

September 282016

EUR/USD Goes Down as Traders Wait for Signs from Fed & NFP

EUR/USD went down today, though losses were limited. Several Federal Reserve members are going to speak today, and traders hope to hear something that might reveal Fed’s plans for the future of monetary policy. The most important speaker, Fed Chairperson Janet Yellen, already spoke today but did not give any clues. Therefore, perhaps market participants are going to focus more on the next week’s nonfarm […]

Read more September 27

September 272016

EUR/USD Ends Four-Day Rally

EUR/USD fell today, declining for the first day in five. One of the major reason for this was the general consensus that Hillary Clinton won the Monday’s presidential debate with Donald Trump, and that was considered a positive outcome for the dollar. Tuesday’s economic data from the United States also benefited the US currency, being strong for the most part (with the exception of the manufacturing index). S&P/Case-Shiller home price index rose 5.0% in July […]

Read more September 26

September 262016

EUR/USD Extends Rally for Fourth Day

EUR/USD rose today, extending its rally for the fourth consecutive session. Uncertainty about the outcome of the presidential elections in the United States and concerns that Donald Trump may win Monday’s debate with Hillary Clinton were driving the dollar lower versus its peers. Better-than-expected data from US housing market was unable to provide support for the US currency. Meanwhile, the unexpected climb of the German business climate index contributed to the strength […]

Read more