- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Blog

April 29

April 292016

Rally of EUR/USD Accelerates

After four sessions of modest gains, EUR/USD demonstrated an impressive jump during Friday’s trading. It was not surprising if one takes into consideration that the majority of US economic indicators released during the current trading session were not good. The only better-than-expected piece of data was personal income. All others were below expectations. Personal income and spending rose in March. Income was up 0.4%, […]

Read more April 28

April 282016

US GDP Misses Expectations, EUR/USD Extends Upward Move

Today’s economic data released from the United States was not particularly good. First quarter’s growth of the US economy was slower than economists had anticipated. The number of unemployment claims grew last week. As a result, EUR/USD was able to extend its upward move for the fourth straight session. US GDP rose 0.5% in Q1 2015 according to the advance (first) estimate. The reading failed to meet the consensus market expectations […]

Read more April 27

April 272016

Fed Holds Interest Rates Steady, EUR/USD Up

The main theme of Wednesday’s trading session was the monetary policy announcement from the Federal Reserve. The Fed offered no surprises, holding its policy steady and giving no particular hints about its plans for the future. EUR/USD was very volatile immediately after the event but steadied quickly and moved mostly sideways afterwards, though with an upward bias. Pending home sales rose 1.4% in March from the downwardly revised […]

Read more April 26

April 262016

EUR/USD Rides on Poor Data Coming from USA

EUR/USD fared quite well today and has rallied strongly following a series of macroeconomic reports coming out of the United States. Nearly all indicators have disappointed the dollar bulls, adding strength to the euro attack against the greenback. Durable goods orders added only 0.8% in March according to the preliminary report by the US Census Bureau. That was much better than the last month’s drop by 3.1% but considerably worse than […]

Read more April 25

April 252016

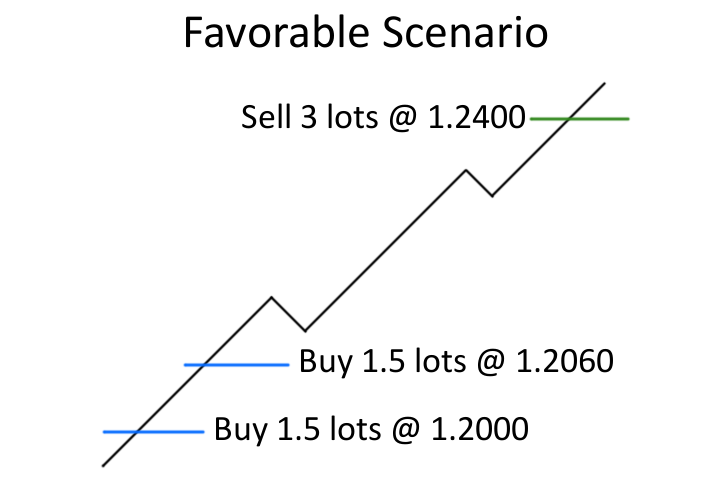

Using Aggressive Pyramiding to Go Beyond Margin Limits

When you read about pyramiding in Forex, the first association that sparks up is scaling in, that is increasing the size of profitable positions. I have written about this concept before and I am not very fond of scaling into normal trades. Aggressive pyramiding is a different kind of beast. It is a way to increase the size of the position beyond the limits imposed by the initially available margin. As your starting position’s […]

Read more April 24

April 242016

Forex Brokers Update — April 24th, 2016

The last three weeks have seen some numerous updates to the existing brokers but only one addition of the new company to the list of brokers on EarnForex.com. TradeWiseFX — an offshore broker from Saint Vincent and the Grenadines with classic and ECN account types. Both are based on MetaTrader 4 platform and have $25 minimum size. TradeWiseFX Updates during the period include: AMarkets no longer has offices in the USA, Singapore, and the UK. Opened […]

Read more April 24

April 242016

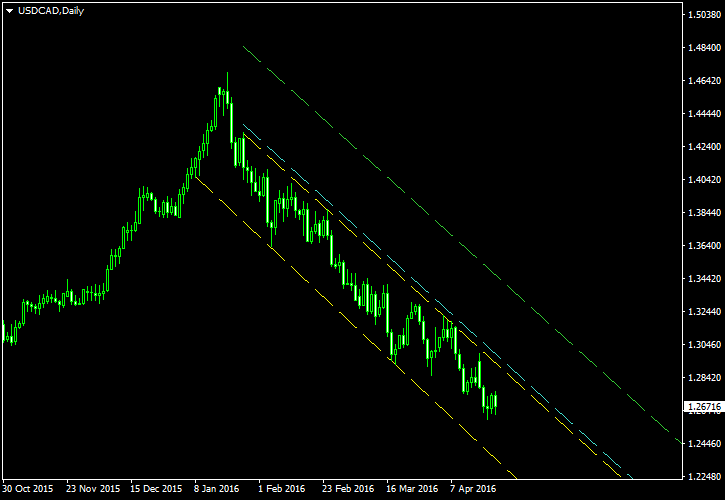

USD/CAD in Descending Channel Since January 2016

A very long descending channel can now be seen on the daily chart of the USD/CAD currency pair. It had started forming right after the multi-year peak registered on January 20. As a continuation pattern, descending channel interrupts an uptrend, which is to be continued following a bullish breakout of the upper border. The chart screenshot below shows the channel itself outlined with the yellow lines. The cyan line points to an entry level in case […]

Read more April 23

April 232016

Weekly Forex Technical Analysis (Apr 25 — Apr 29)

EUR/USD Floor pivot points 3rd Sup 2nd Sup 1st Sup Pivot 1st Res 2nd Res 3rd Res 1.0971 1.1093 1.1154 1.1276 1.1337 1.1460 1.1521 Woodie’s pivot points 2nd Sup 1st Sup Pivot 1st Res 2nd Res 1.1078 1.1124 1.1261 1.1307 1.1444 Camarilla pivot points 4th Sup 3rd Sup 2nd Sup 1st Sup 1st Res 2nd […]

Read more April 21

April 212016

EUR/USD Erases Gains After ECB Meeting

EUR/USD had started a strong rally after 9:00 GMT but has lost it after the monetary policy meeting of the European Central Bank. (Event A on the chart.) Now, market participants focus on the next week’s meeting of the Federal Reserve, and some of analysts say that the Fed may be more bullish than traders are anticipating. US data was not that great today (with the exception of jobless claims), but […]

Read more April 20

April 202016

EUR/USD Goes Down After Three Sessions of Gains

EUR/USD fell for the first day in four during Wednesday’s trading. Prospects for monetary easing loom over the euro, liming the attractiveness of the currency to investors. Most analysts do not expect for the European Central Bank make a move during tomorrow’s meeting, but comments from ECB officials may hurt the euro all the same. Meanwhile, the dollar found support from the positive housing data, which followed yesterday’s negative report. Existing […]

Read more