- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Blog

July 1

July 12018

Forex Brokers Update â July 1st, 2018

One new broker has been added during the last two weeks: Coinexx — an unregulated MT5 crypto/Forex broker based in the United Kingdom. They offer trading in cryptocurrencies via CFD. Traditional currency pairs are also available. Coinexx Updates to the listed companies included: ActivTrades opened an office in Bahamas. BDSwiss launched a custom Webtrader platform. Blackwell Global renounced its CySEC license. FIBOGroup now supports deposits and withdrawals […]

Read more June 30

June 302018

Weekly Forex Technical Analysis (Jul 2 — Jul 6)

EUR/USD Floor pivot points 3rd Sup 2nd Sup 1st Sup Pivot 1st Res 2nd Res 3rd Res 1.1373 1.1450 1.1567 1.1644 1.1760 1.1837 1.1953 Woodie’s pivot points 2nd Sup 1st Sup Pivot 1st Res 2nd Res 1.1460 1.1586 1.1653 1.1780 1.1847 Camarilla pivot points 4th Sup 3rd Sup 2nd Sup 1st Sup 1st Res 2nd […]

Read more June 29

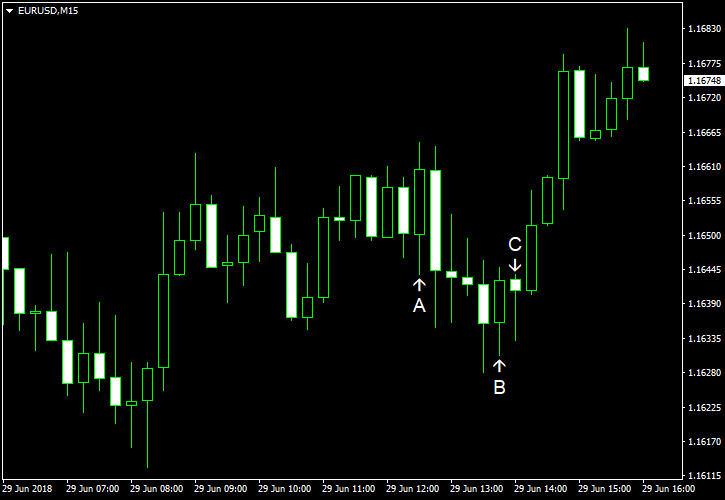

June 292018

EUR/USD Strong After EU Immigration Deal

EUR/USD jumped sharply today after the leaders of the European Union reached a deal about immigration. Strong eurozone inflation data also helped the currency pair. Meanwhile, US data was mixed. Both personal income and spending increased in May, by 0.4% and 0.2% respectively. Analysts had predicted a 0.4% rate of increase for both indicators. The April increase of income was revised from 0.3% to 0.2%. The increase of spending also got a negative […]

Read more June 28

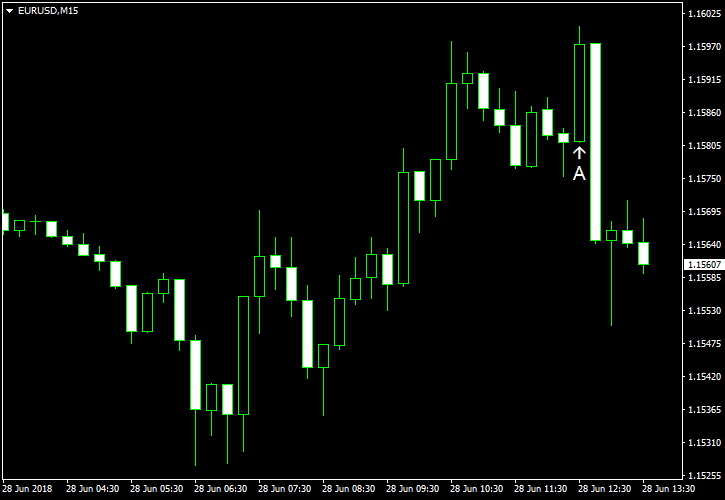

June 282018

EUR/USD Logs Small Gain on Thursday

EUR/USD edged a little higher today after two sessions of losses. US economic data released during the trading session was below expectations, boosting the currency pair, though it fell sharply afterwards. Nevertheless, currently EUR/USD trades above the opening level. US GDP rose 2.0% in Q1 2018, according to the final estimate, after increasing 2.9% in Q4 2017. Analysts had expected the same 2.2% rate of growth […]

Read more June 27

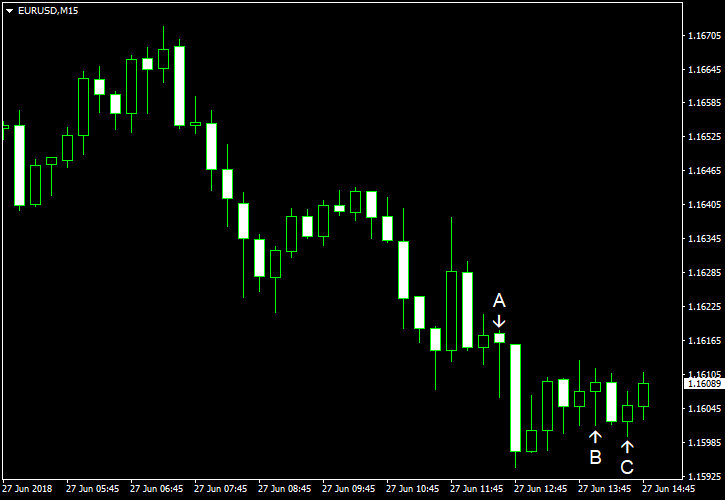

June 272018

EUR/USD Declines for Second Day As Trade War Fears Persist

EUR/USD declined for the second consecutive session today even after US President Donald Trump avoided imposing the harshest possible measures against China in the escalating trade war. While markets responded positively to the news, there were concerns that investment curb will touch not just China, but other countries as well, including European ones. US data released today was mixed, meaning it did little […]

Read more June 26

June 262018

EUR/USD Declines Under Weight of Trade War Fears

EUR/USD declined today as the threat of trade wars continued to weigh on markets. Today’s US data did not provide a direction to the currency pair because it was mixed. The housing and consumer confidence reports were underwhelming, while the manufacturing data was surprisingly good. S&P/Case-Shiller home price index rose 6.6% in April, year-on-year, missing the average estimate of 6.9% and slowing from the previous month’s 6.7% rate of growth. Month-on-month, the index […]

Read more June 25

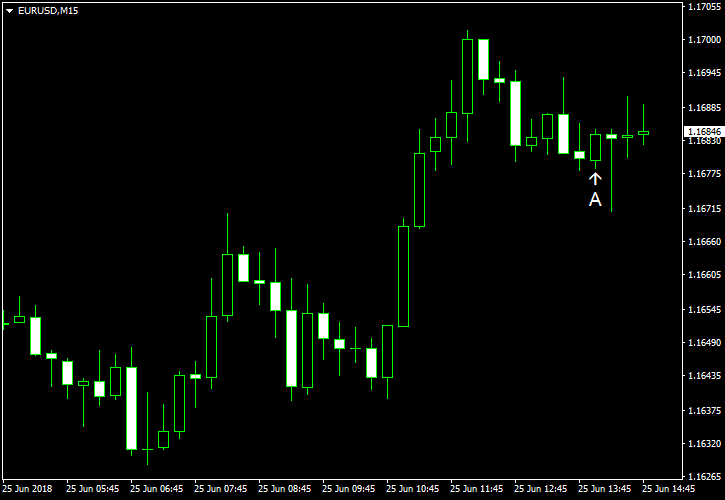

June 252018

EUR/USD Rallies After Intraday Drop

EUR/USD fell today, dragged down by fears of a trade war between the United States and the European Union as well as by mixed macroeconomic data in the eurozone. Yet the currency pair managed to bounce afterwards and remained stable after the underwhelming US housing report. New home sales were at the seasonally adjusted annual rate of 689k in May, missing traders’ expectations of 665k. Moreover, the April figure got a negative revision from 662k to 646k. (Event […]

Read more June 23

June 232018

Weekly Forex Technical Analysis (Jun 25 — Jun 29)

EUR/USD Floor pivot points 3rd Sup 2nd Sup 1st Sup Pivot 1st Res 2nd Res 3rd Res 1.1382 1.1445 1.1550 1.1612 1.1717 1.1779 1.1884 Woodie’s pivot points 2nd Sup 1st Sup Pivot 1st Res 2nd Res 1.1456 1.1570 1.1623 1.1737 1.1790 Camarilla pivot points 4th Sup 3rd Sup 2nd Sup 1st Sup 1st Res 2nd […]

Read more June 21

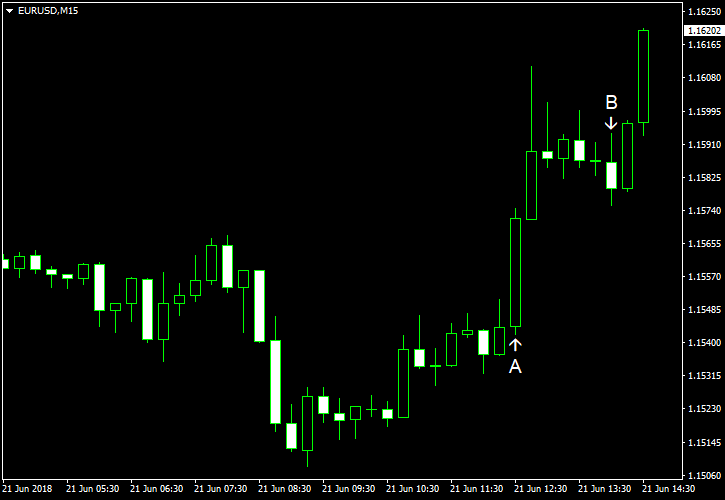

June 212018

EUR/USD Reverses Losses, Boosted by Weak Manufacturing Index

EUR/USD was falling during the current trading session but managed to reverse its losses. The rebound gained momentum after the Philadelphia Fed reported that its manufacturing index fell this month much more than was expected. The US leading indicators also provided an unpleasant surprise, and unemployment claims was the only decent indicator released in the United States today. Philadelphia Fed manufacturing index fell from 34.4 […]

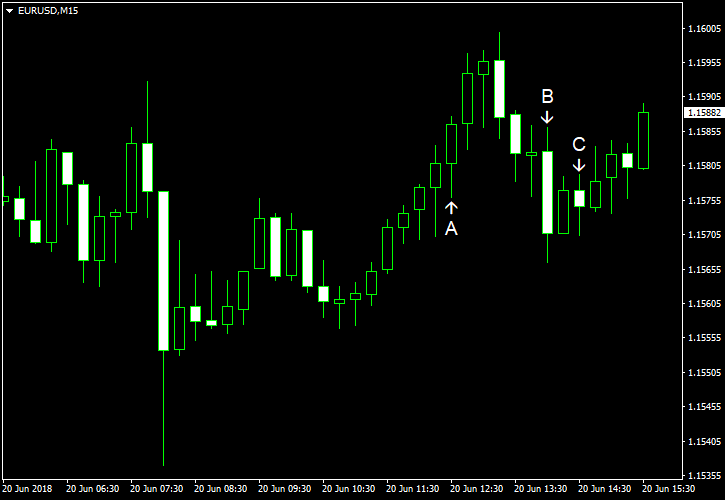

Read more June 20

June 202018

EUR/USD Recovers After Diving Intraday

EUR/USD fell intraday during the current trading session but managed to bounce by now. The currency pair was under influence of various factors, including US tariffs and planned retaliation to them from the European Union, the speech of European Central Bank President Mario Draghi, and the positive surprise from the German Producer Price Index. As for US macroeconomic data, it was mixed. Current account balance logged a deficit of $124.1 billion in Q1 […]

Read more