- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Blog

January 23

January 232015

Euro Continues to Feel Pressure from ECB

EUR/USD extended yesterday’s drop today, falling to the lowest level since September 2003, as the euro continues to feel pressure from the yesterday’s drop of the European Central Bank. While the currency pair trimmed its losses as of now, it still trades below the opening level. Existing home sales rose to the seasonally adjusted annual rate of 5.04 million in December from the downwardly revised 4.92 million in November. The median forecast promised an increase […]

Read more January 22

January 222015

EUR/USD Weakest Since 2003 After ECB

Data from the United States was rather mixed both yesterday and today but it was not the main driver for the Forex market during the current trading session. The major event today was the monetary policy announcement from the European Central Bank. The ECB unveiled its expanded asset purchase plan, driving the euro down. (Event A on the chart.) While the drop of EUR/USD was not big at first, the currency pair quickly […]

Read more January 21

January 212015

E-Book Review: Consolidation Breakout Signals on the Forex Market by Duane Shepherd

Duane Shepherd is a currency analyst and trader who is running a website www.drfxtrading.blogspot.com. He specializes in swing trading, and his main method of entry into the market appears to be consolidation breakouts. He has written several e-books based on his trading method, and he generously shared one of them with my blog’s readers. is an introductory piece into the technique described as a consolidation breakout by the author. Consolidation breakouts are a more […]

Read more January 20

January 202015

New Forex VPS with Multiple Server Locations — WINNERvps

WINNERvps has been launched back in 2011 under a brand name ServerKeren. From 2013 onwards, it is known as WINNERvps. The company offers multiple VPS hosting plans and several operational system choices. They claim to be catering to retail Forex traders, but I could not find any features that would be aimed at FX traders specifically. Here are some of their features: Hosting plans start […]

Read more January 19

January 192015

When Will EUR/USD Reach Parity?

EUR/USD traded at 1.0000 last time on December 6, 2002 — almost 13 years ago. The highest price it has traded at since then was 1.6037 in June 2008. After that, it was a way down with three correctional upswings if you look at the currency pair on monthly chart: For someone, who did not trade or monitor Forex before the year 2003, the idea of EUR/USD parity (one US […]

Read more January 18

January 182015

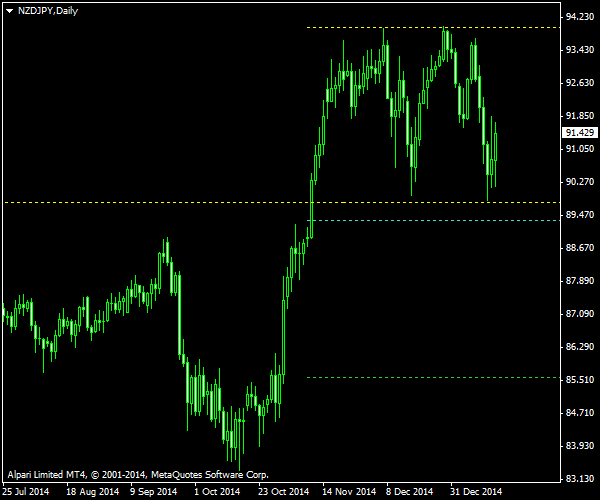

Double Top Terminates NZD/JPY Uptrend

NZD/JPY is showing a great bearish breakout opportunity that has crystallized now when the double top formation on the daily chart can be seen clearly. It appears to be terminating a strong rising trend that was active since mid-October. A breakout signal is needed for confirmation of this assumption as there is a chance for the currency pair to continue going up following current consolidation. The chart shows the double top […]

Read more January 17

January 172015

Weekly Forex Technical Analysis (Jan 19 — Jan 23)

EUR/USD Floor pivot points 3rd Sup 2nd Sup 1st Sup Pivot 1st Res 2nd Res 3rd Res 1.0977 1.1218 1.1389 1.1630 1.1801 1.2042 1.2213 Woodie’s pivot points 2nd Sup 1st Sup Pivot 1st Res 2nd Res 1.1201 1.1354 1.1612 1.1766 1.2024 Camarilla pivot points 4th Sup 3rd Sup 2nd Sup 1st Sup 1st Res 2nd […]

Read more January 17

January 172015

Forex Brokers Update — January 17th, 2015

There were quite a few updates to the brokers’ descriptions this week: FXDD is no longer accepting euro and pound deposits. Alpari declared insolvency due to EUR/CHF shock. Cornèr Trader added German, French, Italian, and Russian languages to its website. Vinson Financials added Arabic and Persian versions of their website. Pantheon Finance no longer has an office in Kazakhstan. Liga Forex launched Croatian website. FirewoodFX is […]

Read more January 16

January 162015

EUR/USD Pushed Down by Poor US Fundamentals

EUR/USD was falling during almost whole trading session today. It reacted negatively both to positive and negative US data reports. It entered a significant correction wave after setting a new long-term low at 1.1459. Nevertheless, the currency pair was clearly in a downtrend today. US CPI fell by 0.4% in December after declining by 0.3% in November. Such deflation has been expected by the markets. (Event A on the chart.) Both industrial […]

Read more January 15

January 152015

SNB Removes Franc Cap, EUR/CHF Reaches 0.94

Three years and four months after introducing its controversial 1.2000 EUR/CHF floor, the Swiss National Bank is abandoning it. At the same time, SNB decreased the interest rate from its current -0.25% to -0.75%. EUR/CHF reaction is predictably volatile. The currency pair lost 2600 pips in under 25 minutes. It bounced from 0.94 support level and currently looks to be more or less stable near 1.04. […]

Read more