- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Blog

January 15

January 152015

Dollar Continues to Rise vs. Euro Following CHF Volatility

The US dollar continued to grow against the euro following a huge wave of FX volatility generated by SNB’s cancellation of EUR/CHF floor (Event A on the chart.) EUR/USD went down to 1.1565 during that turbulence period but then recovered. The currency pair continued to decline following good fundamental reports from the United States. Even poor initial jobless claims report could not stop the euro from falling. Initial jobless claims […]

Read more January 14

January 142015

EUR/USD Recovers After New Multi-Year Low

EUR/USD fell initially following the better than expected (but still weak) reports on industrial productions from the eurozone today (Event A on the chart.) The direction of trading has changed to an uptrend in less than two hours. Probably, traders realized that poor recovery is still good and justifies some euro buying. US fundamentals were far from good and played their role in EUR/USD strength. Retail sales decreased by 0.9% […]

Read more January 11

January 112015

Forex Brokers Update — January 11th, 2015

We have added one new company over the week: TradeStation — a well-known US broker, famous for its proprietary namesake trading platform. Its minimum account size is $2,000, and the leverage on all instruments is limited to the maximum of 1:50. TradeStation Several companies had their listing updated: TenkoFX added Persian language to its website. Opened offices in India, Kyrgyzstan, Indonesia, and Bangladesh. BelforFx launched an Italian website. JustForex […]

Read more January 10

January 102015

Weekly Forex Technical Analysis (Jan 12 — Jan 16)

EUR/USD Floor pivot points 3rd Sup 2nd Sup 1st Sup Pivot 1st Res 2nd Res 3rd Res 1.1516 1.1635 1.1738 1.1857 1.1960 1.2079 1.2182 Woodie’s pivot points 2nd Sup 1st Sup Pivot 1st Res 2nd Res 1.1631 1.1730 1.1853 1.1952 1.2075 Camarilla pivot points 4th Sup 3rd Sup 2nd Sup 1st Sup 1st Res 2nd […]

Read more January 9

January 92015

EUR/USD Reverses Decline Despite Amazing Nonfarm Payrolls

EUR/USD edged up today, erasing yesterday’s losses. It was a big surprise as US nonfarm payrolls were amazingly good and should have driven the currency pair further down. Market analysts explain such behavior by the unexpected drop of average hourly earnings that spoiled otherwise stellar employment data. Nonfarm payrolls grew by 252k in December, exceeding optimistic analysts’ projections of 241k. Moreover, the November value was revised […]

Read more January 8

January 82015

No Stop for Decline of EUR/USD

EUR/USD declined for yet another trading session today ahead of tomorrow’s nonfarm payrolls. Today’s employment data was positive as jobless claims dropped, albeit not as much as was expected. Initial jobless claims were at the seasonally adjusted rate of 294k last week. The value was above the predicted 291k but below the previous week’s 298k. (Event A on the chart.) Consumer credit rose $14.0 billion in November, trailing the forecast increase […]

Read more January 7

January 72015

Economic Data & FOMC Minutes Beneficial for Dollar

The dollar was strong today with the help of positive macroeconomic data and the hawkish minutes of the December policy meeting of the Federal Reserve. EUR/USD dropped to yet another multi-year low. ADP employment grew by 241k in December while analysts predicted the same rate of growth as the revised November’s 227k. (Event A on the chart.) Trade balance showed a deficit of $39.0 billion in November even though experts anticipated it to stay at the revised October’s level of $42.2 […]

Read more January 6

January 62015

EUR/USD Steady After Three Sessions of Decline

EUR/USD was steady today following three sessions of decline. The dollar paused its rally as today’s economic data from the United States was rather disappointing. ISM services PMI dropped from 59.3% in November to 56.2% in December, far below the predicted value of 58.2%. (Event A on the chart.) Factory orders slumped 0.7% in November, at the same rate as in October. Market analysts predicted a 0.3% drop. (Event A on the chart.) If you have […]

Read more January 5

January 52015

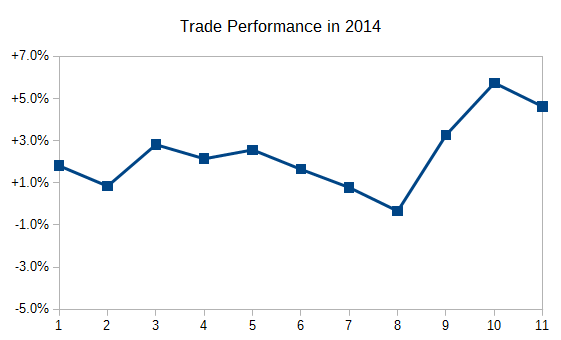

2014 Trading Results — Was Forex Market Profitable for You?

Although 2014 was not a big success in terms of Forex trading for my main account, which I use for chart pattern trading, it was not a bad one either. With 4.6% profit, it stands worse than my 2012 result of 26.7% gain, but much better than 2013’s 8.8% yearly loss. This year’s profit is mostly attributed to my last two successful trades. It also includes a profitable […]

Read more January 3

January 32015

Weekly Forex Technical Analysis (Jan 5 — Jan 9)

EUR/USD Floor pivot points 3rd Sup 2nd Sup 1st Sup Pivot 1st Res 2nd Res 3rd Res 1.1705 1.1852 1.1927 1.2074 1.2148 1.2295 1.2370 Woodie’s pivot points 2nd Sup 1st Sup Pivot 1st Res 2nd Res 1.1834 1.1891 1.2056 1.2112 1.2277 Camarilla pivot points 4th Sup 3rd Sup 2nd Sup 1st Sup 1st Res 2nd […]

Read more