- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Fundamental Analysis

February 7

February 72019

EUR/USD Extends Decline After Downgrade of Growth Forecasts

EUR/USD extended its decline for the fourth consecutive session today after the European Commission downgraded its growth forecasts. Poor macroeconomic data from the eurozone also weighed on the currency pair. Initial jobless claims fell from 253k to 234k last week. That is compared to the average forecast of 220k. (Event A on the chart.) Consumer credit rose by $16.5 billion in December, matching market expectations, after increasing $22.4 billion in November. […]

Read more February 6

February 62019

EUR/USD Falls for Third Consecutive Session on Economic Data

EUR/USD fell today for the third day in a row after Germany released a disappointing report on factory orders. Meanwhile, US data was good, with the trade deficit decreasing more than was expected. Signs of positive developments in the Sino-US trade talks provided additional boost to the US dollar against its rivals, including the euro. US trade balance deficit shrank to $49.3 billion in November down from the revised reading of $55.7 […]

Read more February 5

February 52019

EUR/USD Falls Despite Poor US Services PMIs

EUR/USD fell today on mixed macroeconomic data in the eurozone. US reports were not good as well, with services Purchasing Managers’ Indices dropped, but that did not prevent the dollar from attempting to stage a bounce. Markit services PMI was at 54.2 in January, down slightly from 54.4 in December, according to the final estimate, matching analysts’ forecasts and the preliminary estimate. (Event A on the chart.) ISM services PMI dropped to 56.7% […]

Read more February 1

February 12019

EUR/USD Rallies, Keeps Gains After Mixed Nonfarm Payrolls

EUR/USD rallied today on the back of better-than-expected inflation data released in the eurozone and kept its gains after mixed US nonfarm payrolls. The currency pair dipped for a short while following the release of positive US manufacturing reports but bounced back very quickly afterwards. Nonfarm payrolls climbed by 304k in January, much more than analysts had predicted — 165k. On the negative side, the previous month’s reading got a downward revision […]

Read more January 31

January 312019

EUR/USD Falls on Eurozone Macroeconomic Data

EUR/USD fell today, likely dragged down by mixed macroeconomic data released in the eurozone during the Thursday’s trading session. US economic reports were mixed as well, but that did not prevent the dollar from gaining on the euro. Initial jobless claims jumped from 200k to 253k last week. Market participants were completely unprepared for such a big jump, expecting just a relatively small increase to 215k. Chicago PMI […]

Read more January 30

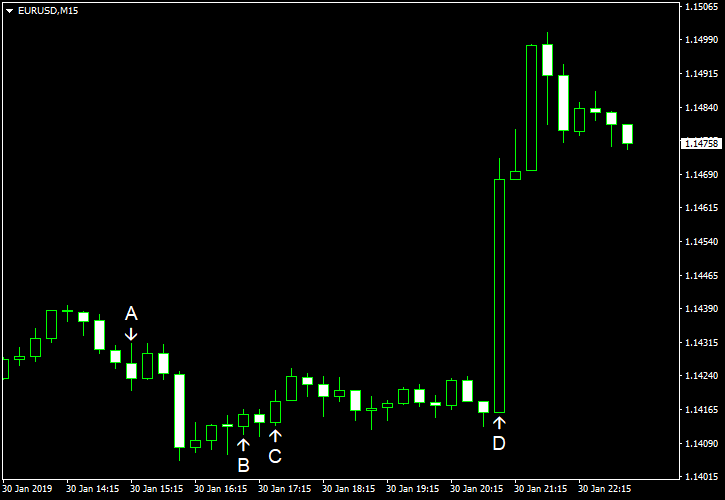

January 302019

EUR/USD Jumps After FOMC Dovish Statement

EUR/USD jumped sharply today after the Federal Open Market Committee demonstrated a dovish stance in its monetary policy statement. Before the release, the dollar was boosted by the better-than-expected employment data. ADP employment rose by 213k in January, exceeding the average forecast of 180k. The December increase got a negative revision from 271k to 263k. (Event A on the chart.) Pending home sales dropped by 2.2% in December instead of rising by 0.8% as analysts had predicted. […]

Read more January 24

January 242019

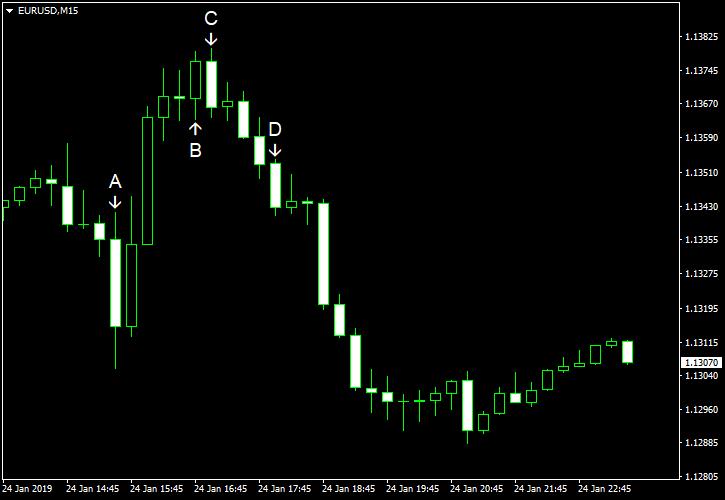

EUR/USD Dragged Down by Dovish Draghi

EUR/USD dropped today. The decline was largely a result of dovish comments from European Central Bank President Mario Draghi, though poor PMIs for the eurozone hurt the currency pair as well. (Event A on the chart.) Meanwhile, US reports were decent, with the unemployment and manufacturing reports being especially positive. Initial jobless claims fell to 199k last week from the previous week’s slightly revised level of 212k. It was the lowest […]

Read more January 23

January 232019

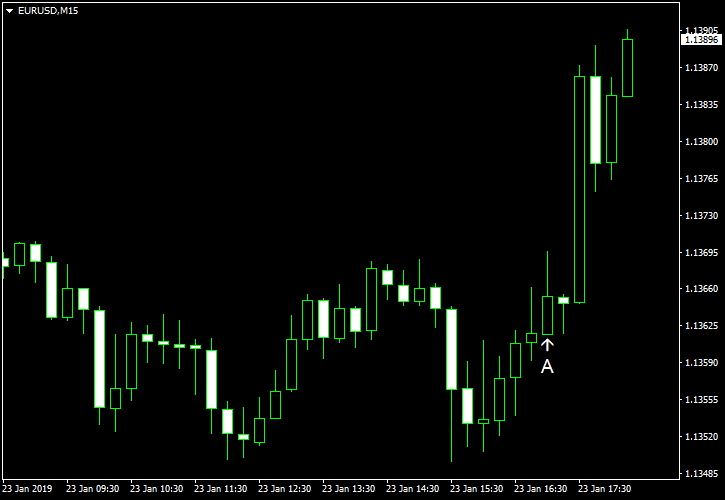

EUR/USD Falls on Wednesday

EUR/USD fell during Wednesday’s trading. Analysts pointed at several possible reasons for the drop, including the continuing government shutdown in the United States and cancellation of trade talks between the USA and China scheduled for this week. As for macroeconomic data, the government shutdown means that there will be few reports this week. Richmond Fed manufacturing index rose from â8 in December to â2 in January, matching forecasts exactly. (Event A on the chart.) Yesterday, […]

Read more January 18

January 182019

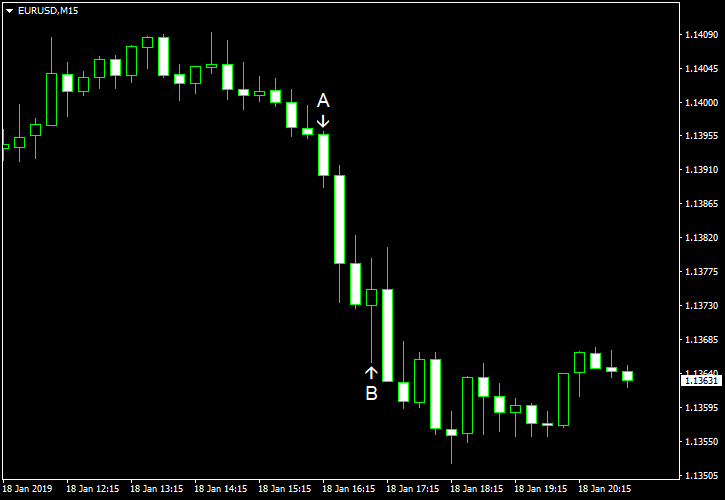

EUR/USD Declines amid Speculations About US Tariffs Rollback

EUR/USD declined today even as the US consumer sentiment worsened significantly this month. Yet the improving industrial production helped the dollar to gain on the euro. Another reason for the dollar’s strength was the rumor that the United States are considering lifting tariffs on Chinese imports. Industrial production rose 0.3% in December after increasing 0.4% in November (revised, 0.6% before the revision). Analysts had expected a bit smaller increase by 0.2%. Capacity […]

Read more January 17

January 172019

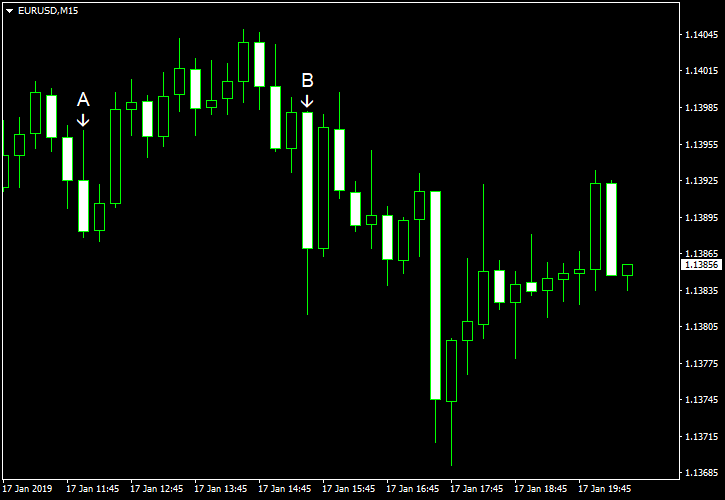

EUR/USD Little Changed Despite Disappointing Eurozone Inflation, Positive US Data

EUR/USD was little changed today even after the inflation print released in the eurozone came out below expectations (event A on the chart), while US macroeconomic indicators surprised positively. Philadelphia Fed manufacturing index jumped from the revised reading of 9.1 in December to 17.0 in January. Analysts had predicted a much smaller increase to 9.7. (Event B on the chart.) Initial jobless claims fell from 216k to 213k last week instead […]

Read more