- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Fundamental Analysis

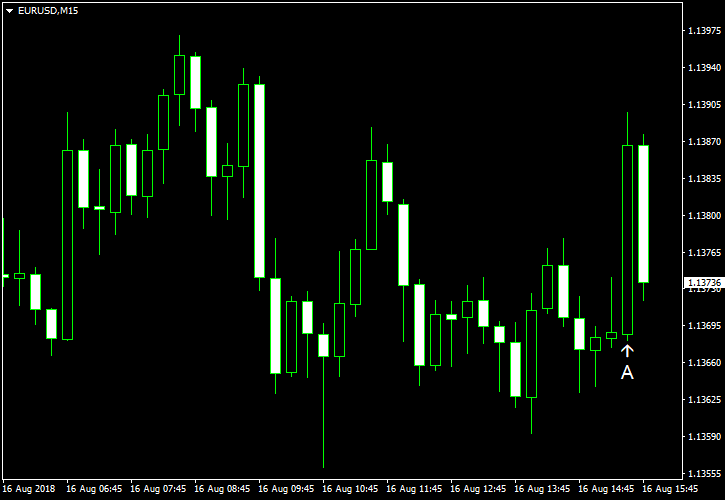

August 16

August 162018

EUR/USD Recovers as Market Sentiment Improves, US Manufacturing Slows

EUR/USD rebounded today, extending its recovery, amid improving market sentiment. Market participants became a bit more optimistic due to the news about Qatar investing in Turkey and renewed trade talks between the United States and China. US macroeconomic data, being rather unimpressive, did not prevent the rally of the currency pair. The Philly Fed manufacturing index was especially disappointing. Housing starts and building permits rose a bit in July. […]

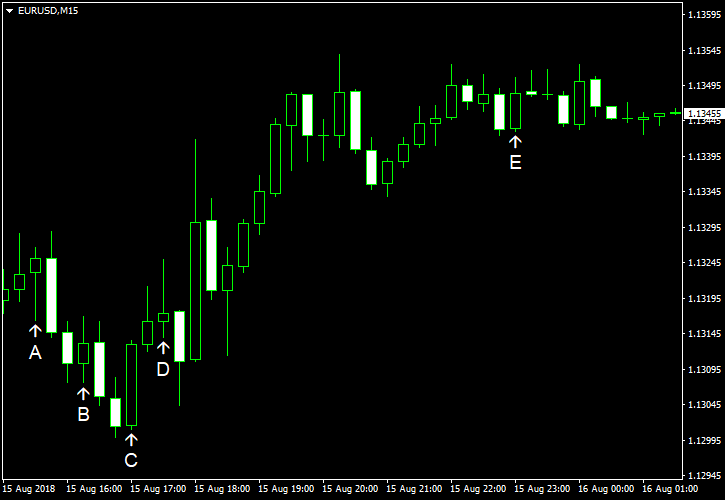

Read more August 15

August 152018

EUR/USD Recovers After Touching 13-Month Low

EUR/USD dropped intraday on Wednesday as the euro touched the lowest level in more than a year. By the end of Wednesday’s trading, though, the currency pair managed to recover, staying near the opening level. There were plenty of US economic reported released over the trading session. Retail sales rose 0.5% in July, seasonally adjusted, exceeding the median forecast of a 0.1% increase. The previous month’s increase got a negative revision from 0.5% to 0.2%. (Event […]

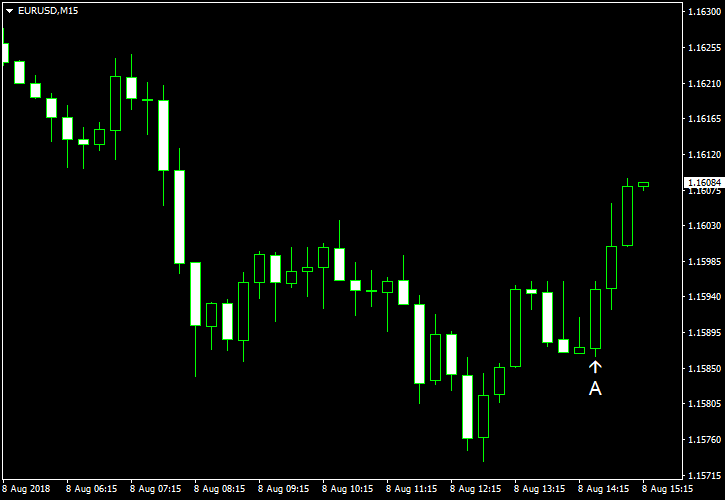

Read more August 10

August 102018

US Sanctions on Turkey Drive EUR/USD Down

EUR/USD dropped to the lowest level in a year today on concerns that the negative impact of US sanctions against Turkey can spill over to the European banking system, which has strong exposure to Turkish assets. Positive US inflation data also weighed on the currency pair. US CPI rose 0.2% in July on a seasonally adjusted basis, in line with expectations. Consumer inflation accelerated a bit from June’s 0.1%. (Event A on the chart.) Treasury […]

Read more August 9

August 92018

EUR/USD Falls Despite US PPI Missing Forecasts

EUR/USD declined today even as US producer inflation missed expectations. Consumer inflation data will be released tomorrow, and if it fails to meet expectations as well, that would bode ill for the US currency. PPI showed no change in July, whereas experts had predicted an increase by 0.2%. The index rose 0.3% in June. (Event A on the chart.) Initial jobless claims were at 213k last week, down from the previous […]

Read more August 8

August 82018

EUR/USD Consolidates amid Light Macroeconomic Data

EUR/USD consolidated today, looking for direction. The current session was light in terms of macroeconomic data in the United States, providing no help for the currency pair in determining its next move. US crude oil inventories decreased by 1.4 million barrels last week, two times less than the market has anticipated — 2.8 million. The stockpiles increased by 3.8 million barrels the week before. At the same time, total motor gasoline inventories […]

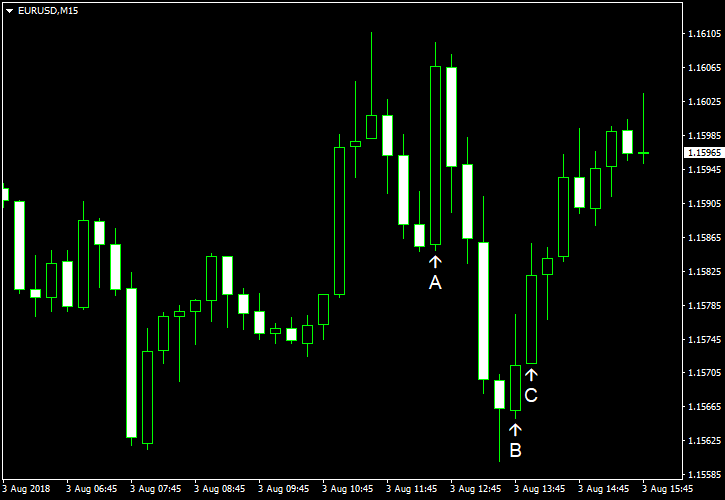

Read more August 3

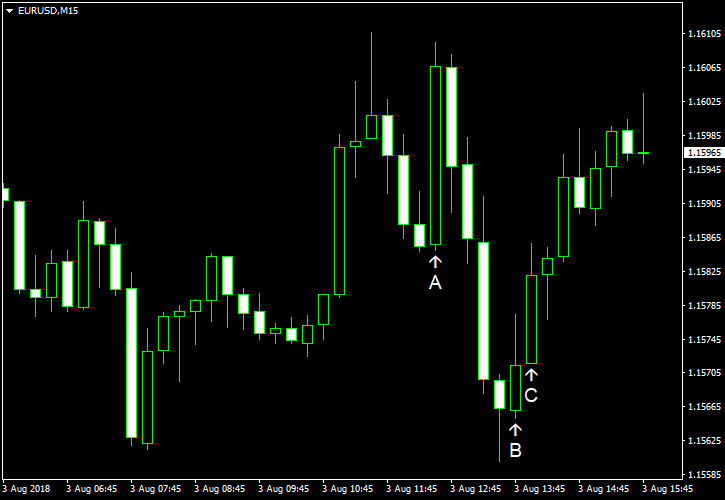

August 32018

EUR/USD Volatile After NFP, Stabilizes Above Opening Level

US nonfarm payrolls released today were mixed, with disappointing employment growth but solid wage inflation and falling unemployment rate. EUR/USD jumped immediately after the release, but slumped afterwards before stabilizing above the opening level. Other macroeconomic reports released in the United States today were not good either, showing a widening trade balance deficit and slowing growth of the services sector. Nonfarm payrolls rose by 159k […]

Read more August 3

August 32018

EUR/USD Volatile After NFP, Stabilizes Above Opening Level

US nonfarm payrolls released today were mixed, with disappointing employment growth but solid wage inflation and falling unemployment rate. EUR/USD jumped immediately after the release, but slumped afterwards before stabilizing above the opening level. Other macroeconomic reports released in the United States today were not good either, showing a widening trade balance deficit and slowing growth of the services sector. Nonfarm payrolls rose by 159k […]

Read more August 2

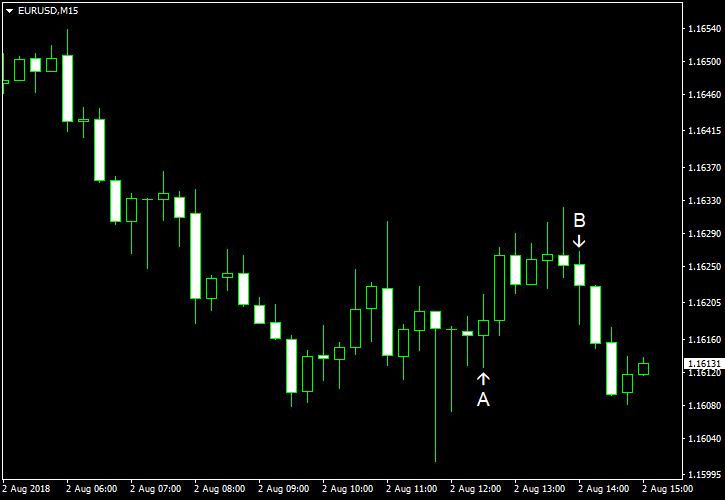

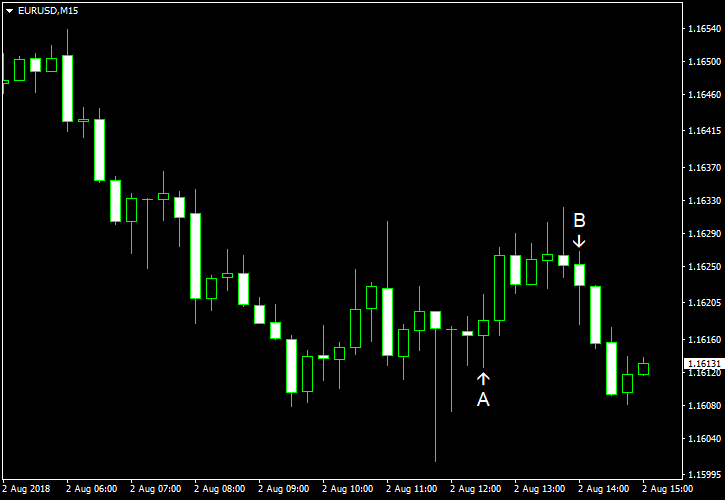

August 22018

EUR/USD Declines As US-China Trade Conflict Escalates

EUR/USD declined on the reports that the trade war between the United States and China continued to escalate as the USA considered additional tariffs on Chinese imports. As for US macroeconomic reports, there were just two of them today, and both were within expectations. Initial jobless claims were at the seasonally adjusted rate of 218k last week, just marginally above the previous week’s level of 217k. That is compared to the median forecast of 220k. (Event […]

Read more August 2

August 22018

EUR/USD Declines As US-China Trade Conflict Escalates

EUR/USD declined on the reports that the trade war between the United States and China continued to escalate as the USA considered additional tariffs on Chinese imports. As for US macroeconomic reports, there were just two of them today, and both were within expectations. Initial jobless claims were at the seasonally adjusted rate of 218k last week, just marginally above the previous week’s level of 217k. That is compared to the median forecast of 220k. (Event […]

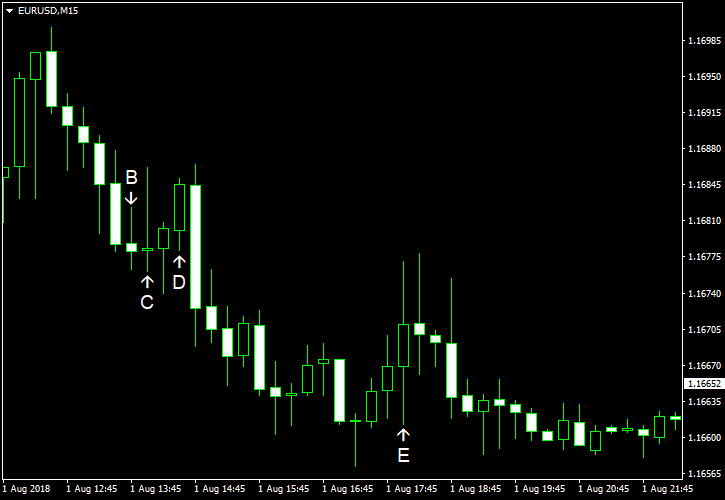

Read more August 1

August 12018

EUR/USD Drops, Pays Little Attention to FOMC Policy Announcement

EUR/USD was falling on Wednesday even as most US macroeconomic reports were underwhelming (with the notable exception of employment data). The policy meeting of the Federal Open Market Committee was in focus today, but in reality its impact on the market was limited. While traders did not expect any changes for monetary policy, they were looking for the statement to provide more clues about the FOMC plans. But the statement had not […]

Read more