- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Fundamental Analysis

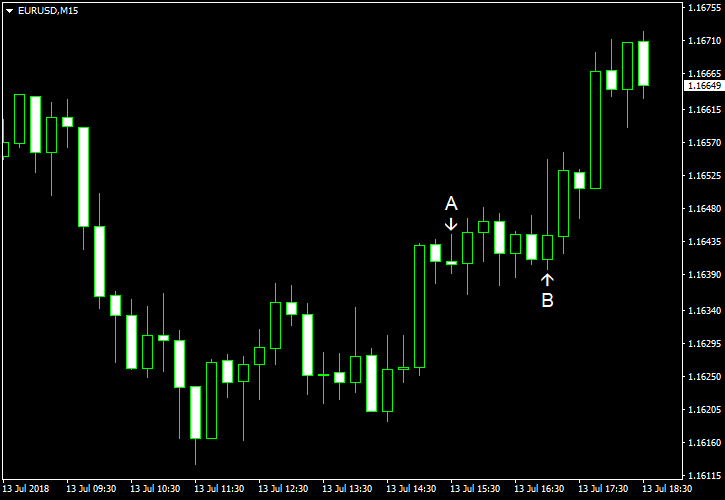

July 13

July 132018

EUR/USD Fails to Enter Downtrend, Ignores US Fundamentals

EUR/USD was falling during the European trading session and rising during the US one today, but did not pay a lot of attention to the macroeconomic indicators. Those were largely negative for the US dollar. US export and import prices demonstrated mixed performance in June. Export prices increased by 0.3% while the import prices decreased by 0.4%. The latter was a bitter surprise for the dollar bulls who had hoped for a 0.1% increase. On a brighter […]

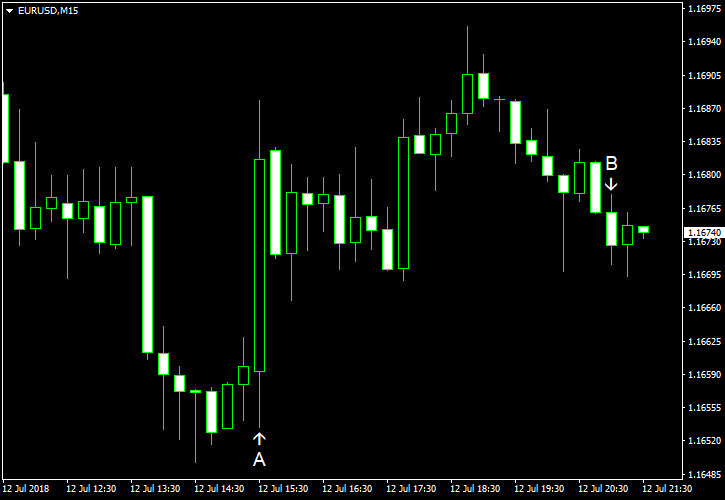

Read more July 12

July 122018

EUR/USD Recovers on Mixed US Data

The euro had fallen against the US dollar during the first half of the European trading session before the US macroeconomic data was released. Following the release of the inflation and employment indicators, the EUR/USD currency pair has recovered its losses. US CPI was reported to have risen 0.1% in June on a seasonally adjusted basis, failing to meet the expectations and repeat the May’s growth of 0.2%. At the same time, the core measure of the consumer price index […]

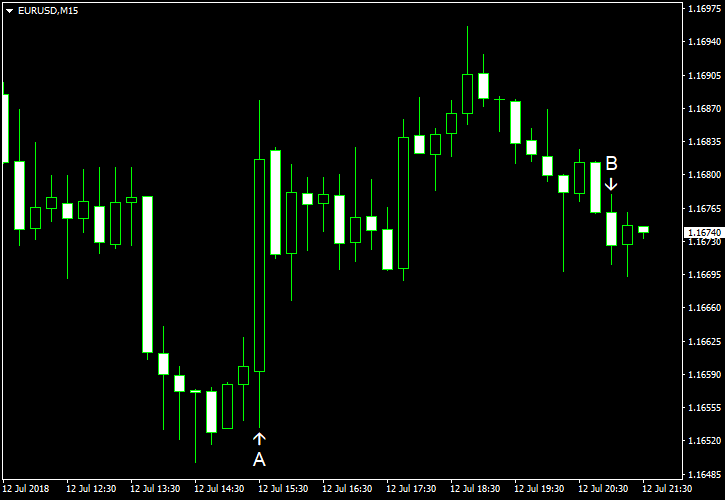

Read more July 12

July 122018

EUR/USD Recovers on Mixed US Data

The euro had fallen against the US dollar during the first half of the European trading session before the US macroeconomic data was released. Following the release of the inflation and employment indicators, the EUR/USD currency pair has recovered its losses. US CPI was reported to have risen 0.1% in June on a seasonally adjusted basis, failing to meet the expectations and repeat the May’s growth of 0.2%. At the same time, the core measure of the consumer price index […]

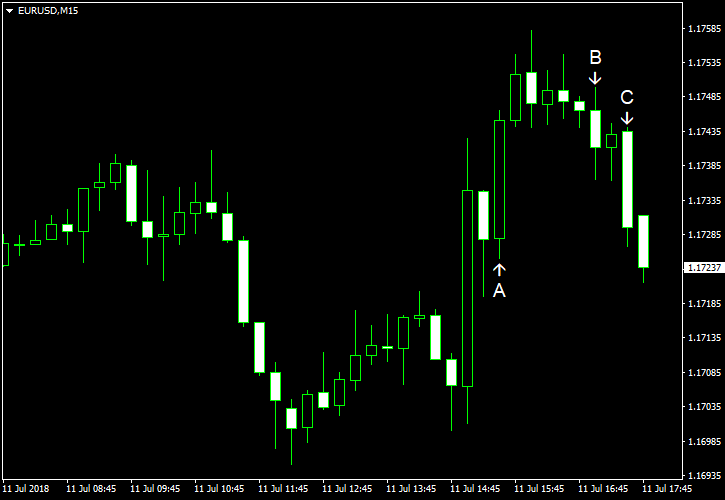

Read more July 11

July 112018

EUR/USD Trades Mostly Unfazed by US Macro Indicators

The EUR/USD currency pair has experienced some intraday volatility during the early European trading session, but mostly ignored the US fundamentals, which were rather good. The euro is trading just below its open level against the US dollar now. US PPI increased by 0.3% in June on a seasonally adjusted basis, going faster than 0.2% gain predicted by markets, but well below the May’s pace of 0.5%. […]

Read more July 11

July 112018

EUR/USD Trades Mostly Unfazed by US Macro Indicators

The EUR/USD currency pair has experienced some intraday volatility during the early European trading session, but mostly ignored the US fundamentals, which were rather good. The euro is trading just below its open level against the US dollar now. US PPI increased by 0.3% in June on a seasonally adjusted basis, going faster than 0.2% gain predicted by markets, but well below the May’s pace of 0.5%. […]

Read more July 6

July 62018

EUR/USD Rallies on Soft NFP

EUR/USD rallied today, finding help from the disappointing US nonfarm payrolls. While employment rose more than was expected, other indicators failed to meet expectations. The currency pair rallied even as new US tariffs of Chinese goods kicked in, meaning that the trade war between the United States and China has officially started. Nonfarm payrolls surprised positively in terms of employment growth, showing an increase by 213k in June, […]

Read more July 5

July 52018

EUR/USD Gets Boost from Underwhelming US Employment

EUR/USD rallied today, getting boost from worse-than-expected US employment data. Meanwhile, data in the eurozone was good. ADP employment rose by just 177k in June, missing the analysts’ average estimate of 190k. On a positive note, the May increase got a positive revision from 178k to 189k. (Event A on the chart.) Initial jobless claims rose unexpectedly from 228k to 231k last week, seasonally adjusted, instead of falling to 225k as analysts had […]

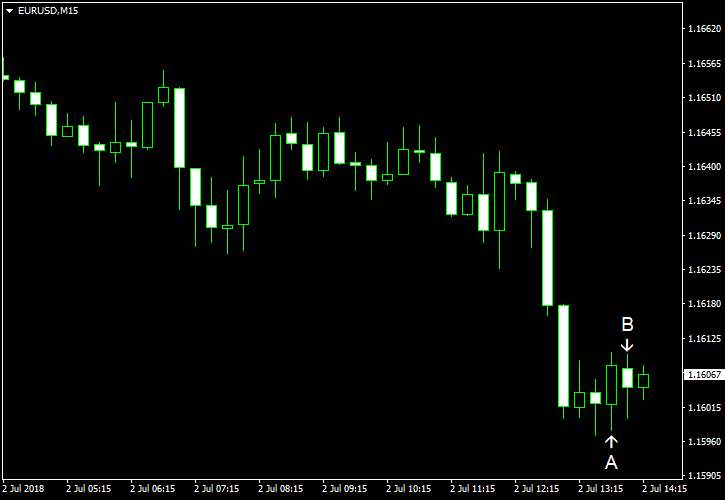

Read more July 2

July 22018

EUR/USD Continues to Feel Pressure from Trade War Fears

EUR/USD fell today as markets continued to feel pressure from fears of a trade war between the United States and their trading partners. Although all the markets took the hit, European assets were particularly vulnerable after US President Donald Trump shifted focus of his criticism from China to the European Union. Today’s US macroeconomic data was confusing as one report showed a slowdown of manufacturing growth, while other showed […]

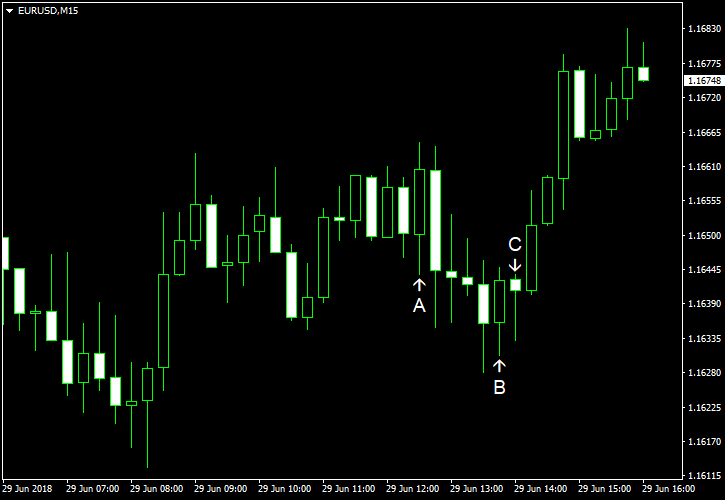

Read more June 29

June 292018

EUR/USD Strong After EU Immigration Deal

EUR/USD jumped sharply today after the leaders of the European Union reached a deal about immigration. Strong eurozone inflation data also helped the currency pair. Meanwhile, US data was mixed. Both personal income and spending increased in May, by 0.4% and 0.2% respectively. Analysts had predicted a 0.4% rate of increase for both indicators. The April increase of income was revised from 0.3% to 0.2%. The increase of spending also got a negative […]

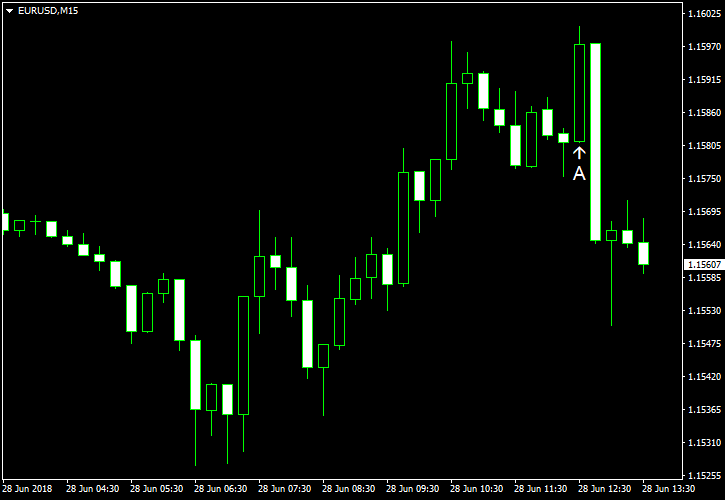

Read more June 28

June 282018

EUR/USD Logs Small Gain on Thursday

EUR/USD edged a little higher today after two sessions of losses. US economic data released during the trading session was below expectations, boosting the currency pair, though it fell sharply afterwards. Nevertheless, currently EUR/USD trades above the opening level. US GDP rose 2.0% in Q1 2018, according to the final estimate, after increasing 2.9% in Q4 2017. Analysts had expected the same 2.2% rate of growth […]

Read more