- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Fundamental Analysis

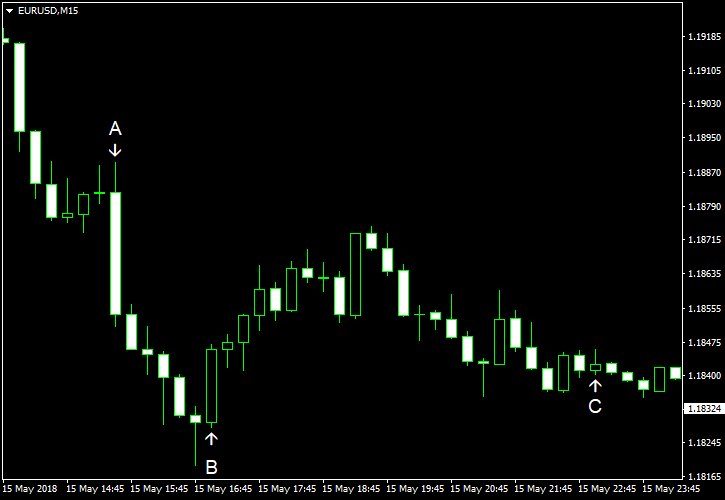

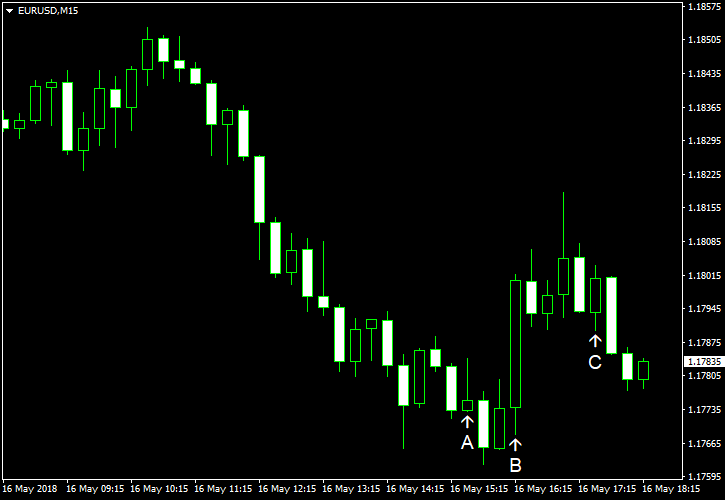

May 16

May 162018

EUR/USD Sinks as US 10-Year Treasury Yield Soars

The US dollar was extremely strong, prompting EUR/USD to tank, as the benchmark 10-year Treasury yield climbed above 3%. Adding to the strength of the currency were economic releases in the United States. Most of them were good with the exception of retail sales that missed expectations, though just a little bit. Retail sales rose 0.3% in April, missing the analysts’ average estimate of a 0.4% increase slightly. The March increase received a positive revision from […]

Read more May 16

May 162018

EUR/USD Falls on European Politics

EUR/USD dropped today on speculations that the Italian populist coalition may seek government debt forgiveness from the European Central Bank, though officials denied such allegations. As for US macroeconomic releases, the data was mixed, but no indicator was really bad. Housing starts were at the seasonally adjusted annual rate of 1.29 million in April, down from 1.34 million in March and missing the analysts’ average estimate of 1.32 million. […]

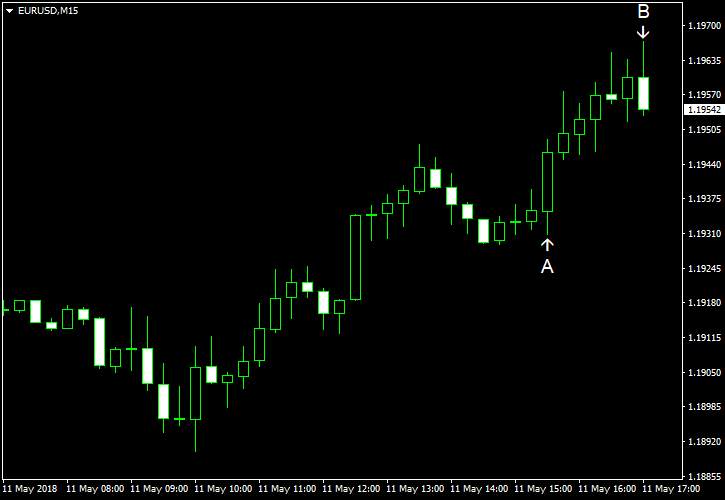

Read more May 11

May 112018

EUR/USD Extends Rally Caused by CPI Miss

EUR/USD extended yesterday’s rally caused by the miss of the inflation data. Today’s data in the United States was a bit mixed, but mostly decent. Yet that did not prevent the currency pair from rising, erasing its losses over the week. Both import and export prices rose in April. Import prices increased by 0.3%, missing the average forecast of a 0.5% increase. On top of that, the March reading was revised from no […]

Read more May 10

May 102018

EUR/USD Halts Decline After US CPI Misses Expectations

EUR/USD rose for the first time after four consecutive sessions of losses as the US Consumer Price Index rose less than was expected. Other macroeconomic indicators released in the United States over today’s trading session beat expectation, but that hardly affected the rally. CPI rose 0.2% in April, failing to meet the consensus forecast of a 0.3% growth. The index fell 0.1% in March. (Event A on the chart.) Initial jobless claims were […]

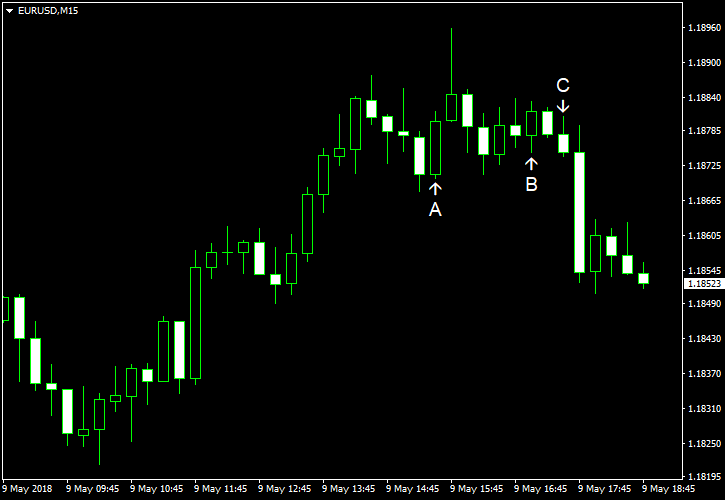

Read more May 9

May 92018

EUR/USD Pulls Back After Attempt to Rally

EUR/USD attempted to rally during the Wednesday trading session, but has pulled back by now, and is currently trading near the opening level. As for economic data, the US Producer Price Index missed expectations. Now, traders wait for tomorrow’s release of the Consumer Price Index. PPI rose by just 0.1% in April, seasonally adjusted. That was a slower rate of growth than 0.2% predicted by analysts and 0.3% registered in March. (Event A on the chart.) […]

Read more May 4

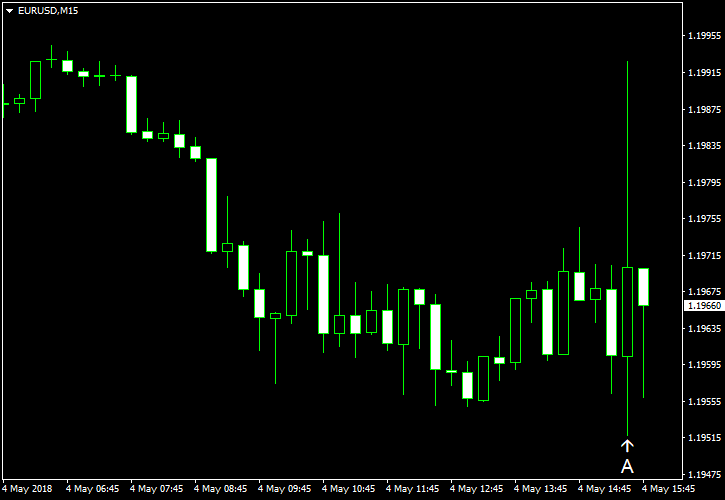

May 42018

EUR/USD Fails to Rally on Disappointing Nonfarm Payrolls

US nonfarm payrolls came out surprisingly weak, prompting EUR/USD to jump immediately after the release. But the rally was extremely short-lived, and the currency pair is still hanging below the opening level right now. Nonfarm payroll employment increased by 164k in April, failing to meet the consensus forecast of a 190k increase. The March gain got a positive revision from 103k to 135k. Average hourly earnings rose by just 0.1%, also […]

Read more May 3

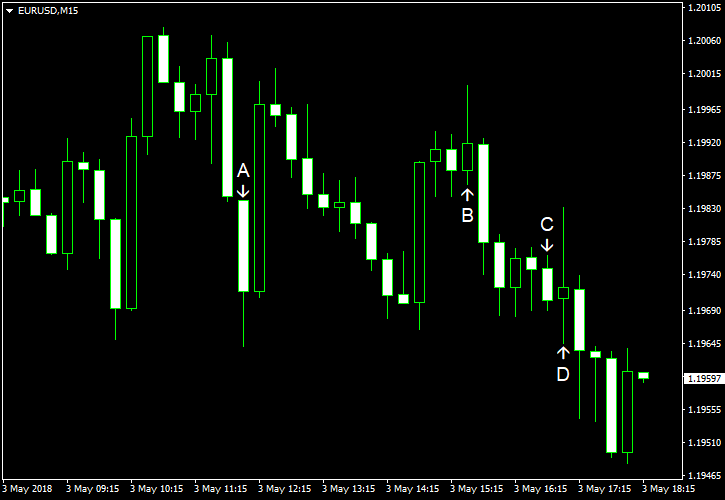

May 32018

EUR/USD Attempts to Rally on Profit-Taking, Fails

EUR/USD attempted to rally today as the dollar seemed rather soft due to profit-taking that followed the greenback’s strong performance yesterday. Yet the rally failed, and the currency pair is trading near the opening level right now. Macroeconomic data was not beneficial to the currency pair as eurozone inflation slowed unexpectedly (event A on the chart), while US reports were good for the most part. Nonfarm productivity rose 0.7% in Q1 2018. That […]

Read more May 2

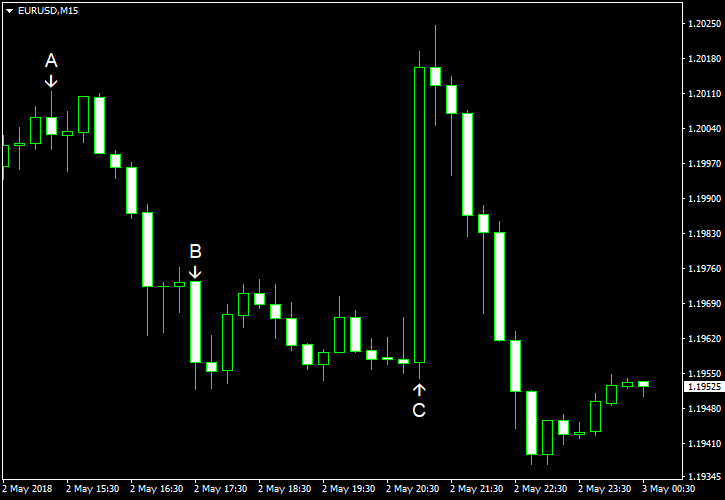

May 22018

EUR/USD Volatile After FOMC Announcement

EUR/USD was very volatile after the release of a policy statement by the Federal Open Market Committee. The currency pair leaped after the release but immediately started to back off and went below the opening level after some time. Market analysts thought that the FOMC made some dovish changes to the statement, and that was the reason for the initial jump. Yet it looked like the outlook for monetary policy did not change substantially […]

Read more May 1

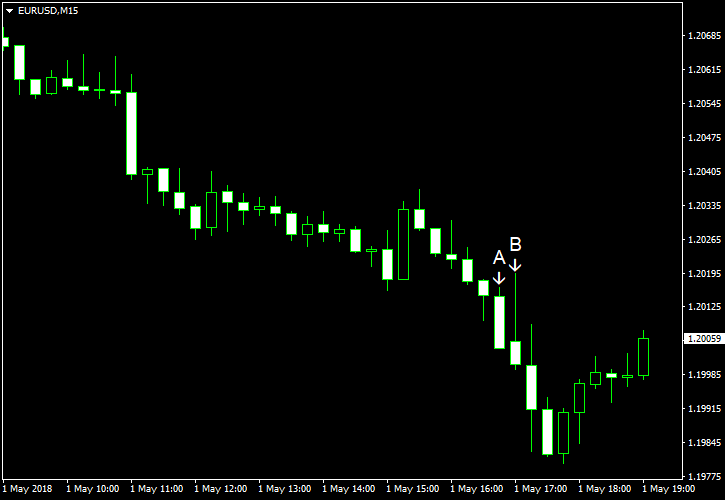

May 12018

EUR/USD Drops Ahead of Wednesday’s FOMC Announcement

EUR/USD fell today, dropping for the ninth time in eleven session. Market analysts thought that the currency pair was driven by the same forces as previously — mainly by anticipation of higher interest rates from the Federal Reserve. While basically nobody expects the Fed to announce a hike tomorrow, traders still wait for the Fed’s statement, hoping that it may signal whether US policy makers consider four hikes it total this […]

Read more April 30

April 302018

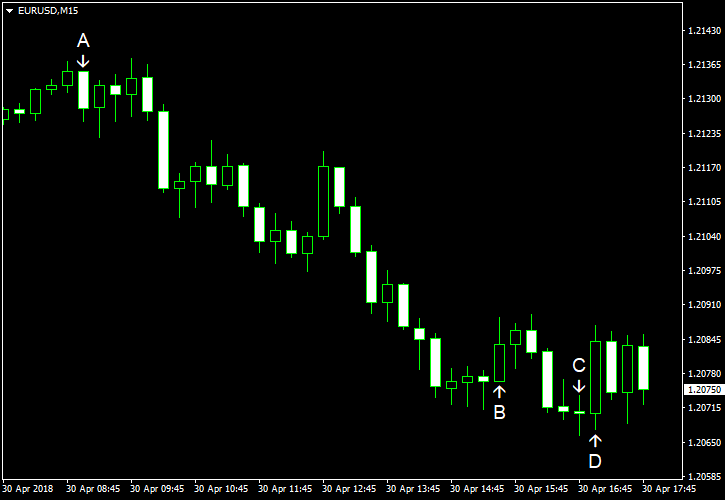

EUR/USD Declines After Disappointing German Retail Sales

EUR/USD was trading in a range at the start of Monday’s trading but began a decline shortly after German retail sales came out, turning out to be much worse than was expected. (Event A on the chart.) US macroeconomic data was not hot either, but that did not help the currency pair. This week will be full with important releases in the United States, including PMIs, employment data, […]

Read more